Independent economist Tarric Brooker has posted an analysis estimating the shortfall of Australian housing over the pandemic.

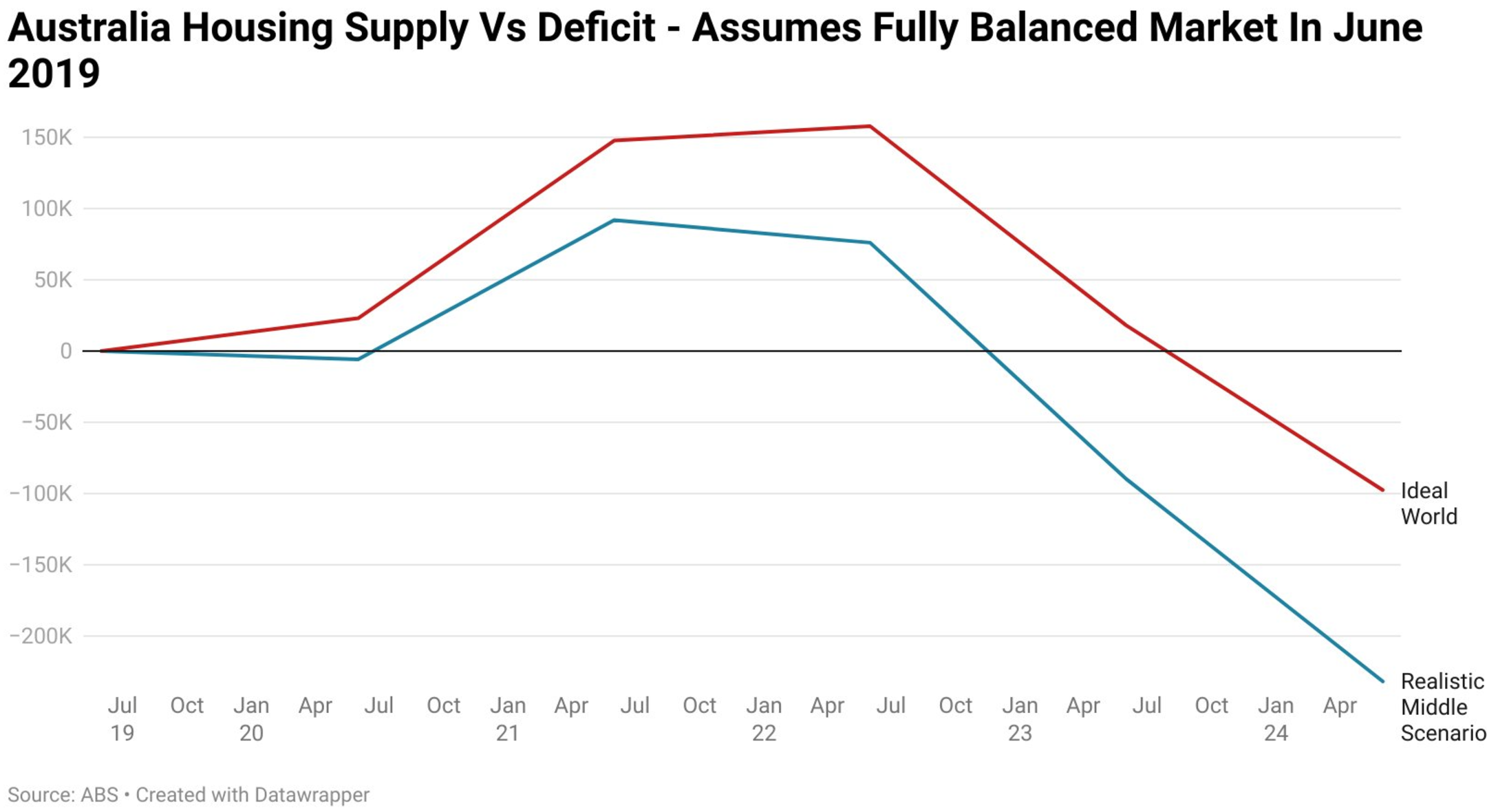

Brooker has assumed two scenarios, explained below.

The Ideal World Scenario:

- Not one dwelling completion in the last 5 years is a knockdown rebuild or development (in reality 10-15% are).

- Not one newly completed home will sit empty (5-10% of homes are empty at any given time).

- No dwelling completions are holiday homes or AirBnbs.

- That the nation was fully adequately supplied with homes in June 2019.

- Then the actual growth in the number of households is added (direct from the ABS) to calculate the net balance.

The Realistic Scenario:

As above, but assumes:

- Conservatively, one in 10 homes is a knockdown and rebuild; and

- 5% will remain empty.

As illustrated in the following chart from Brooker, Australia’s housing deficit has grown by 98,000 homes between June 2019 under the ‘ideal world’ scenario.

However, under the ‘realistic” scenario, Australia’s housing deficit grew by 232,000 homes over the same period.

