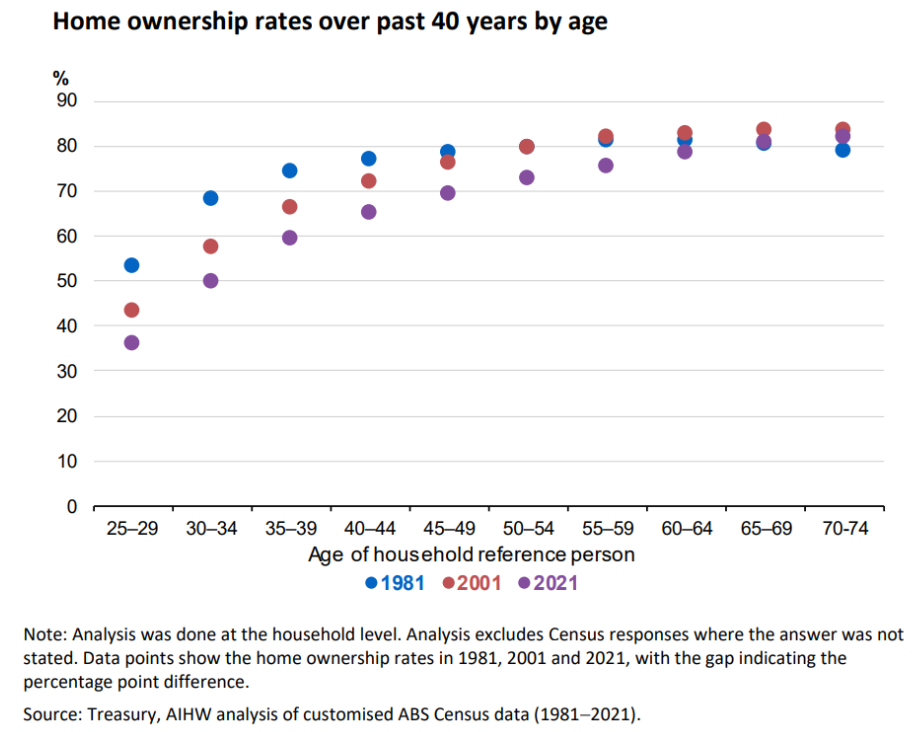

The 2023 Intergenerational Report presented the following chart showing the structural decline in property ownership among younger Australians.

In 1981, over 55% of Australians aged 25 to 29 owned a home.

Four decades later, there has been a dramatic reduction to slightly more than 35%.

The gap narrows as you progress up the age groups.

The proportion of Australians aged over 70 who own a home is now around the same as in 1981. This is because the majority of people over the age of 70 purchased their homes in the 1980s and 1990s, before home values took off.

The disparity will remain as the current generation of under-30s moves up the band and will increase further as the next generation of under-30s joins the data.

The chart above is based on 2021 Census data, and housing affordability has deteriorated since then.

