DXY continues its consolidation.

But AUD crashed anyway.

As CNY let go.

Oil is going to break.

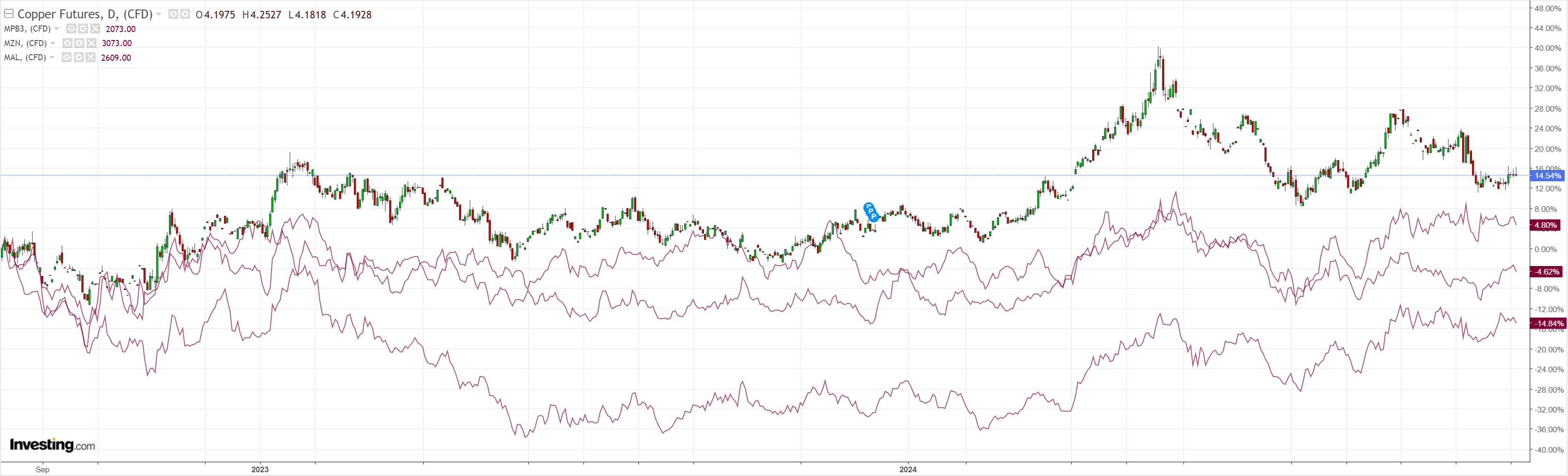

Dirt too.

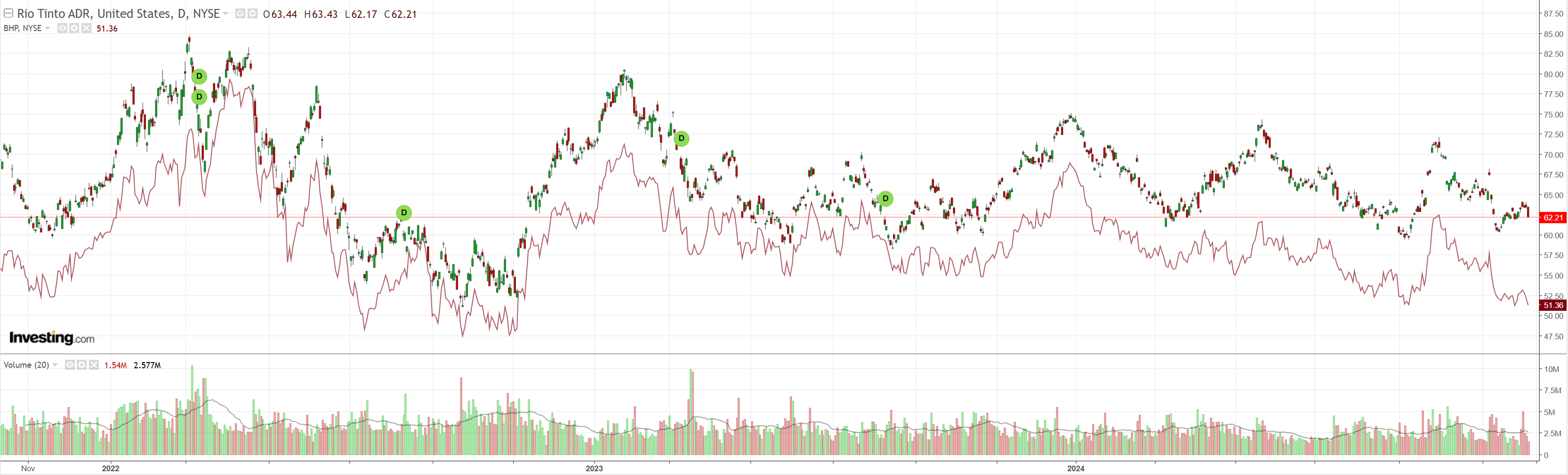

Miners are breaking.

EM pfft.