Source: Tarric Brooker

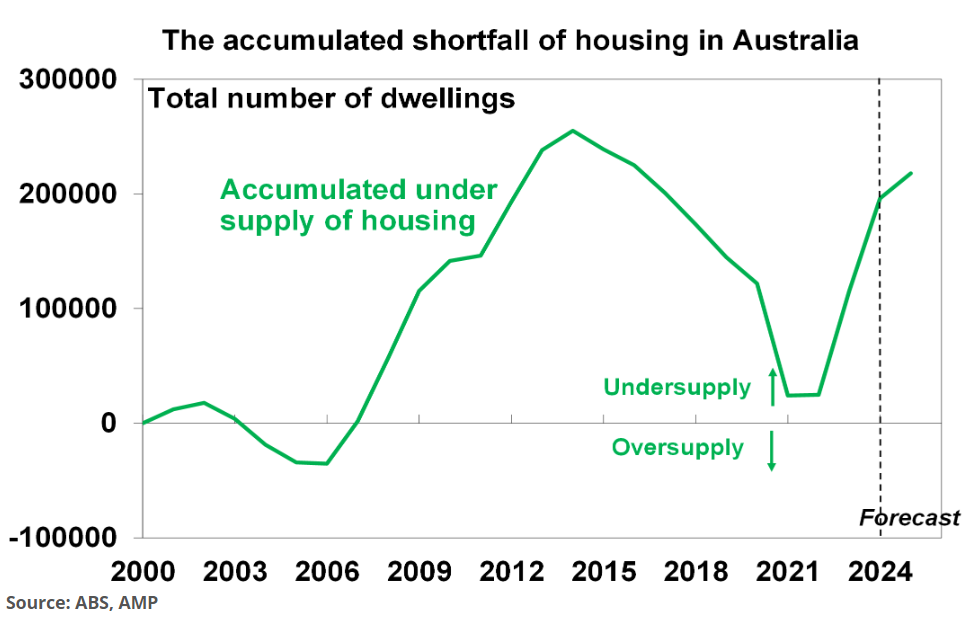

Brooker’s estimates compare to those of AMP chief economist Shane Oliver, who estimated in June that Australia’s housing shortage had surpassed 200,000 after being nearly eradicated at the beginning of the pandemic.

