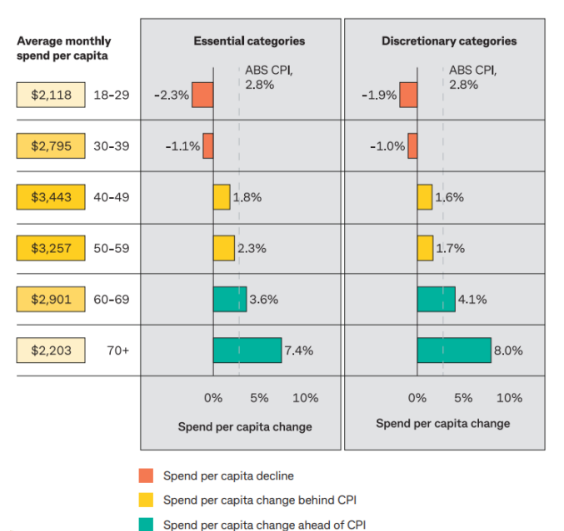

Last month, CommSec released data showing how Australians aged over 60 increased their consumption spending by more than inflation over the past year.

Source: CBA

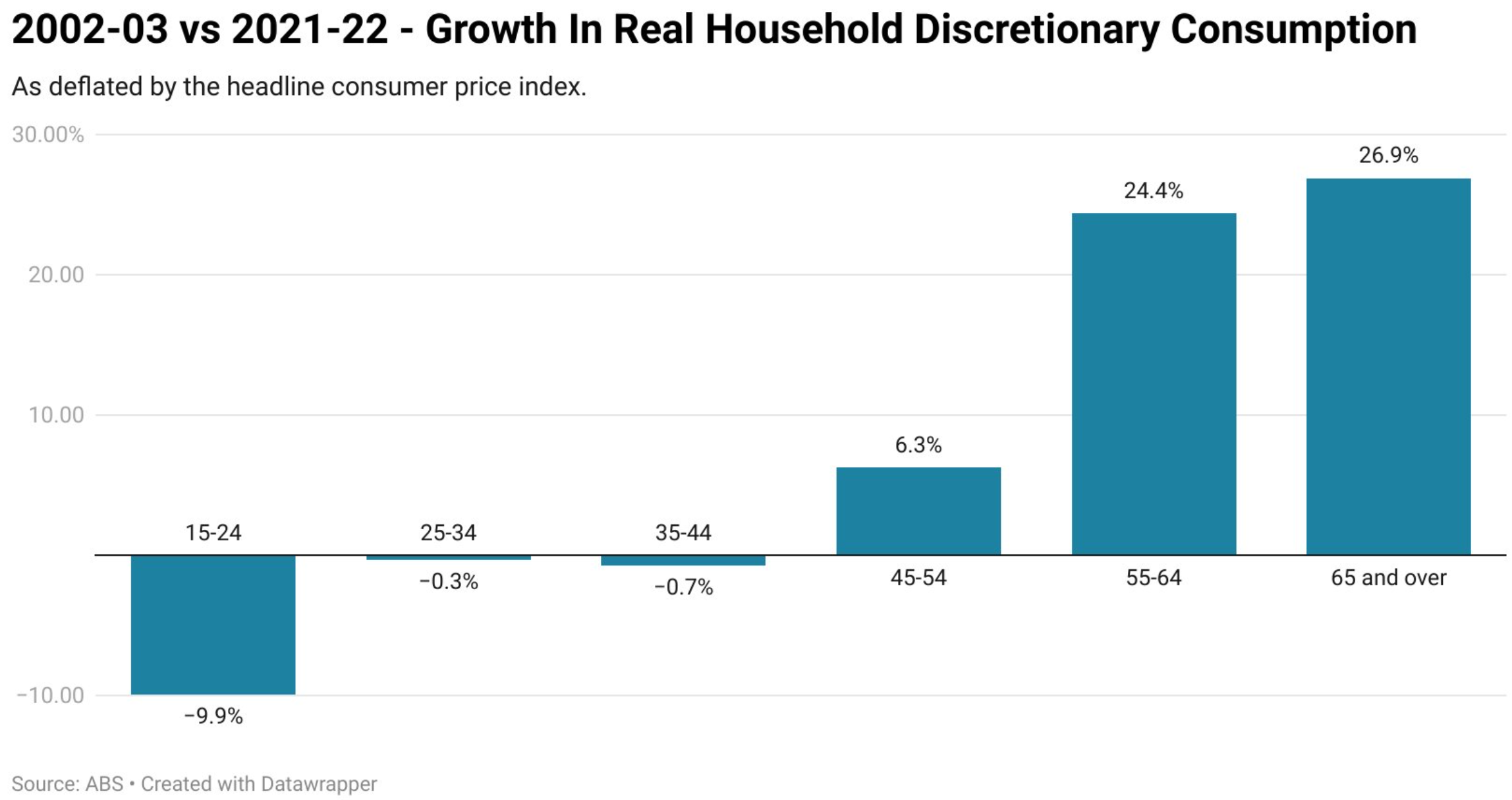

Independent economist Tarric Brooker created the following chart, taking a longer perspective on household spending. It shows