Sydney and Melbourne dwelling values have ended 2025 deep in the red, dragging down prices nationally.

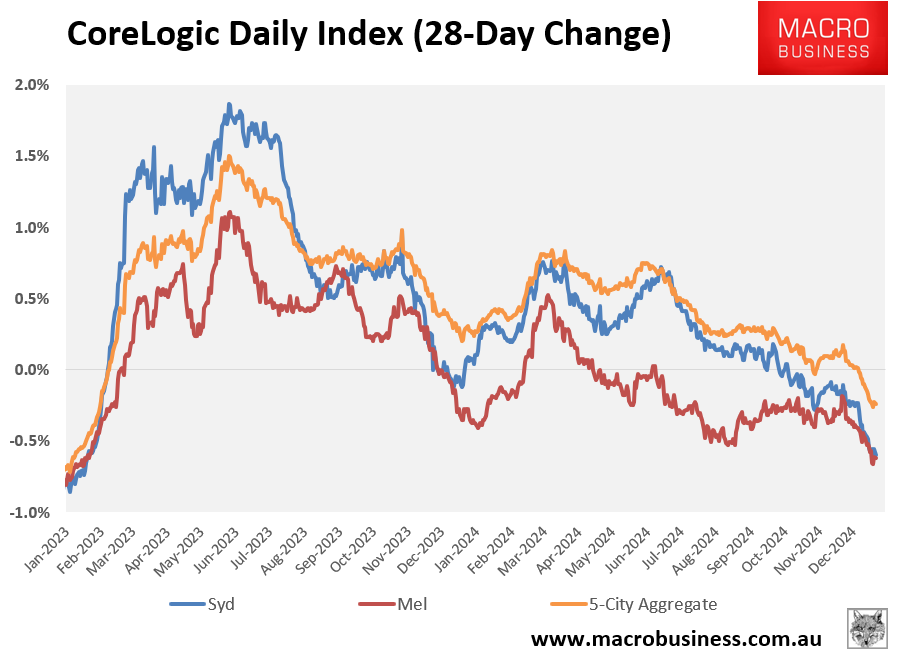

The following chart illustrates that CoreLogic’s daily dwelling values index has recorded declines of 0.6% across Sydney and Melbourne over the past 28 days, pulling values at the 5-city aggregate level down by 0.2%.

