Economist Chris Richardson has posted an analysis on Twitter (X) showing that “Lady Luck has shone on Jim Chalmers, handing the budget truly magnificent manna from heaven”.

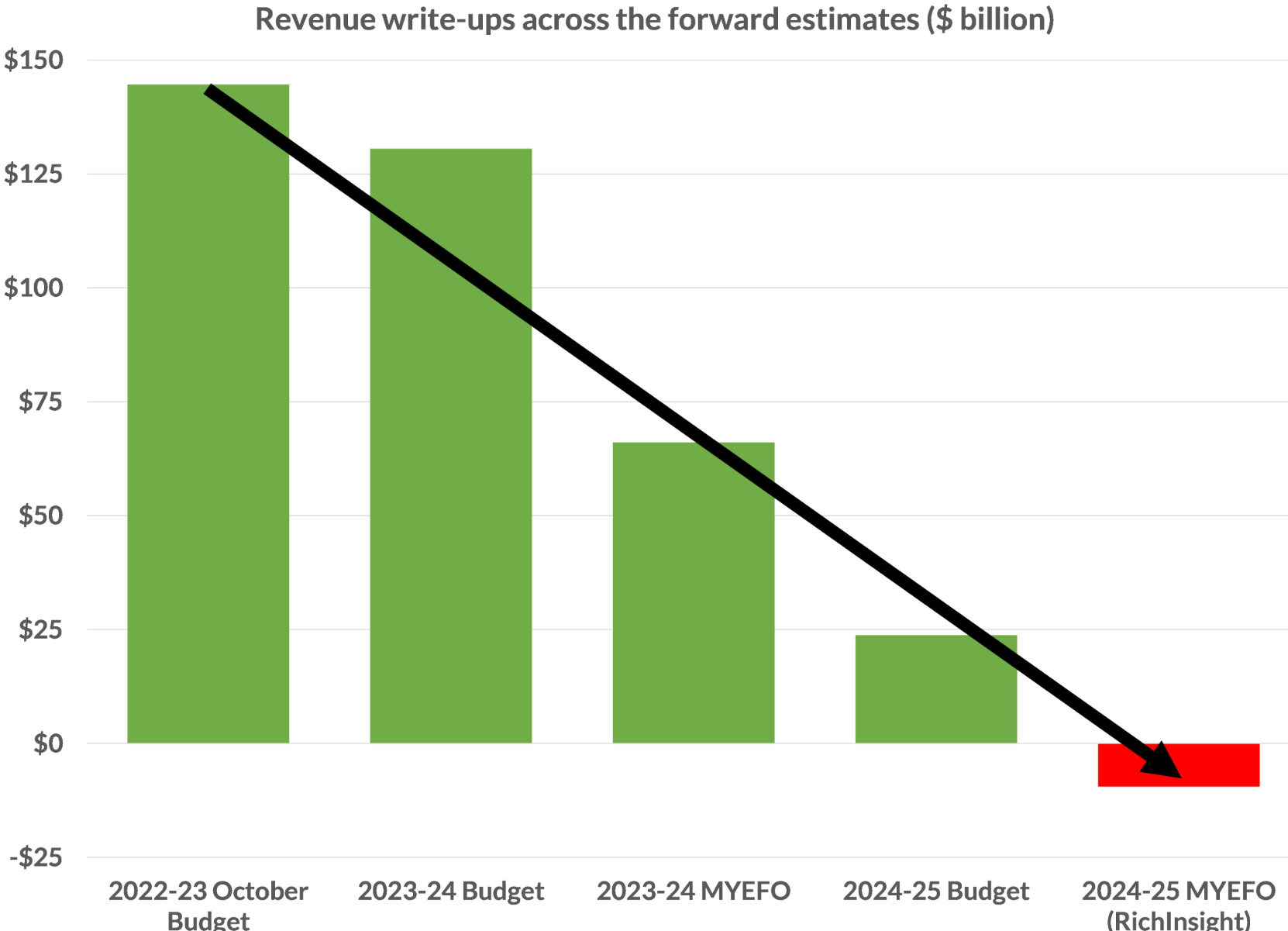

As illustrated in the following chart, “in a span of less than 20 months, Treasury jacked up the estimated tax take by a remarkable $365 billion”.

Three fortuitous factors drove the revenue upgrade.

