Research from credit rating agency Equifax suggests that 39% of Australians are experiencing financial stress.

The Equifax survey also found that about 50% of Australians reduced their discretionary spending in the last year, compared with 37% in 2022.

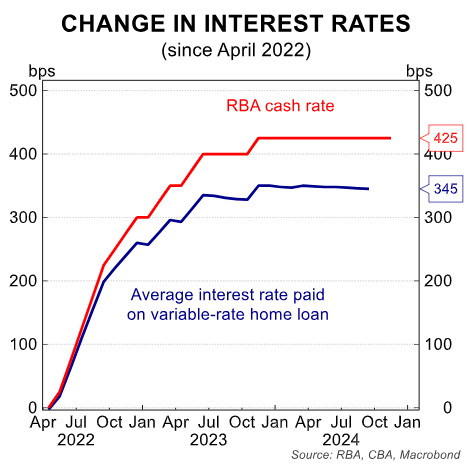

The rise in Australians experiencing financial stress aligns with the surge in mortgage payments resulting from the RBA’s 4.25% interest rate increases.

Even though the RBA has not lifted the cash rate since November 2023, mortgages continue to roll off at ultra-low fixed rates, and the housing credit stock has grown.

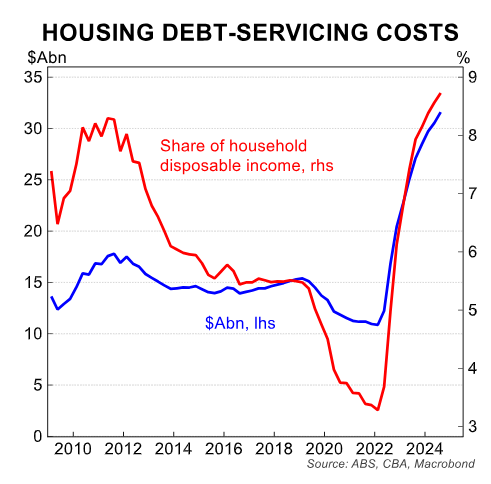

As a result, housing loan servicing costs continue to rise, both in dollars and as a percentage of income.

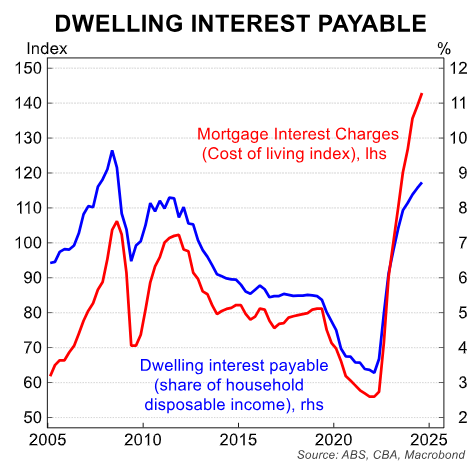

In turn, interest payments are consuming a growing portion of household disposable income. Interest payable on housing increased by 3.4% in Q3 2024, up from 2.8% in Q2 2024.

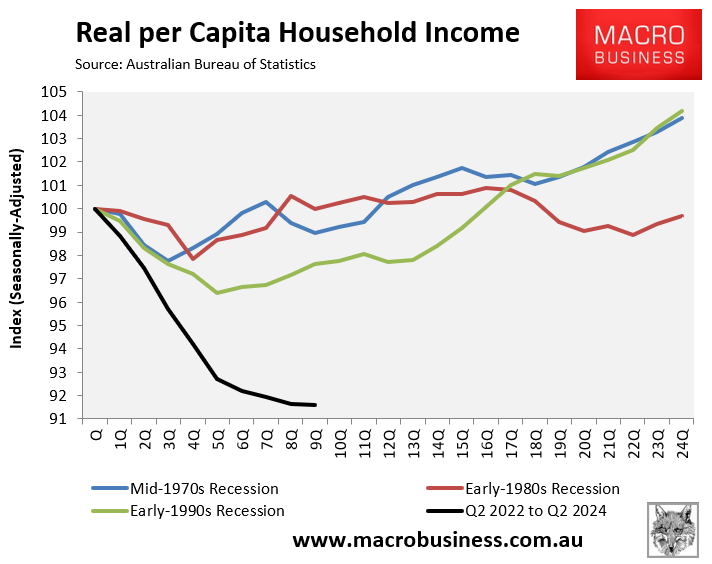

One reason for the collapse of Australian household disposable income, which has fallen 8.4% since Q2 2024, is the rise in debt servicing payments.

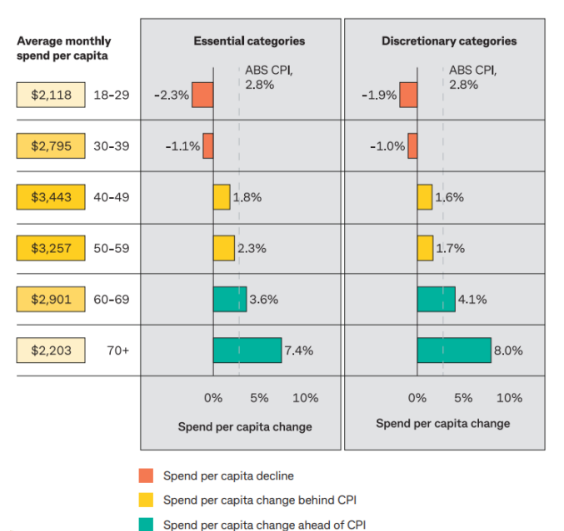

This decline in disposable income has prompted younger Australians suffering from rental and mortgage stress to slash spending.

Equifax’s survey also showed that 50% of respondents said their biggest financial priority for 2025 is paying down debt or ceasing to live from one pay cycle to the next.

Separate data from the Australian Financial Security Authority shows that personal insolvencies increased by 6.4% year-on-year in the September quarter.

In short, Australian households are desperate for interest rate relief.