DXY is hacking its way through more serious timber.

AUD is off the lows.

Aided by North Asia.

Oil needs to be $10 lower. I think we’ll get there.

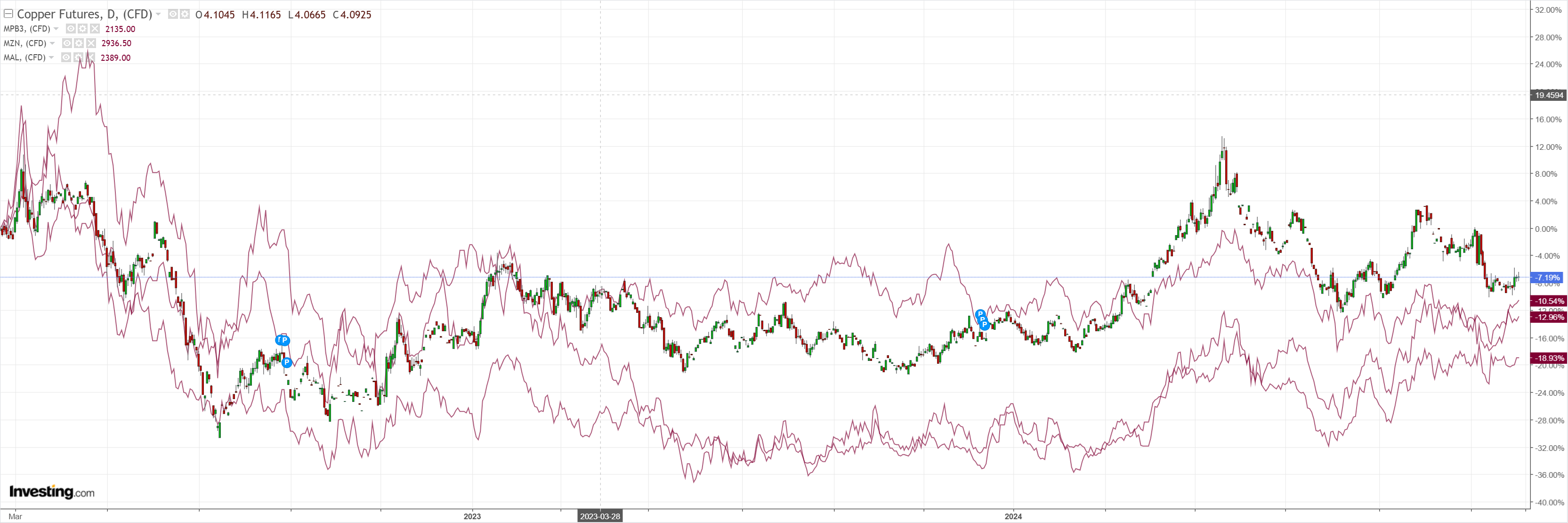

Dirt meh.