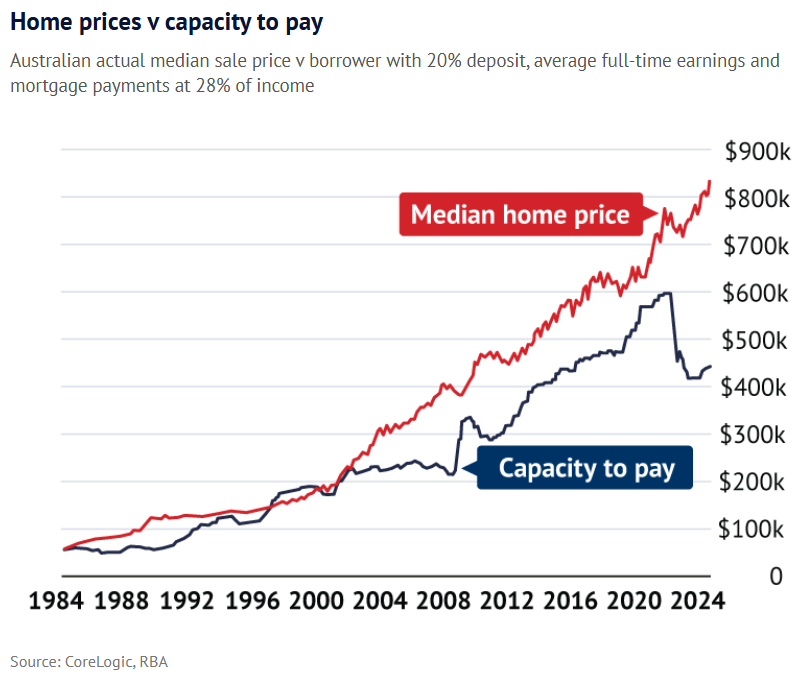

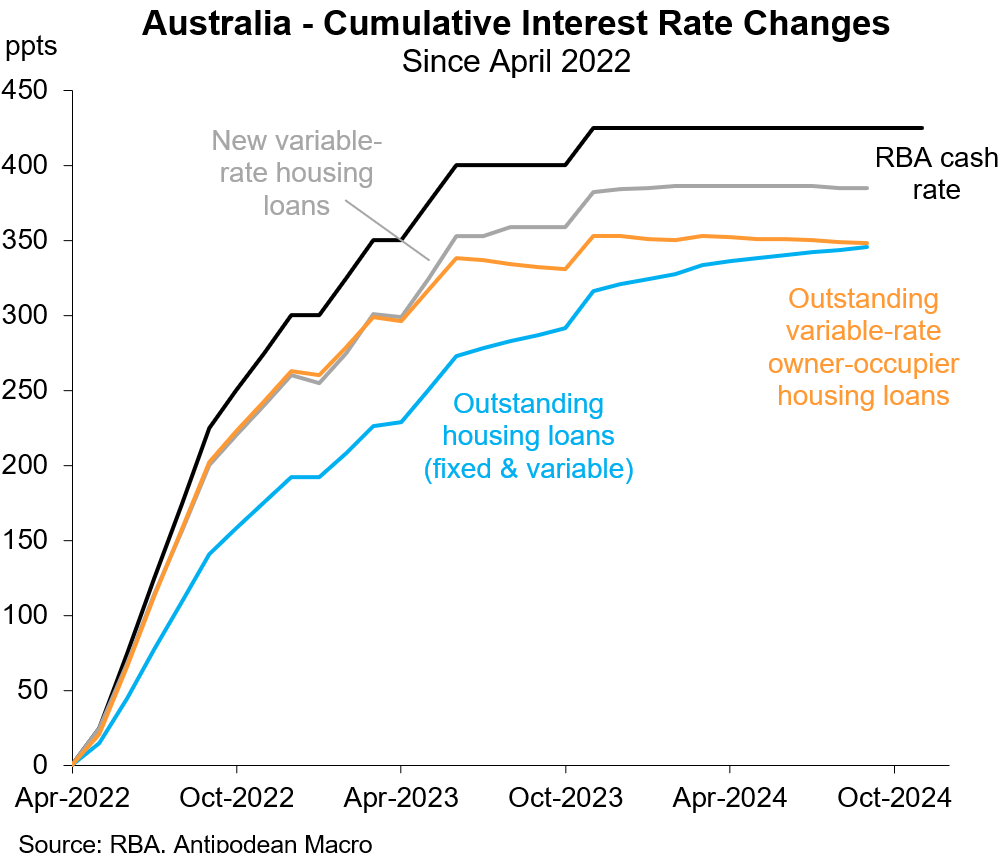

Australian home values and mortgage rates have risen materially since the 2021 Census.

