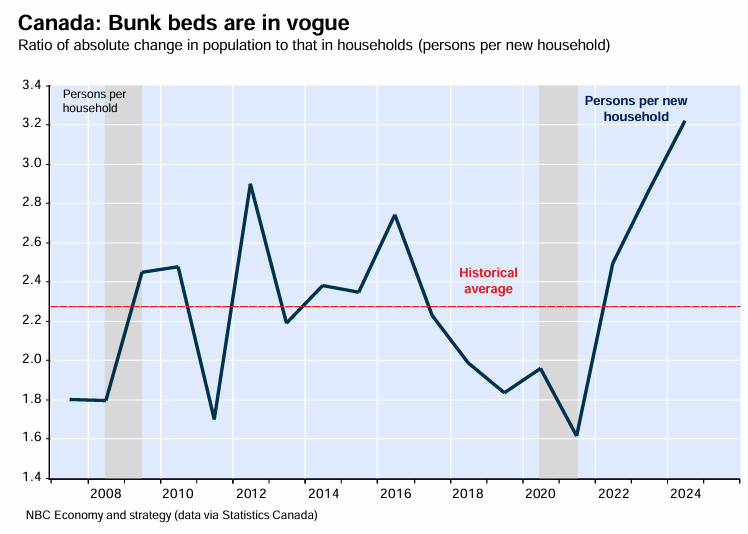

Economists at the National Bank of Canada (NBC) produced the following chart showing how “since 2021, there has been a significant imbalance between the strong increase in population and the absence of a significant rebound in construction”.

“This has contributed to a deterioration in affordability in both the rental and resale markets, and has led to a reversal in the trend in household size”.

Statistics Canada released data last week showing that the nation’s population ballooned by 3.0% in 2024, whereas the number of households increased by ‘only’ 2.3%. This represented the largest gap between the two measures since data began in 2006.

“The ratio between the absolute change in the population and that of the number of households has been above its historical average for the past three years and has grown steadily”, the NBC economists note.

“As a result, the number of people per new household created during the year has doubled since 2021, rising from 1.6 to a record level of 3.2 individuals in the face of the challenges arising from the lack of housing supply”.

“So, if you are looking for a flat mate or to sell a bunk bed on the classified ad sites, you may not have much trouble succeeding”.

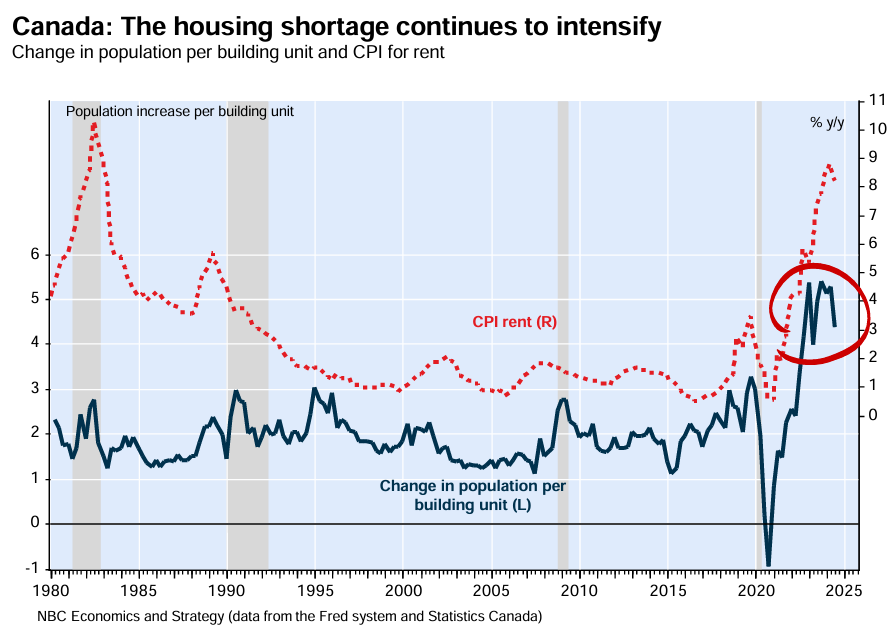

Separate analysis from NBC’s economists revealed that the record population growth, primarily due to net overseas migration, was outpacing the supply side of the housing market.

“Rent inflation is not coming down and new construction remains largely insufficient to mitigate the current imbalance between supply and demand”, the NBC economists noted.

