The Q3 national accounts release from the Australian Bureau of Statistics (ABS) revealed the astonishing decline in real per capita household disposable incomes.

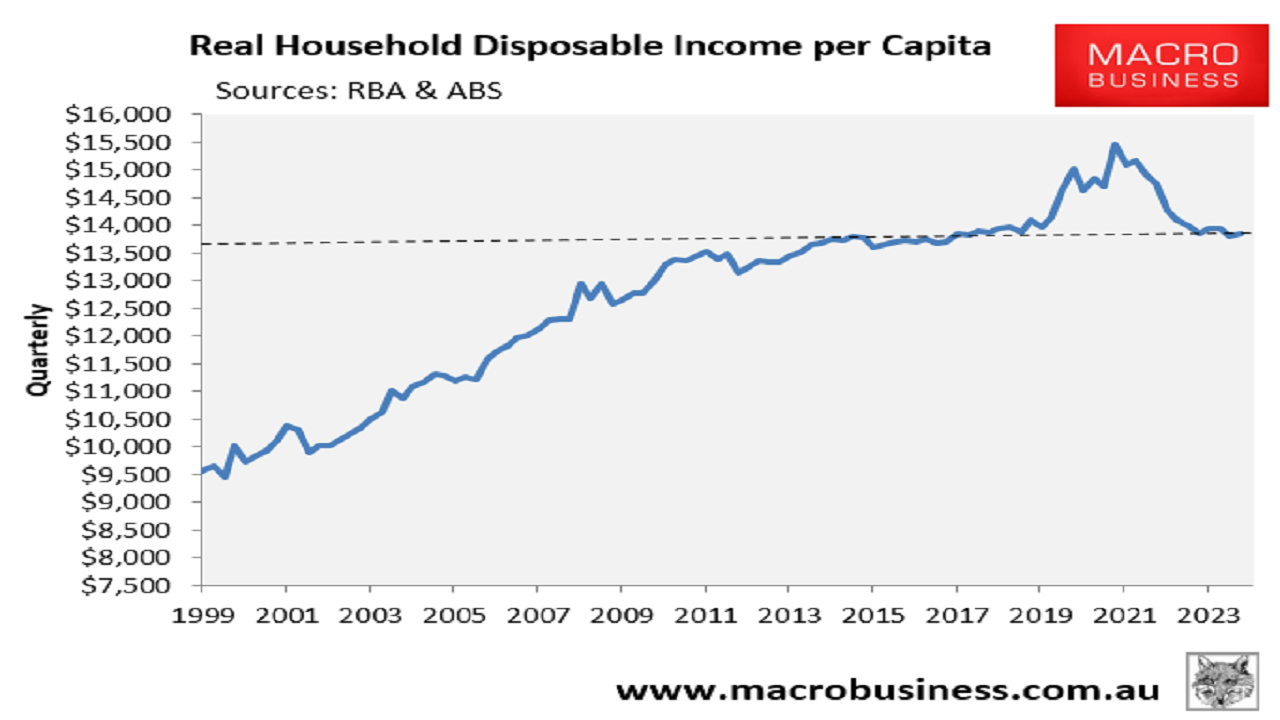

On a quarterly basis, real per capita household incomes have declined by 8.7% from the peak in Q1 2022.

As a result, real household incomes were tracking only 1.2% above their level a decade earlier in Q1 2024.

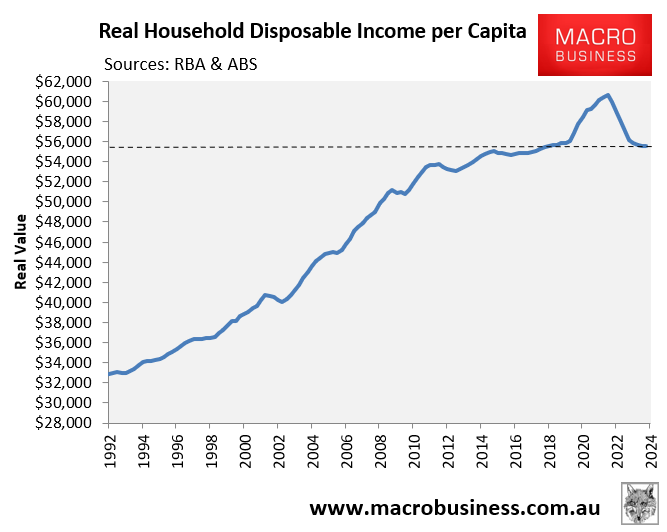

In annual terms, Australian real per capita household disposable income in Q3 2024 was tracking 8.4% below the Q2 2022 peak and was only 2.2% higher over the decade.

