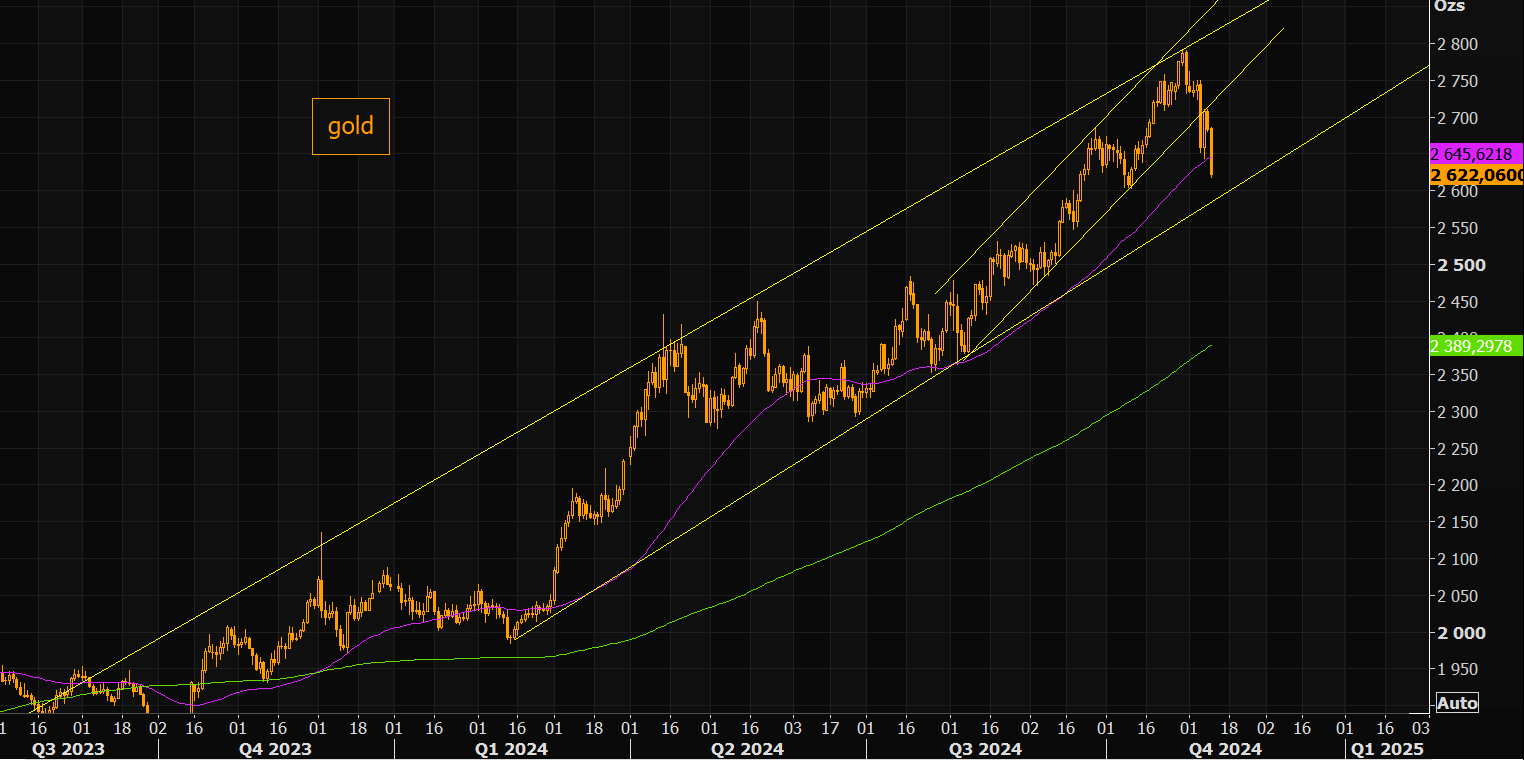

Gold is a nice snapshot of everything that is going wrong with commodities today.