“In Q3 2024, there was still only one new build for every 4.4 people added to the population, which is still clearly insufficient given that the average between 1980 and 2019 was one new build for every 1.9 people”.

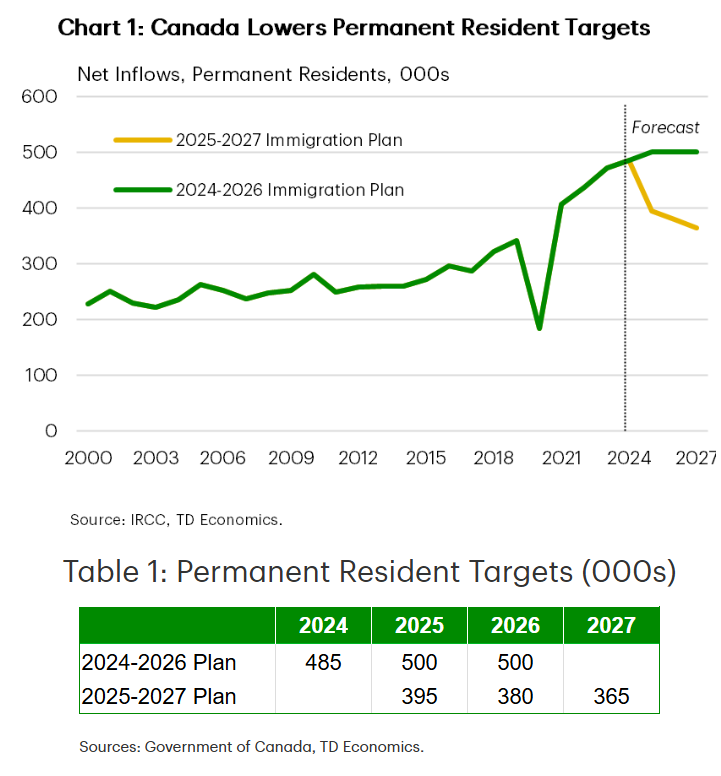

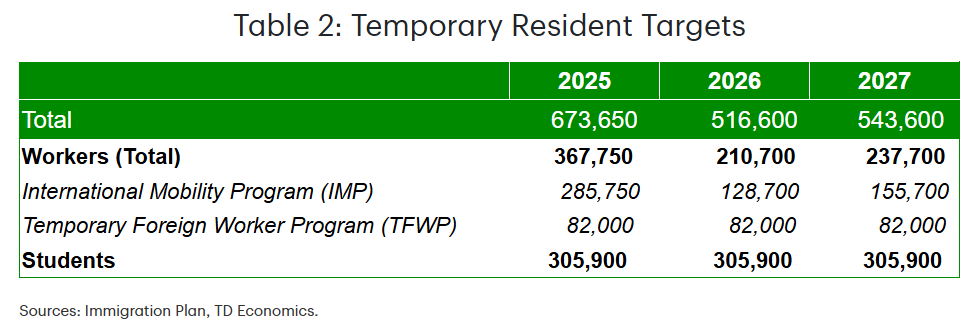

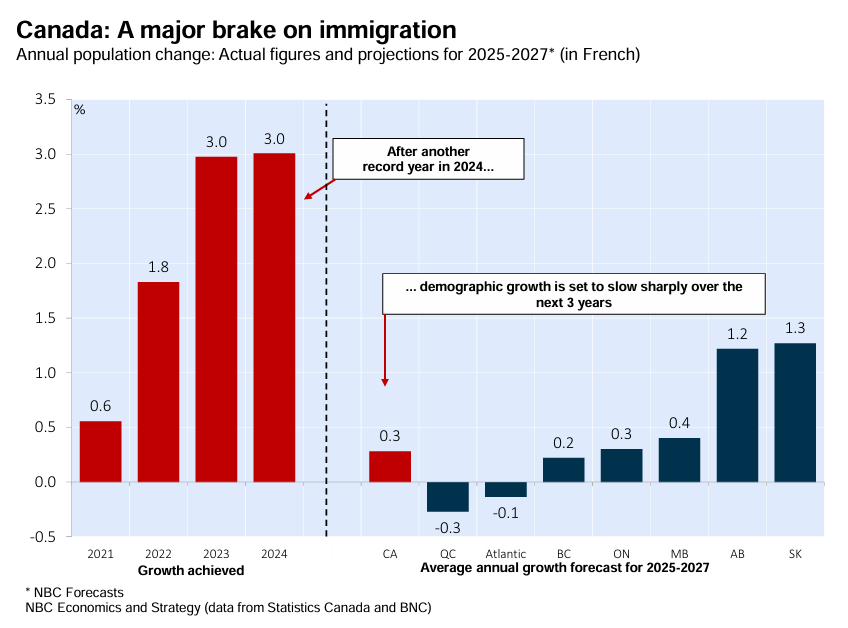

The positive news is that the Canadian government announced significant cuts to the number of new permanent residents over the next three years.

