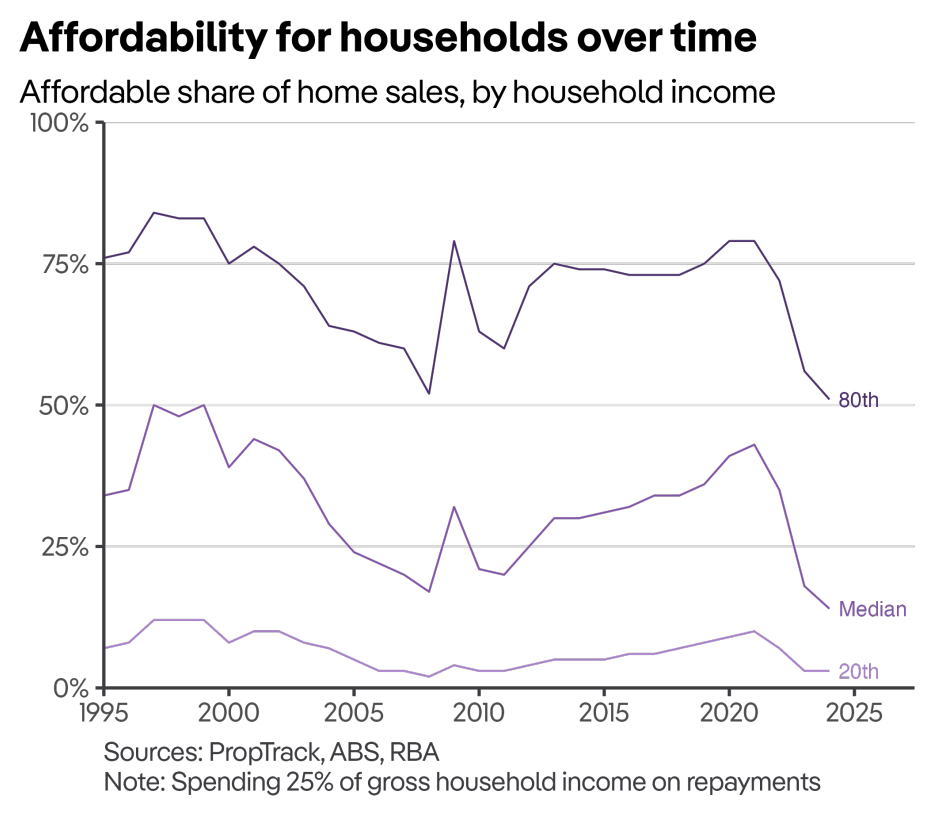

Last month, PropTrack released data showing that Australian housing affordability has declined to its lowest level on record with median-income households earning just over $112,000 a year able to afford only 14% of homes sold across the nation.

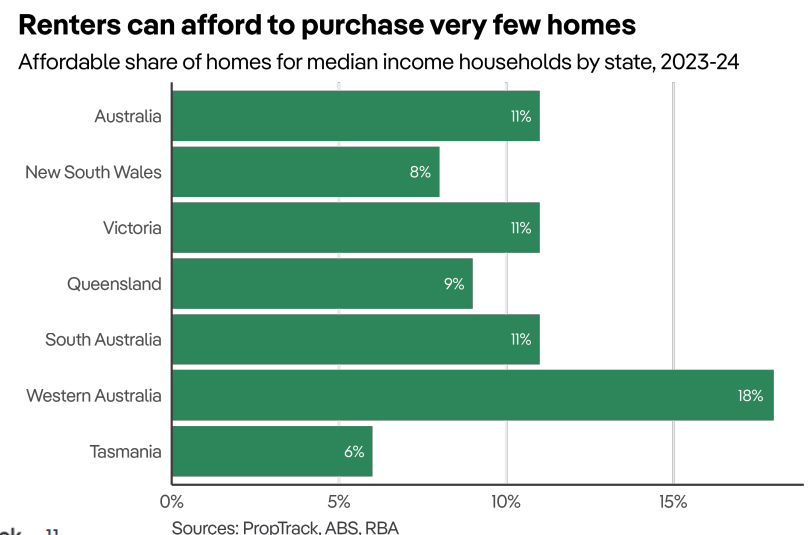

A median-income renting household could only afford 11% of homes sold in the previous year (and just 9% of houses), according to PropTrack.