that older Australians drove consumer spending over the two decades to 2021–22, whereas younger Australians cut back on spending.

Chart by Tarric Brooker

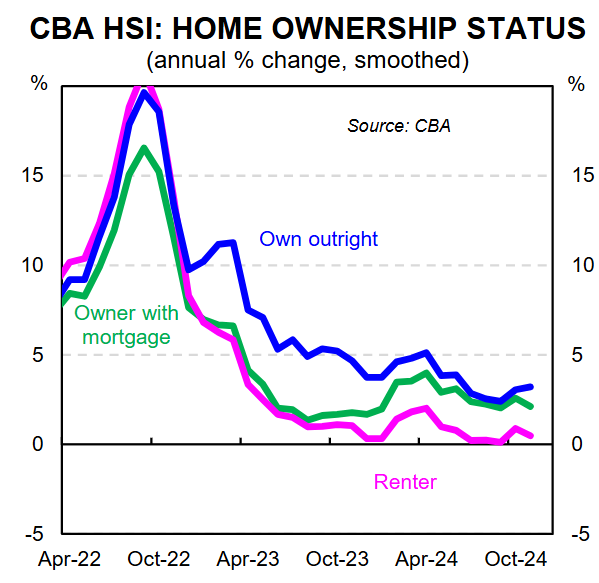

CBA’s November Household Spending Insights (HSI) survey also showed that households who own their homes outright increased their spending the most in the year to November.