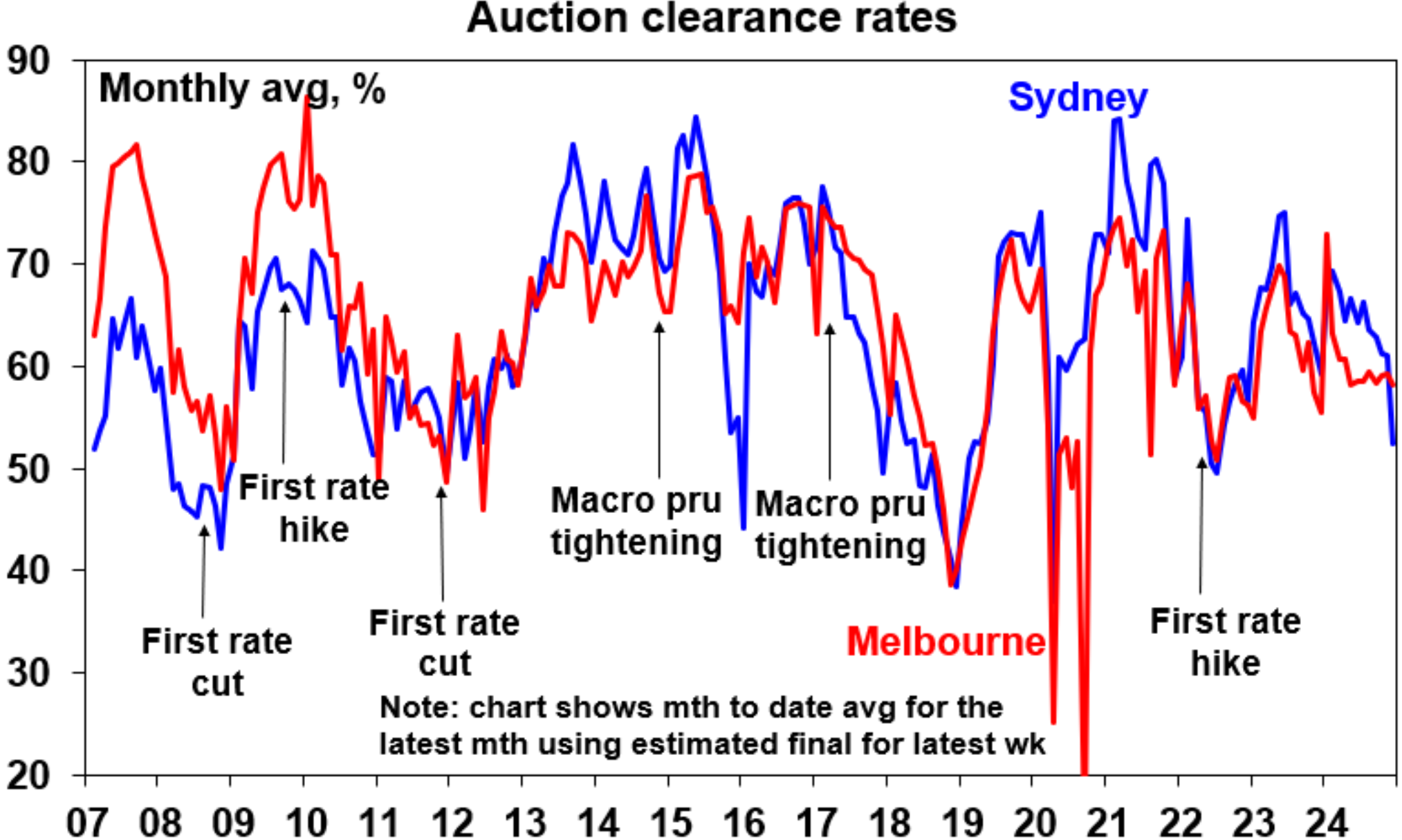

The value decline matches the auction market, where clearance rates have fallen sharply through the year, especially in Sydney.

Source: Shane Oliver (AMP)

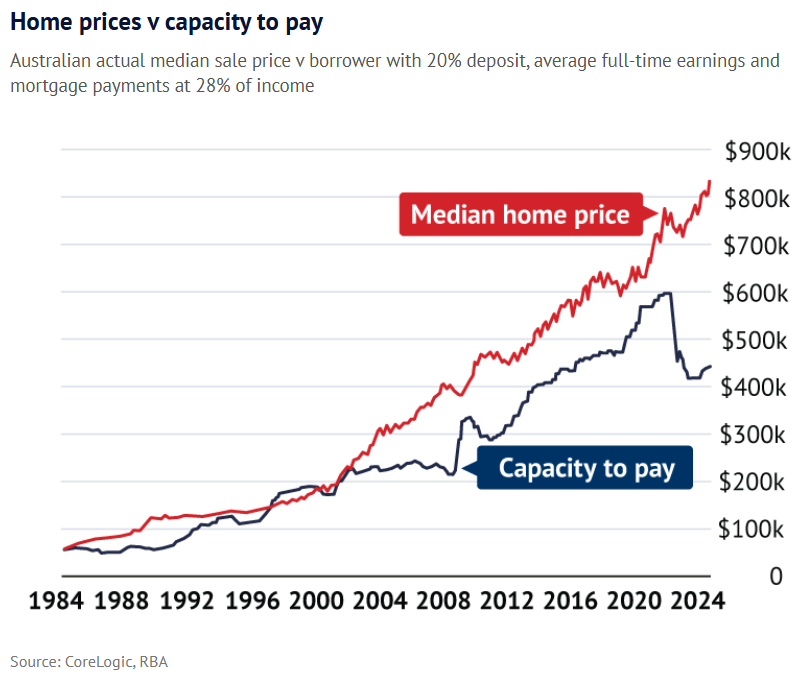

It is worth remembering that most economists and analysts (me included) expected house prices to fall in response to the Reserve Bank of Australia’s (RBA) aggressive interest rate hikes.

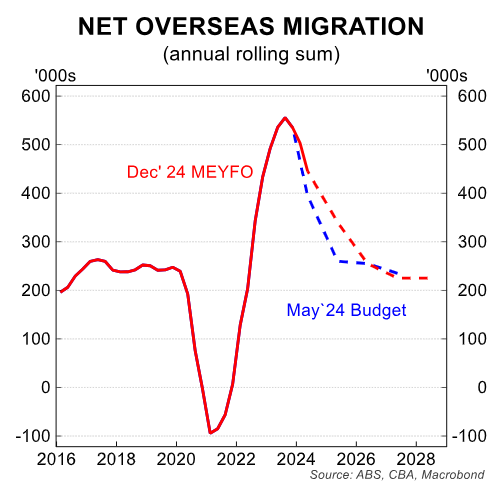

Prices unexpectedly rose due to unprecedented net overseas migration and stock shortages.

As a result, dwelling values detached from borrowing capacity, leading to record low affordability.

Now that net overseas migration is slowing and stock levels have rebounded, the normal relationship between mortgage rates and dwelling values is beginning to assert itself.

Home values will, therefore, likely continue to fall until the RBA cuts interest rates, increasing borrowing capacity.