Sydney’s housing market is in a slump as 2024 draws to a close, with auction clearances and values declining simultaneously.

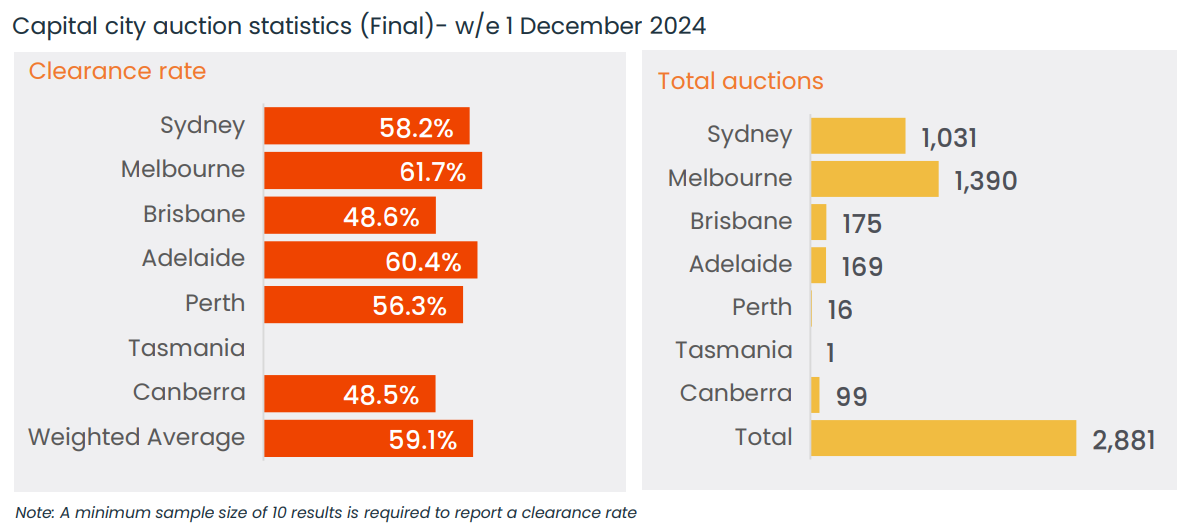

CoreLogic’s final auction results for last weekend showed that Sydney recorded its sixth consecutive weekly result below 60%.

Sydney’s final clearance rate was 58.2% last weekend, down from the 59.0% recorded prior week.

Source: CoreLogic

One year ago, 62.5% of Sydney auctions were successful.

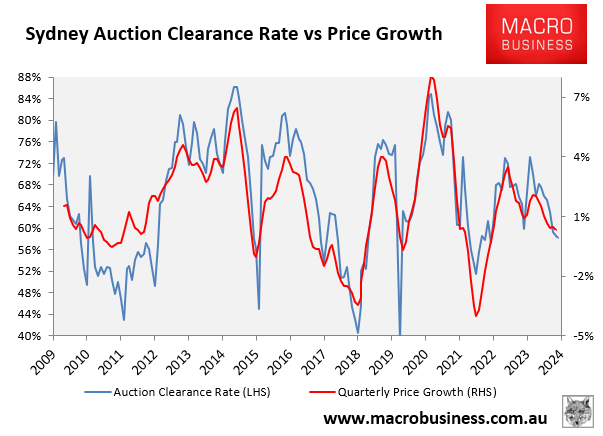

The following chart plots Sydney’s monthly average final auction clearance rate against quarterly dwelling value growth.

As you can see, there is a strong correlation between the decline in the auction clearance rate and house price weakness.