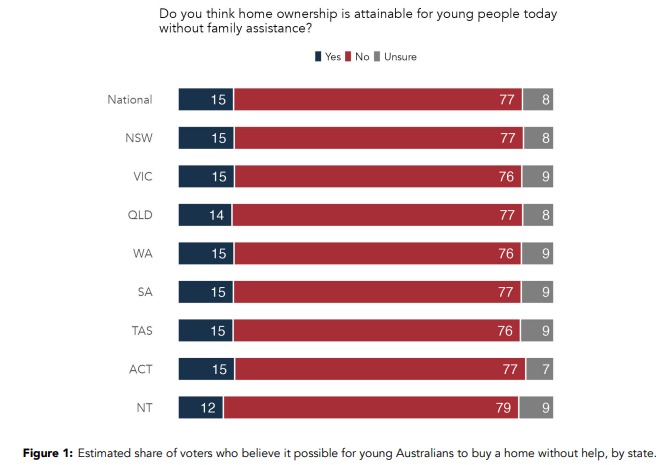

A survey by Accent Research also found that only 15% of respondents believed that young Australians could purchase a home without financial assistance.

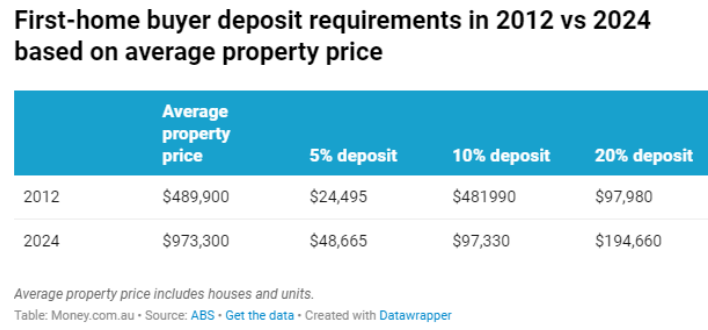

Money.com.au also estimated that first-time homebuyers needed to save an unprecedented deposit merely for the privilege of taking out a mega-mortgage for an ordinary home.

