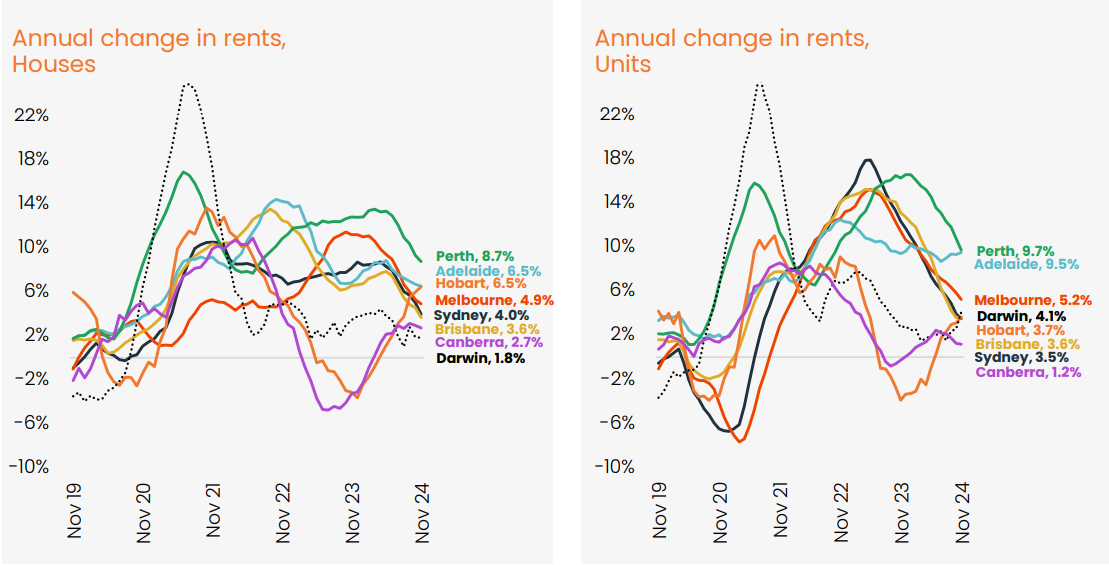

There was some positive news on the rental front. CoreLogic reported that national rental growth slowed to just 0.2% in November, the slowest monthly growth rate since April 2021.

This meant that the annual rate of rental growth slowed to 5.3%, down from 8.1% at the same time last year and by more than 9% over the prior two years.

Source: CoreLogic

“At 5.3% annual growth, rents are still rising at more than twice the pre-pandemic decade average of 2.0%, but given the weak monthly change the annual trend is set to slow further from here”, CoreLogic’s head of research Tim Lawless said.

“It will be interesting to see if the rate of rental growth rebounds through the seasonally strong first quarter of the year in 2025, but beyond any seasonality, it looks increasingly like the rental boom is over”.

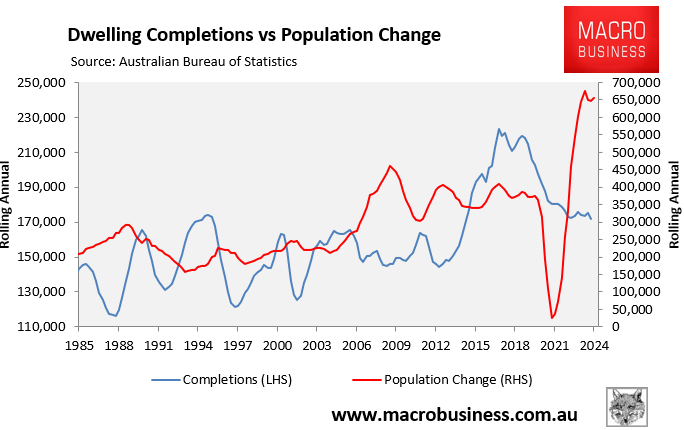

Lawless attributed the slowing in rents across most markets to a combination of slower population growth, driven by lower net overseas migration, and a gradual increase in the average household size, helping to moderate rental demand.

“A trend towards smaller households during the pandemic was a key factor boosting housing demand, particularly demand for rental housing, as group households split up and Australians gained a preference for more space”, Lawless said.

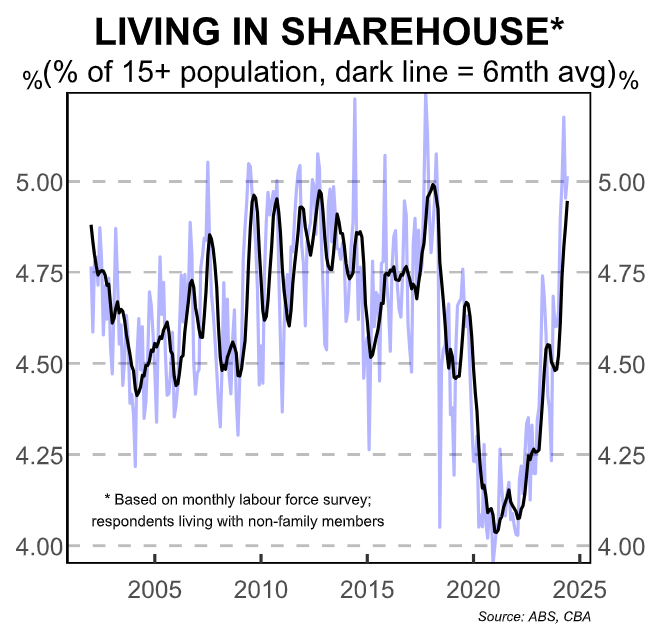

“A record low in rental affordability is probably a central reason for the rebound in household size, with high rents likely to be forcing a restructuring of households as renters look for ways to minimise their housing costs”.

The following chart from CBA shows that tenants have responded to strong rental inflation by economising on costs and moving into shared housing. There has also been an increase in Australians living with family members.

The latest National Share Accommodation Survey (NSAS) from Flatmates.com.au also revealed that 43% of respondents said affordability constraints had pushed them into share accommodation.

“While share house living has long been associated with younger demographics who might be unable to crack into the housing market, we have seen a significant increase in Australians over 55 entering share house living arrangements in recent years”, Flatmates.com.au Product Manager Claudia Conley said.

The expansion of shared housing has helped to alleviate rental pricing pressures. However, it is only a temporary solution.

As long as the nation’s adult population grows faster than the supply of housing and infrastructure, the rental market will continue to face intense pressure.