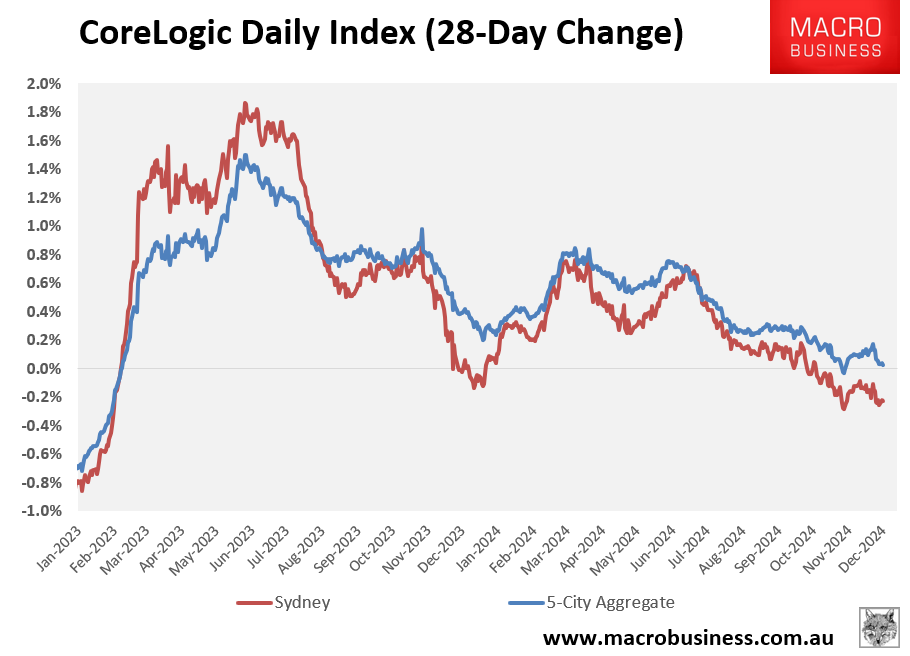

Indeed, CoreLogic’s daily dwelling values index shows that Sydney values are trending down on a rolling 28-day basis.

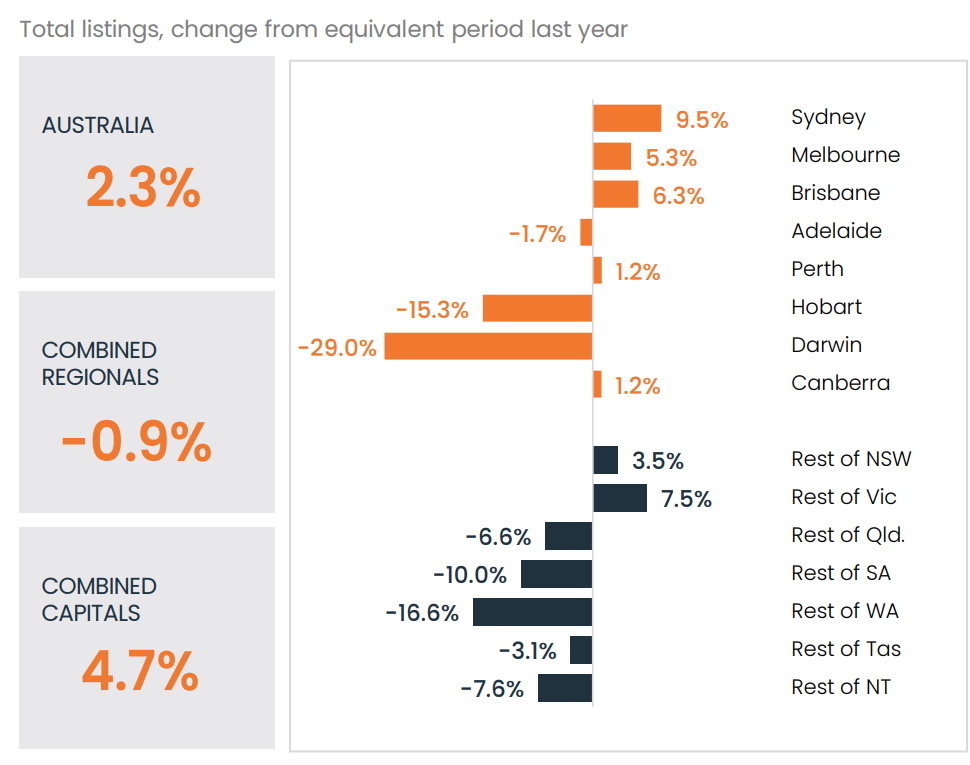

One key factor weighing on Sydney auction clearance rates and values is the increase in properties listed for sale.

