Below is a note on today’s ABS labour force report by Gareth Aird, head of Australian economics at CBA.

Key Points

- Employment grew by a robust 35.6k in November following an increase of 12.1k in October (previously reported +15.9k).

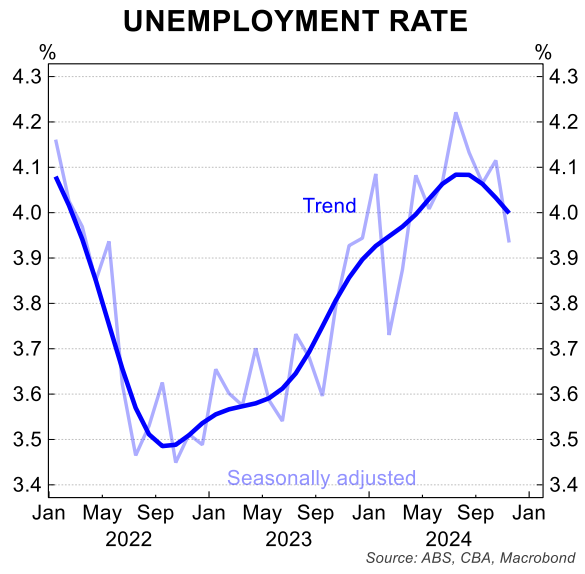

- The unemployment rate dropped to 3.9% from 4.1% as the participation rate dipped by 0.1ppt to 67.0%.

- Full-time employment rose by 52.6k in November, partially offset by a fall in part-time employment of 17.0k.

- Hours worked was broadly flat following a 0.1%/mth lift in October, pointing to another soft GDP outcome in the December quarter.

- The labour market data, coupled with the decline in wages growth, supports our view that the non-accelerating inflation rate of unemployment (NAIRU) is comfortably below the RBA’s implied estimate of 4.5%.

- But the labour market data today does not strengthen the case for a February RBA rate cut (indeed it weakens it).

- Notwithstanding we stick with our call for a 25bp rate cut in February given our expectation for the Q4 24 trimmed mean CPI to come in below the RBA’s forecast. The December labour force survey, due 16 January, will also be a key input into the February RBA Board decision.

Labour market data firm in November – a February rate cut in doubt

The November labour force survey was an unusual configuration of numbers.

But overall it was solid and casts doubt over our call for the RBA to commence normalising the cash rate in February.

Employment growth was solid at 35.6k, right in line with our pick and stronger than the market median forecast of 25.5k.

But the unemployment rate ticked down by 0.2ppts to 3.9% due to a fall in the participation rate (consensus 4.2%, CBA in line with consensus). We expected to see a lift in participation.

The composition of jobs growth was strong. Full-time employment rose by 52.6k, partially offset by a fall in part-time employment of 17.0k.

But despite the solid jobs gains hours worked was broadly flat in November. It is unusual to see strong growth in full-time jobs and no growth in hours worked over the month. The latter is consistent with soft growth in GDP.

The trend unemployment rate held firm at 4.0% (our preferred measure of unemployment).

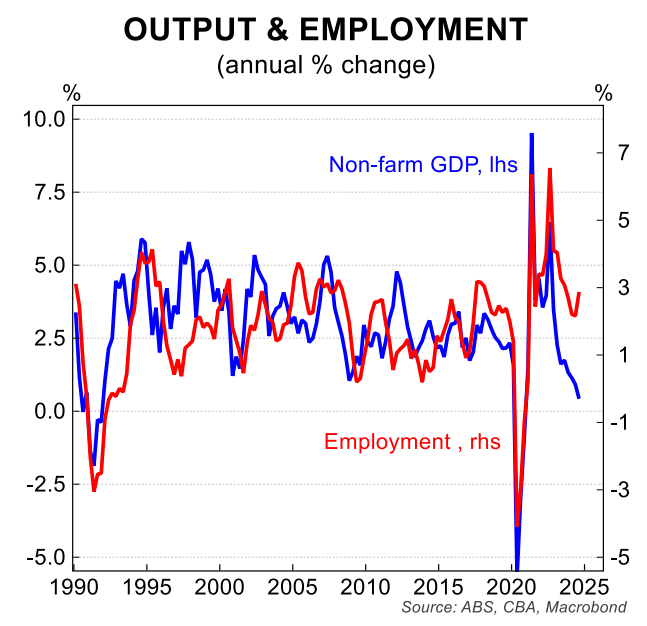

Taken at face value the data indicates that the labour market is not loosening despite well below-trend GDP growth and forward indicators of labour demand all consistent with a softening labour market.

Indeed the labour market data continues to defy the signal coming from GDP growth and other higher frequency activity indicators.

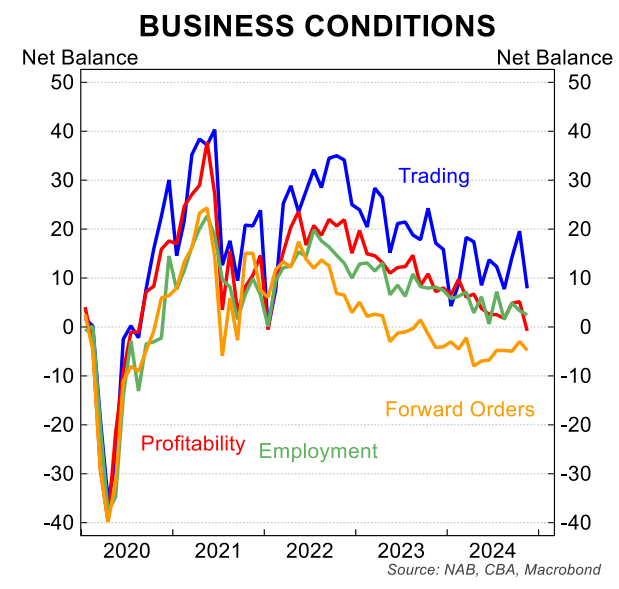

The November NAB Business survey, out earlier this week, was particularly soft. And the employment component of the survey was weak. But despite this, the official data suggests the labour market is not loosening.