The Canadian government also announced that it would reduce the number of non-permanent residents from 6.5% to 5.0% of the population over a two-year period.

As a result, the NBC economists forecast that population growth will “average just 0.3% over the next three years, ten times less than the growth recorded in the last year”.

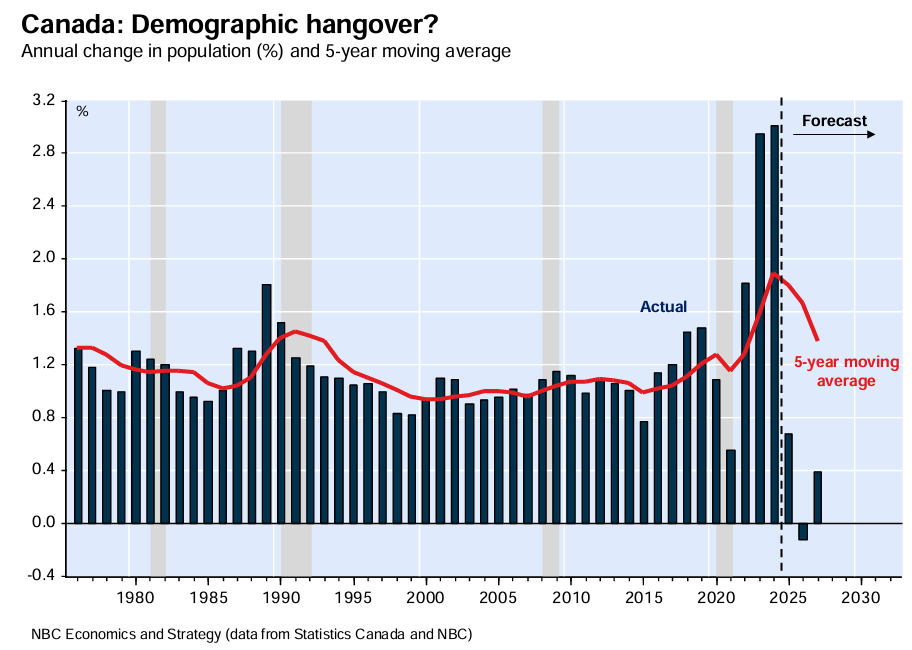

This is how Canada’s population forecasts look from a historical perspective.

The forecast halting of population growth, if it is achieved, will obviously alleviate Canada’s housing pressures and allow supply to catch up.

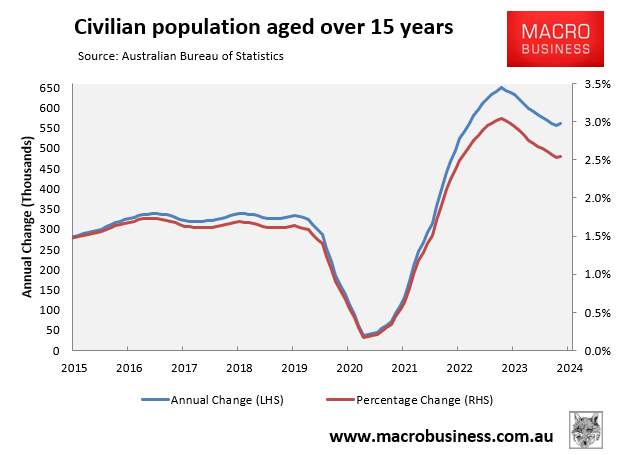

Australia is experiencing similar, albeit less extreme, population and housing pressures.

The number of Australians aged 15 and up increased by 561,000 (2.5%) in the year to October.

Australia’s 15-plus population has also grown by 1.2 million (5.6%) in the last two years.

