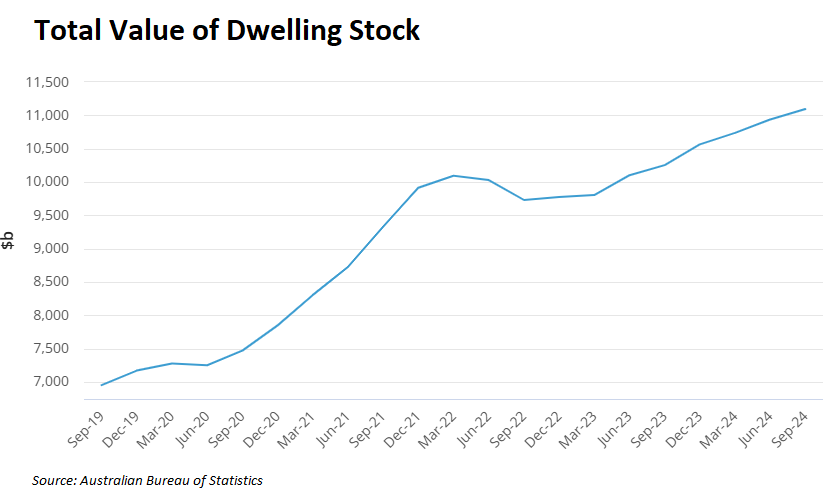

The Australian Bureau of Statistics (ABS) recently released data on the value of the country’s residential housing stock.

As of 30 September 2024, there were 11,252,600 residential dwellings worth $11,093.8 billion.

This implied that the average Australian home was valued at $985,900.

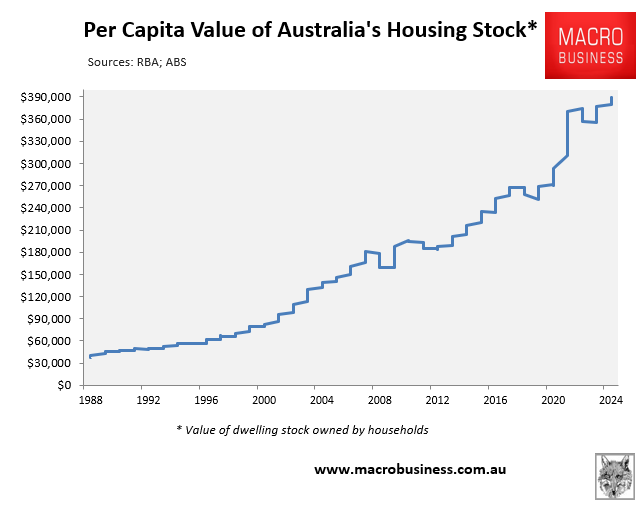

As of September 30, 2024, an estimated 27,368,029 Australians held a record-high $389,400 housing assets per capita.

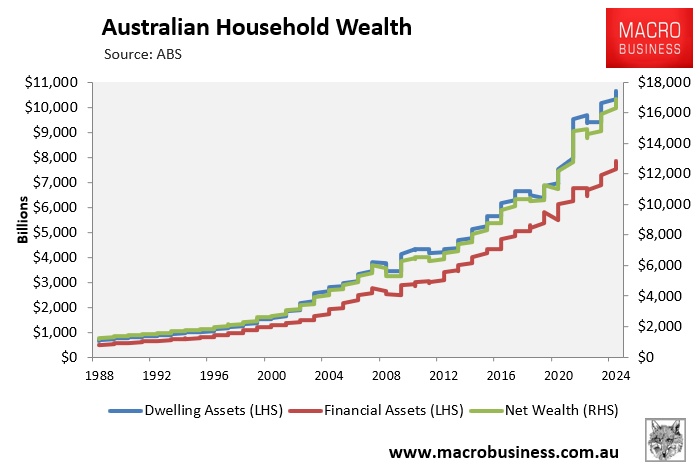

Separate data released by the ABS on Thursday showed that household wealth hit an all-time high of $16,884.9 billion in Q3 2024 after increasing by $400.9 billion over the quarter.

Dwelling asset values rose to a record high of $10,657.1 billion, whereas financial assets grew to a record high of $7,842.7 billion.

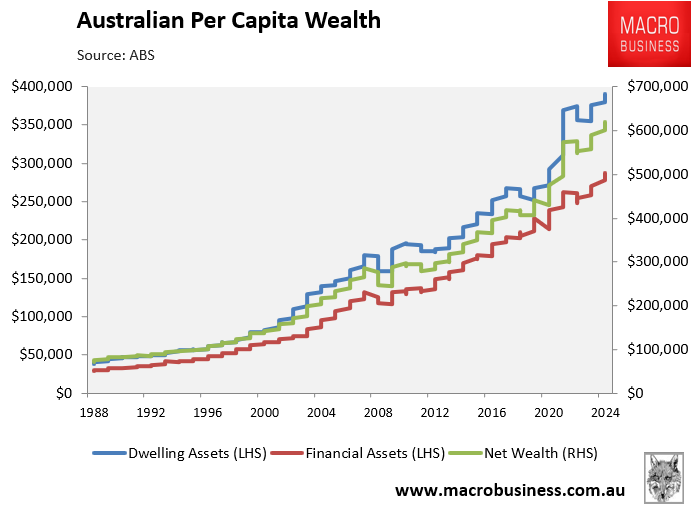

Per capita household wealth also increased to a record high of $616,957 in Q3 2024.

The per capita value of dwelling assets rose to a record high of $389,400, whereas financial assets grew to a record high of $286,564 per capita.