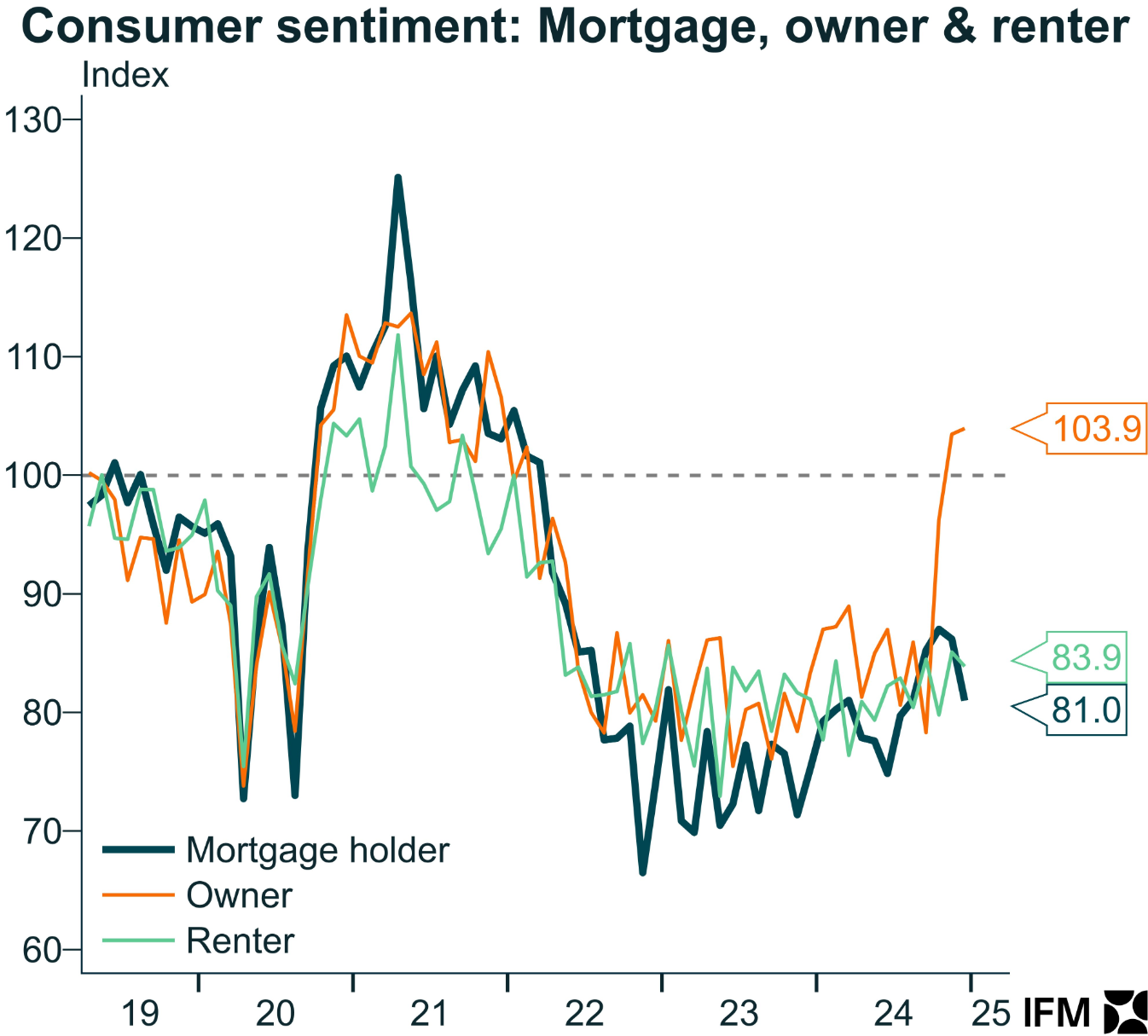

On Tuesday, Westpac released its final consumer sentiment survey for 2024. As illustrated below by Alex Joiner at IFM Investors, sentiment among outright home owners is strong and tracking far above renters and mortgage holders.

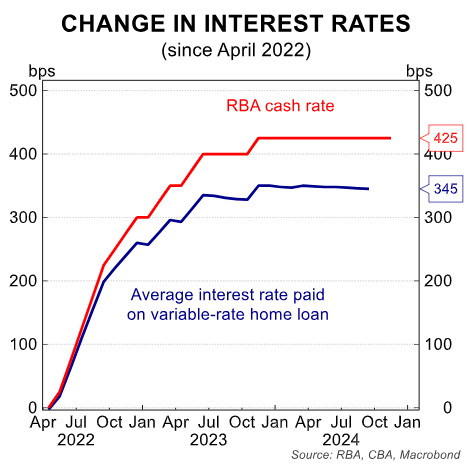

The Reserve Bank of Australia’s 4.35% interest rate hikes directly impact around one-third of owner-occupier mortgage-holding households, notably Generation Xers and Millennials with young children.

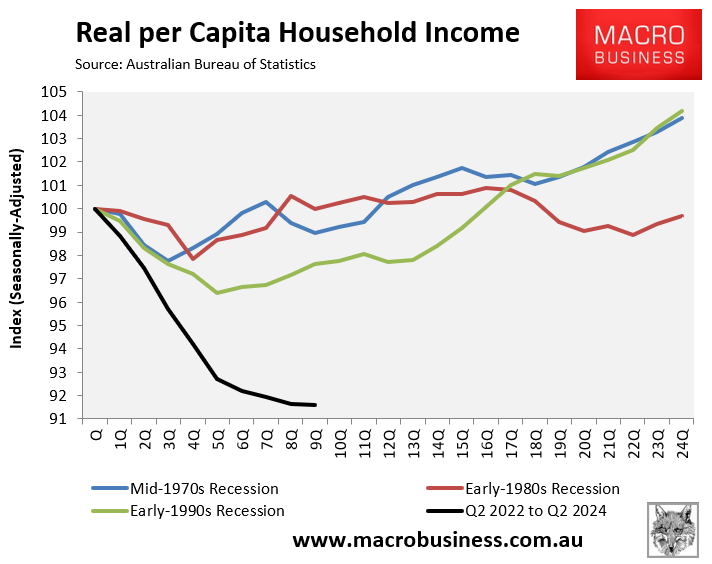

They have seen their mortgage payments rise by around 50%, contributing to the record decline in household disposable income.

