DXY is firming again.

AUD is at more new lows.

CNY is threatening.

Gold and oil both up.

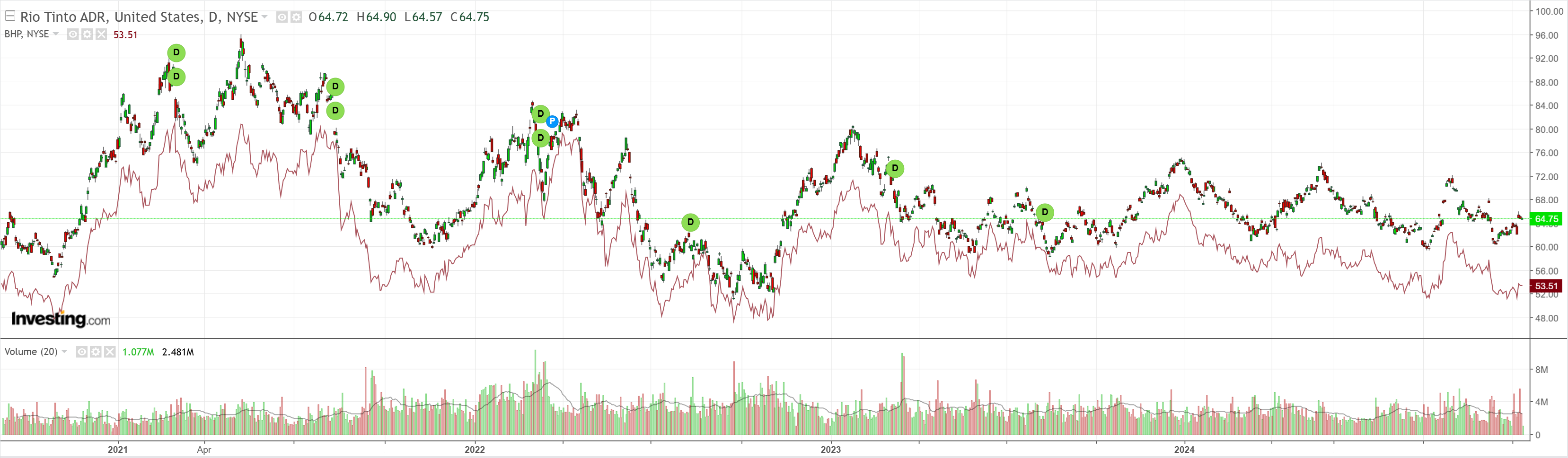

Dirt down,

Miners meh.