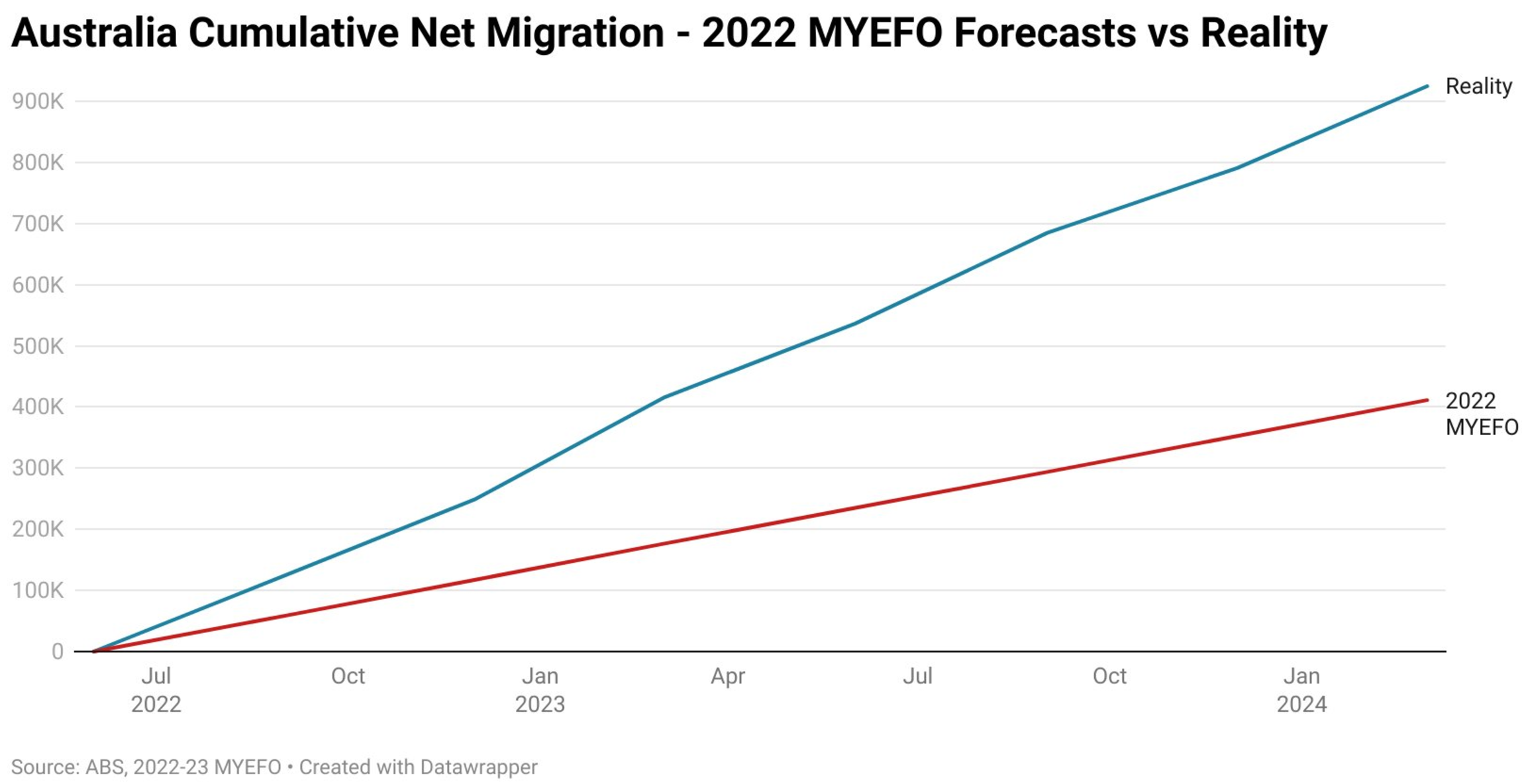

Both estimates come in the context of net overseas migration exceeding Labor’s initial projections by 513,000 in just 21 months:

Source: Tarric Brooker

The federal budget and the Intergenerational Report projected that Australia’s net overseas migration would remain high at 235,000 per year forever.

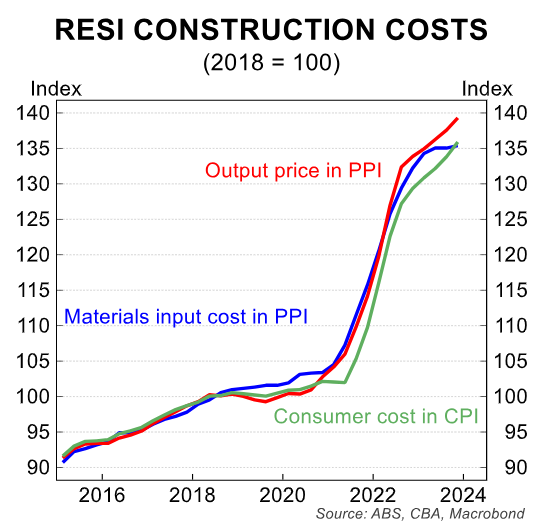

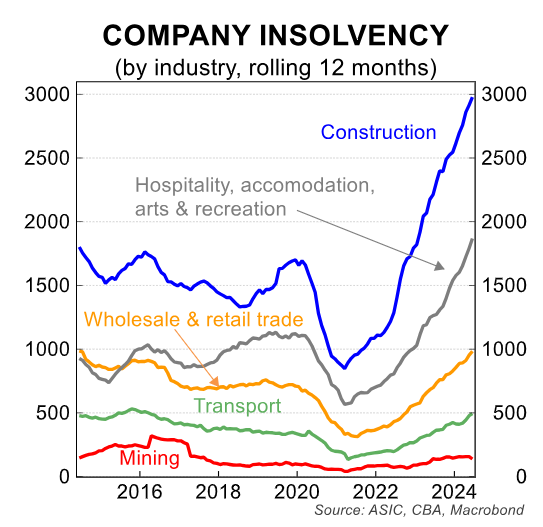

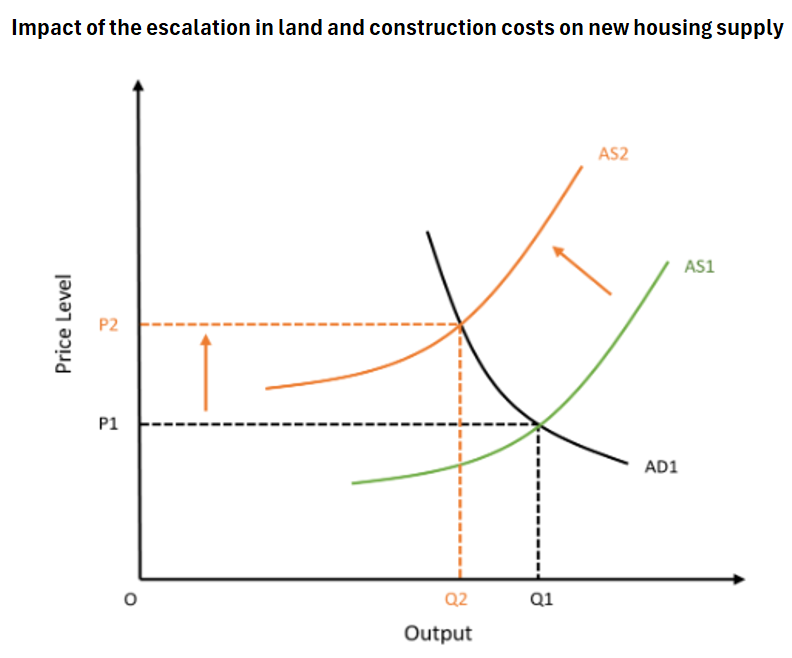

At the same time, the supply side has been hindered by structurally higher construction costs, interest rates, labour shortages, and builder insolvencies.

These forces have effectively shifted the supply curve for Australian housing to the left, reducing capacity and increasing prices.

Australia’s housing shortage will continue to grow as long as the federal government continues to pursue a high immigration policy.