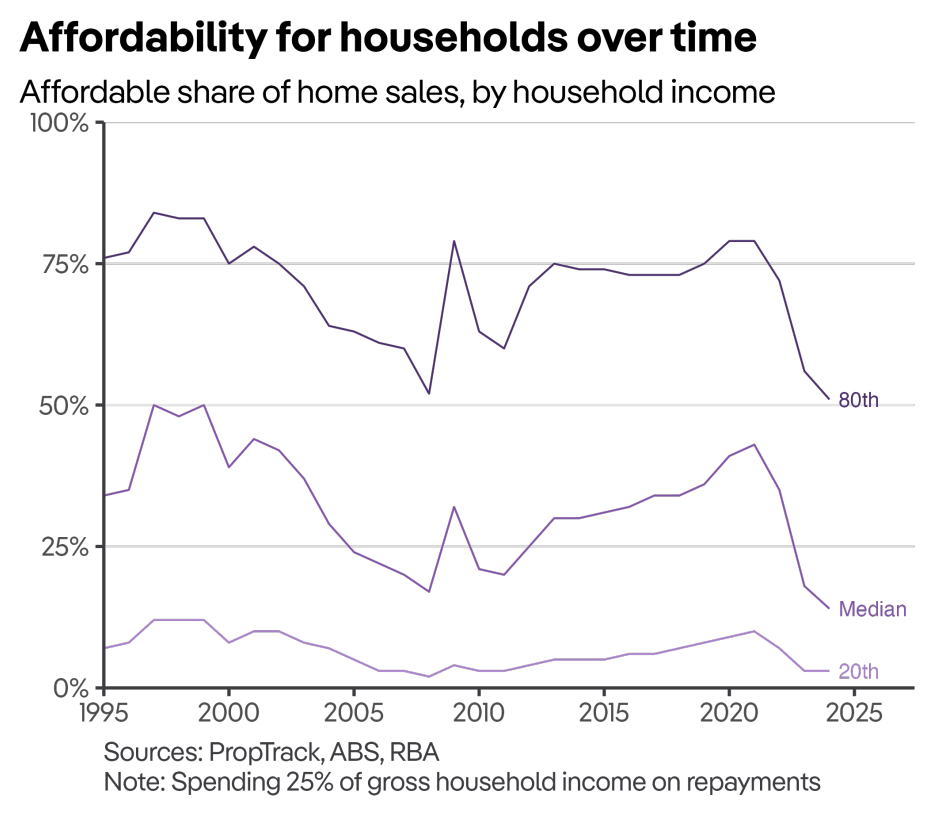

As a result, housing affordability has plummeted to its lowest point on record, according to PropTrack, with median-income households earning just over $112,000 per year able to purchase only 14% of homes sold nationwide in the previous year.

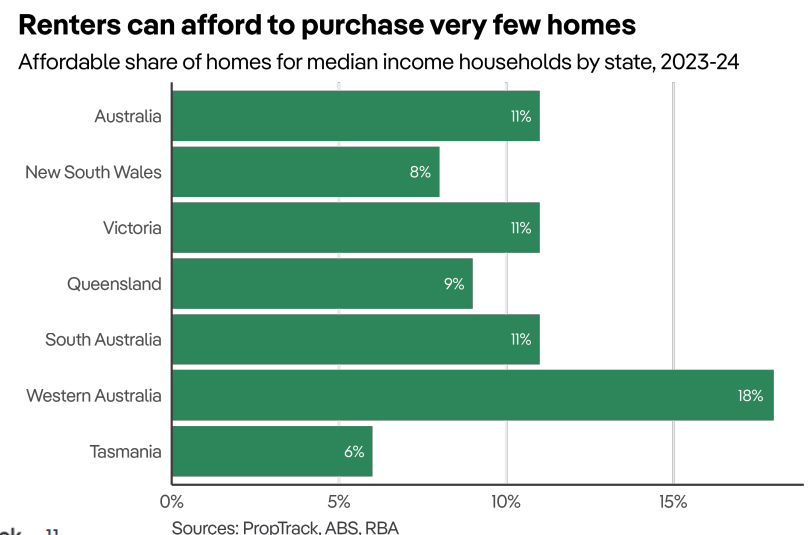

A median-income renting household could only afford 11% of homes sold in the previous year (and just 9% of houses).

