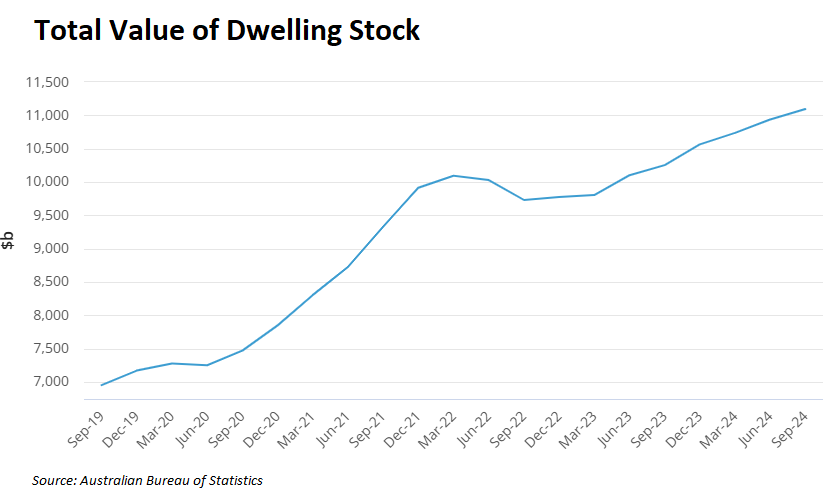

The Australian Bureau of Statistics (ABS) released data on the value of the nation’s dwelling stock.

As of 30 September 2024, there were 11,252,600 residential dwellings valued at $11,093.8 billion.

This meant that the average Australian home was worth $985,900.

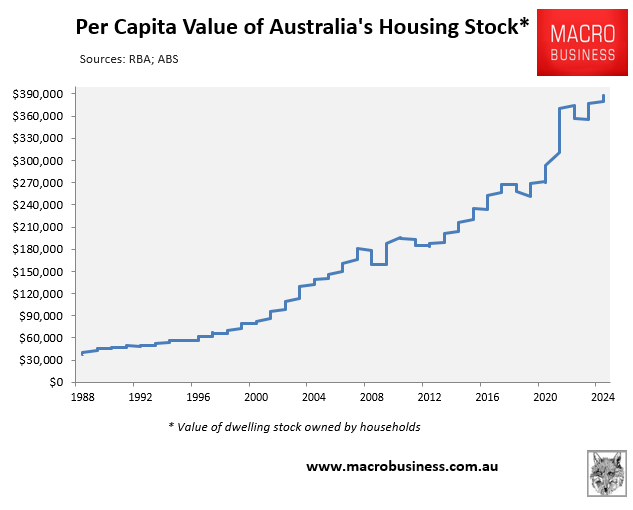

Across an estimated 27,448,845 persons as of 30 September 2024, Australian households owned a record high of $388,250 worth of residential housing per capita.

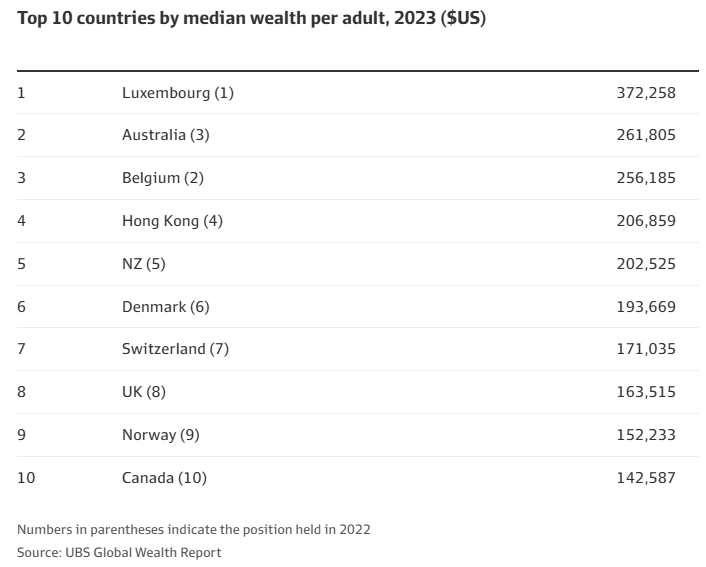

The above figures will keep Australian households at the top of the worldwide wealth rankings.

According to the most recent UBS Global Wealth Report, based on data from 2023, Australian households had the second-highest wealth in the world, after Luxembourg.

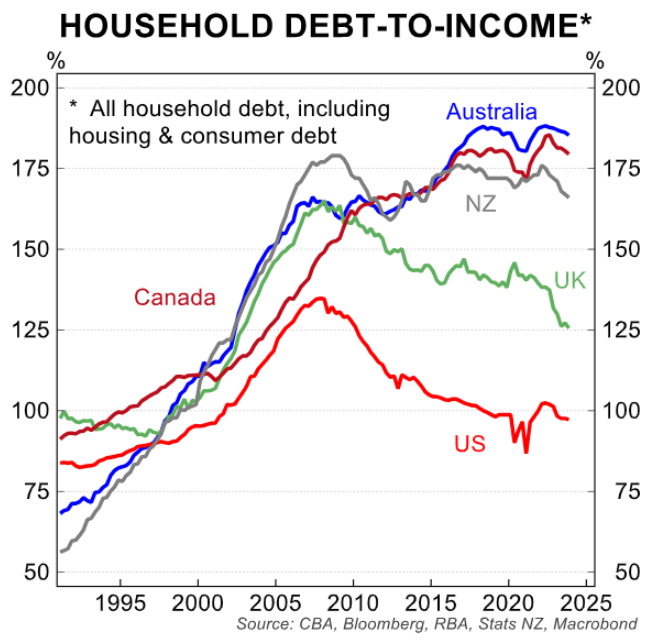

Meanwhile, Australians have buried themselves in mortgage debt, with the average loan size driving up prices.