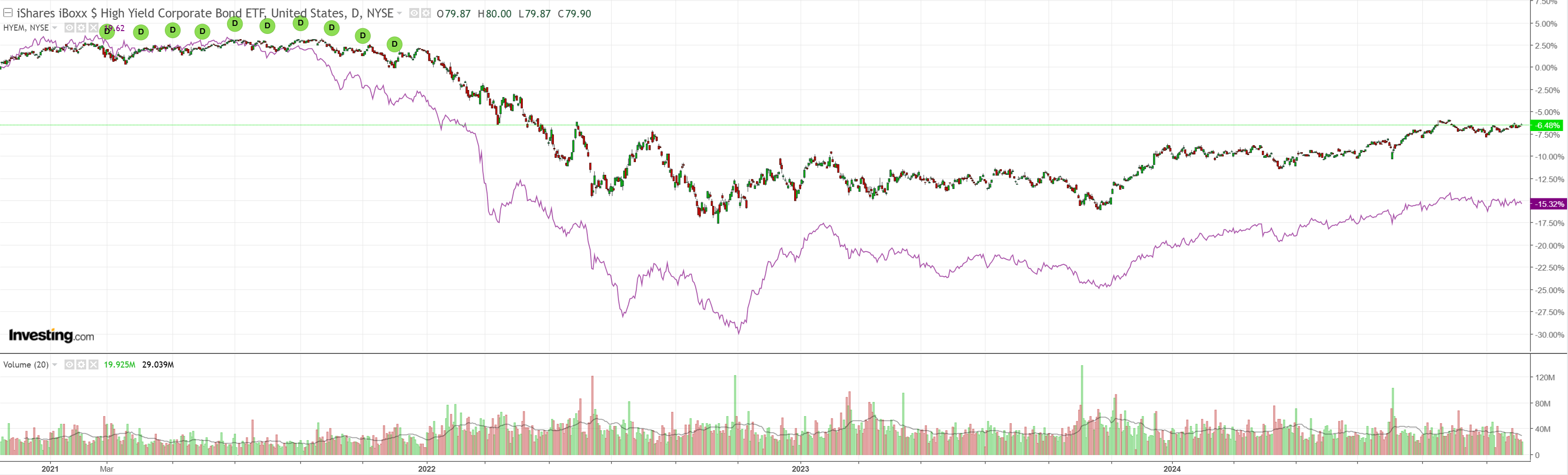

Junk jaws are opening on US tariffs.

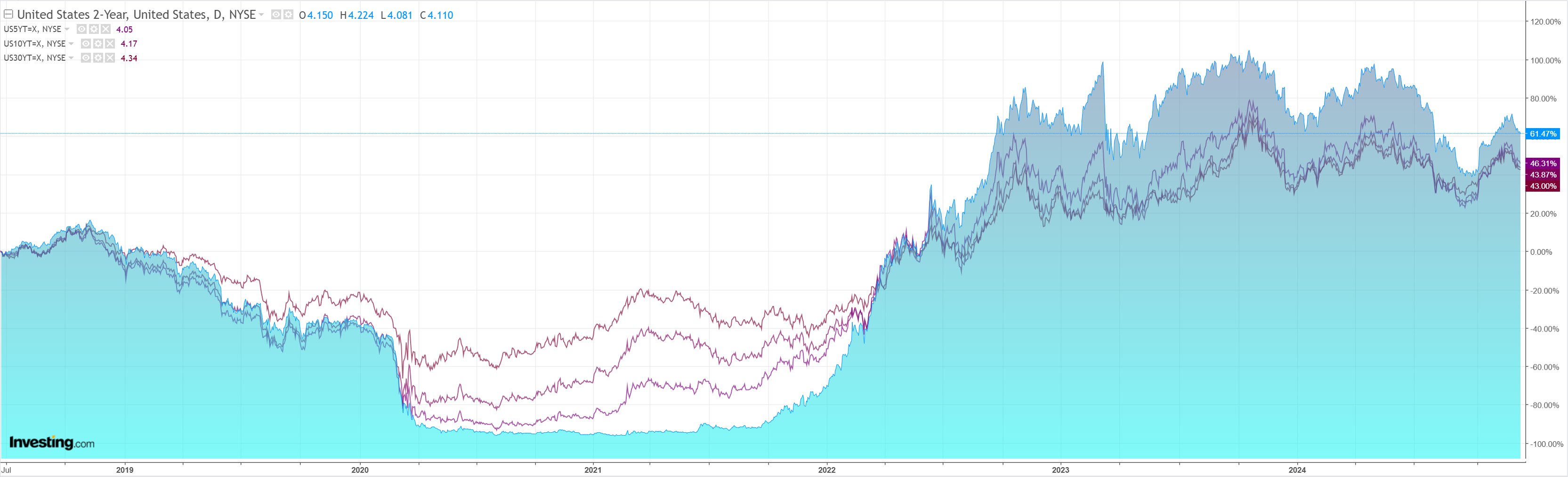

Yields fell.

