Justin Fabo from Antipodean Macro has compiled the following table summarising the key figures from Wednesday’s Mid-Year Economic and Fiscal Update (MYEFO).

After recording a budget surplus in 2023–24, deficits are forecast across the forward estimates.

In fact, Fabo shows that the underlying budget balance is projected to be in deficit for the next decade.

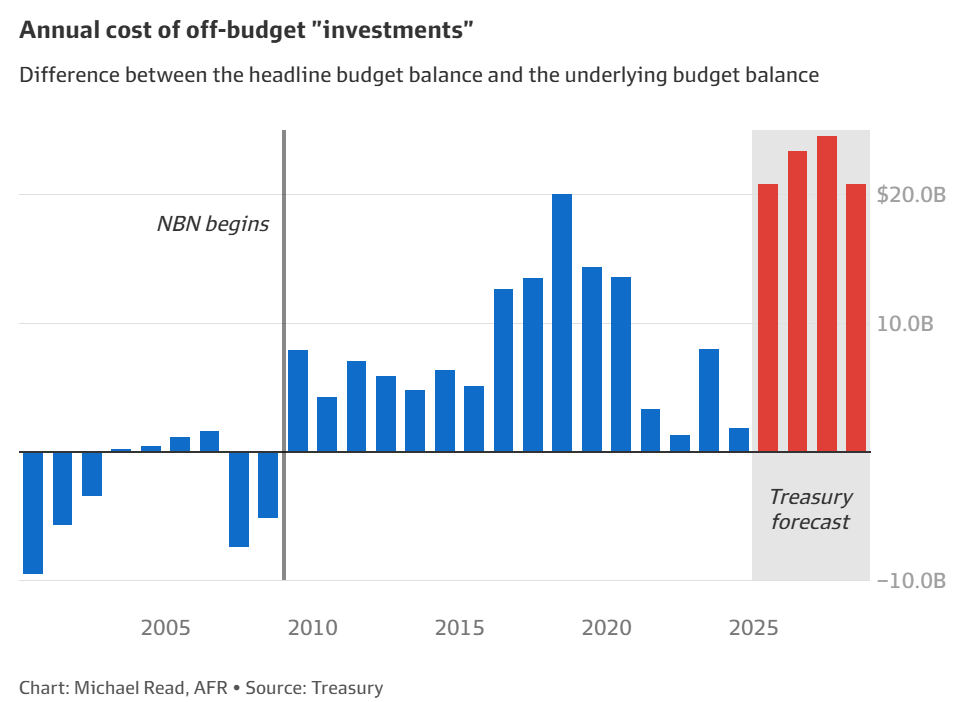

As noted on Wednesday, the federal government will spend a record $90 billion “off-budget” over the next four years, obscuring the true situation facing the budget.

This off-budget spending surge in off-budget spending will push the headline deficit to $70.3 billion 2026-27.

Treasury projects that headline deficits will cumulatively equal $233 billion over the next four years, representing a $33.6 billion deterioration on the May budget.

Michael Read at The AFR compiled the following list of off-budget measures implemented by the Albanese government.

Economist Chris Richardson estimated that the Albanese government received a federal budget windfall of $384 billion from three primary factors:

- Russia’s invasion of Ukraine drove up global commodity prices, resulting in higher mining company tax receipts.

- Higher than forecast immigration lifted personal income tax receipts.

- Higher than expected inflation further increased personal income tax receipts via bracket creep.

Richardson noted on Twitter (X) that the Albanese government “made decisions that have raised spending by $124 billion, and have raised taxes by $46 billion, for a net worsening in the budget position across the forward estimates of $78 billion”, illustrated below.

Source: Chris Richardson

The projected decline in tax receipts comes at the same time as spending commitments like the NDIS continue to balloon in cost.

As a result, Australians are facing a decade of deficits.

The next federal government should revisit the 2010 Henry Tax Review and commence a process of fundamental tax reform.

The federal government needs to broaden the tax base away from personal income and company taxes toward taxes on consumption, resources, and land.

With the ageing population, Australia’s tax base must be broadened.