Besides oil, Australia has nearly every natural resource the world needs.

Australia has vast amounts of coal, gas, uranium, cobalt, nickel, copper, and lithium.

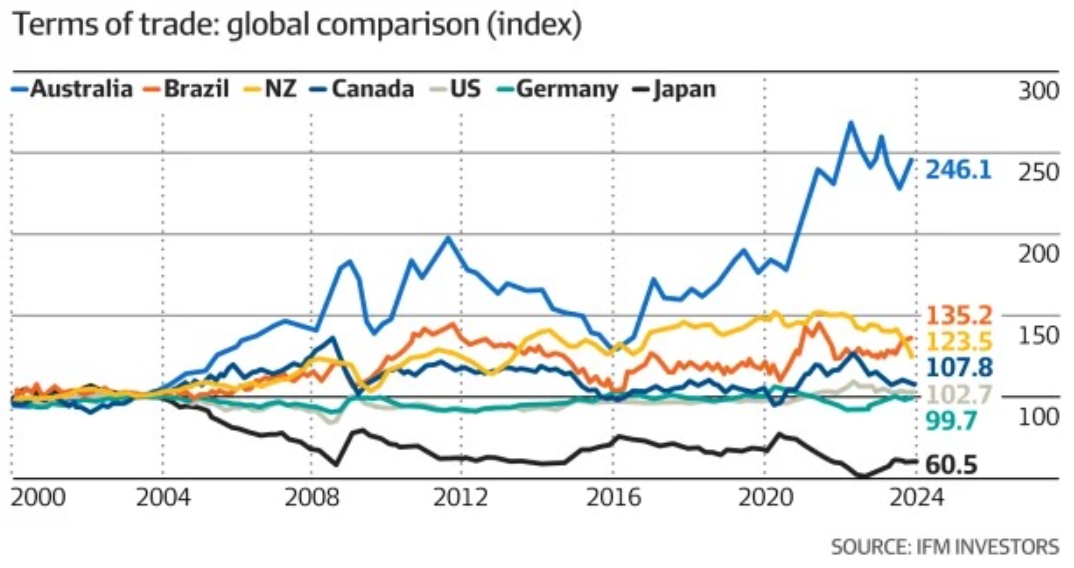

Australia has benefited the most from global commodity prices over the last 20 years.

However, our policymakers have impoverished us by disallowing Australians from burning our own energy resources, creating an artificial shortage and driving up its cost.