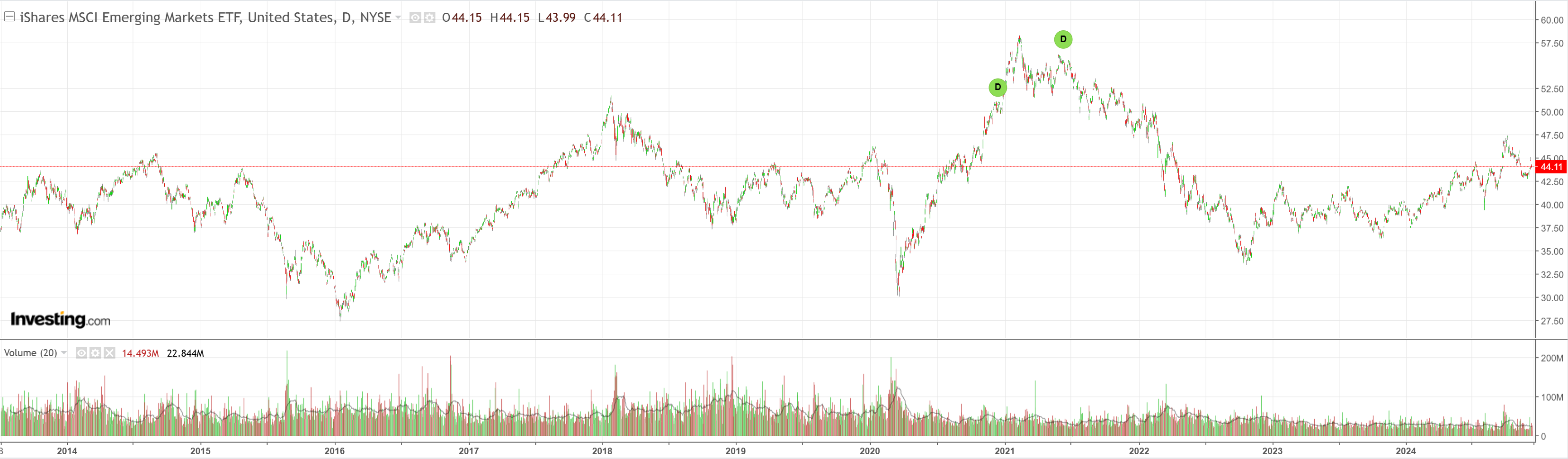

EM meh.

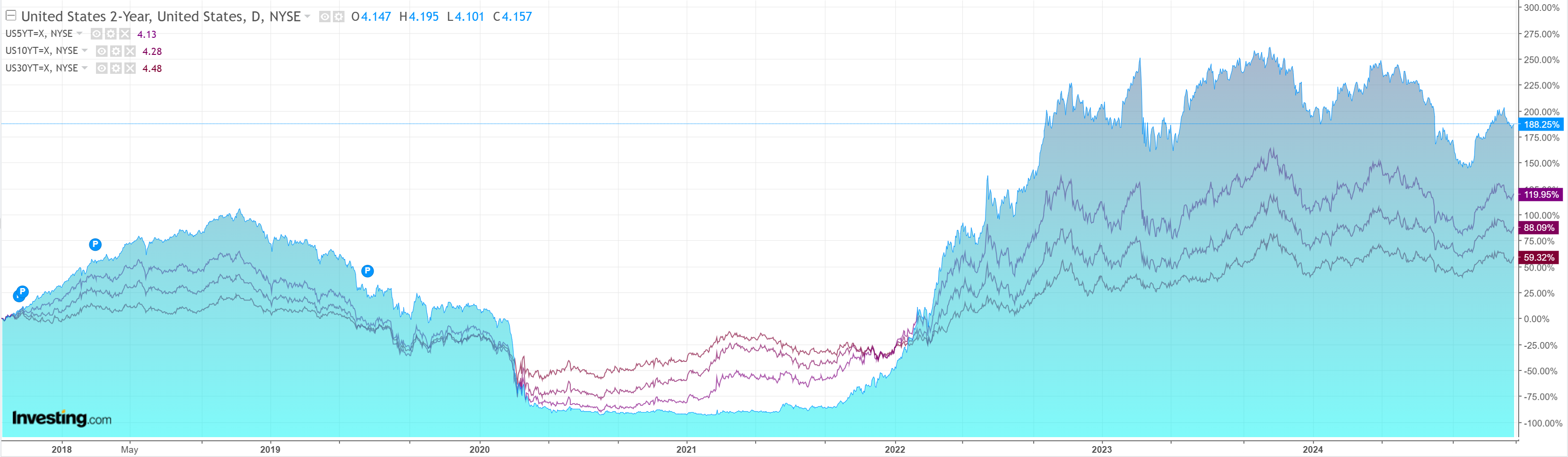

Junk was OK despite rising yields.

Nasdaqorama.