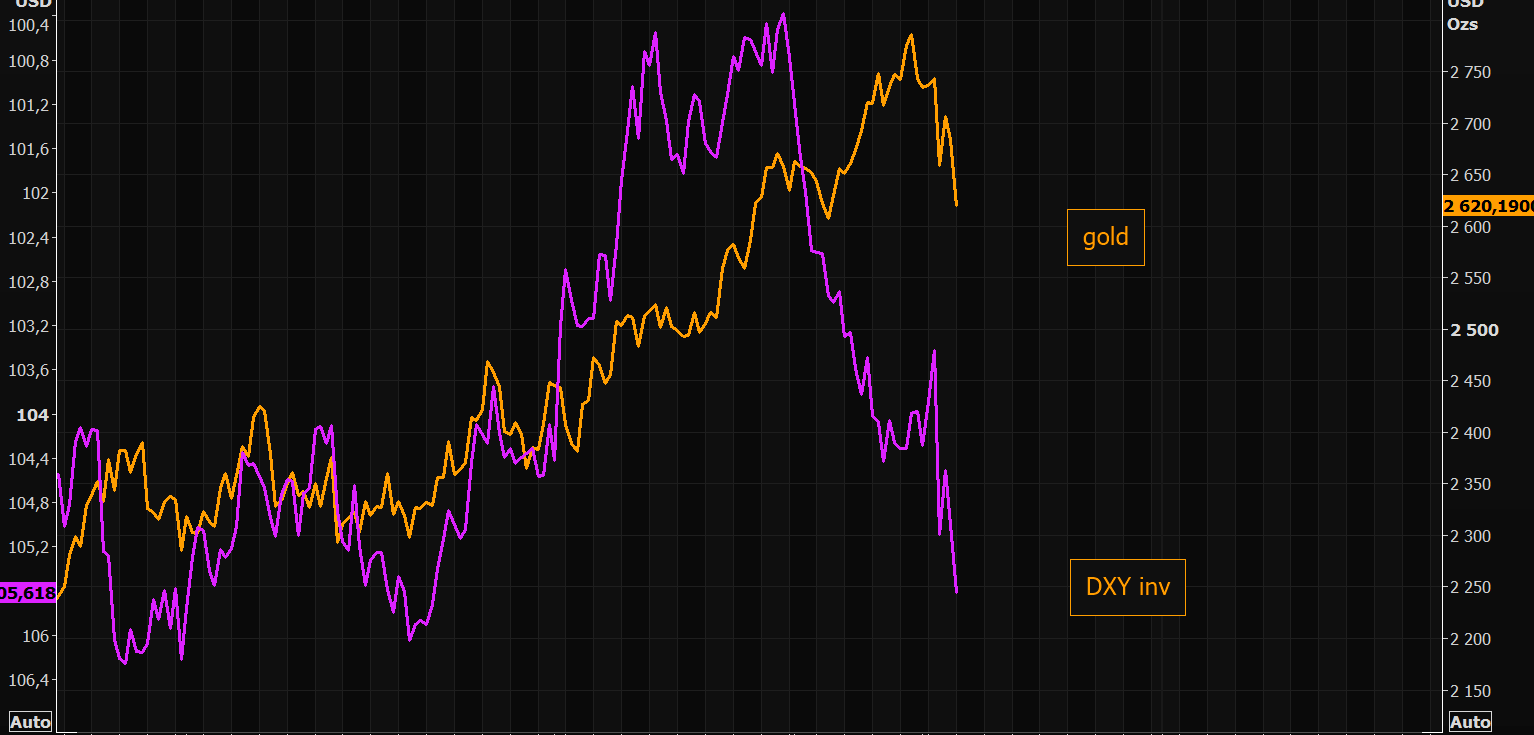

The DXY steamroller is loose.

