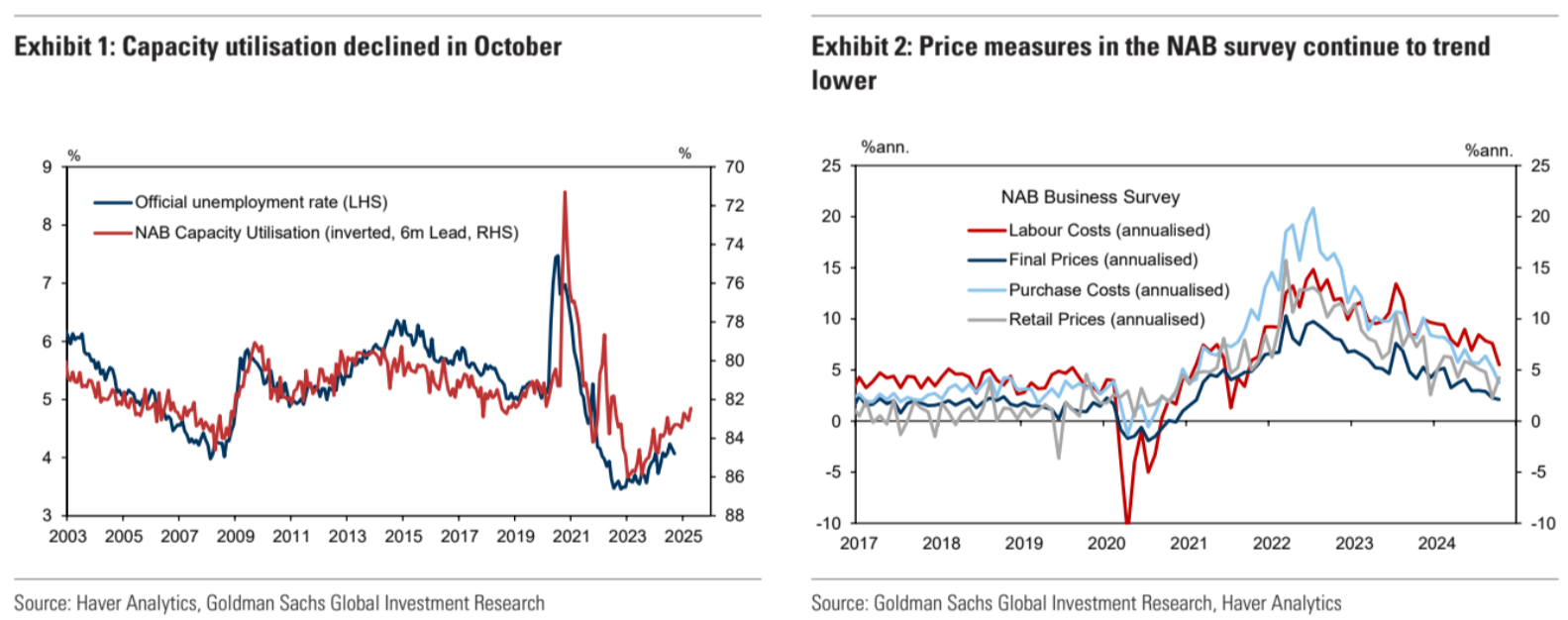

3.2% is the six-month annualised wage growth rate. The way markets and the press have responded to this, it might as well be 32%.

But 3.2% is low, not high.

It is plenty low enough to keep deflating service inflation, even without productivity gains.

The secret to this was discovered in the last business cycle when the then-LNP government broke away from convention and raised immigration into an economic bust.

The result was twofold.

Capital shallowing killed productivity growth.

Weak wage growth was possible despite no productivity gains because the constant labour supply shock destroys worker pricing power, also delivering lowflation.

The RBA wholeheartedly supports this dreadful economy, cheerleading mass immigration at every turn.