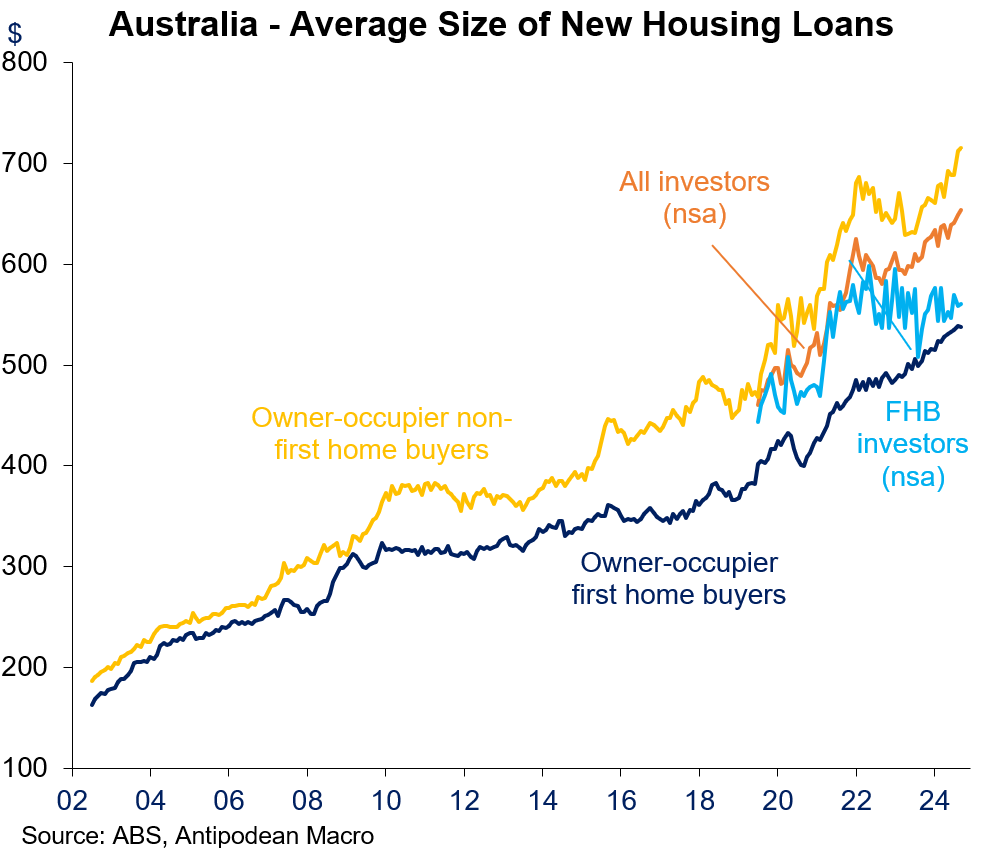

These results came as the average first-home buyer owner-occupier mortgage rose to a record high of $538,200 in September 2024.

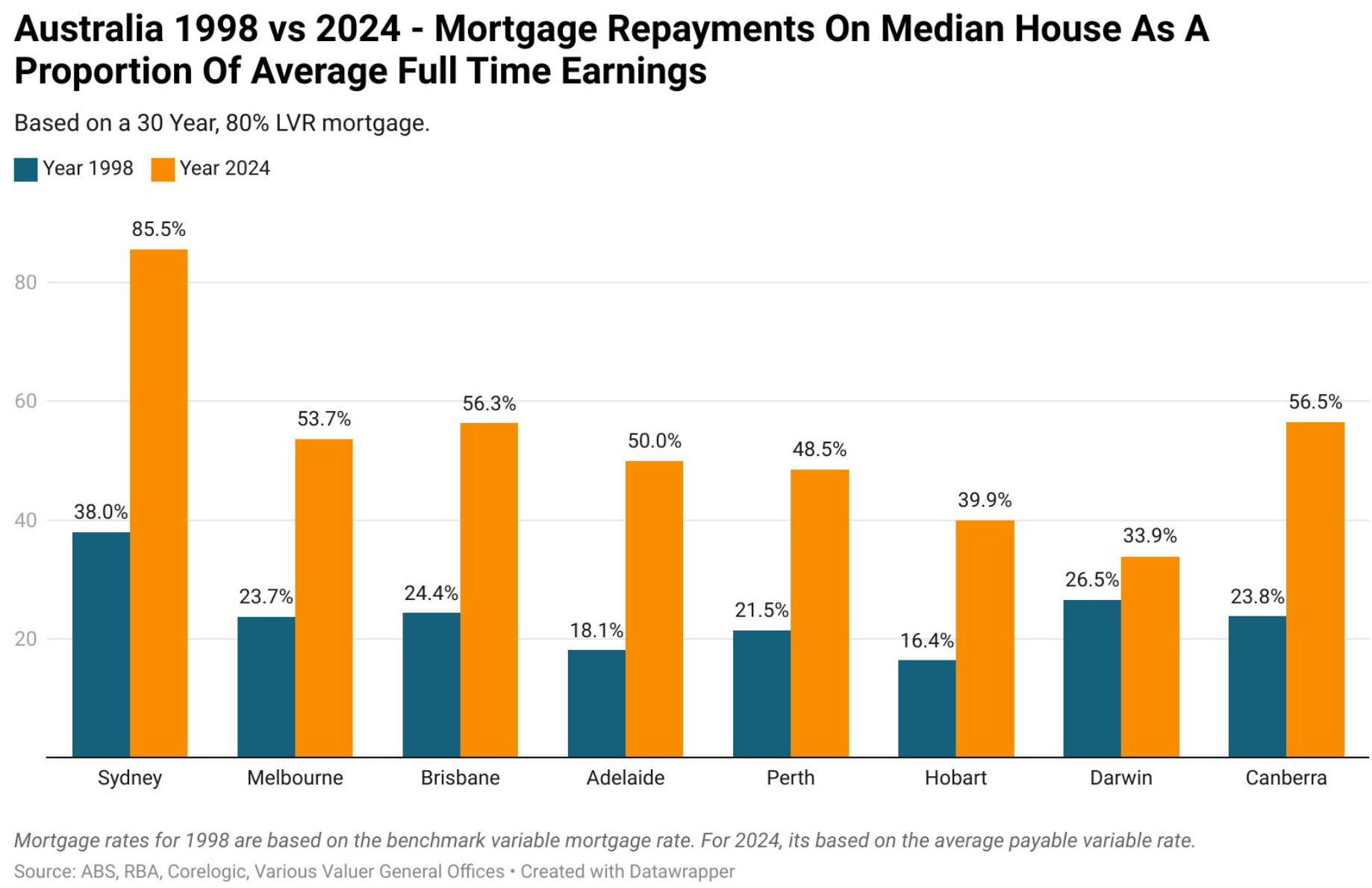

Independent economist Tarric Brooker posted the following chart on Twitter (X) comparing Australian housing affordability in 1998 versus 2024.

