The Market Ear on the gold puke.

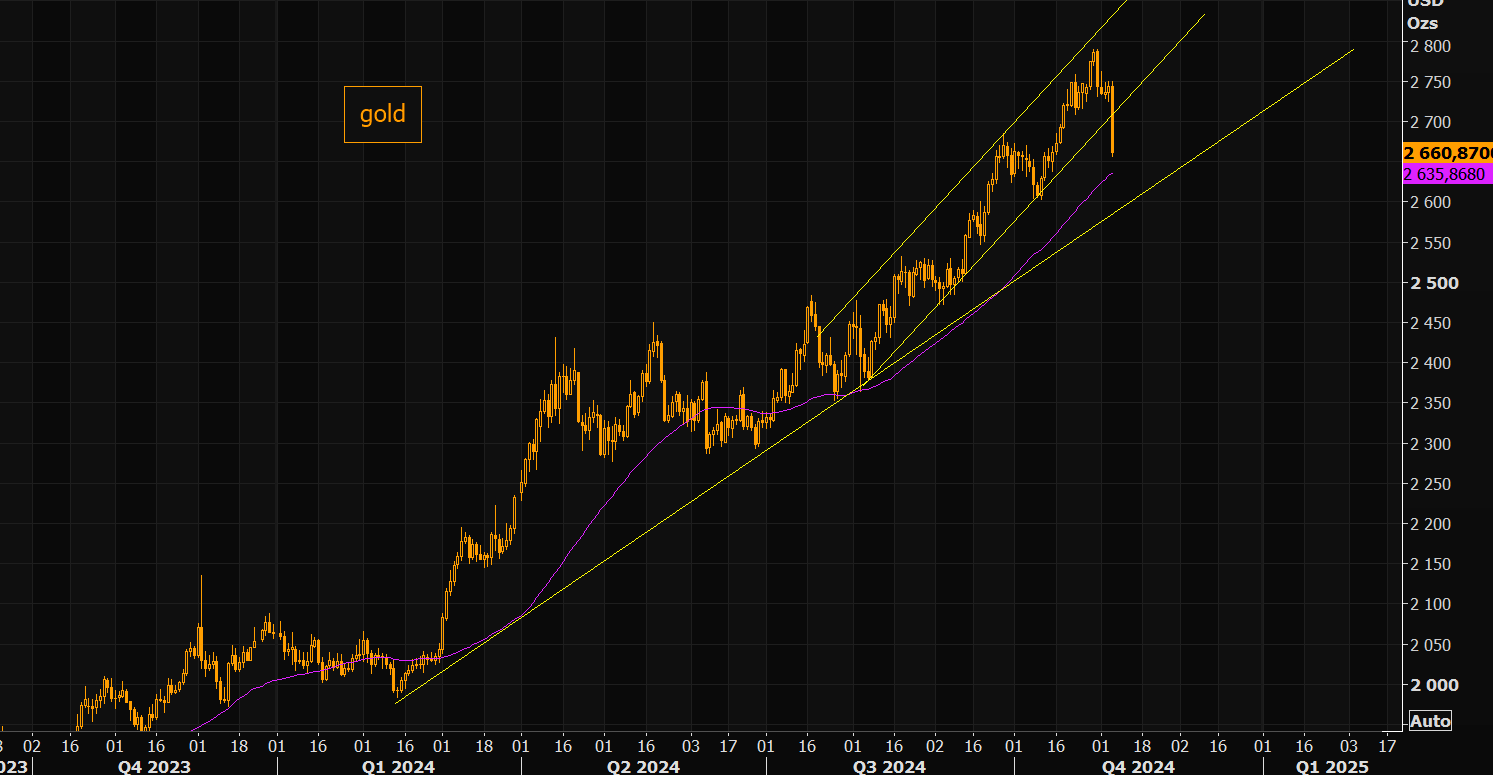

All good things…

….must come to an end. Gold is puking, putting in the biggest down candle in forever as it breaks below the short term trend channel. The 50 day comes in around $2635, and the bigger trend line around $2600.