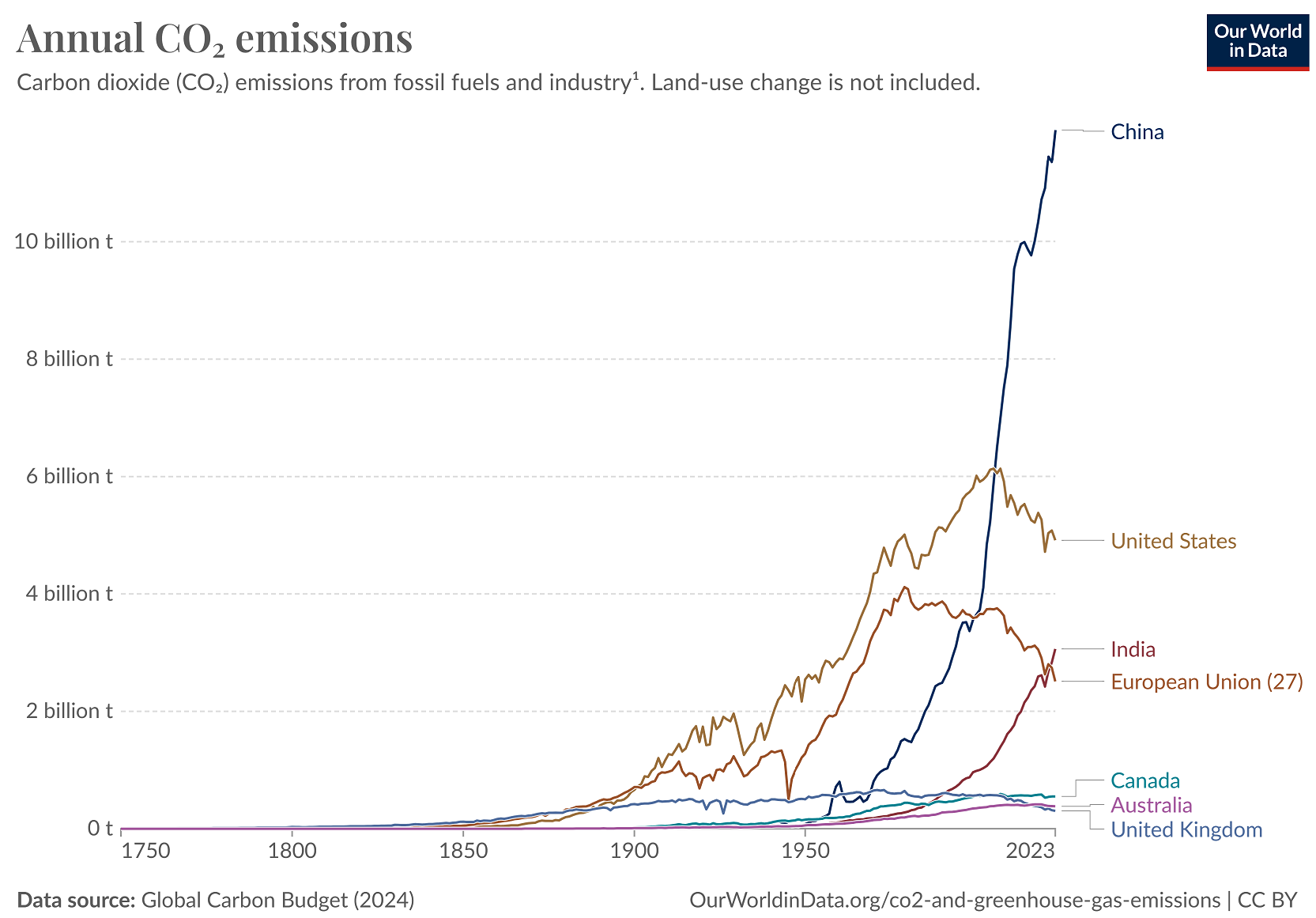

Meanwhile, China is consuming everything we are digging out of the ground, driving global carbon emissions.

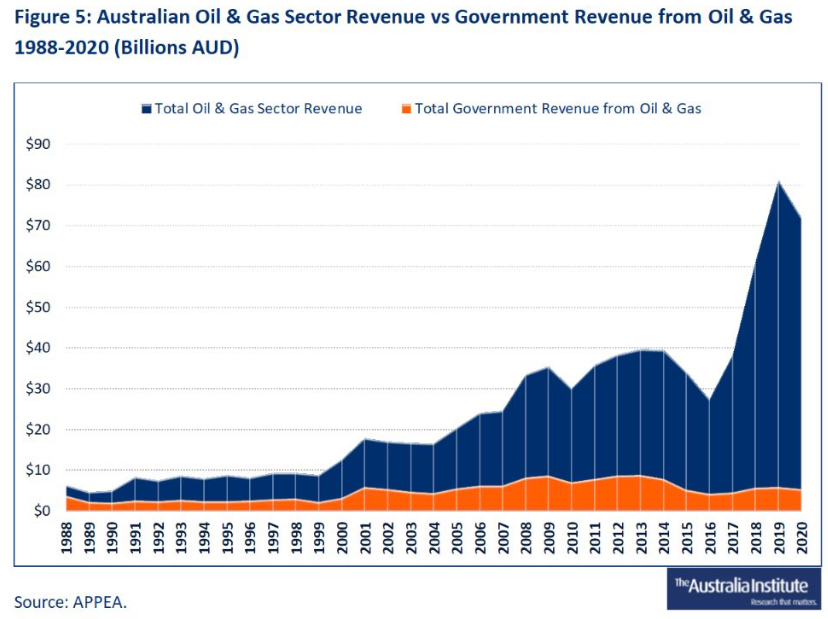

Equally maliciously, policymakers have failed to adequately tax the resources industry, leaving the federal budget chronically underfunded while residents are suffering from soaring energy costs and a deindustrialised economy.