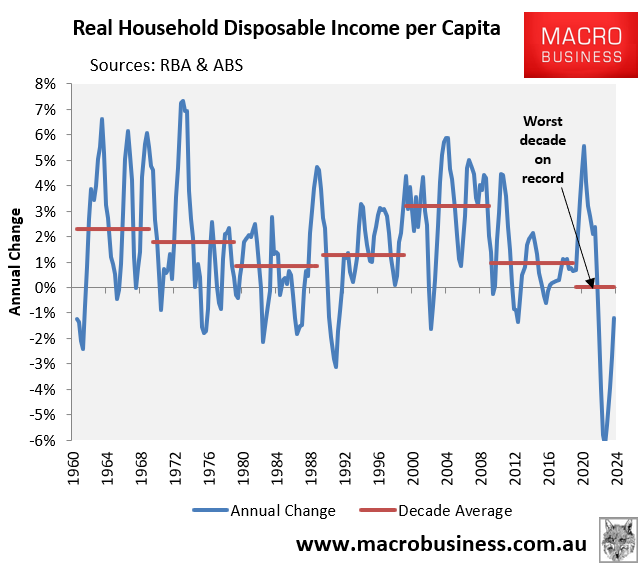

The 2020s are shaping as a ‘lost decade’ for Australian households, with real per capita incomes experiencing zero growth so far—the worst decade average growth in more than 60 years of data.

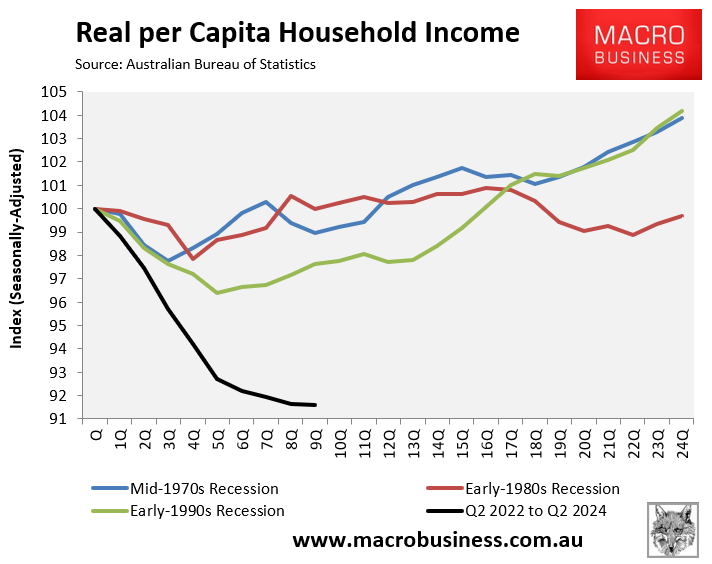

The following chart plots the current decline in real per capita household incomes against previous downturns.

As you can see, the current 8.4% decline is unprecedented and dwarfs the 3.6% peak-to-trough decline experienced during the technical recession of the early 1990s.

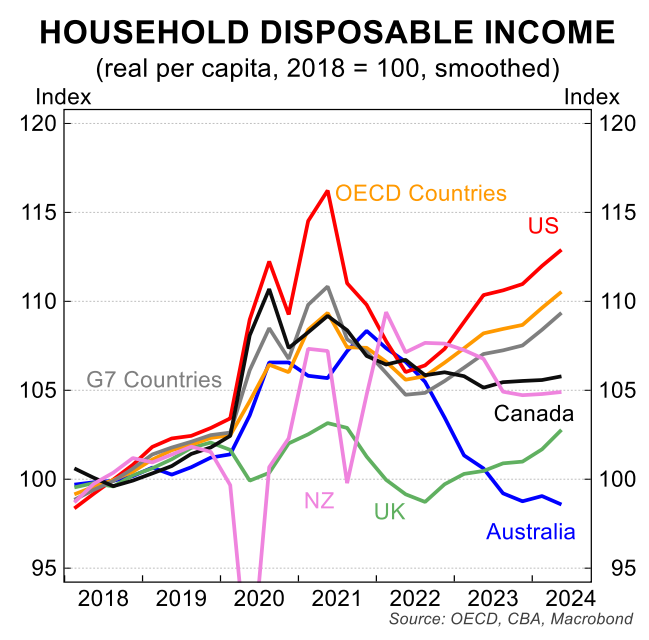

According to OECD data, Australia’s decline in household incomes has also been the largest in the developed world.

