The Westpac card tracker is not happy.

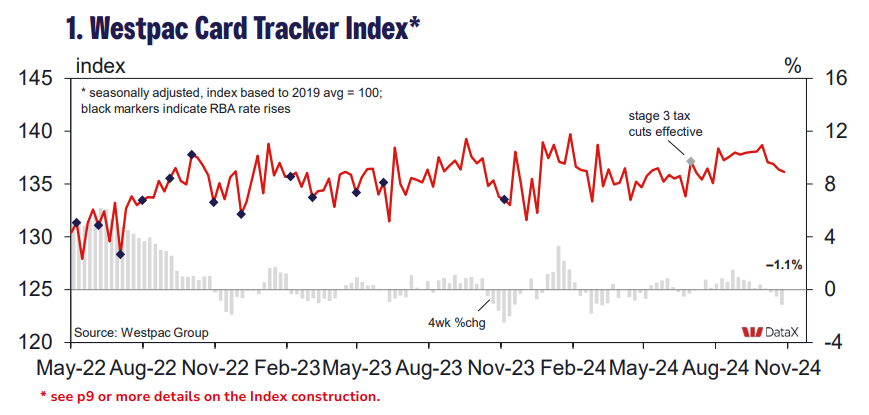

The Westpac Card Tracker Index* declined further over the last fortnight, falling -0.7pts to 136.2 for the week ended November 2.

With the full October results now on hand, Q4 seems to have begun on a weak footing. The index has fallen for four consecutive weeks, a result only evidenced three times before (excluding the COVID-19 period), finishing October -0.4% lower than September.

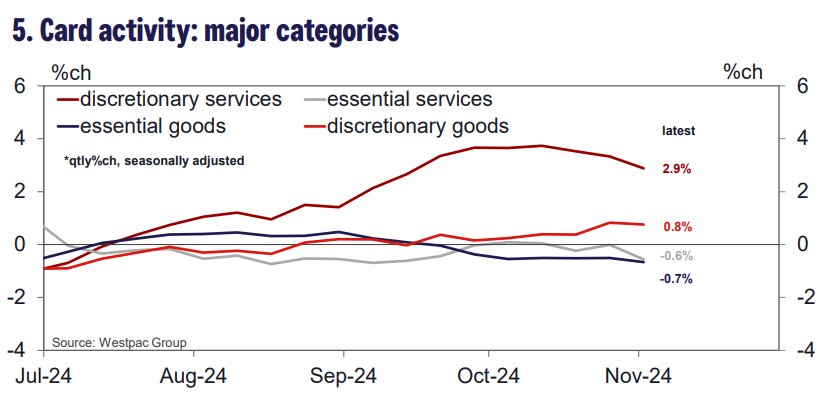

The category breakdown continues to show spending activity concentrated on discretionary goods and services. However the monthly pulse points to some notable slowing, particularly for vehicle and travel related spending.

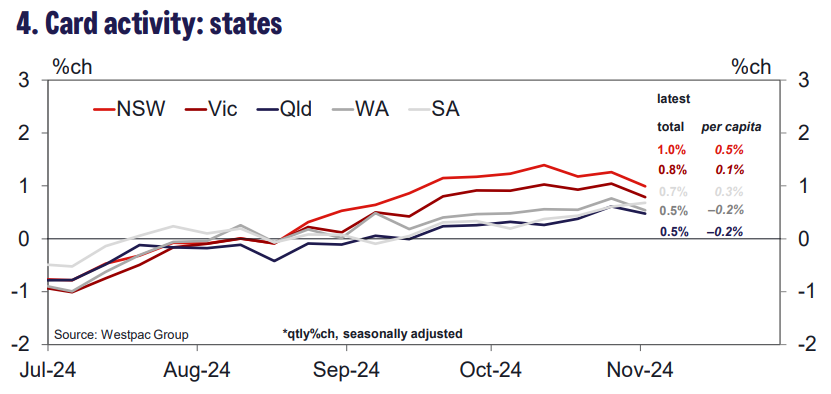

By state, spending-related card activity in WA has continued to pick up in recent weeks, even on a per capita basis. This stands in contrast to other states, where momentum has slowed.