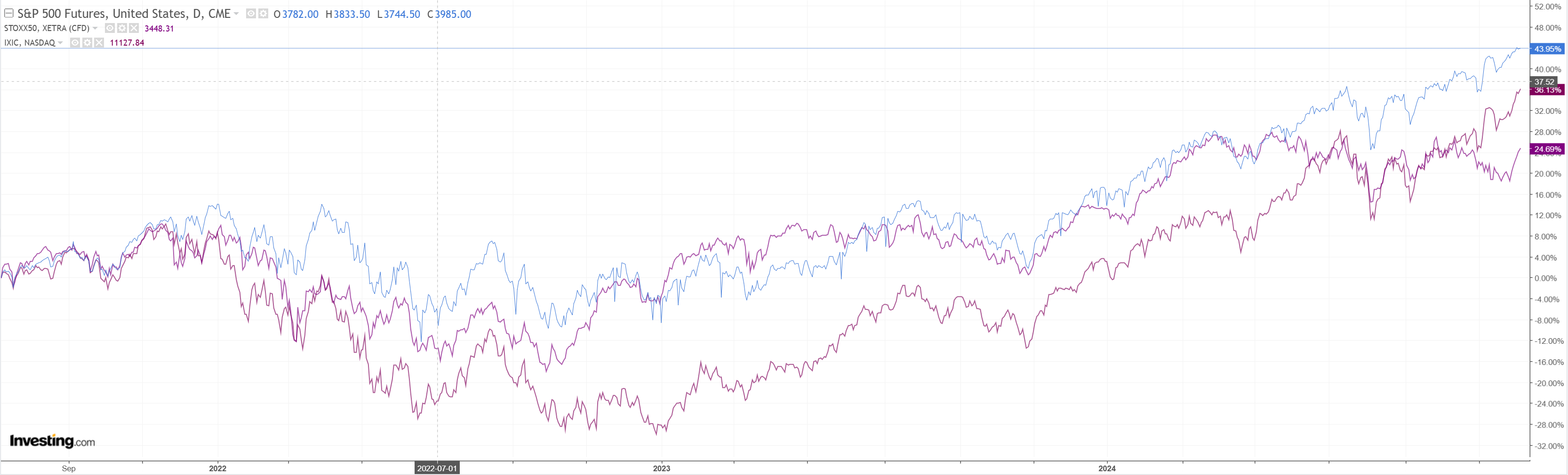

Stocks up.

US jobs were Goldilocks with firm job creation but rising unemployment and easing wage growth.

Total nonfarm payroll employment rose by 227,000 in November, and the unemployment rate changed little at 4.2 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in health care, leisure and hospitality, government, and social assistance. Retail trade lost jobs.

…The change in total nonfarm payroll employment for September was revised up by 32,000, from +223,000 to +255,000, and the change for October was revised up by 24,000, from +12,000 to +36,000. With these revisions, employment in September and October combined is 56,000 higher than previously reported.

The prospects for an FOMC cut lifted. However, DXY was stable anyway.

Why did AUD crash again? It’s not clear. Almost every bank economist I read says the RBA will stay hawkish this week.

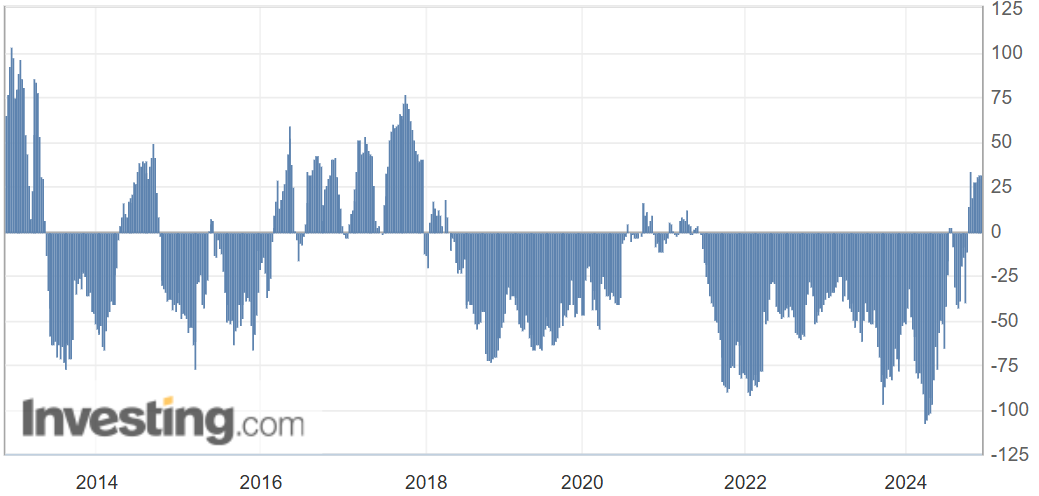

Perhaps that is why CFTC speculative positioning is steadfastly long in a losing position.

I have never seen a currency fall so fast without an equally large swing in speculative positioning. It is incredibly bearish.

I have been musing recently about a future external crisis for Australia as the currency collapses because monetary and fiscal easing is paralysed by gas cartel inflation.

Maybe it is already here.