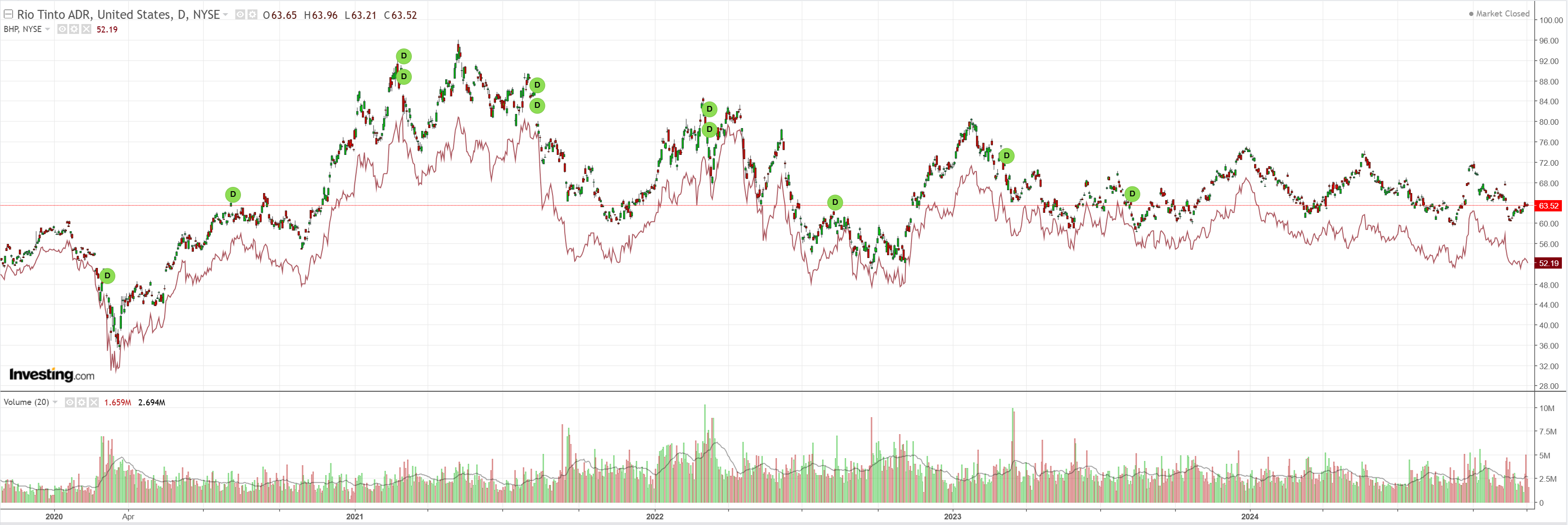

Miners meh.

EM meh.

Junk meh.

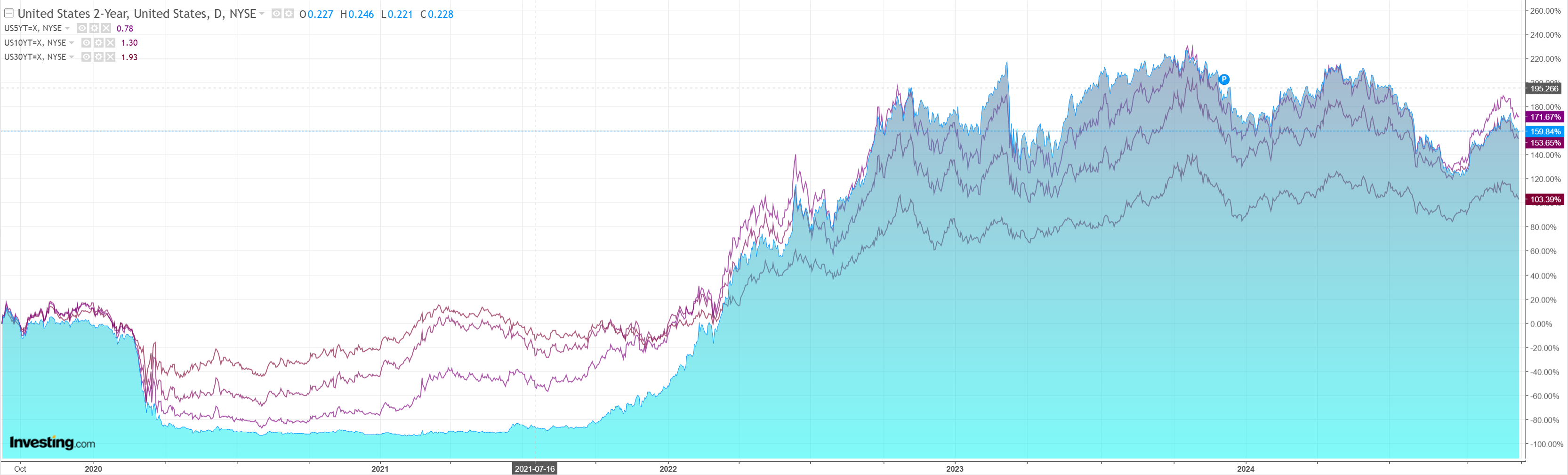

Looks like Treasuries are setting up for US jobs disappointment.

Which stocks will love.

Goldman on the NFP tonight.

We estimate nonfarm payrolls rose by 235k in November, above consensus of +215k … the end of strikes and the recent hurricanes that weighed on October job growth will likely boost November job growth. We estimate that the unemployment rate was unchanged at 4.1%, in line with consensus.

Even that would probably be enough to keep the pressure on DXY and offer relief to AUD.

DXY is still very overbought.

It will take a blowout jobs number to prevent further consolidation.