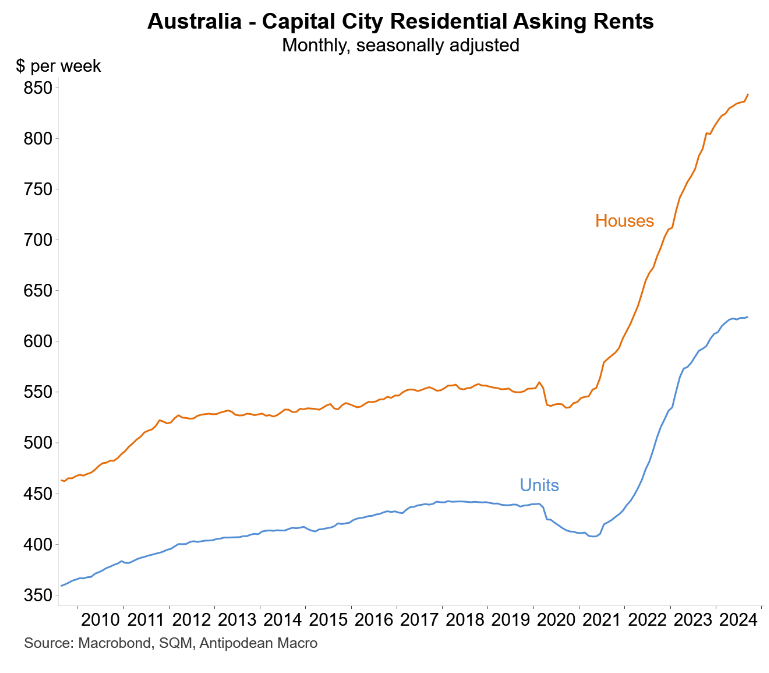

Another third of (mainly young) renting households have been negatively impacted by the surge in rents, which has drained their disposable incomes.

On the other hand, the baby boomers are experiencing favorable economic conditions.

They typically own their homes outright, so rising mortgage rates and rents have little effect on them.

Some baby boomers are even benefiting from rising rents, as they own a large share of the country’s investment properties (many of which are mortgage-free). They are also receiving higher interest on their savings.

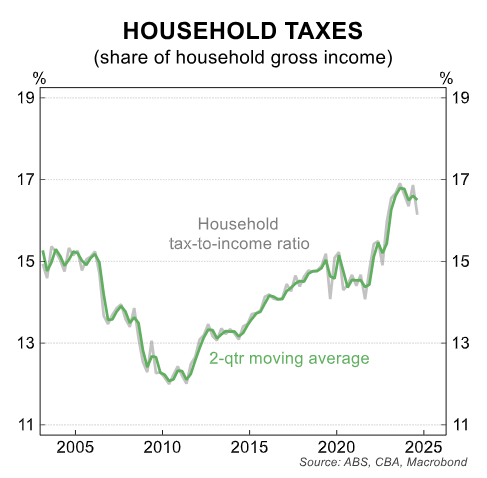

Most older Australians do not work; therefore, income tax hikes owing to bracket creep do not affect them.

Finally, Australians receiving the aged pension have their payments linked to inflation. Therefore, their buying power has been largely preserved, unlike workers’ incomes.

The figures data highlights why Australia requires fundamental tax reform that shifts the base away from productive activities (i.e., taxing work) and towards more efficient sources such as resources, land, and consumption.

Australia’s tax system is unsustainable, inequitable, and inneficient as it relies on a diminishing share of workers who continue to be slugged higher rates of tax.

At the same time, the share of taxes collected via indirect sources (e.g., GST and fuel excise) is declining.

The situation is made worse by the fact that the share of older Australians is expanding and paying lower taxes than ever, despite holding most of Australia’s wealth.

No wonder they are feeling confident.