This is ridiculous.

In the last week, analysts at NAB, Citi, Capital Economics, RBC Capital Markets and UBS have all pushed back their rate cut forecasts to May.

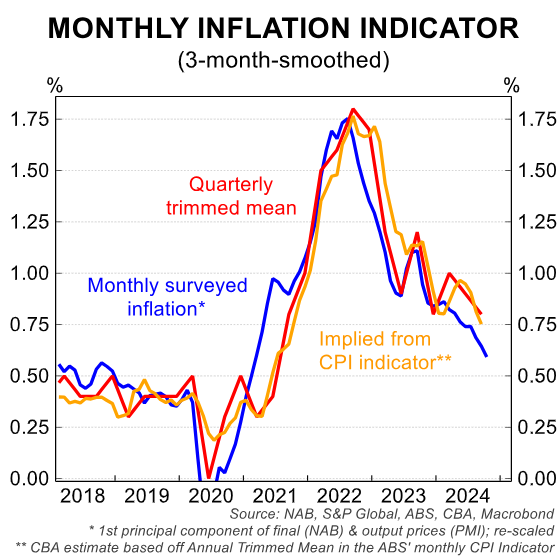

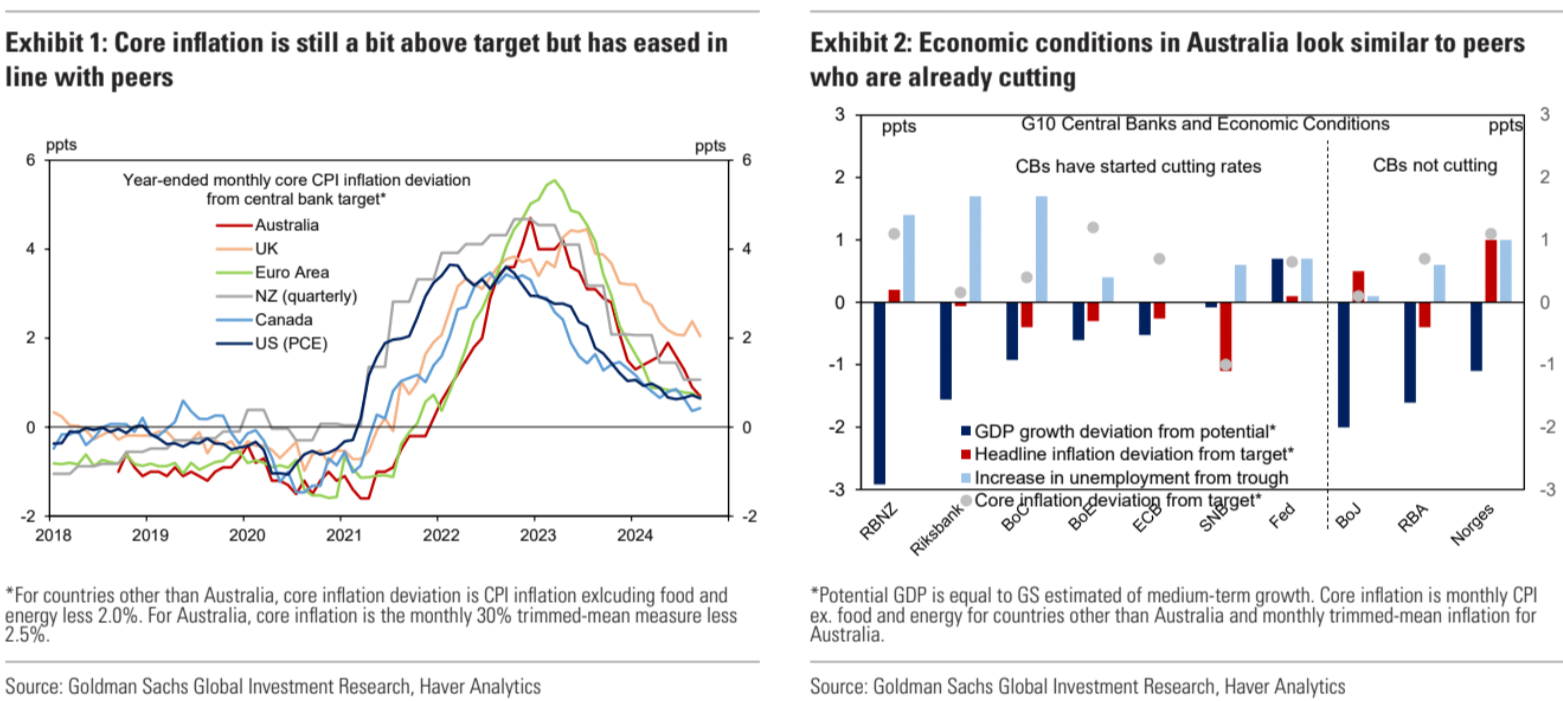

Australian disinflation is going swimmingly.

