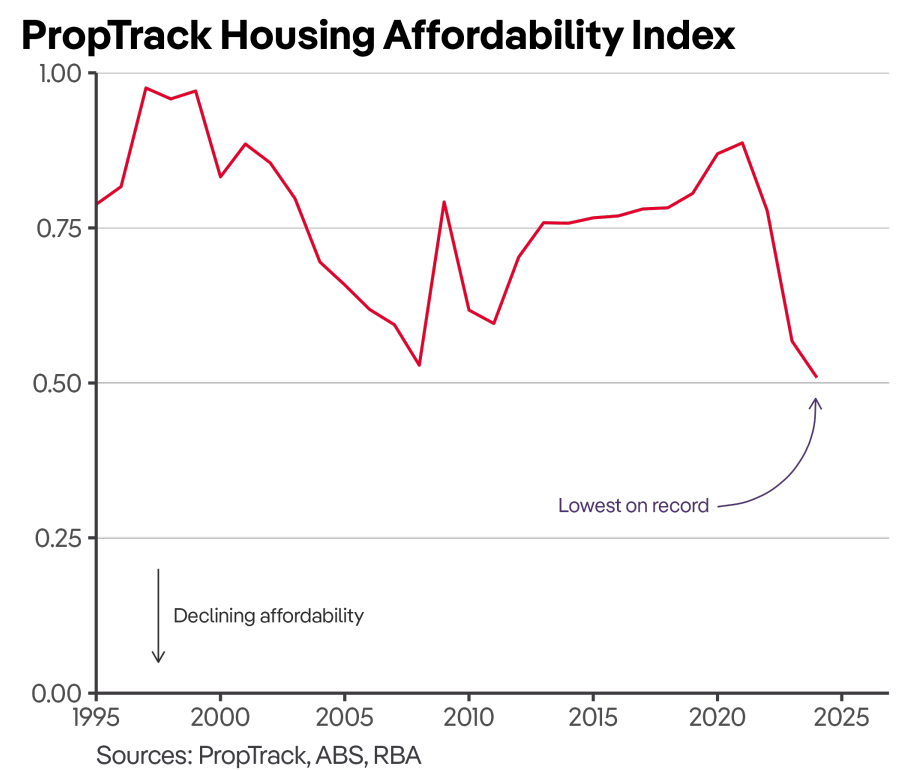

Housing affordability has never been worse in Australia.

According to a recent analysis from PropTrack, a household with a median income could afford the lowest share of homes on record.

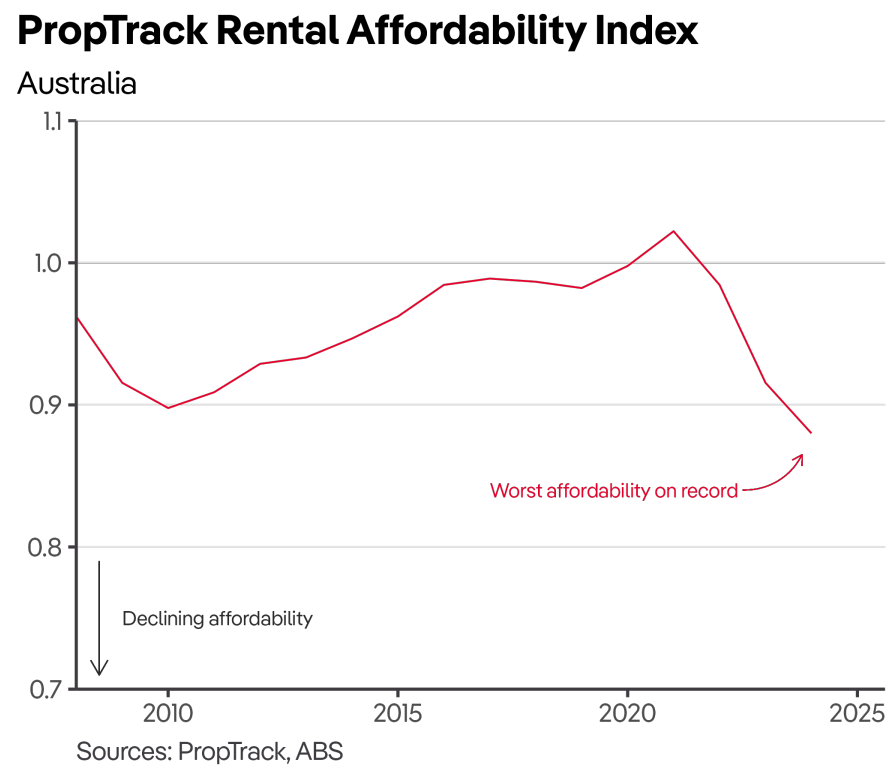

Rental affordability has also fallen to a record low, making it harder for first-time buyers to save up a deposit.