Refinitiv

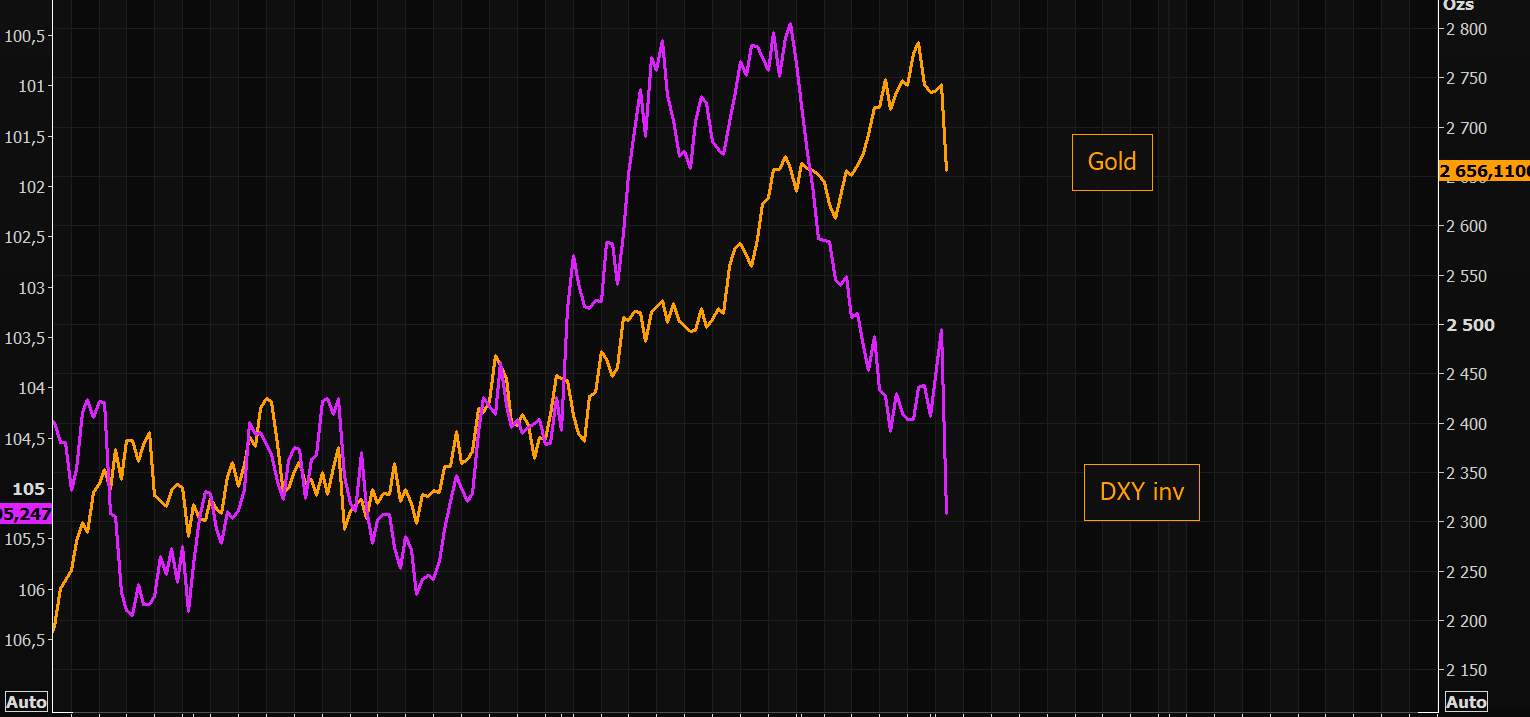

Can’t handle the dollar

Gold waking up to a “new” world where it simply can’t take the dollar strength.