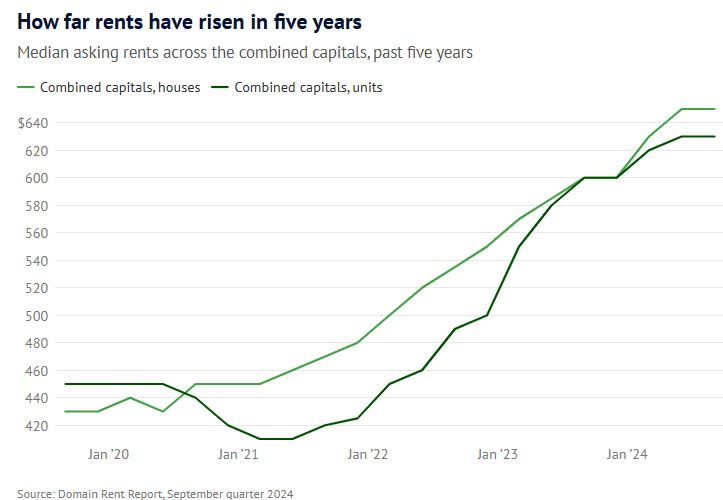

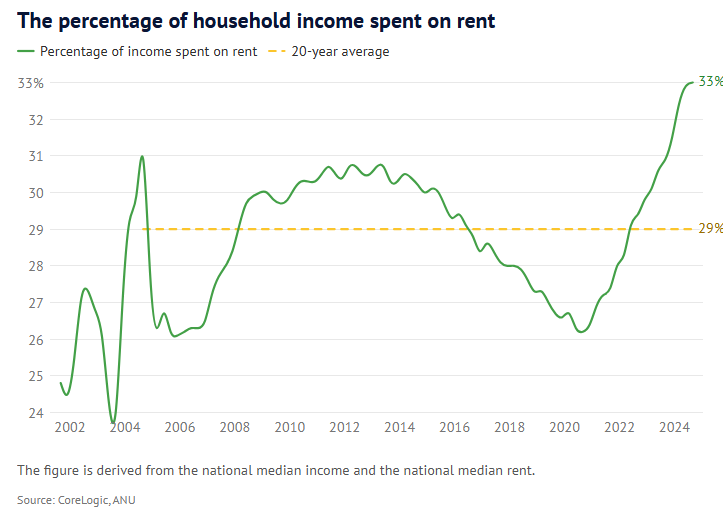

The spike in Australia’s 15-plus population has resulted in an unprecedented rental crisis, as seen by historically low clearing rates and rising rents.

As a result, affordability has reached a new low, with the average tenant spending 33% of their salary on rent.

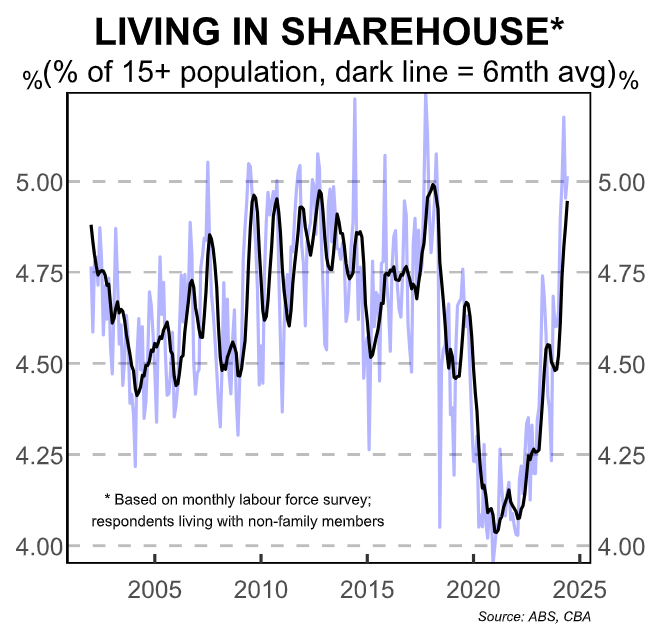

Tenants have responded to high rental inflation by reducing costs and relocating into shared living. In addition, more people are living with siblings, cousins, parents, and grandparents.

Indeed, according to the most recent National Share Accommodation Survey (NSAS) by Flatmates.com.au, 43% of respondents cite affordability as a motivator for sharing their living space.

The RBA also noted in its August Statement of Monetary Policy that the average household size had increased further over recent months “possibly in response to affordability constraints”.

The Australian federal government should emulate Canada’s and significantly curtail both permanent and temporary migration to allow the supply-side of the housing market to catch up.

Otherwise, Australia’s rental crisis will become permanent.