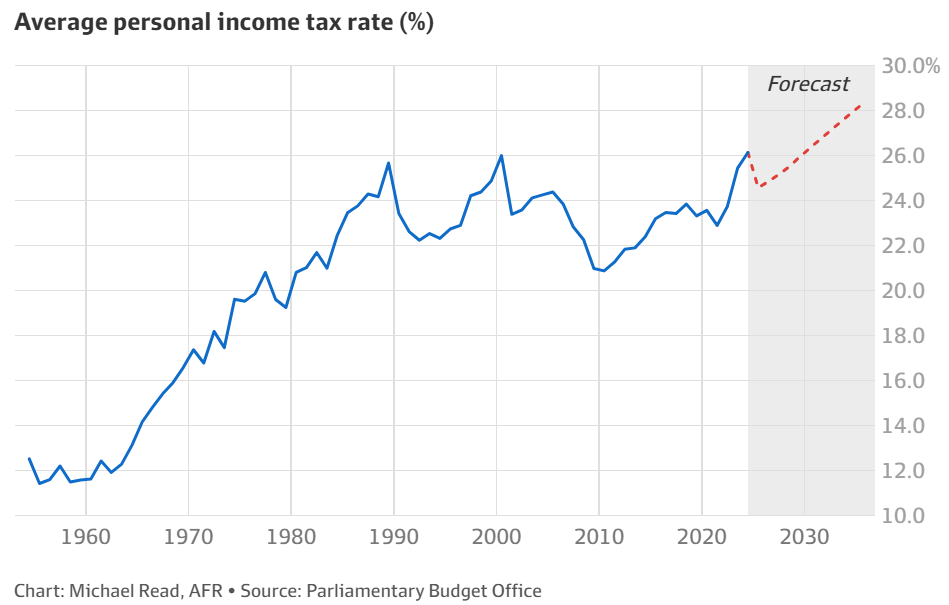

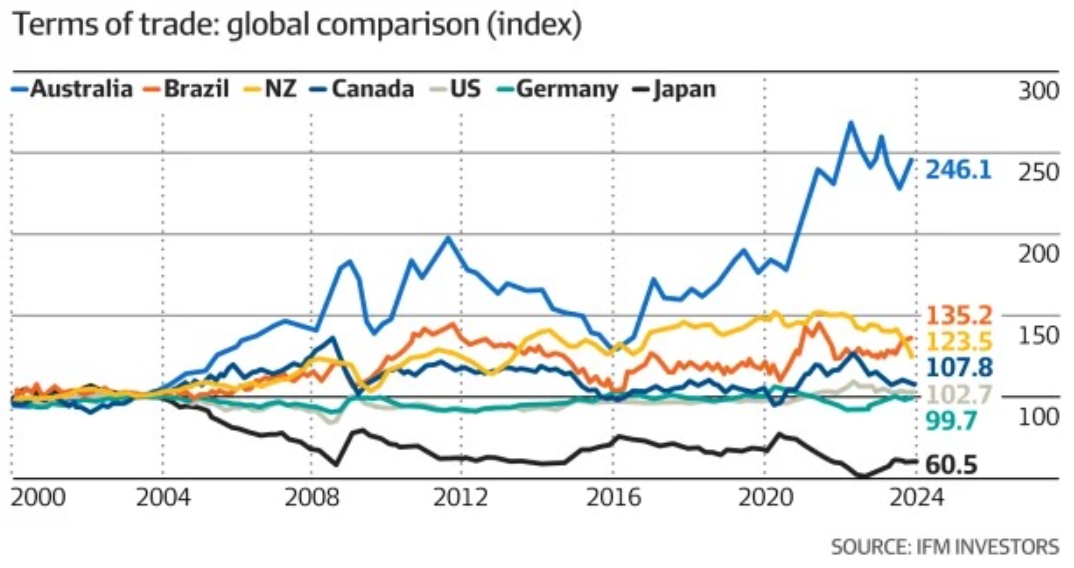

“War drove up the price of things Australia sells to the world, so the pie we tax got bigger”, Richardson explained. “And migration saw population growth roar, which also boosted the pie that we tax. Finally, inflation changed slices of the national pie: families got less, and the taxman got more”.

While the federal budget benefited from these factors, households incurred the costs through higher energy prices, the rental crisis, and record tax expenditures.

Richardson noted that the goldilocks conditions are fading or reversing, which will result in the federal budget swinging into deficit.

“Our budgetary luck is running out”, Richardson noted. “Iron ore prices are down, inflation is too, and migration is slowing, while the hollow log provided by past Treasury conservatism is much less hollow than it used to be”.

