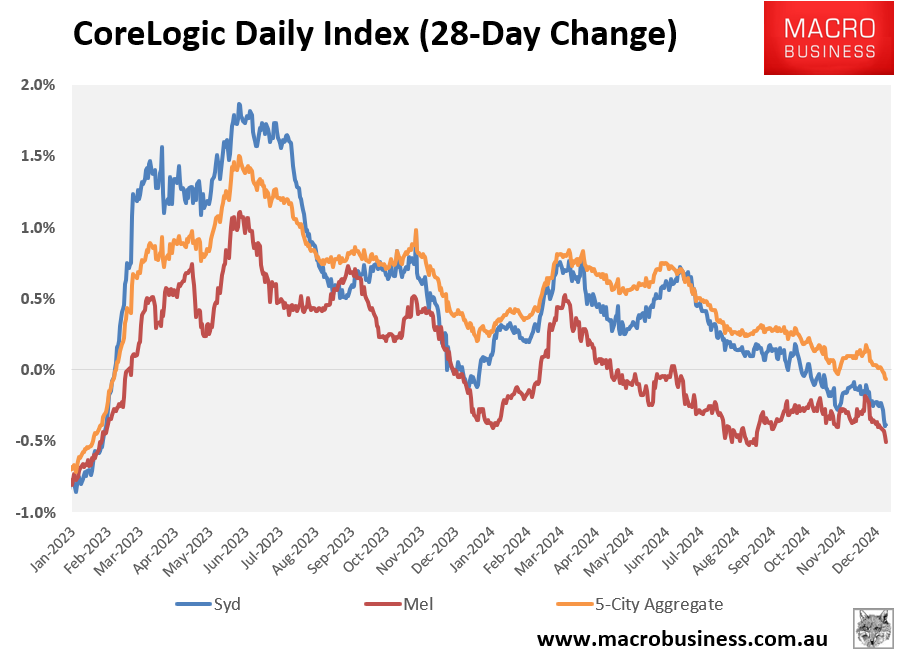

CoreLogic’s daily dwelling values index suggests that Australia’s house price correction is accelerating, led by Sydney and Melbourne.

Dwelling values in Sydney have fallen by 0.4% over the past 28 days, whereas Melbourne’s have declined by 0.5%.

These two cities have pulled values down by 0.1% at the 5-city aggregate level.

Tim Lawless from CoreLogic expects the residential housing market to be “subdued” until the Reserve Bank of Australia (RBA) begins reducing the official cash rate next year.

“It does look like conditions have weakened further, and although we don’t track the national index daily, it looks likely that the national index is probably, if not flat, it might be down a little bit by now”, Lawless said.

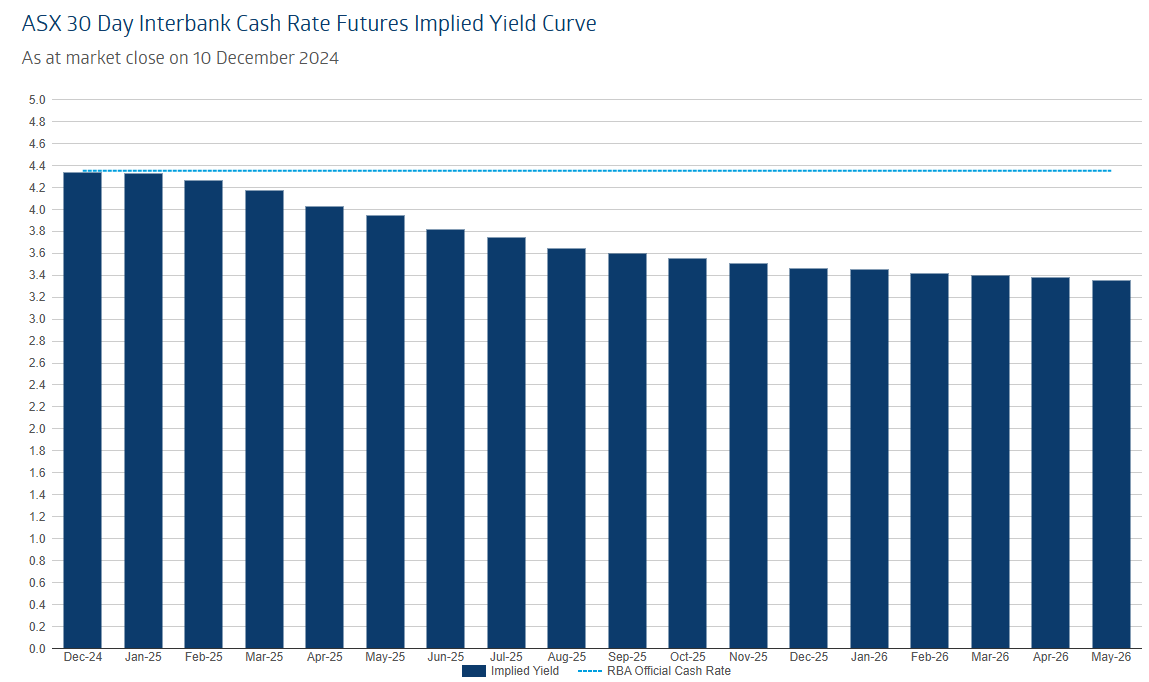

ANZ Bank economist Madeline Dunk says the RBA is likely to announce the first rate cut in May, although February remains a possibility.

AMP’s chief economist Shane Oliver believes a February rate cut is a 50-50 proposition and would put a floor under house prices.

“If we do get a cut in February, I’d say it’s now 50-50, then it could bring forward the bottoming of the soft patch in the market and put a floor under prices”, he said.

For the record, futures markets are currently pricing the first rate cut for March 2025.

Sydney and Melbourne dwelling values will likely continue to fall until the RBA commences its easing cycle.