Brooker notes that the 1998 figure is based on benchmark rates, whereas the 2024 figure is based on actual payable rates (which is much lower than benchmark rates). Income inequality has also pushed the average away from the median since 1998.

Both comparisons also assume a 20% deposit and required transaction costs.

As you can see, affordability has deteriorated massively since 1998 across every market except Darwin.

Brooker notes that “in 1998, an Australian household on a single average full time income could afford a median priced house in every capital bar Sydney”. Today, only Darwin in moderately affordable.

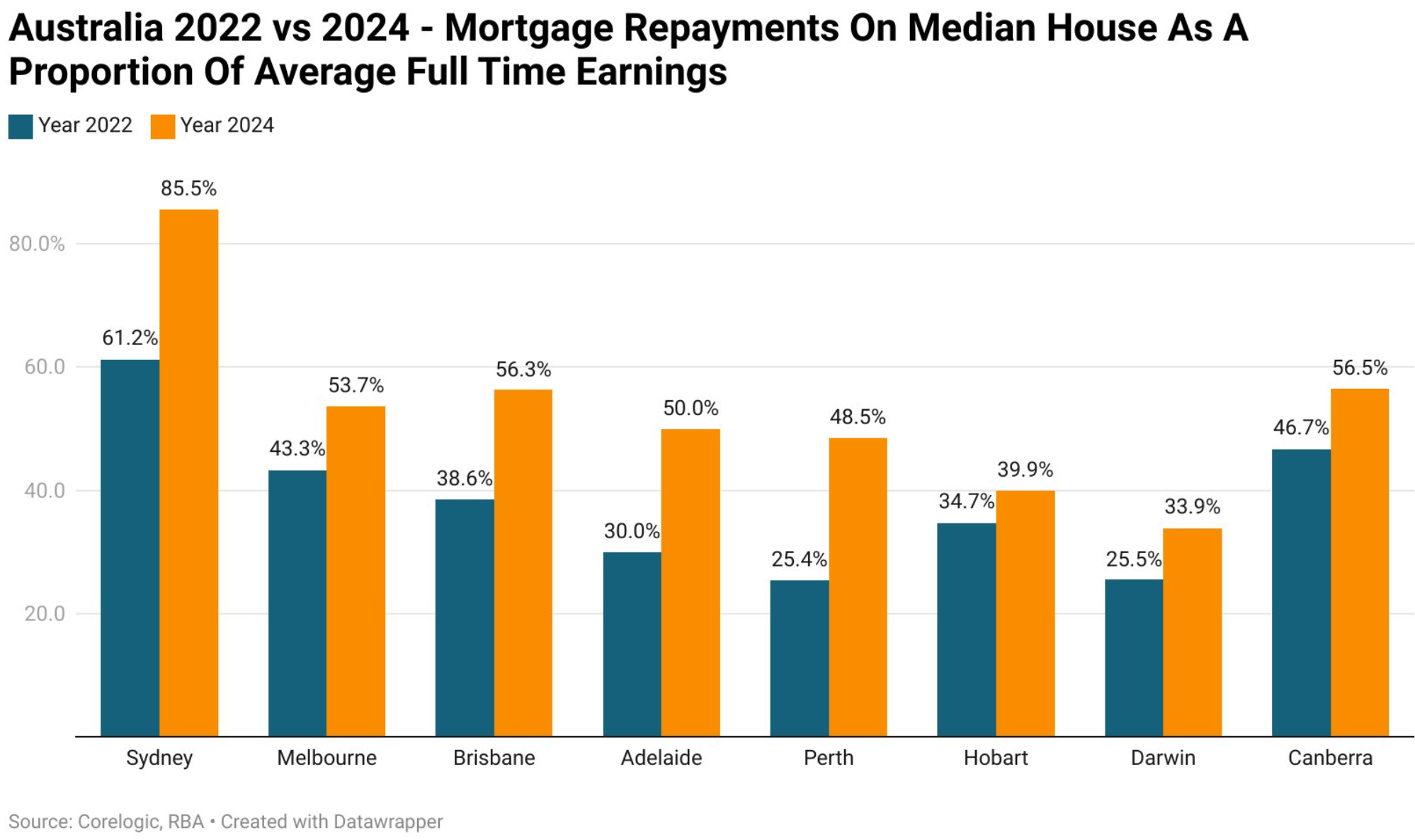

Interestingly, housing was also far less affordable in 2022 before the RBA commenced its monetary tightening cycle than it was in 1998:

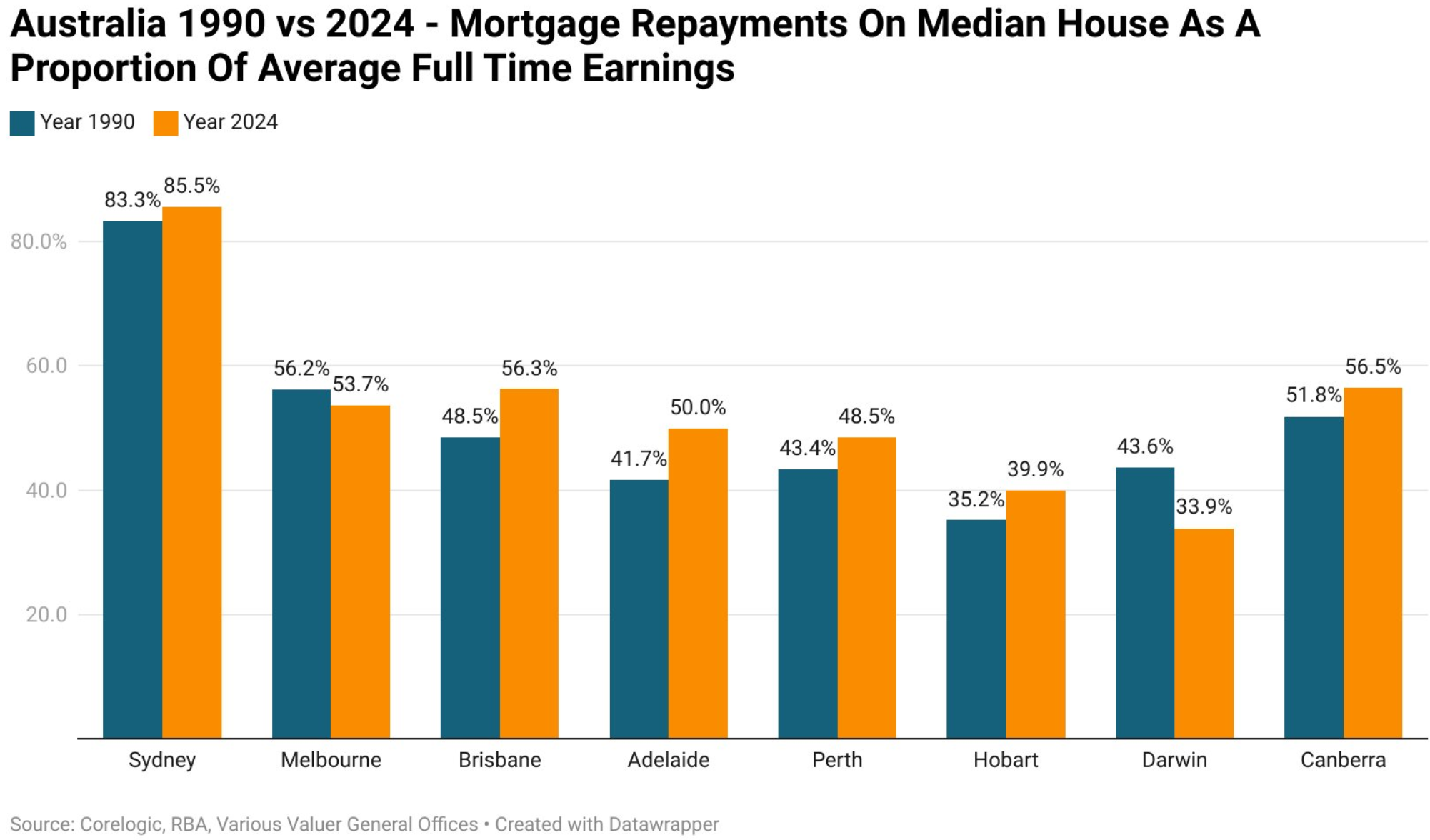

Brooker also estimates that mortgage repayments are higher today than in the 1990s when interest rates hit 17%:

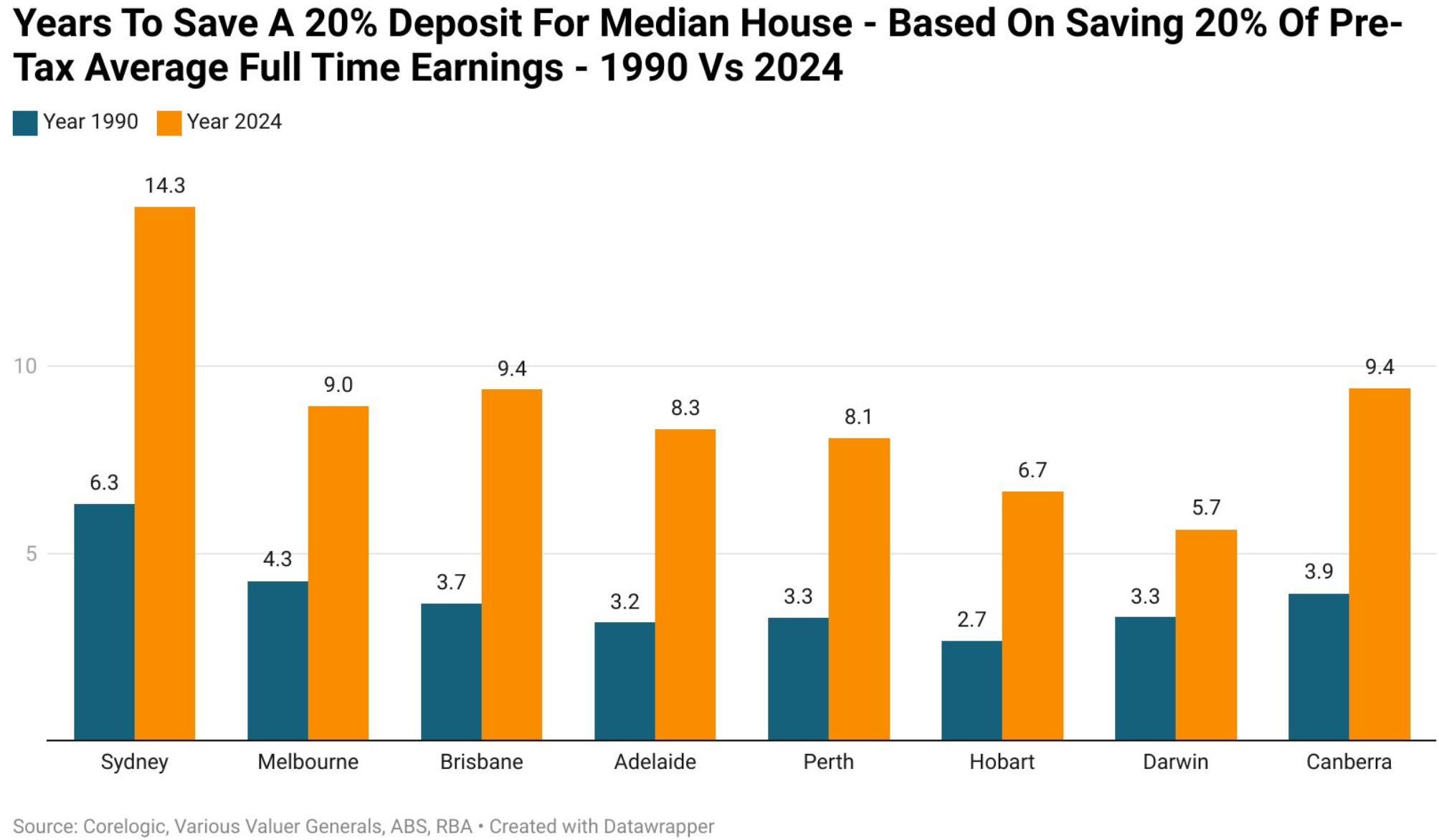

The time taken to save a housing deposit is also far longer today than in 1990:

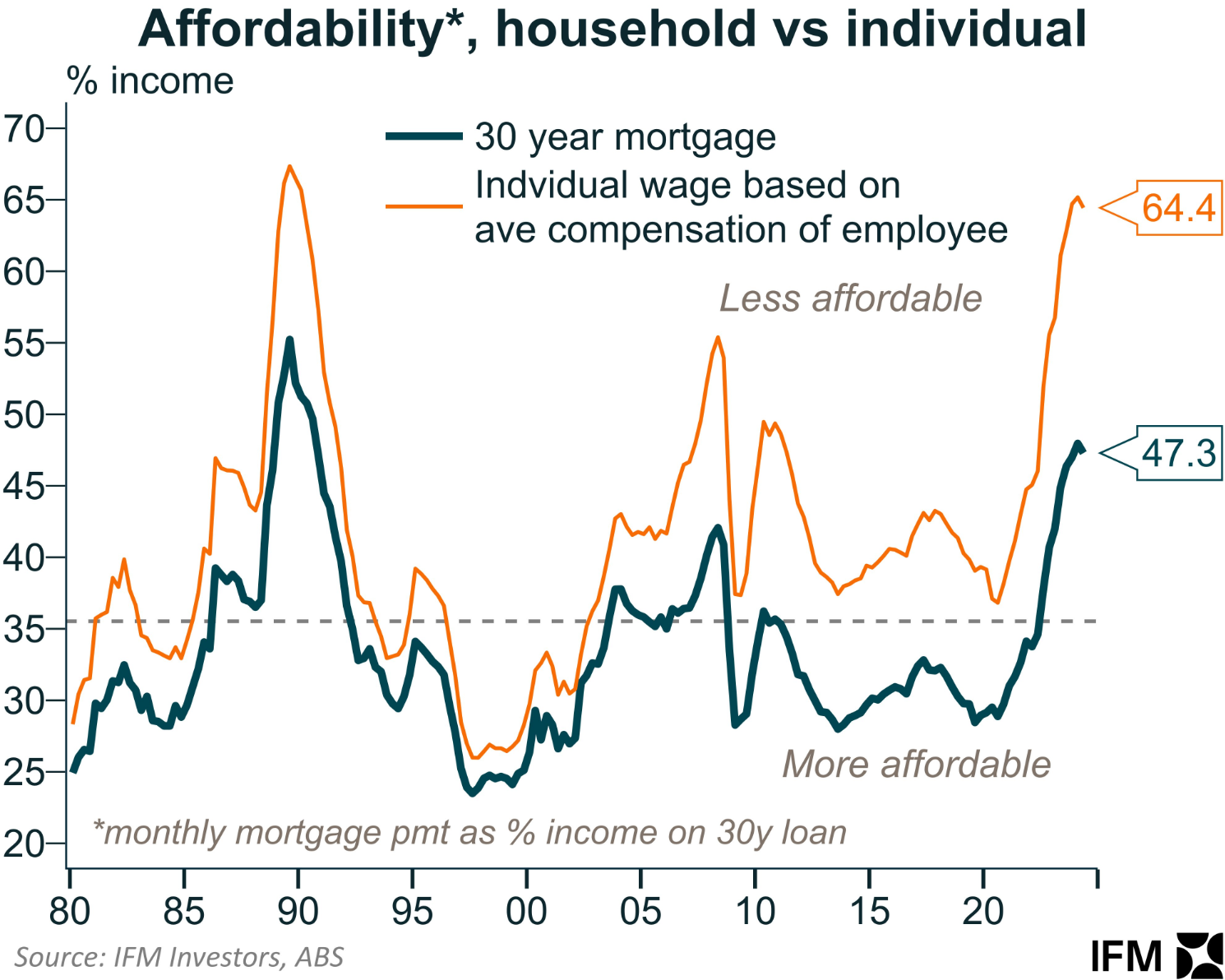

The following chart from Alex Joiner from IFM Investors tells a similar story, although mortgage repayments as a share of income in 1989-90 were slightly higher than today:

“It will be a story we will tell children in future that there was once a time in Australia when a one income household (or individual) could buy a house”, Joiner commented on Twitter (X).

Regardless, it is clear from the data that Australia is no longer the nation of the ‘fair go’ and has transformed into a class-based society.

Intergenerational wealth transfer has replaced the Australian Dream of home ownership.