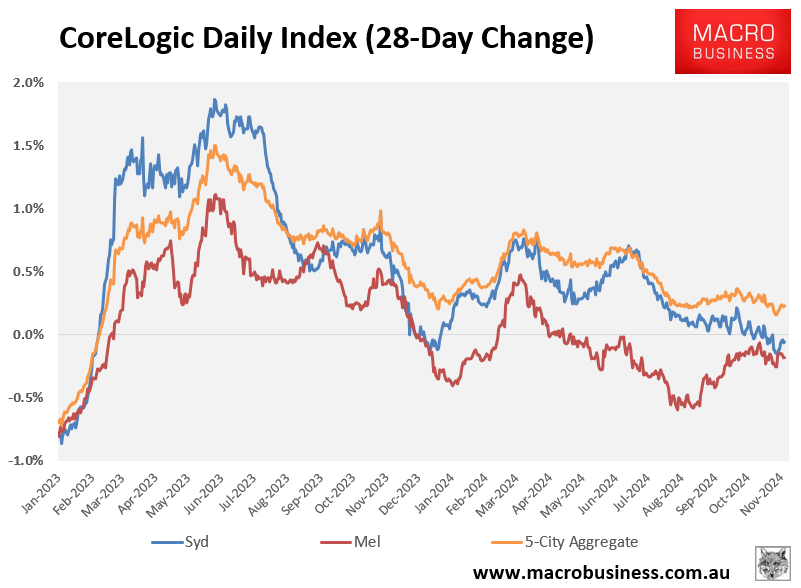

CoreLogic’s daily dwelling values index shows that Sydney and Melbourne home values are now falling, down 0.1% and 0.2% over the last 28 days, respectively.