“Mind you, today’s budgetary times aren’t exactly tough. My forecasts merely trim the impact of luck on the budget since the government was elected from $365 billion down to $355 billion. That’s still a pretty good problem to have”, Richardson said.

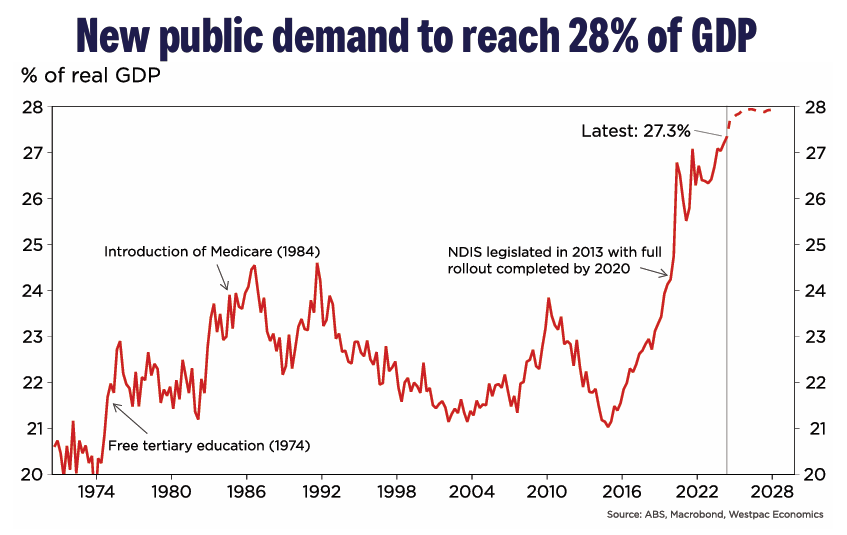

However, Richardson warned that the federal government used the budget windfall to lock in higher expenditures.

“Since its election, its decisions have added $104 billion to spending while raising taxes by $44 billion, a combination that worsened the budget bottom line by a net $60 billion”, he said.

“The luckiest government Australia has ever seen – at least in budgetary terms – didn’t take the opportunity to get the national budget better prepared for the long haul, let alone grab the chance to use its huge windfall to buy its way towards much needed reforms”.

“There’s been little-to-no structural reform of either the economy or the budget for two decades now, with our increasingly dumb budget policies coming at a rising cost to Australians”, Richarson wrote.

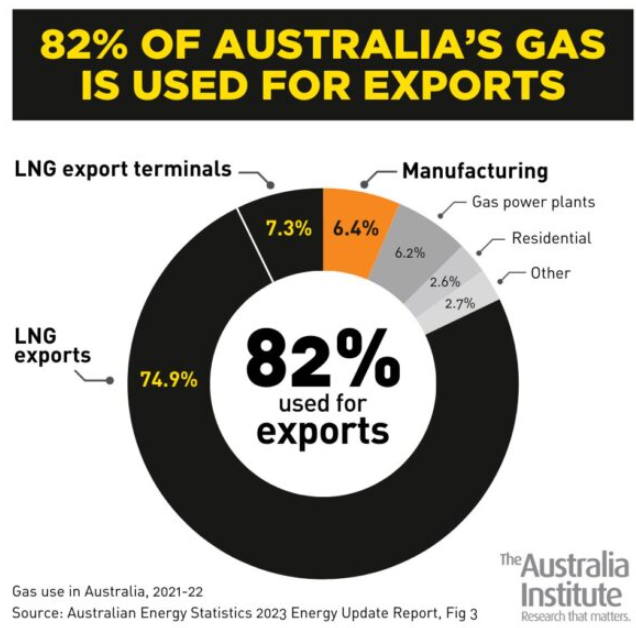

Richardson specifically criticized Australia’s low taxation of its gas industry, which exports 82% of the country’s gas to Asia while creating shortages at home.

“You’d have to try really hard to have a worse policy than how we tax our gas”, Richardson said.

He also called out the explosive cost of the NDIS, which is not delivering value for money and manages “to simultaneously fail both our disabled and our taxpayers”.

Richardson concludes by saying that Australia is now exposed to a severe downturn in budget revenues and has little to show for the enormous windfall:

“Luck is a bandaid that hides worsening fundamentals. Even ignoring spending that’s likely but hasn’t actually been announced (such as another year of electricity subsidies and new universal childcare subsidies), I forecast coming cash underlying deficits to 2027-28 to be $10 billion worse than the Treasury estimated in May’s budget”.