The usual relationship between non-farm GDP and employment growth is simply not there. Indeed it looks bizarre (see facing chart). The disparity is largely explained by strong growth in non-market employment, which doesn’t make a commensurate contribution to measured GDP.

Notwithstanding, it’s still a very unusual dynamic.

Okun’s law, which is an empirically observed relationship between unemployment and GDP, is not in play at the moment. And most economists are having a rough time trying to model and forecast the unemployment rate.

In the RBA Board’s December Statement accompanying the on-hold decision it was noted that, “wage pressures have eased more than expected in the November SMP”.

Recall that the six-month annualised rate of wages growth, as measured by the wage price index, was 3.2% in Q3 24 (a level consistent with the inflation target).

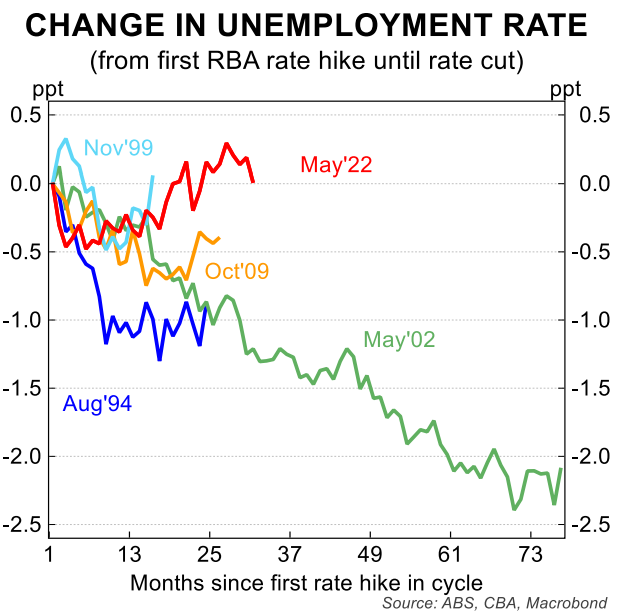

The recent wages data suggests the non-accelerating inflation rate of unemployment (NAIRU) is likely to be comfortably below the RBA’s implied estimate of 4.5% (the unemployment rate has been ~4.0% over the past six months; ~0.5ppts above its 3.5% trough).

Australia should be able to run an unemployment rate of ~4.0% and see inflation within the target band sustainably. But we don’t know if the RBA shares our view (or is coming around to our view).

We stick with our call for the RBA to commence normalising the cash rate in February. But clearly that call is in doubt following the labour force report today.

It will almost certainly require a Q4 24 trimmed mean CPI of 0.6%/qtr or less for the RBA to cut the cash rate in February. And the labour market will need to show signs of loosening in December for the RBA to feel that February is the appropriate month to commence normalising the cash rate (the December labour force survey prints 16 January).

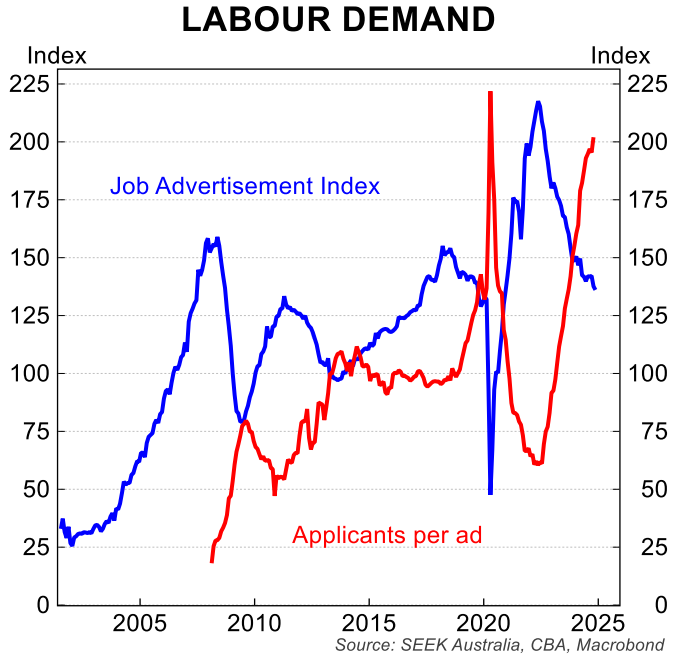

Seek data paints a softer picture of labour demand

Second tier data relating to the labour market was also released by SEEK today. The data was all indicative of a loosening labour market (which was not apparent in the November labour force survey).

According to SEEK Job ads declined over November by 1.1%/mth, following a 3.1%/mth fall in October. And the number of applicants per job ad rose by a solid 3.4%/mth in October (see facing chart).

The SEEK advertised salary index confirmed that wages pressures continue to moderate in November. After growing at 0.3-0.4%/mth for a year, the SEEK advertised salary index has now risen by 0.2%/mth for the last two months.

As SEEK noted, if monthly growth in advertised salaries continues at this rate, by this time next year annual advertised salary growth will be back at pre-COVID levels.