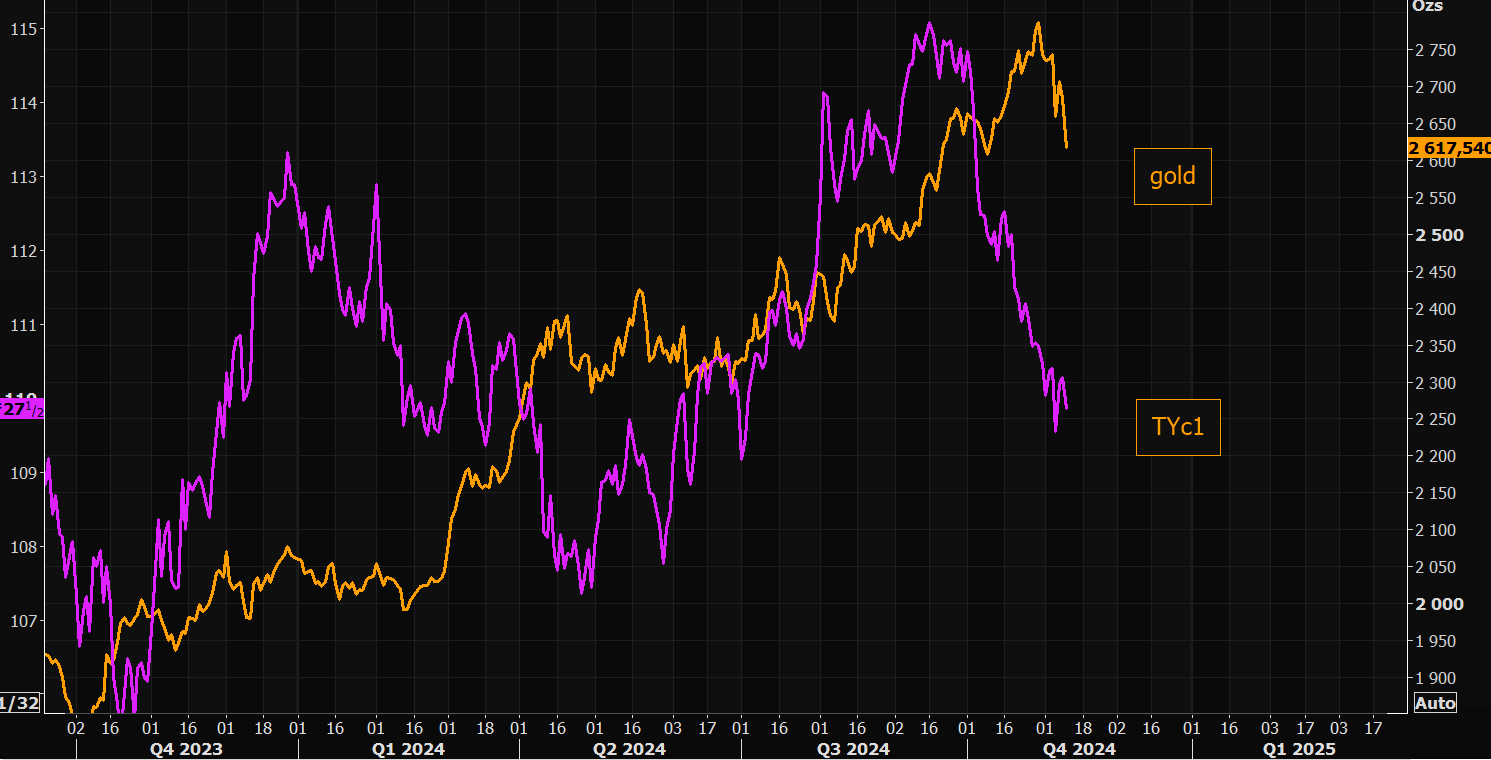

Real yields too.