“Yet there’s a surge in dodgy action off-budget, meaning cash headline deficits maybe $20 billion worse than Treasury estimated”.

“Luck’s a fortune. But it’s not a strategy”.

Australia was the greatest beneficiary of the 20-year boom in commodity prices and should be the wealthiest nation on earth.

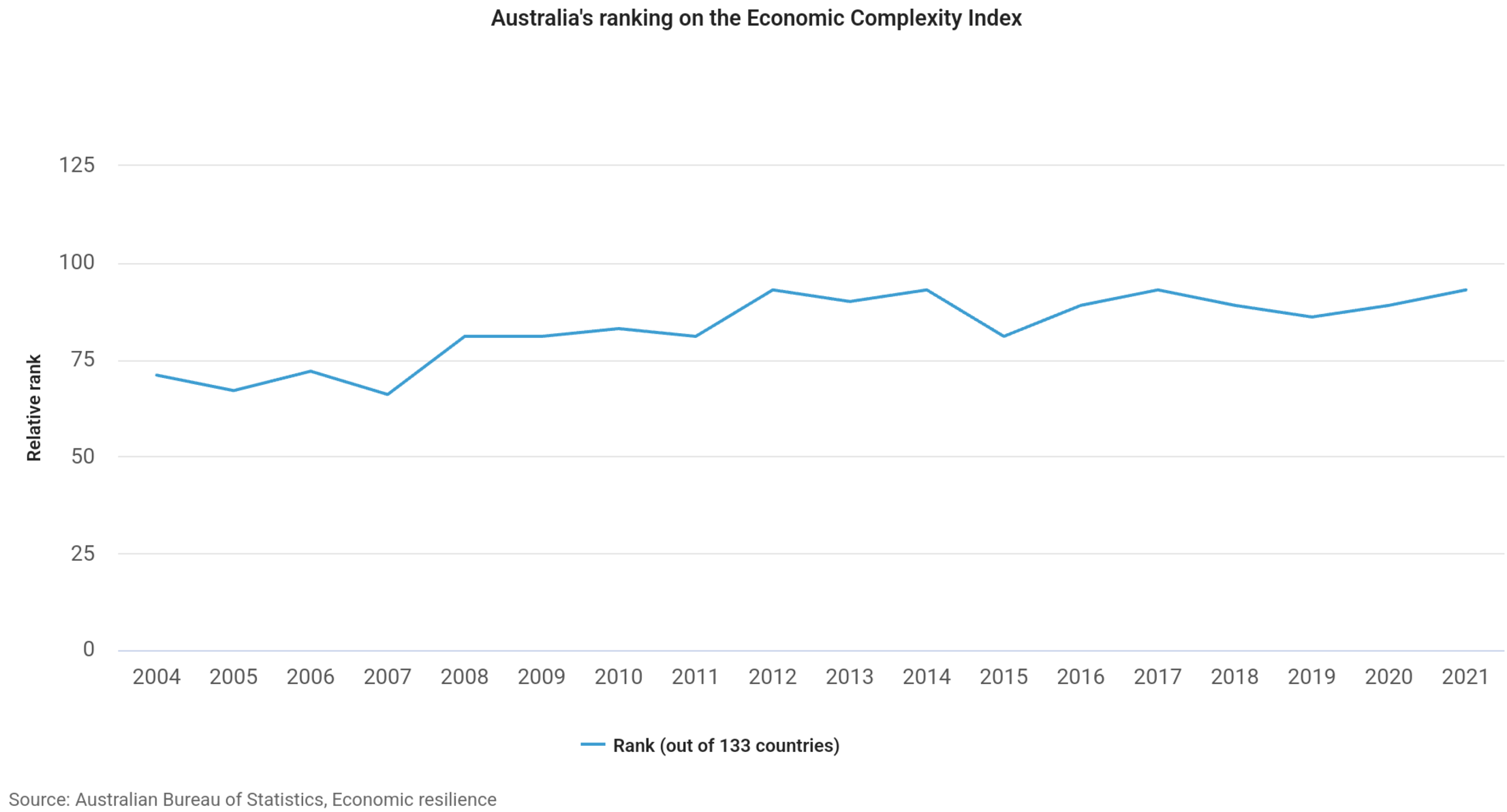

Instead, we have been left with a structurally broken, hollowed-out economy that is among the least complex in the world.

Chart by Tarric Brooker

Being so reliant on commodities, rising property prices, mass immigration, and government spending to drive growth are not the hallmarks of a clever country.