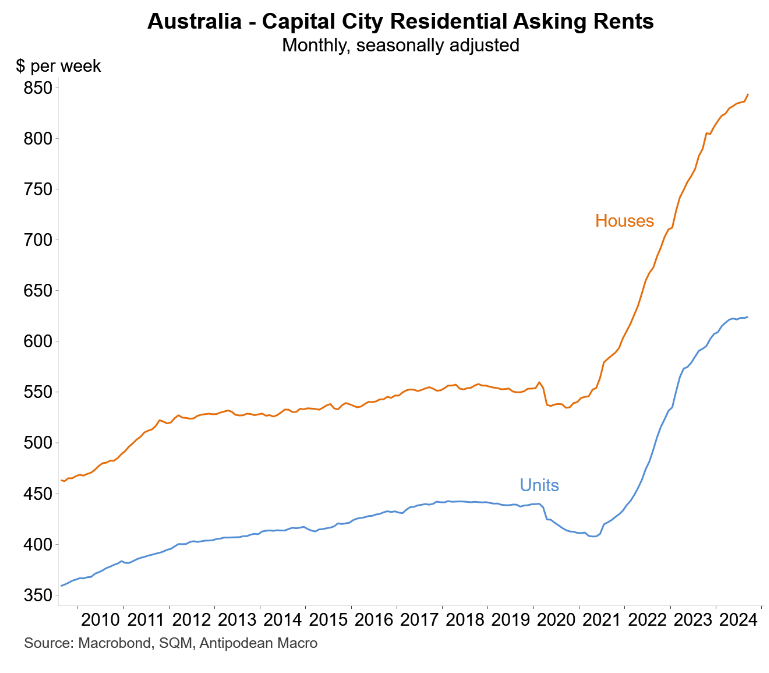

Their situation has also worsened amid the strong rise in rents, which have taken a higher share of renters’ disposable income, making it much harder to save a deposit.

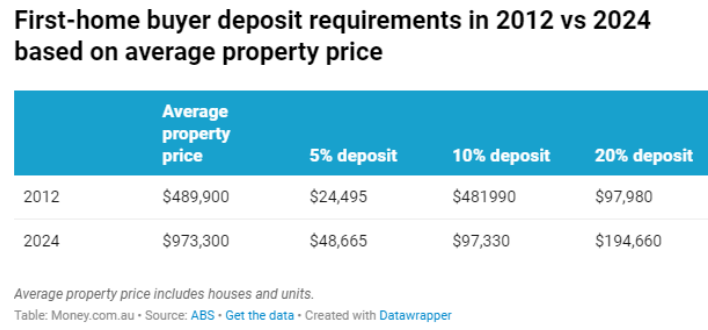

First-time homebuyers must, therefore, save an unprecedented amount of money merely to be able to take out a large mortgage to buy an ordinary home, at the same time as their rental costs have surged.

Accordingly, it has become nearly impossible for a first-time buyer to purchase a home without significant assistance from parents and grandparents.

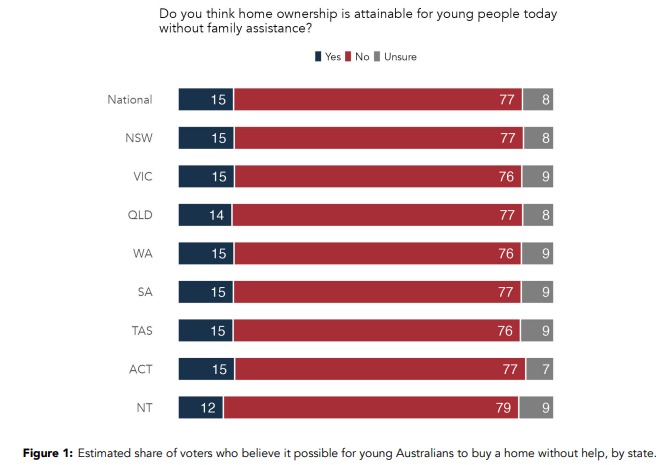

Unsurprisingly, a recent Accent Research survey revealed that only 15% of respondents believe it is possible for young Australians to buy a property without assistance.

Fewer than 8% believe that the next generation of Australians will have a higher quality of life, and just 27% believe their retirement will be financially secure.