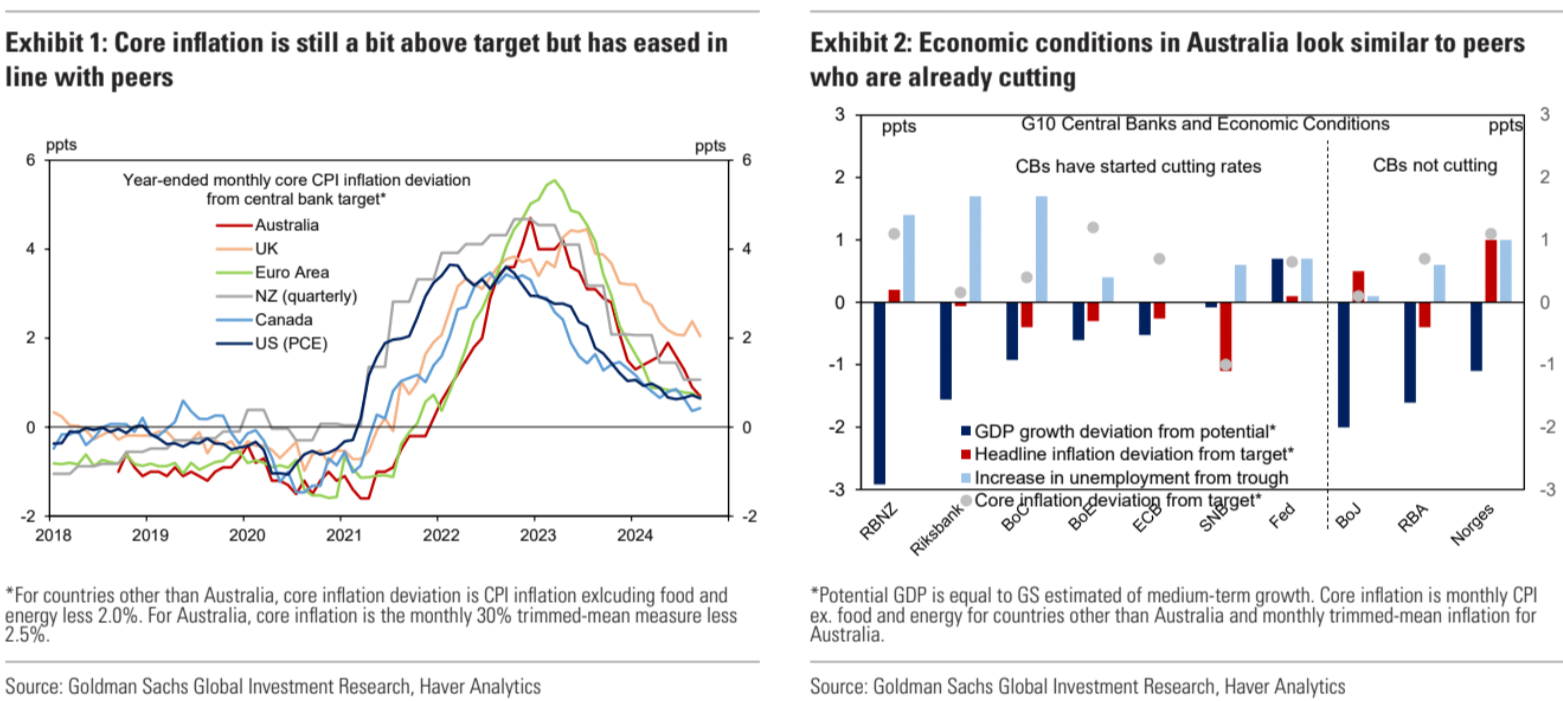

The RBA is smoking some kind of cruelty crack. Inflation is back in the range and crashing. Energy rebates will be extended. Rents are pulling back. Immigration-crushed wages are going nowhere and will kill services inflation. Administered prices will crash. Trump tariffs smash goods prices even more.

Australia is no different from other DMs where rates are tumbling.

Cut the rates you fed and fattened bullhawks.