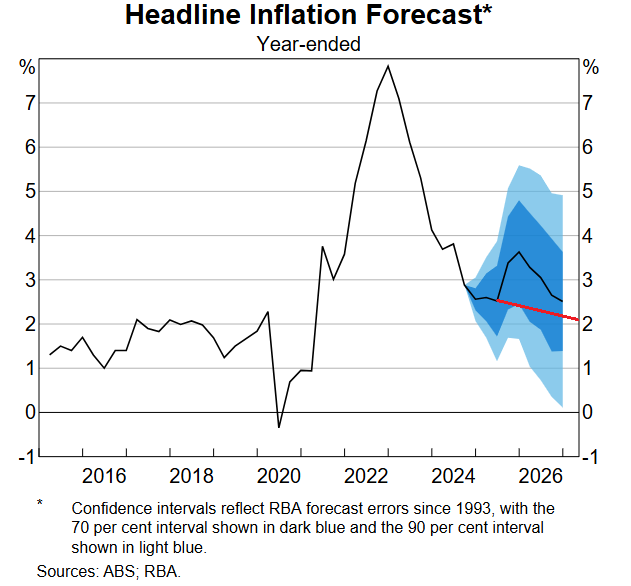

Energy rebates will be extended, leaving headline inflation well within the band all next year.

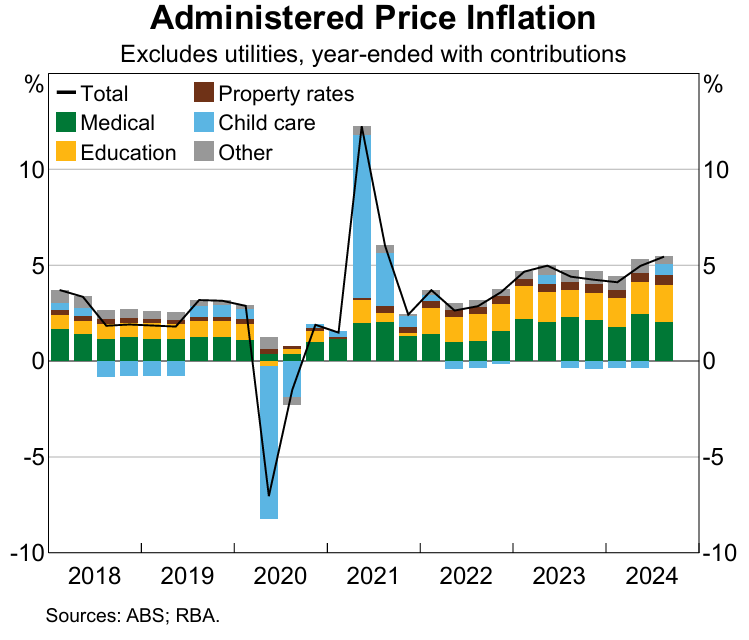

This will drag down the roughly 20% of CPI made up of administered prices that are indexed to the headline rate lowering inflation even further.

