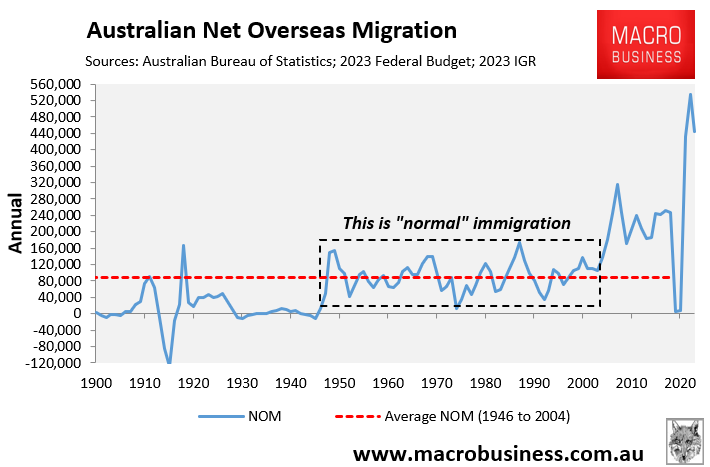

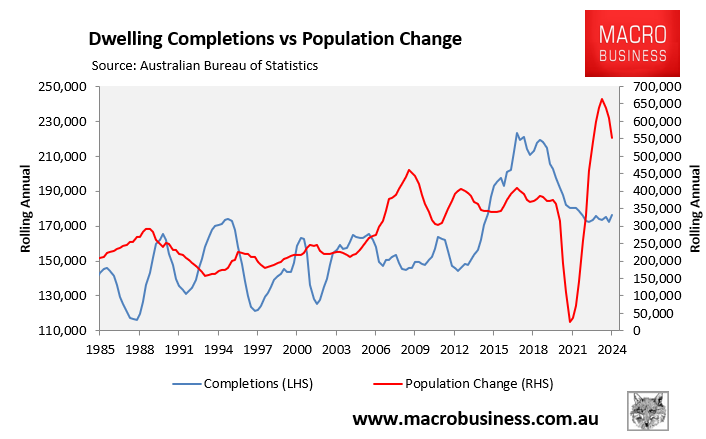

The past several years have seen Australia’s rental market plunge into crisis following the importation of nearly one million net overseas migrants in only two years.

This deluge of migrants hit a supply-constrained market, worsening the housing shortage.

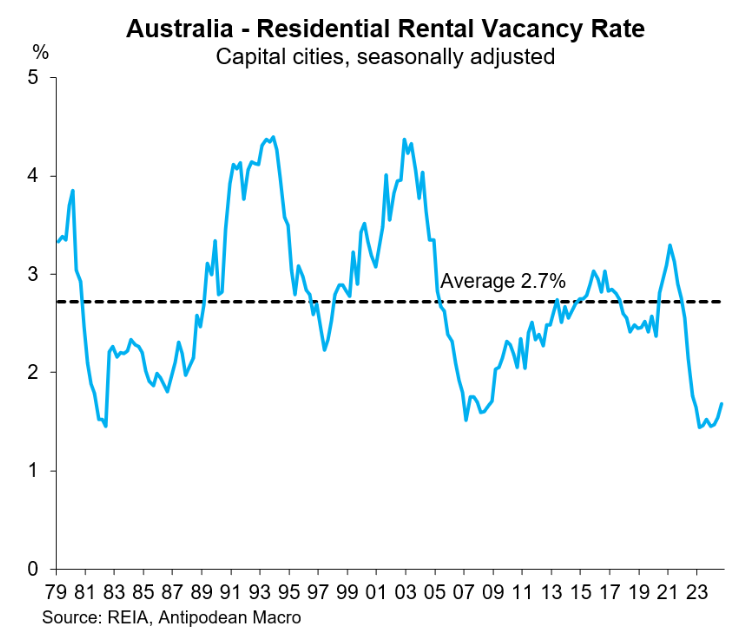

The impact on the rental market has been brutal. As illustrated below by Justin Fabo from Antipodean Macro, the Real Estate Institute of Australia’s (REIA) rental vacancy rate has roughly halved from the decade average.

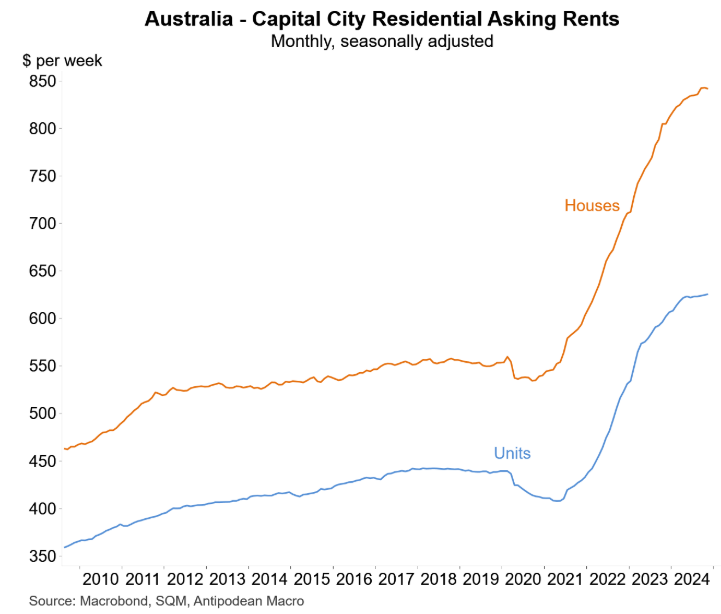

The decline in the rental vacancy rate has resulted in surging asking rents, as illustrated below by Fabo using SQM data.

The recent moderation of net overseas migration combined with tenants moving into shared housing amid affordability pressures has eased vacancy rates and rental inflation.

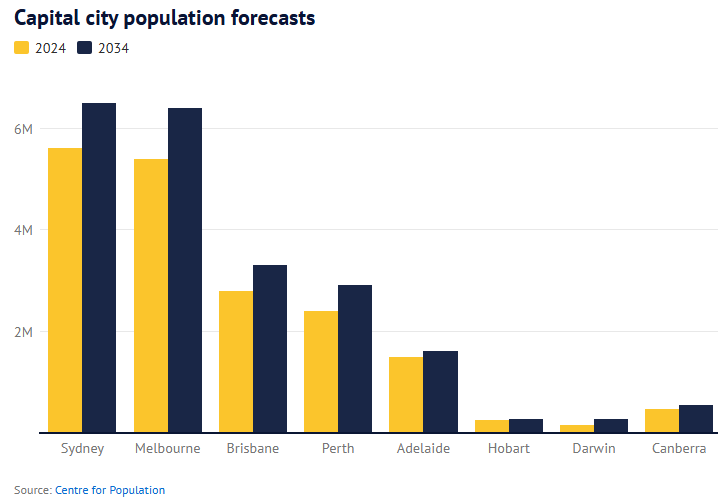

However, the rental market will remain under pressure given the Centre for Population’s latest population projections, which forecast that Australia’s population would swell by 4.1 million residents over the next 10 years—most of whom will live in Sydney, Melbourne, Brisbane, and Perth.

The projected 410,000 annual population growth—almost equivalent to the population of Canberra annually—will ensure that population demand will forever overrun supply, putting upward pressure on rents.

The Centre for Population’s projections are also disastrous for prospective first-home buyers.

The higher rents will make it more difficult to save a deposit. The increased population will also put upward pressure on home prices, pushing ownership further out of reach.

The best thing the federal government could do for renters and prospective first home buyers is slash net overseas migration to sensible and sustainable levels that are compatible with the supply side.