The Australian Bureau of Statistics (ABS) released the Q3 national accounts last week, which was an absolute disaster.

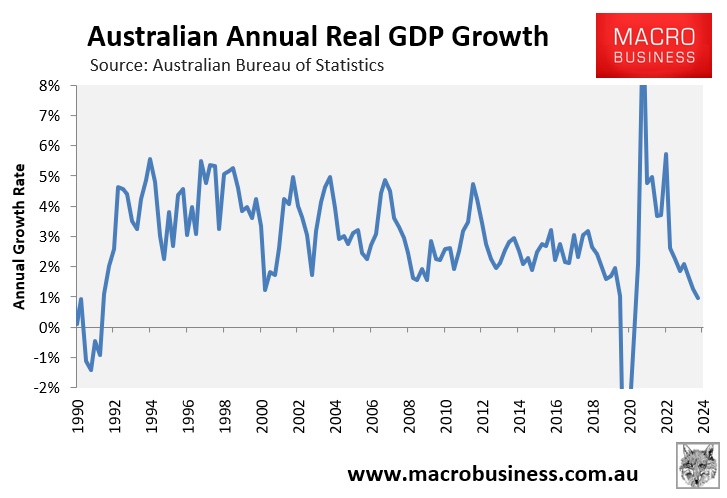

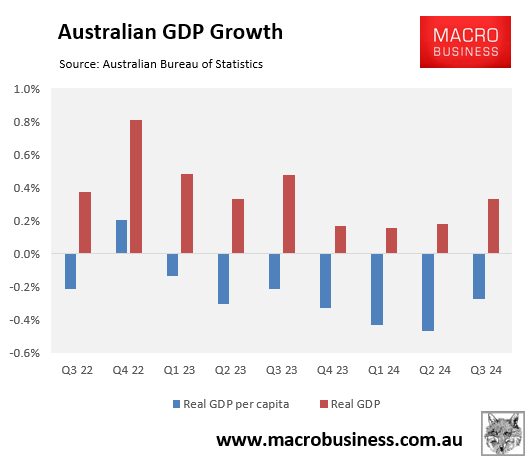

Annual real GDP growth collapsed to only 0.8%, the lowest rate since December 1991 outside of the pandemic.

Australia’s real per capita GDP fell for the seventh consecutive quarter—the most prolonged decline on record.

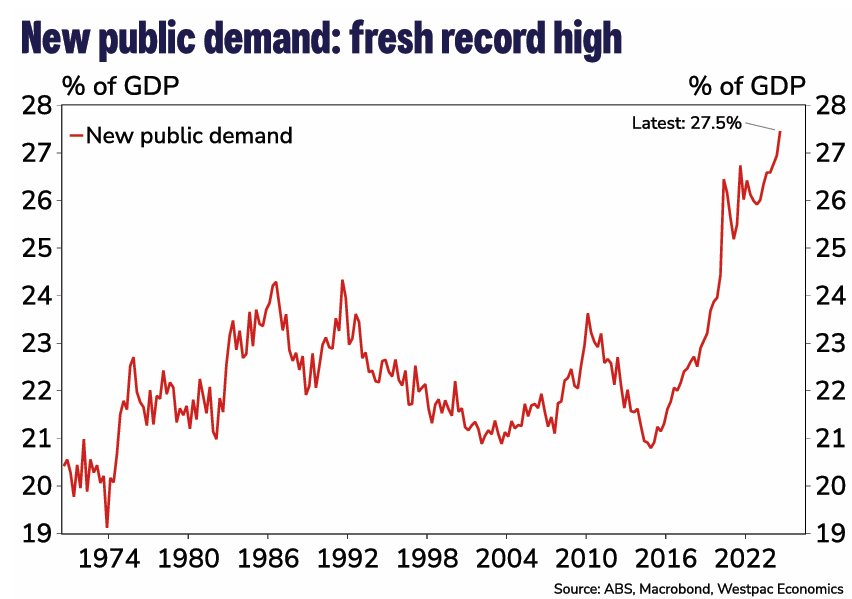

The decline in Australia’s GDP growth came despite record public demand, which hit an unprecedented 27.5% of GDP in Q3.