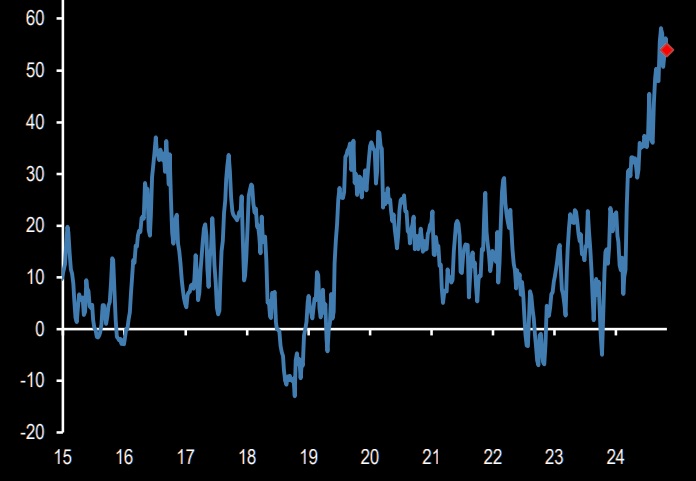

Overbought, oh dear.

This is not over.

We have not seen a macro regime so hostile to gold and commodities since 2015, when the Chinese economy was slowing and the US economy was reviving.

Today, it is more like China is dying and the US booming.

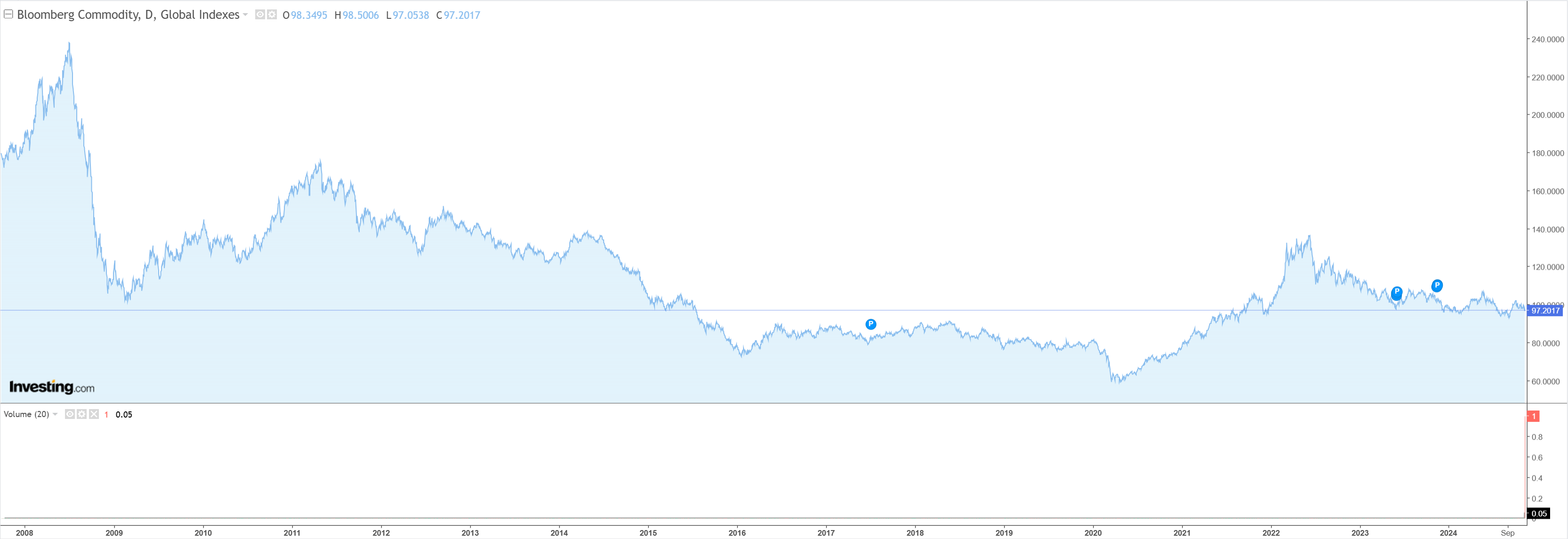

The BCOM index is in a downtrend but has so far held above 2024 lows.

This is going to be retested as:

- DXY surges into the Trump tax and tariff boom.

