The DXY consolidation continues.

AUD caught a Chinese yawnulus thermal.

CNY is still at the cliff.

All commods popped.

Miners gapped higher.

EM blah.

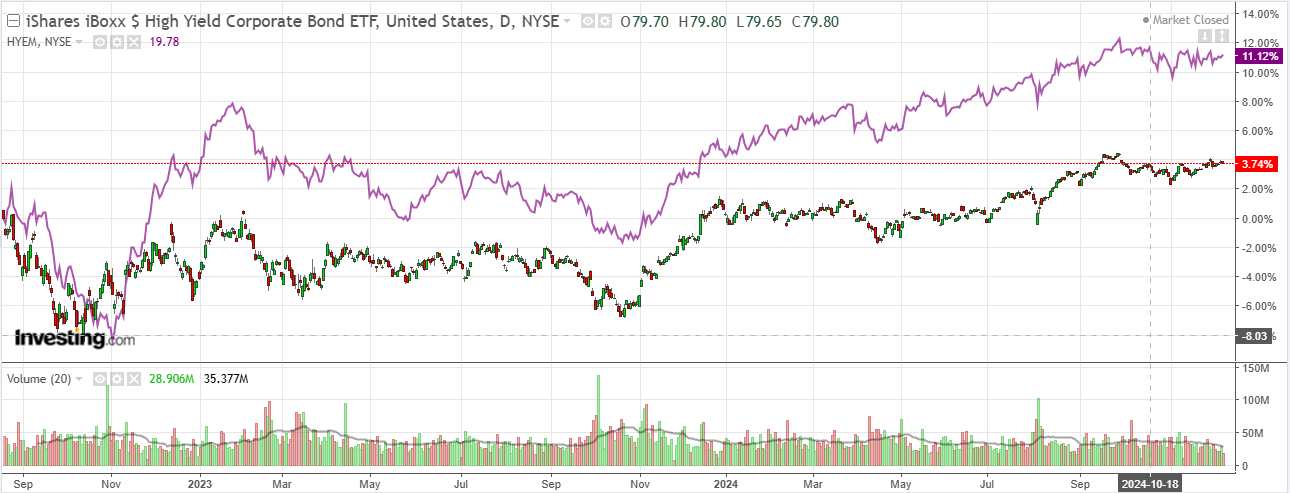

Junk firmed.

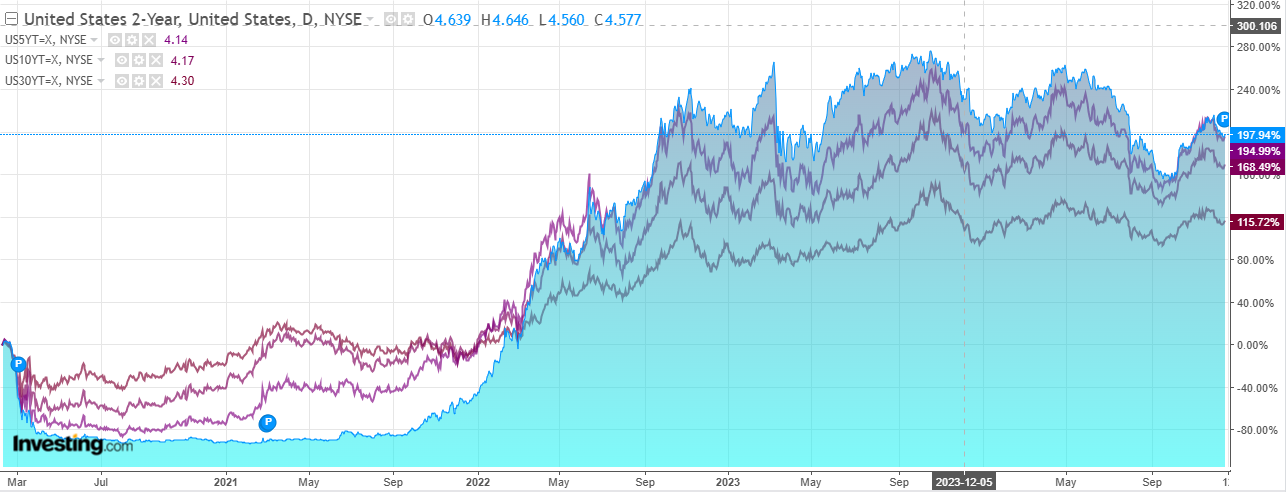

Yields rose.

Stocks faded.

It’s all about another round of Chinese stimmies. And I thought we had the bazooka three months ago.

In late September, Beijing vowed to boost fiscal spending at a quarterly Politburo meeting traditionally reserved for discussing non-economic matters. In reports emerging late Monday from the December gathering, the rhetoric was taken up a notch further. Top officials adopted dovish language on next year’s monetary policy and pledged to “stabilize property and stock markets” in 2025, while the nation’s residential real estate sector enters a fourth year of downturn.

…Unfortunately, there has not been much follow-through — and despite the excitement over Monday’s communications, I don’t expect any more details from this week’s tone-setting Central Economic Work Conference, which normally only establishes a policy stance.

…Bureaucracy could be an explanation for the lack of action. A more plausible explanation is that top policymakers hope that vague, big promises alone can reignite the animal spirits and lift China out of a deflationary spiral.

That sounds right to me. Promises of lifting domestic demand amid structural collapses in the drivers of domestic demand – property and infrastructure – are empty.

Doubtless, Beijing will increase the deficit and some of it will go to households to offset the tariff shock but it is unlikely to be enough if Trump delivers his 60% tariff promises.

I still see CNY as the primary weapon to fight back. That is further confirmed by yesterday’s commitment on looser monetary policy.

I’ll be using any rise in the AUD to push further offshore unless Trump backs off.