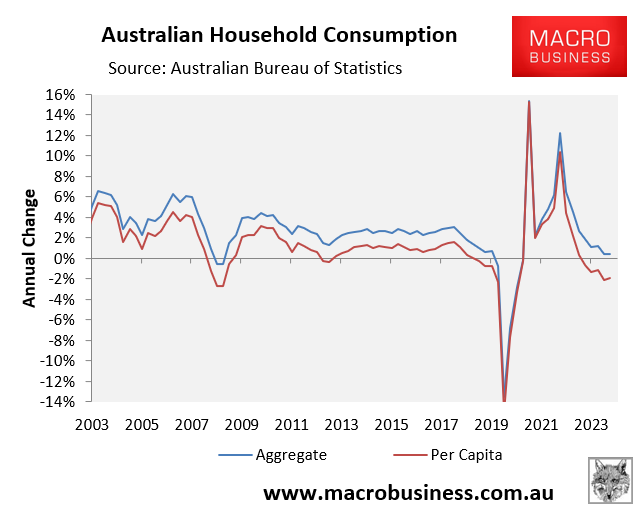

Public demand drove all of Australia’s GDP growth in Q3 and offset the sharp decline in household consumption spending.

Therefore, Australia’s economy is structurally weak, propelled by record public spending and historically high population growth (immigration).

A new analysis published by Justin Fabo at Antipodean Macro reveals that Australia’s economy is even weaker than thought.

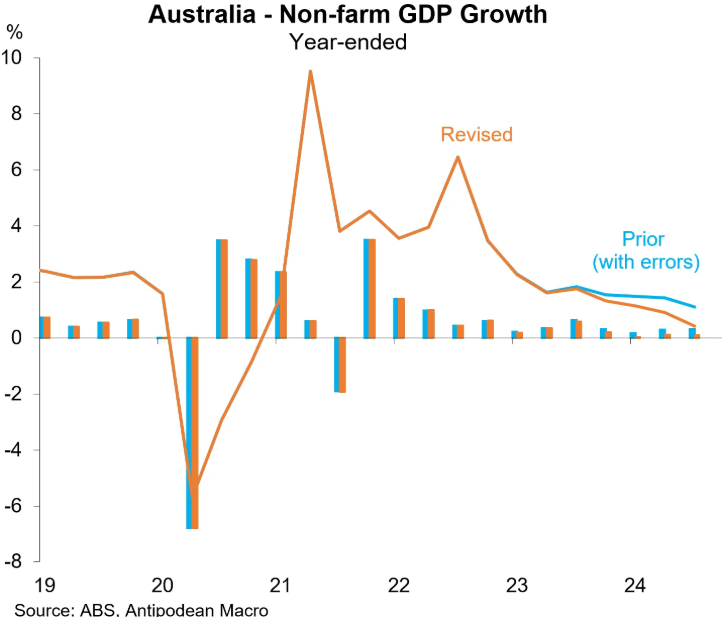

As illustrated below, the ABS on Wednesday revised down Australia’s non-farm GDP growth significantly.

“While total real GDP grew +0.8% y/y in Q3, non-farm GDP rose just +0.4% y/y. (Farm GDP grew a robust +18.3% y/y.) Non-farm GDP has grown just +0.2% over the past three quarters!. That is very weak”, noted Fabo.

“Moreover, the trajectory of non-farm GDP now looks flatter than published three months ago”, noted Fabo.

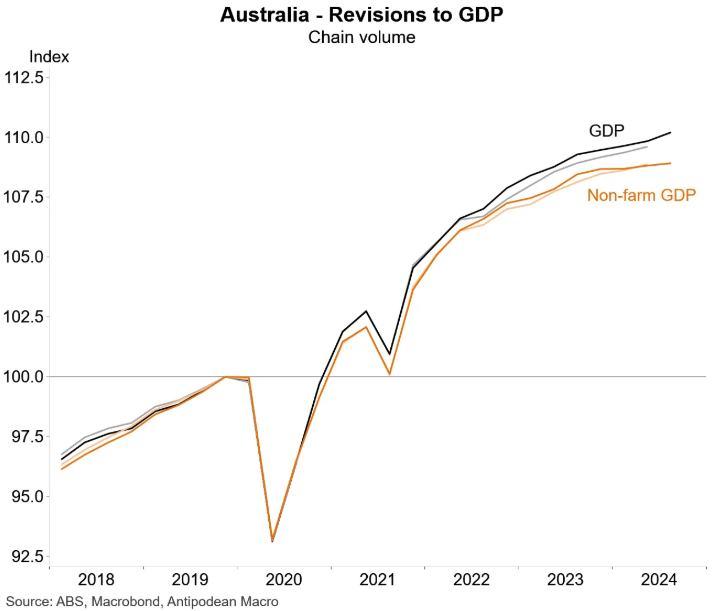

“That is quite different to the upward revisions to total GDP. This has occurred because of significant upward revisions to farm GDP”.

Fabo added that economists “typically focus on non-farm aggregates because they matter most for labour market outcomes. Farm output can be volatile, including because of weather conditions”.

Therefore, the above data is more evidence that Australia’s economy is weaker than it looks.