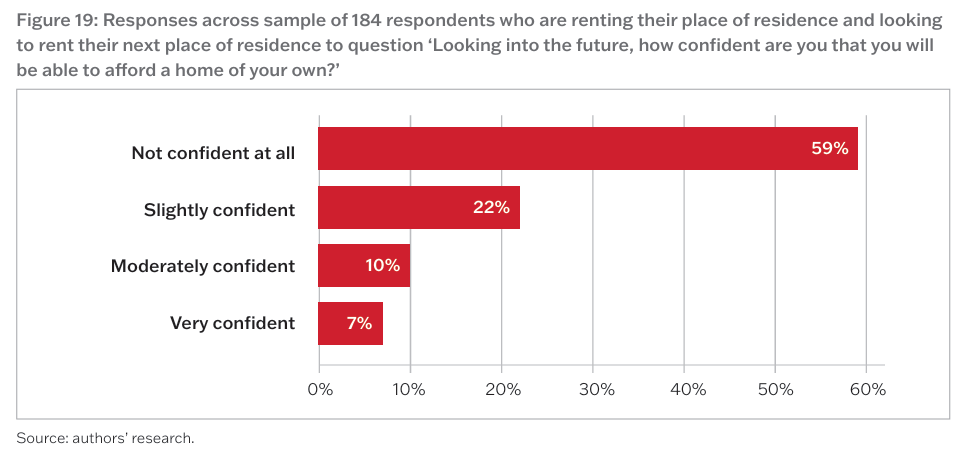

With this background in mind, a new study from the Australian Housing and Research Institute (AHURI) found that while 78% of renters want to buy a home, 59% didn’t think they could.

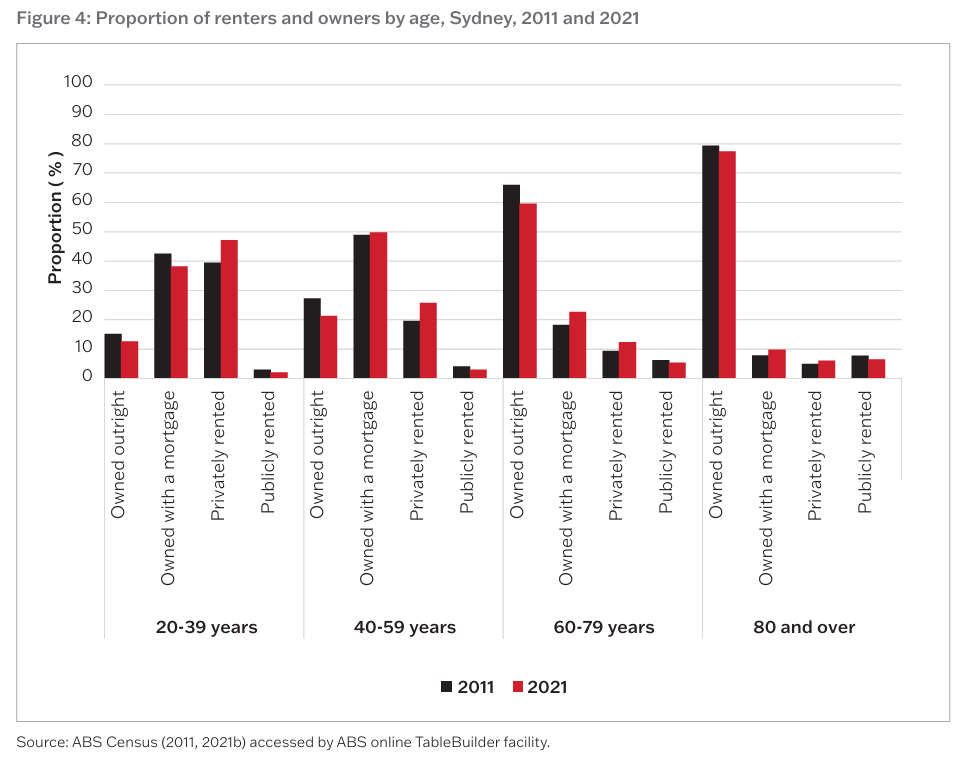

Between 2011 and 2021, the proportion of people renting in the private rental market increased in all age brackets, from 20-year-olds to people aged 80 and above.

