Westpac sums it up.

In the September quarter, the Wage Price Index (WPI) rose 0.8% (3.5%yr), on par with Westpac’s forecast but a touch softer than the market consensus of 0.9%.

It is also below the RBA’s expectation which pointed to a 0.9%qtr rise in both the September and December quarters of 2024.

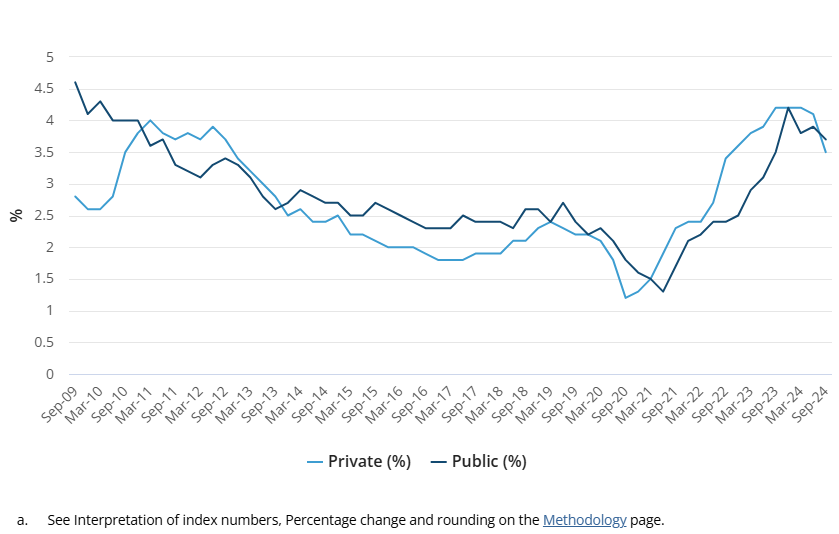

Wage inflation peaked at 4.3%yr in December 2023 and has been drifting lower through 2024, with the six-month annualised pace dropping from 4.9%yr in December 2023 to 3.2%yr in September 2024.

The more critical private sector wages rose 0.8% and this time, was also matched by a 0.8% increase in public sector wages.

The ABS provides (in non-seasonally adjusted terms) the contributions to the quarterly increase in the WPI from Awards, Enterprise Bargaining and Individual Arrangements. Comparing September 2024 to September 2023, the contribution from Enterprise Bargaining has softened to a contribution of 0.46ppt compared to 0.66ppt a year earlier.

Individual Arrangements continue their downtrend, contributing 0.59ppt compared to a September 2023 print of 0.74ppt.

Meanwhile, the Awards/Minimum Wage contribution was just 0.36ppt compared to 0.63ppt a year earlier.

As the Wage Price Index came in just as Westpac expected, we see no reason to change our end 2024 forecast of 3.2%yr and the June 2025 forecast of 2.9%yr. The RBA is currently forecasting annual wages growth to print 3.4%yr for end 2024 and hold at that rate through to June 2025.

Materially below the RBA outlook AGAIN.

3.2% annualised is garbage wage growth.

The central bank bullhawk needs to pivot. The economy has been smashed for too long.

Immigration is out of control and will keep destroying wages. This is a feature, not a bug, of the Aussie economy. Poor productivity is irrelevant amid a permanent labour supply shock.

Remember the last cycle:

Falling wage growth will wreck service inflation. Rent inflation is falling away. Energy rebates will be extended. MAGA will smash goods prices. Administered prices will fold in on the collapsing headline rate.

A commodity smash will unfold next year and crush national income.

Stupid bonds went the other way, I guess because I farted.

It’s over. Cut!