As a result, Australian households have some of the world’s most enormous debt loads.

Despite Australia’s enormous household wealth, derived mostly from its soaring home values, Australian households are struggling financially.

Based on ABS research, Finder Financial Group’s latest Wealth Building Report revealed that the majority of the nation’s wealth was “untouchable” because it was locked up in housing and super funds.

Finder said that superannuation and property accounted for around three-quarters of household net worth.

“A lot of Aussies have a huge amount of their wealth tied up in illiquid assets”, said Graham Cooke, Finder head of research.

“They’re rich, but their wealth is inaccessible without taking out a loan against their equity – and interest rates are through the roof”.

Households had $3.9 trillion in superannuation assets and just shy of $10.5 trillion in residential land and dwelling value.

“Australian fortunes are primarily tied to property and superannuation, making them cash-poor despite their massive net worth”, the report stated.

“Many of these millionaires have landed in this once-elusive club simply because the value of their homes has grown”.

As I frequently argue, much of Australia’s household wealth is “fake” and does not serve society.

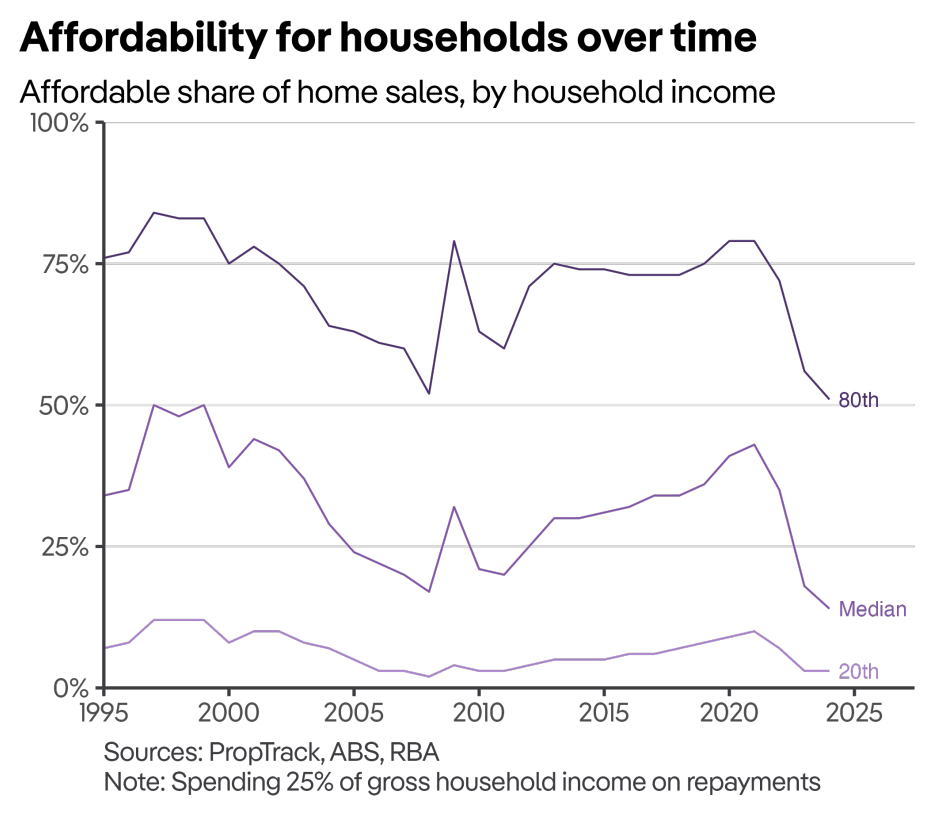

Given that housing affordability is at an all-time low and our younger generations cannot buy a home without parental financial assistance, how can Australians be considered the second wealthiest in the world?

Australians would be “wealthier” if property values had not increased so dramatically; the average home would cost ~$400,000 rather than $800,000, and household debt would be 90% of income rather than 180%.

Australia would be a much more egalitarian society, and we would be financially better off if our homes were half the price they are now, and we owed half the amount.

Australia’s high home prices are harming our children, grandchildren, and future generations by forcing them to pay significantly more for housing than necessary, making them worse off.

Whether it costs $500,000 or $5 million, a home serves the same practical purpose.

Higher housing “wealth” is thus meaningless to the vast majority of people who live in their homes and do not own investment properties.

Australians would be much better off if we had never experienced the 25-year property boom and were not ranked second in the world’s wealth rankings.

Australia has sentenced potential homebuyers to debt servitude or being locked in the rental market.