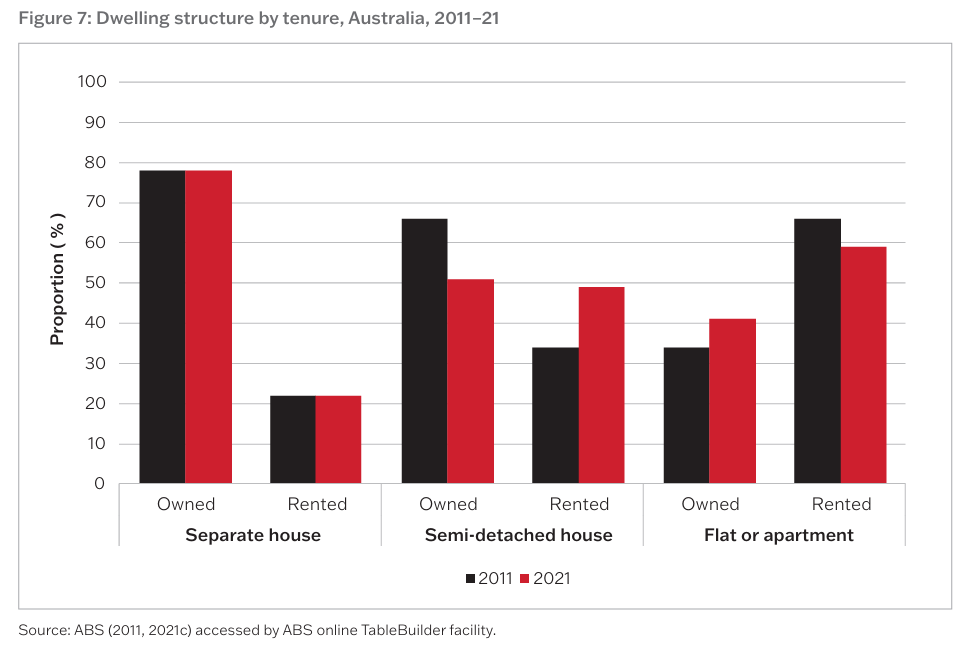

All of the growth in rental tenure has been in higher density dwellings, like apartments and townhouses.

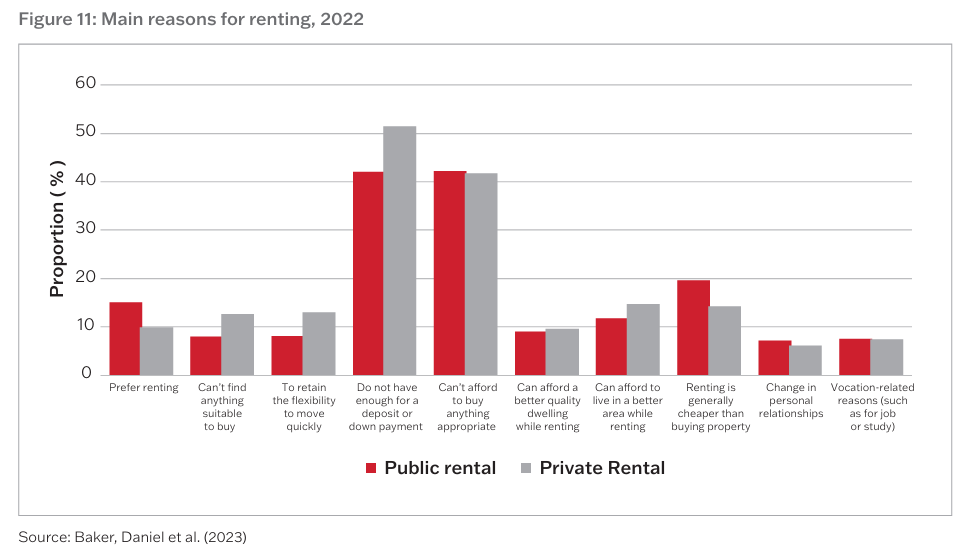

The key motivations for renting are financial, based primarily on affordability grounds.

“This shows a significant shift for Australian renters. Whereas previously anyone who desired home ownership believed they would be able to move into that tenure, now more Australians are conscious that this dream may not be a possibility for them”, lead researcher Professor Emma Baker, of the University of Adelaide, said.

Australia is no longer the nation of the ‘fair go’. It has transformed into a class-based society whereby the majority of future Australians living in the major cities will rent high-rise shoebox apartments.

Intergenerational wealth transfer has replaced the Australian Dream of home ownership.