Source: CoreLogic

As shown above, Sydney has recorded the most significant rise in listings in Australia.

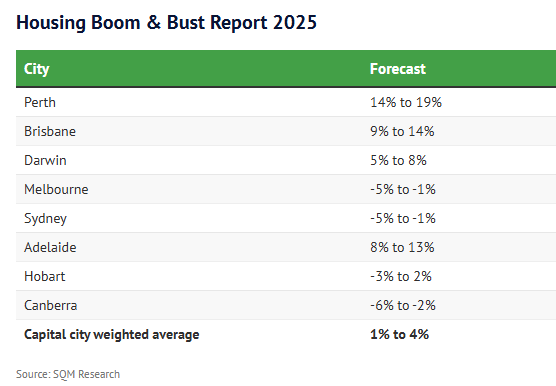

SQM Research’s latest Housing Boom and Bust Report forecasts a -1% to -5% decline in Sydney dwelling prices in 2025, reflecting the rise in listings and poor affordability metrics.

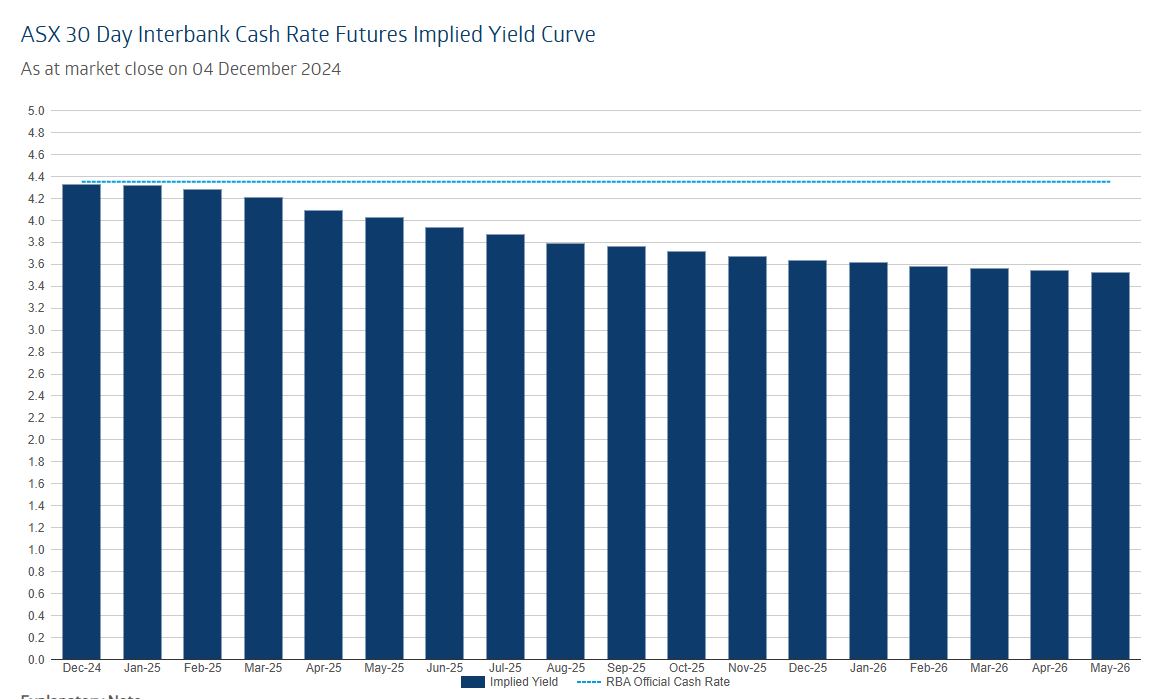

Realistically, values will continue falling until the Reserve Bank of Australia cuts interest rates.

Financial markets are tipping that the first rate cut will arrive in Q2 2025.

Following Wednesday’s poor Q3 national accounts data, I am tipping that the first rate cut will arrive in February.