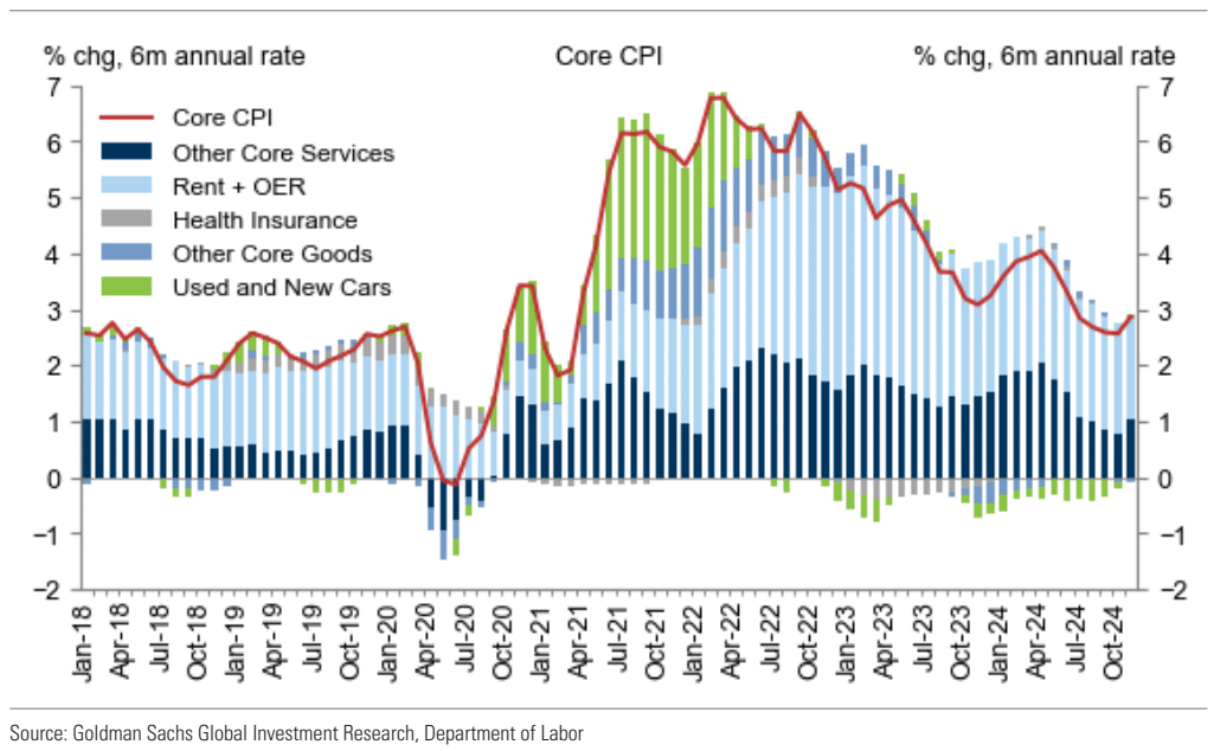

US inflation was OK. Goldman has more.

November core CPI rose 0.31%, slightly above expectations. Th

Non-housing services prices rose 0.34%, and our trimmed core CPI measure rose 0.24% in November (vs.0.27% in October).

Based on the details of the CPI report, we estimate that the core PCE price index rose 0.22% in November, corresponding to a year-over-year rate of +2.93%.

Additionally, we expect that the headline PCE price index increased 0.23% in November, or increased 2.55% from a year earlier.

We estimate that core market-based PCE rose 0.20% in November.

It is still all about OER, which has plenty more disinflation left in it

More important for AUD was CNY.

China’s yuan slid the most in a week following a report that Beijing is considering allowing the currency to weaken next year in response to the threat of a trade war with the US.

The offshore yuan dropped as much as 0.5% to 7.2921 per dollar after Reuters reported that policymakers are mulling letting the currency depreciate, possibly to around 7.5 per dollar. It later trimmed declines.

Letting CNY fall 3-4% is a nothingburger. I’m not sure why you would bother saying it. It’s not exactly ‘art of the deal’.

I guess Beijing fears capital outflow, but I’m not sure why. It is abundantly clear that CNY is no longer a free float. Capital controls and PBoC trickery have control of it.

If this is all Beijing threatens, then AUD has probably fallen enough already.