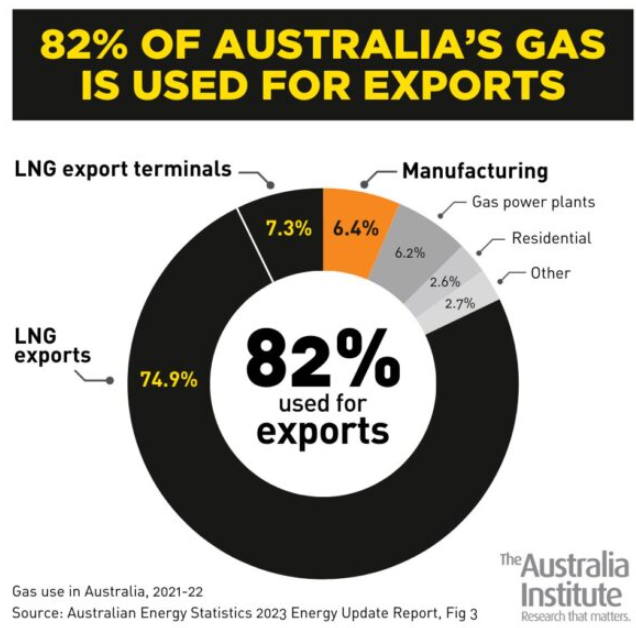

Consider natural gas where Australia is currently the world’s second-largest exporter:

Almost all of Australia’s natural gas is exported, which has caused an artificial domestic gas shortage on the East Coast, where no domestic reservation policy exists, and internationally high gas and electricity costs.

The surge in LNG exports, which is reflected in the unprecedented rise in Australia’s terms of trade, has created massive profits for foreign-owned oil and gas companies.

However, Australia’s tax revenues from this boom have stagnated:

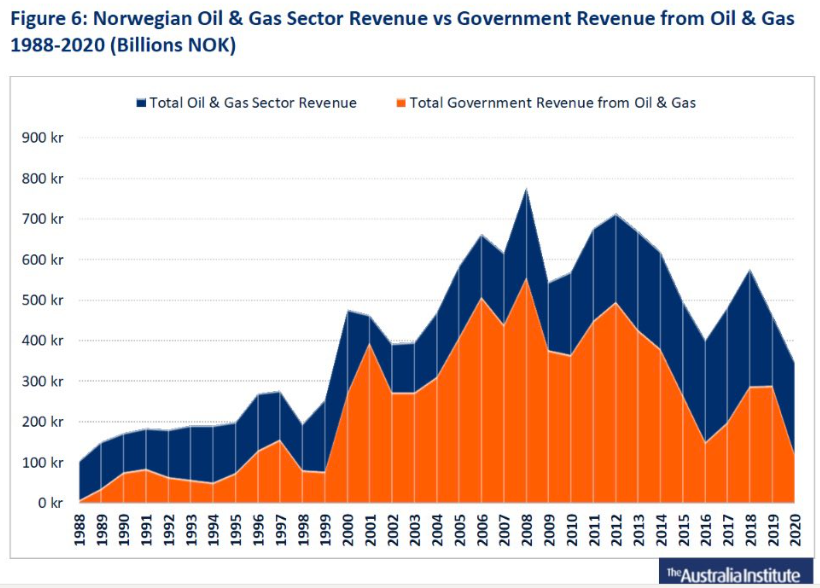

By contrast, Norway, which taxes its oil and gas sector at around 80%, has enjoyed a massive tax windfall from its oil and gas sector:

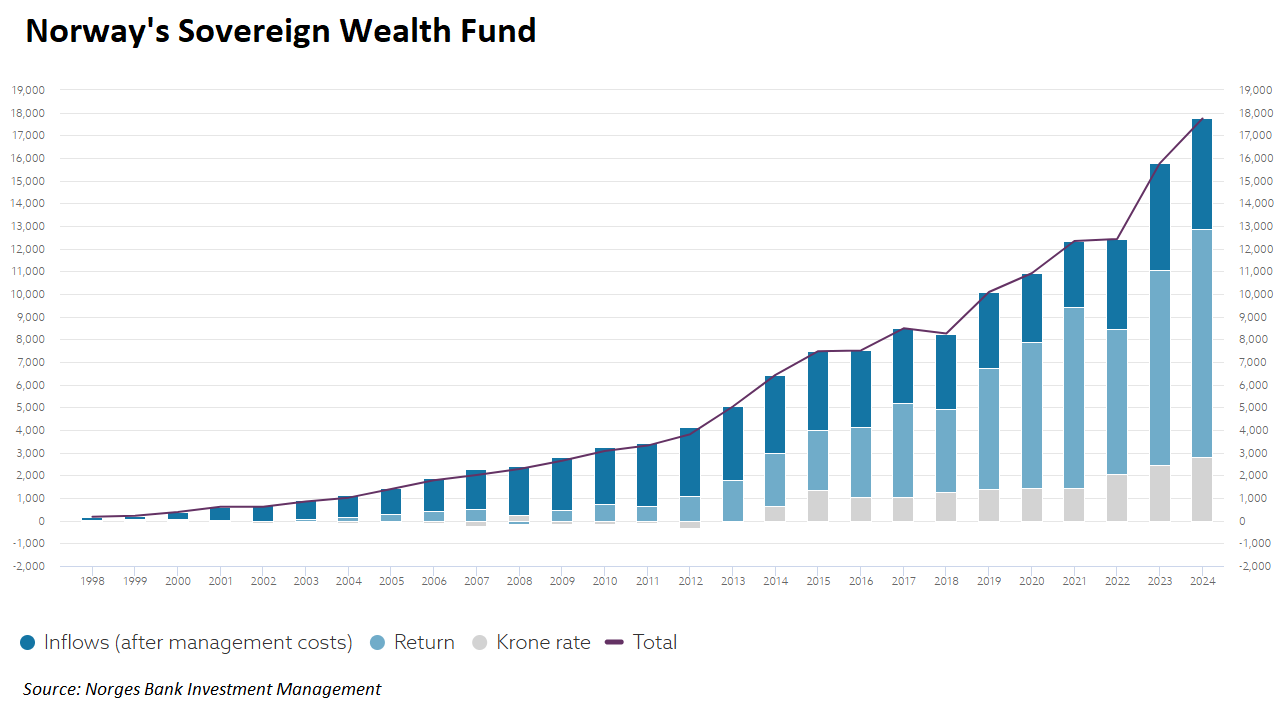

Norway has invested its oil and gas windfall in a sovereign wealth fund that is the world’s largest and valued at approximately US$310,000 per Norwegian resident:

Norway’s oil and gas sector wealth has made Norwegians the richest people on the planet, a title Australia would have claimed if we appropriately taxed our resources.

It is a similar story for Qatar, the world’s third-largest gas exporter.

As Matt Barrie explained earlier this year, “Qatar generates enough wealth from this trade that residents pay zero income tax, zero property tax, zero corporate income tax, have free healthcare, free education, have subsidised housing and plentiful access to cheap electricity and petrol”.

By contrast, “in Australia, most of our export facilities pay no royalties at all to the state or federal government”.

Indeed, the Financial Times reported that Qatar has also used its gas exports to create a $500 billion sovereign wealth fund, servicing just 2.7 million people:

“Qatar, one of the world’s top LNG exporters and wealthiest nations in per capita terms, has spent almost $30bn to increase production capacity at its vast North Field gasfield from 77mn to 126mn tonnes a year by 2027”.

“The IMF estimated in a report two years ago that by 2027 the expansion was expected to raise the small Gulf state’s real GDP by 5.7% and add roughly 3.5% of GDP in export receipts a year”.

“The QIA will be the main recipient of the LNG revenues, and Sowaidi said the inflows had the potential to double its size over five years”.

“The QIA [Qatar Investment Authority] has built a portfolio of high-profile assets, including UK department store Harrods as well as significant stakes in Canary Wharf and Heathrow airport. It is also a shareholder in German carmaker Volkswagen and Spanish energy group Iberdrola”.

Australia could have done the same with our resource exports and should be the richest nation on earth.

Instead, we have impoverished ourselves by engineering an artificial gas shortage, driving up domestic gas and electricity prices while also diluting the nation’s mineral wealth via mass immigration.