- Europe is smashed, and the EUR falls into accelerated rate cuts.

- China accelerates rate cuts as well and lets the CNY go as its primary response to the trade war.

- EMs are the meat in the sandwich.

This is very hostile to commodity prices as both real economy and financial pressures come to bear.

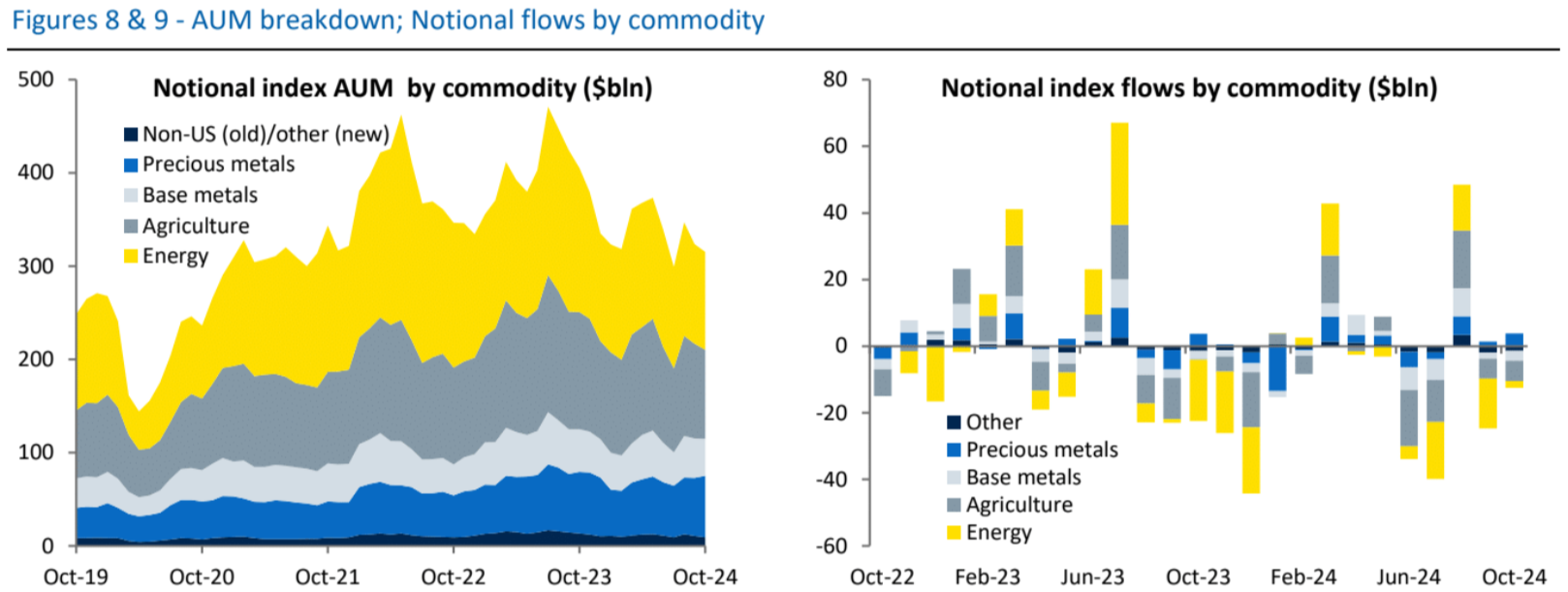

Markets are already sensing this. AUM was trending lower in October despite the so-called Chinese “bazooka” which was no such thing.

There will come a time in the new year when Europe and China face the question of how to respond to tariffs with fiscal policy.

If the response is powerful, it could reverse the commodity trend. If it is not, then all bets are off.

My guess is the latter. Chinese stimulus is not commodity-intensive these days. And Europe is very troubled on all fronts as Trump and China open cracks between technocrats and populists.

An outbreak of peace in Russia, one of the largest community producers in the world currently suffering from sanctions, could make this situation even worse with the return of supply.

Commodities are in serious trouble in 2025 unless something big changes.