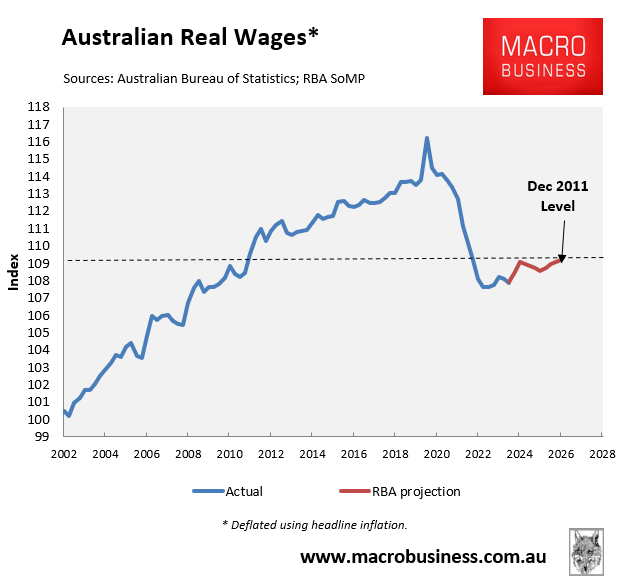

Yet it refuses to accept how it works and so keeps punishing workers for fear of a wage growth breakout that will never come.

And now we are back there again. From Andrew Boak.

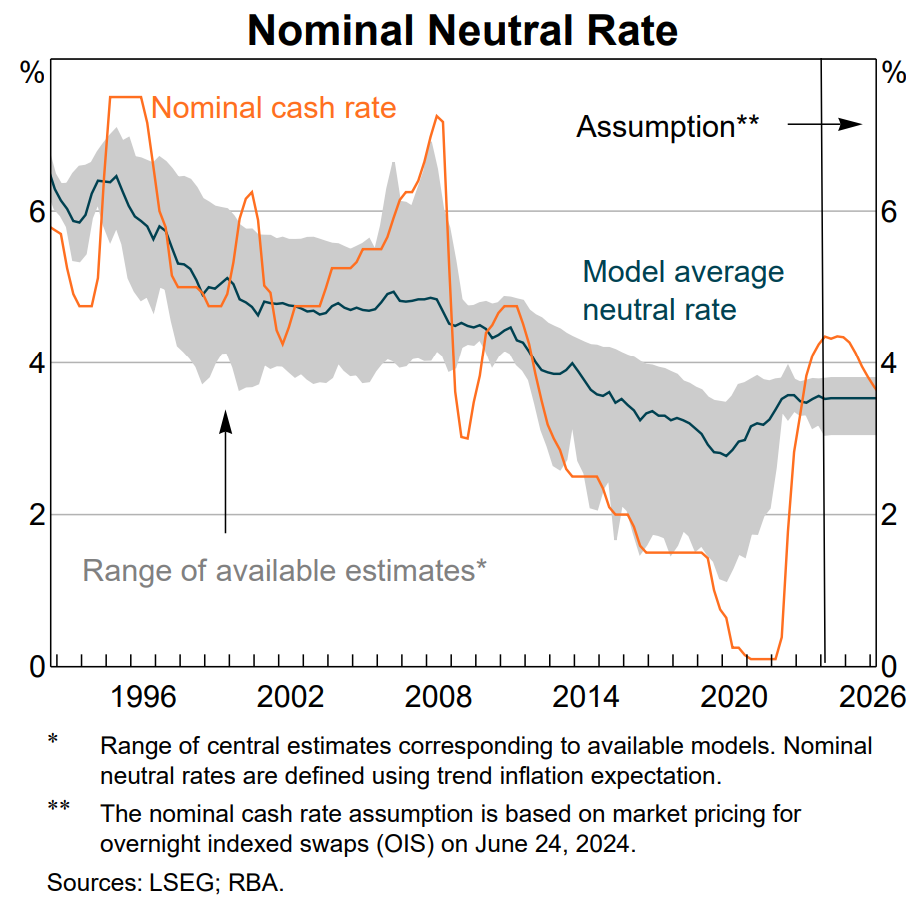

Check out how slow the RBA was to cut its neutral interest rate assumptions through the lowflation period and now it has raised it too high.

Treasury is destroying workers with a mass immigration growth model and the RBA is doubling down on the destruction by refusing to admit that it is happening.

Phil Lowe was sacked mostly for failing to understand this.

Michele Bullhawk better wake up.