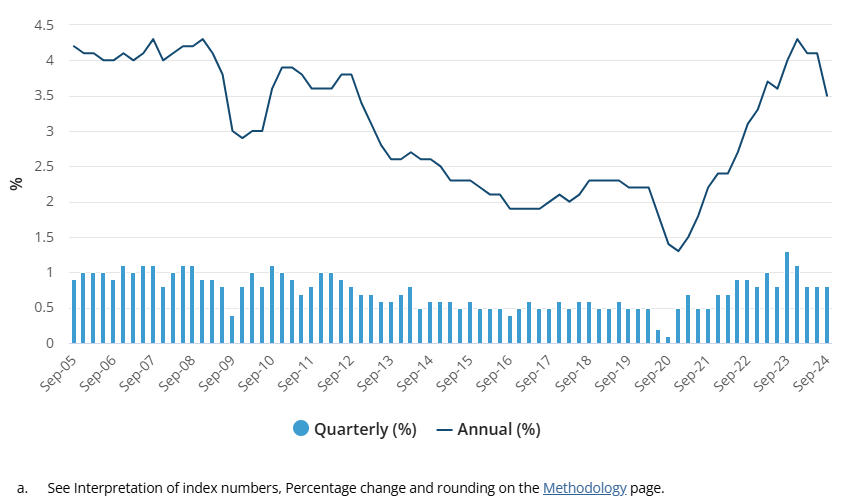

Wage growth is cooked, ensuring sticky services inflation will disappear. We’ve had nine months annualised of weak 3.2% growth.

Next year’s tariff shock will smash goods prices as US demand is cut off from global exporters and those goods go everywhere else.

It will also drag steel and iron ore prices down, delivering more national income falls, hurting wages even more and the budget.

Australia looks like everywhere else where cuts are well underway.

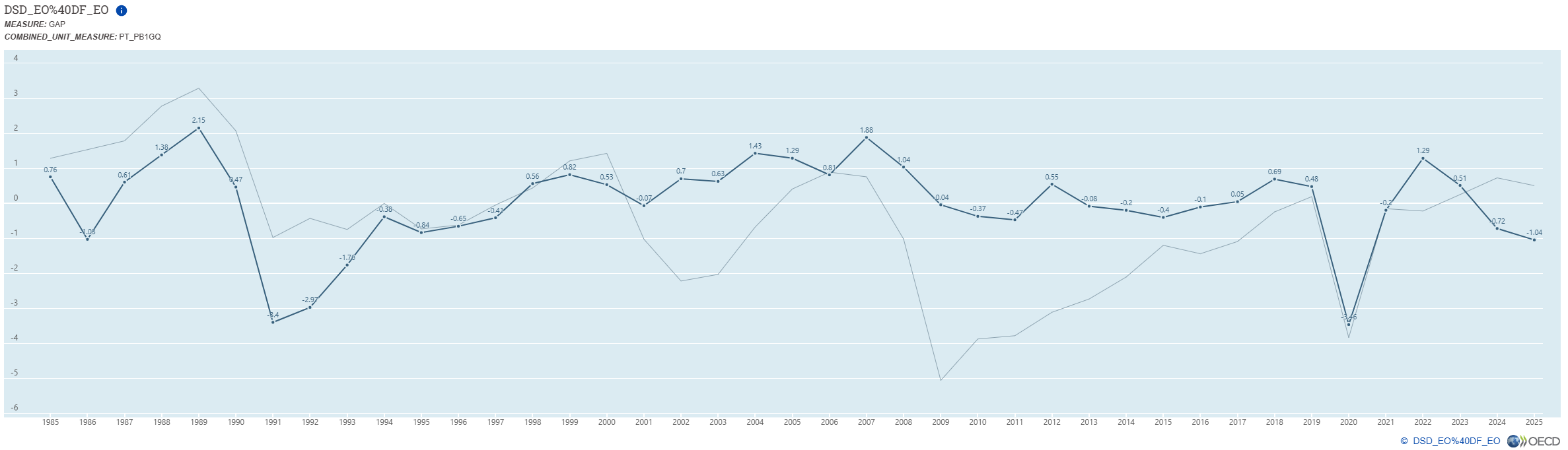

This all makes perfect sense because the OECD measure of the Aussie output gap has collapsed into the material economic slack, below even the pre-GFC lowflation period. And far below the US (thin line) where rates are already being slashed.

Australia’s inflation surge is beaten.

The sadistic RBA is torturing households for fun.

Just as did for eight years before COVID.

WTF.