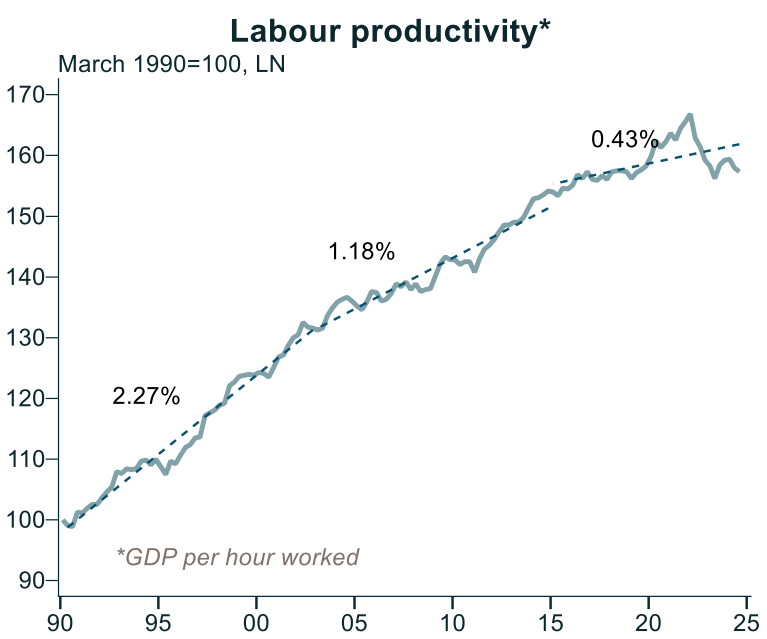

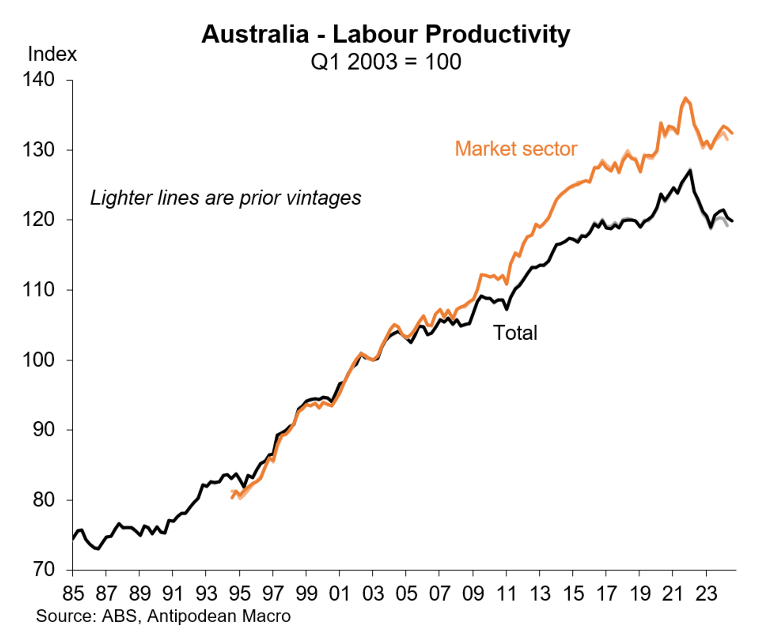

The rebound from the income recession is likely to be weak owing to Australia’s structurally poor labour productivity growth, which has collapsed to 2016 levels.

Source: Alex Joiner (IFM Investors)

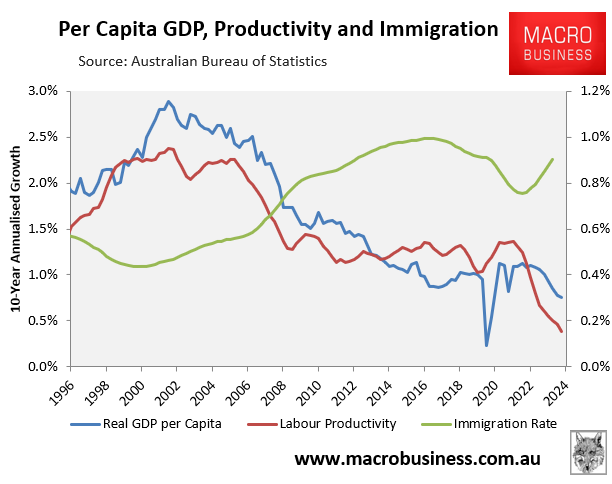

The Australian economy remains wholly reliant on the public sector and population growth (immigration).

This has resulted in too many low-productivity, non-market sector jobs.

It has also led to chronic capital shallowing, as population growth has outrun infrastructure, business, and housing investment.

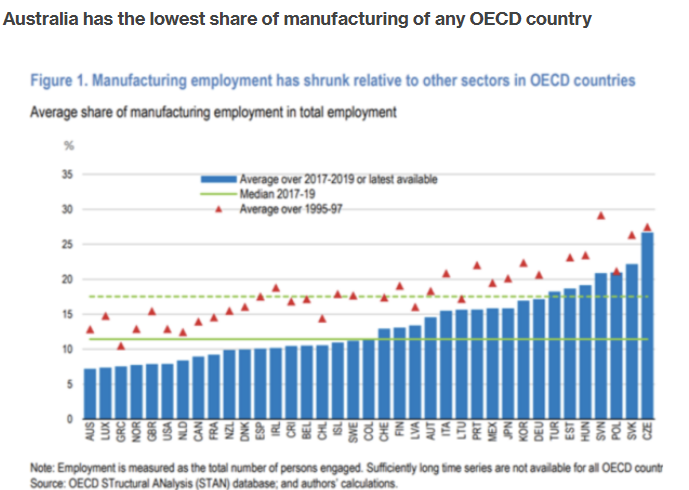

High energy costs have also hollowed out Australia’s manufacturing base, further destroying productivity growth.

Australia will remain a low-productivity, low-income growth economy if it follows the same ‘Ponzi’ paradigm.