DXY is up, up, up. Consolidation over?

AUD is approaching support at 63 and 62 and then it’s vacuum…

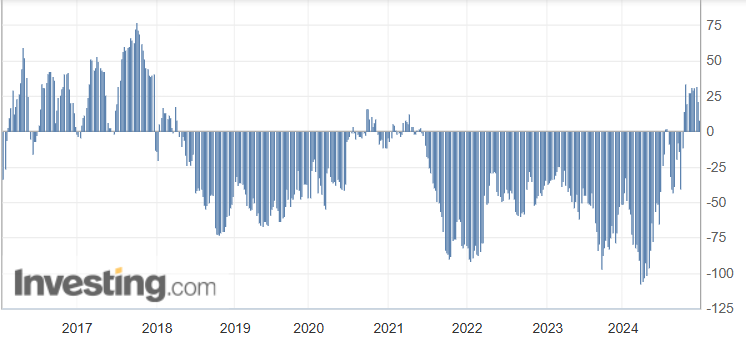

Some speculators finally gave up on the losing losing ling but still oodles of room to fall.

Bomb, bomb, bomb…bomb, bomb Iran…

Dirt hosed.

Mining despair.

EM splat.

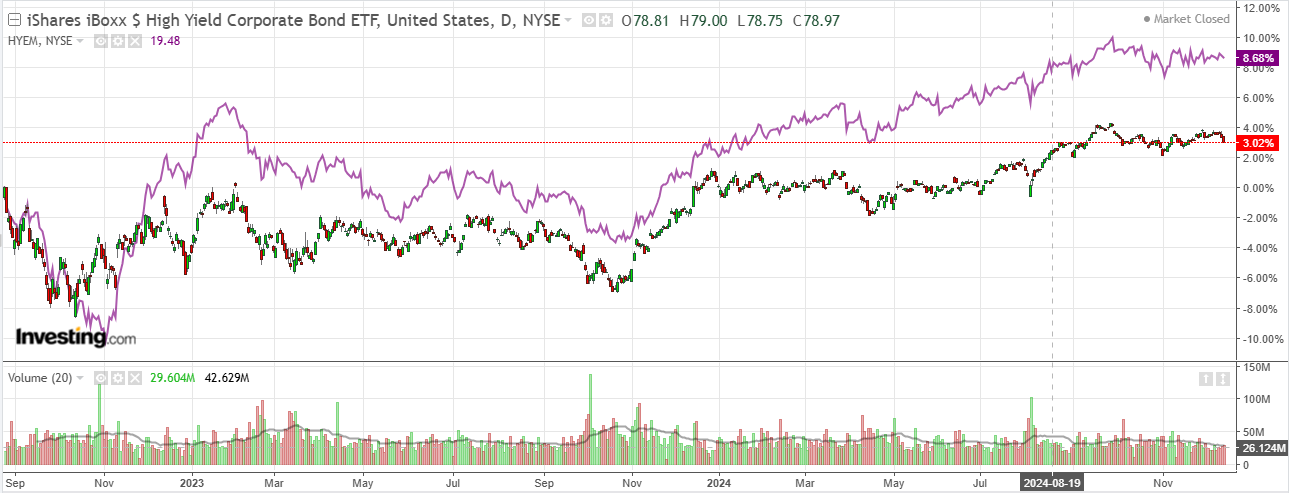

Junk will eventually be a problem for stocks.

As yields rise!

Stocks held on.

The US PPI has coughed up what will be a likely weak PCE for the Fed to cut. Goldman.

Based on details in the PPI and CPI reports, we estimate that the core PCE price index rose 0.13% in November, corresponding to a year-over-year rate of +2.83%.

Additionally, we expect that the headline PCE price index increased 0.15% in November, or increased 2.47% from a year earlier.

We estimate that core market-based PCE rose 0.13% in November.

Plenty more Fed in that.

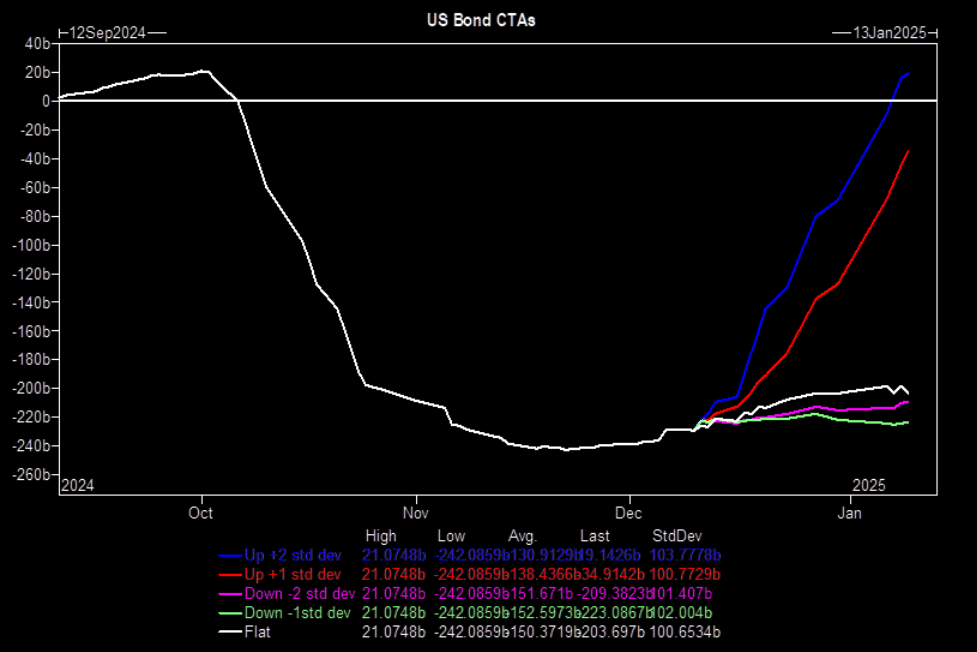

But yields are rising anyway…

With robots poised for more.

I am wondering if Trump hubris might not be the theme of 2025.

He’s going to apply 60% tariffs to China, deliver tax cuts, turf out millions of illegal workers, and now…bomb, bomb, bomb…bomb, bomb Iran (set the tune of the Beach Boys for the beltway) to deliver an oil spike?

U.S. President-elect Donald Trump’s transition team told VOA Persian on Friday that all options remain on the table when it comes to addressing Iran’s nuclear program.

“The Trump administration is committed to reestablishing peace and stability in the Middle East,” Brian Hughes, spokesperson for Trump’s transition team, said in an email, responding to an inquiry made by VOA Persian regarding a Friday Wall Street Journal report suggesting that the Trump administration is considering military options to curb Iran’s nuclear ambitions.

“President Trump will keep all options on the table as it relates to the Iran Regime, including Maximum Pressure,” Hughes said.

Are of the deal? Maybe. But if that’s not a wildly inflationary agenda then I have never seen one.

If we get all of that then I suggest we will also see an unruly surge in the US dollar, followed by an ungodly crash as the Fed reverses course to hikes, and the US plunges into recession.

In short, AUD has not bottomed.