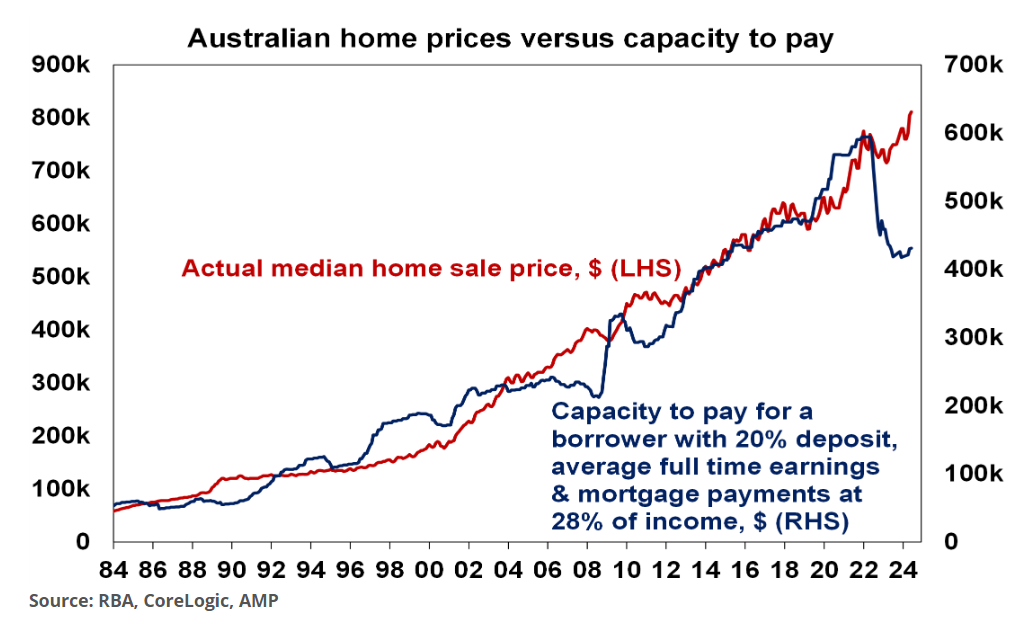

A key problem is that home prices have risen to record highs while the costs of servicing a mortgage have surged.

As a result, the gap between borrowing capacity and prices has never been wider.

One solution being put forward by lenders is to extend loan terms, thereby allowing buyers to pay lower monthly repayments or borrow larger sums.

Indeed, 40-year mortgage terms have been introduced without concern from regulators or policymakers.

The 40-year mortgage pitched out to the mortgage brokers this week from the Pepper Money group is aimed at “clients struggling with serviceability”.

In other words, those who can’t make their monthly mortgage repayments.

This is the tip of the iceberg. The major banks will join the party in the coming months once the notion of a mass-market, 40-year mortgage is up and running. Until now the majority of new mortgages were for 30 years.

As adviser, Stuart Wemyss of Prosolution Private Clients says: “This offers more flexibility and many people can afford to pay more — but, it’s also beyond doubt good business for lenders”.

On a $650,000 loan at 6.5%, if the customer moves from a 30-year term to a 40-year term, they will pay about $300 less per month. But, should they leave the terms unchanged, they will be up for around $346,000 of additional interest over the life of the loan.

Extending mortgage terms is another blatant attempt to stimulate housing demand and usher in a new price boom.

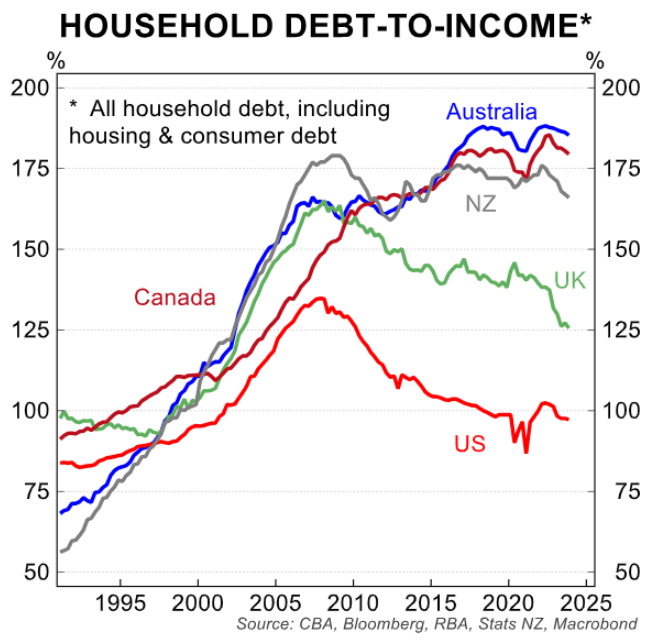

Allowing people to borrow more for housing will do what it has always done: drive debt levels higher and result in more expensive housing over the longer term.

The last 20 years are living proof of how the story will end.

Neither politicians nor the housing industry genuinely want more affordable homes since it would require lower prices.

They will never advocate reducing immigration to reasonable, sustainable levels of below 120,000 a year so that housing supply can keep pace with demand.

Nor will our politicians undertake broad-based tax reforms to shift economic activity away from housing speculation to productive pursuits.

Instead, politicians and the industry will pretend to care by implementing false solutions for would-be first-home buyers while systematically driving housing costs higher through self-defeating demand-side stimulatory policies.