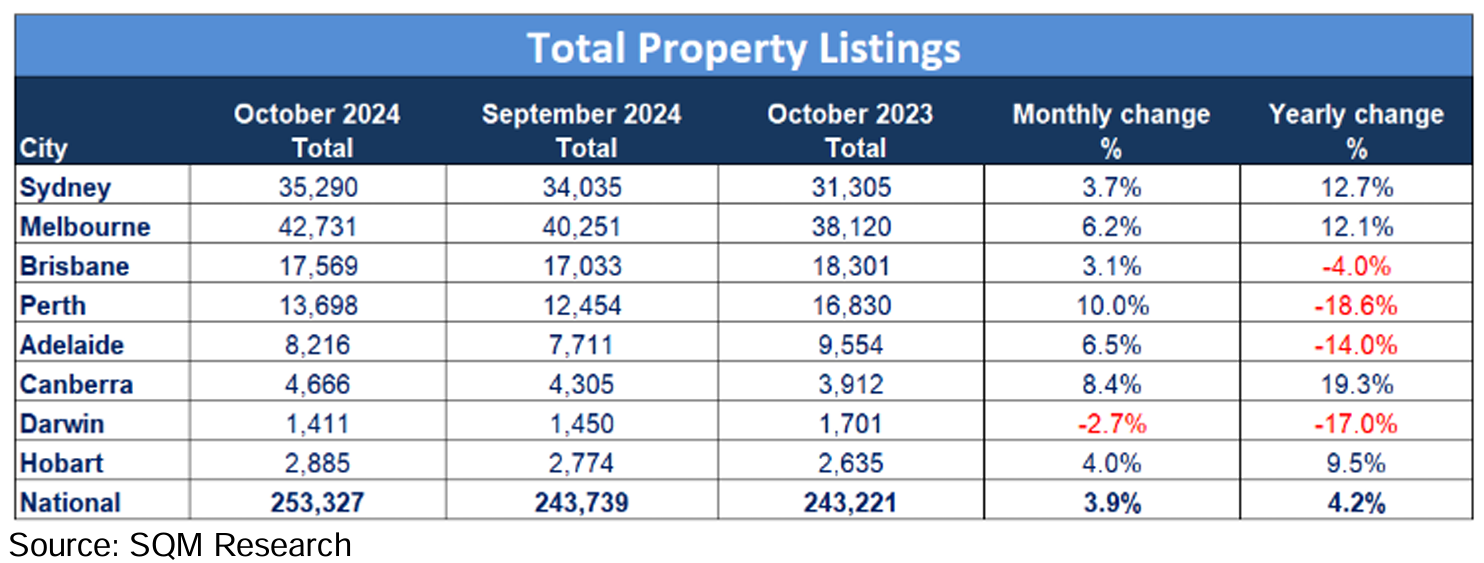

SQM Research released data on the number of for-sale listings, which revealed that Sydney (+12.7%) and Melbourne (+12.1%) have experienced the sharpest rise in listings out of the major capital city markets over the past year:

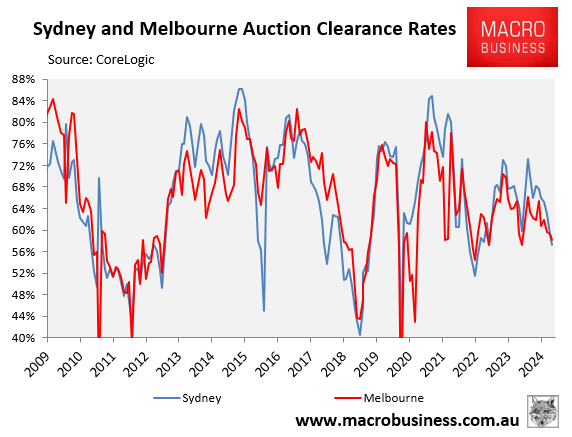

The rise in listings is also reflected in the auction market, where final auction clearance rates have tanked.

As illustrated in the following chart, Sydney’s final auction clearance rate came in at 57.2% last week, after the previous week recorded the lowest clearance rate the city has seen all year (55.9%).

Melbourne’s final auction clearance rate fell to 58.1%, down from 62.3% over the previous week.

This is why prominent Sydney auctioneer Tom Panos advised vendors not to list their homes this year because “there’s so much stock in the marketplace”.

“An over supply of listings is the killer to price growth”, Panos said. “That is why vendors are dropping their prices”.

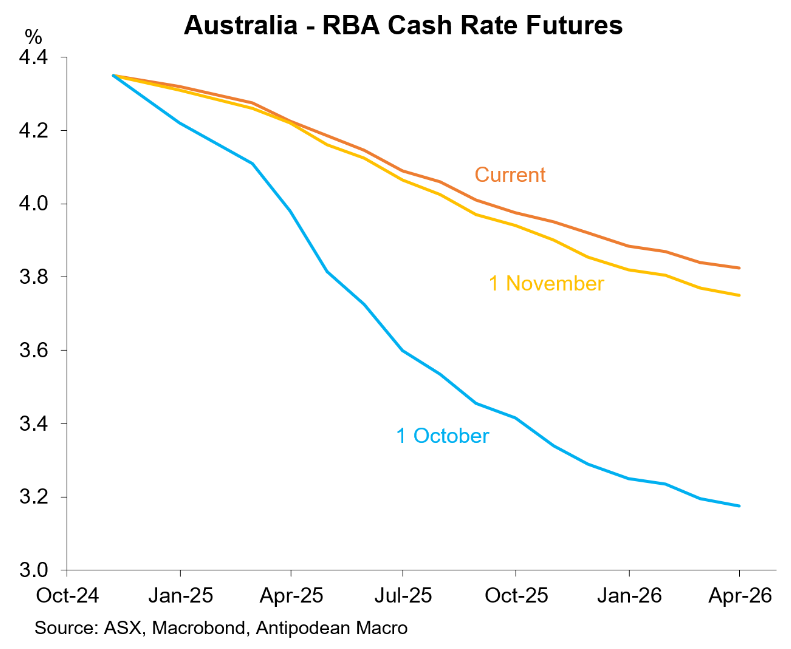

The delay of expected interest rate cuts into the middle of next year is also likely to dampen buyer enthusiasm.

This was the view of Kevin Brogan, a director of national valuation firm Herron Todd White.

“You do get the sense that property market activity is slowing”, Brogan told The Australian Financial Review.