Refinitiv

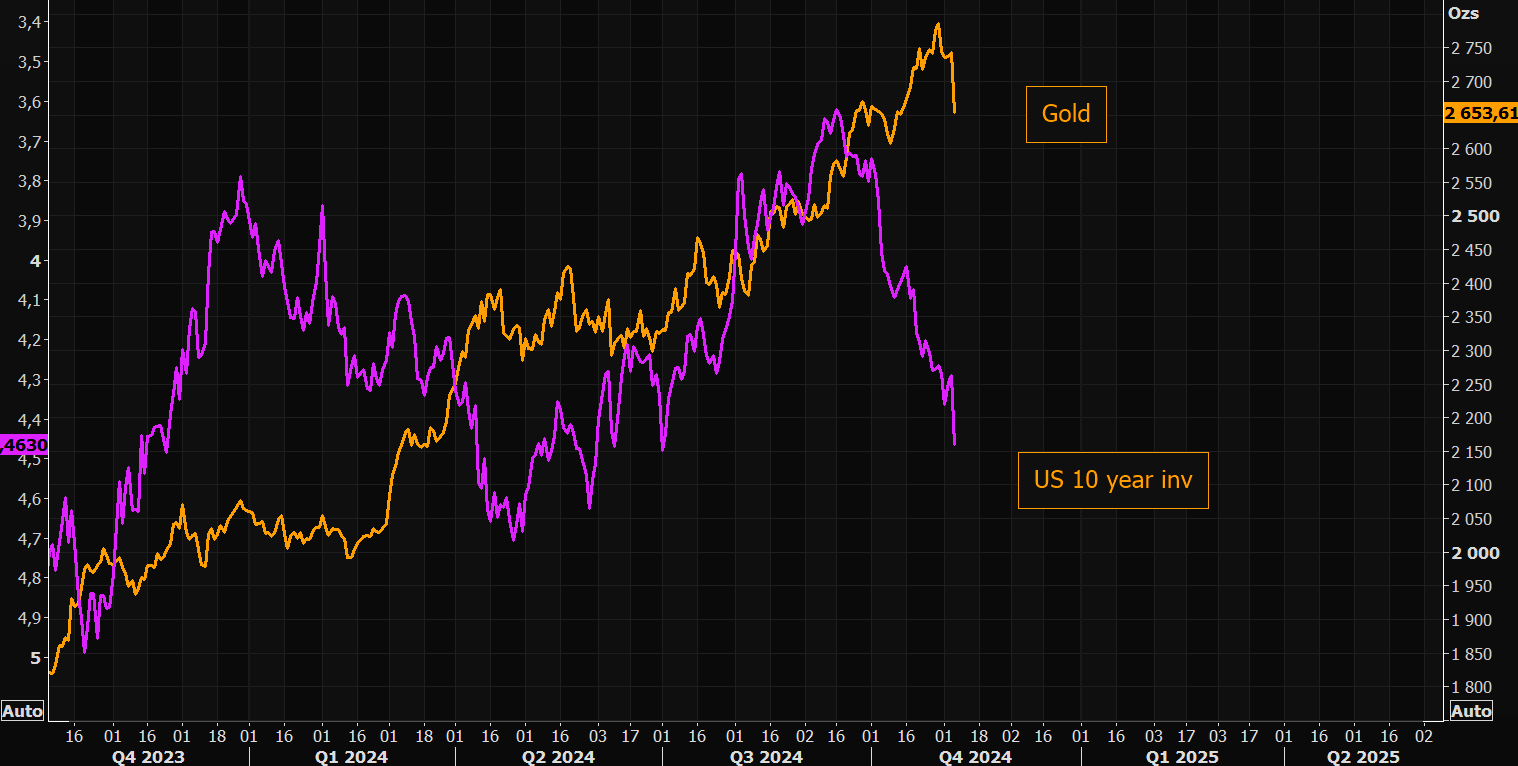

The gold vs rates gap

Imagine rates start to matter for gold…

Refinitiv

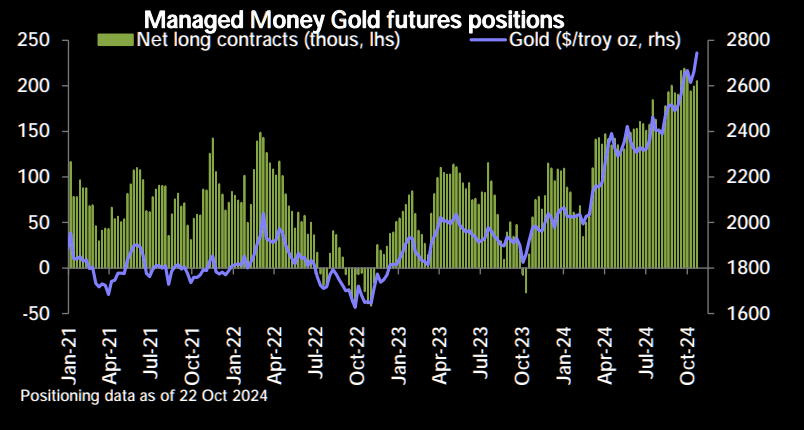

Goldilongs

The crowd is very long gold.

DB

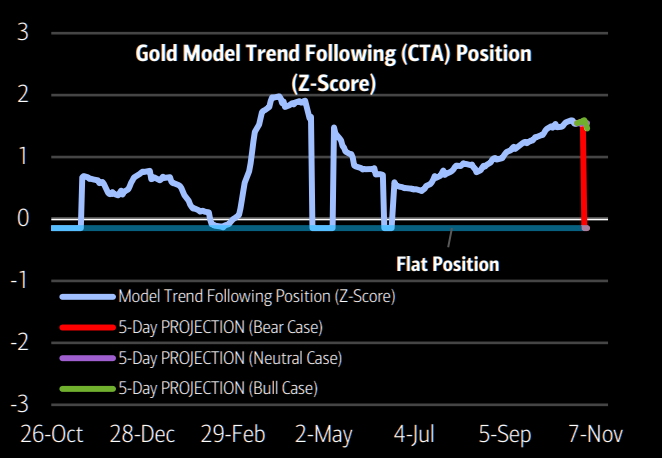

Beware potential gold sellers

CTA downside convexity in gold could get “dynamic”…

BofA

We could add that gold ETFs are brimming over.

It may not be all bad for gold in the medium term if you believe that US deficits will face some kind of bond vigilante reckoning.

I don’t.

Fewer wars, plus an inflationary American boom coupled with a deflationary global bust, are not promising for gold.