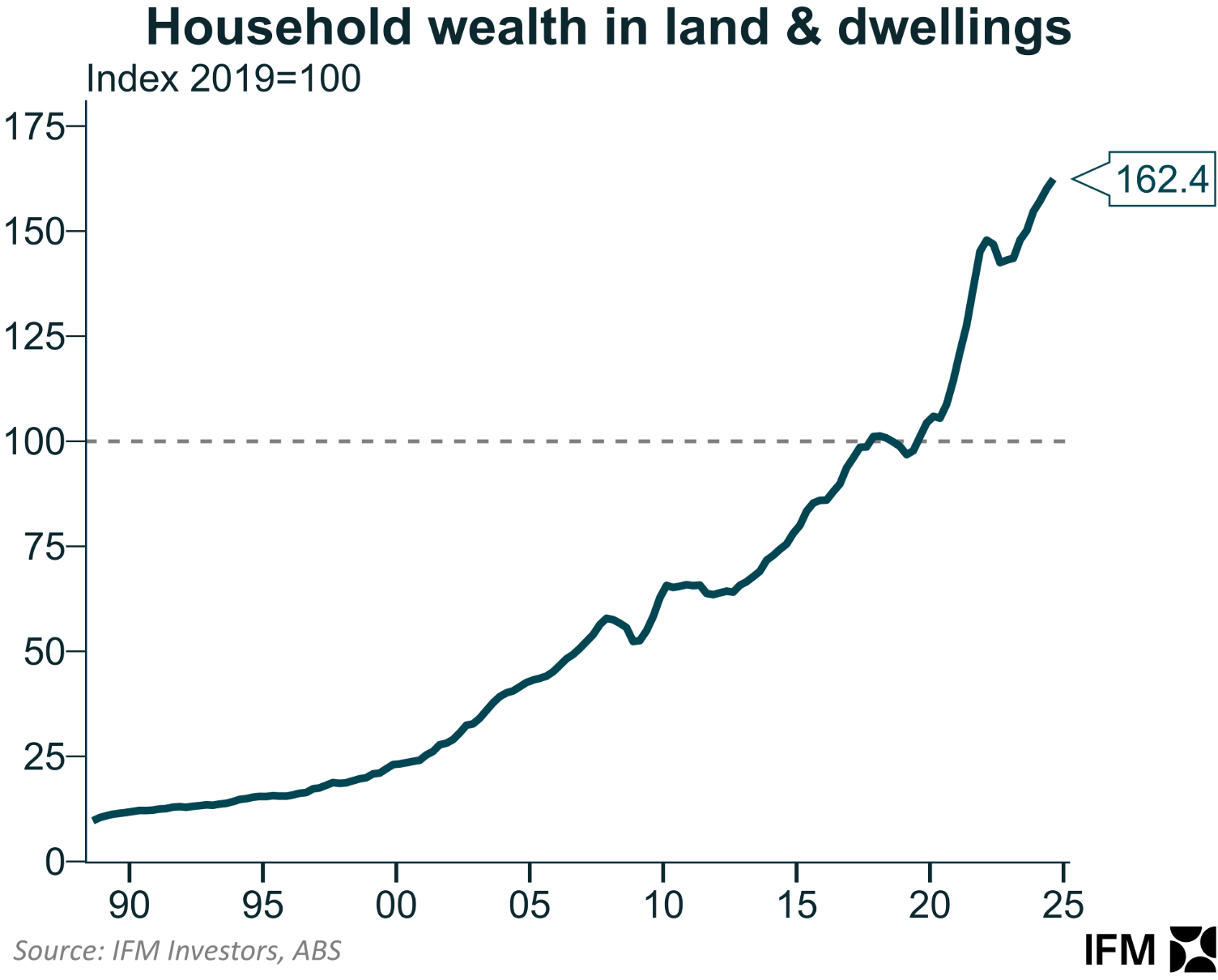

As illustrated below by Alex Joiner from IFM Investors, household wealth due to home ownership has increased by 62% since 2019.

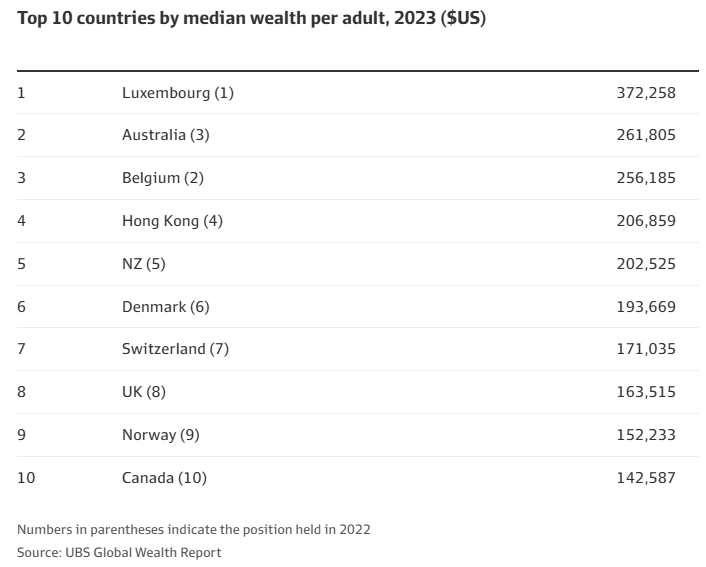

The above data explains why Australian households are at the top of the world wealth rankings.

According to the most recent UBS Global Wealth Report, based on data from 2023, Australian households had the world’s second-highest wealth after Luxembourg.

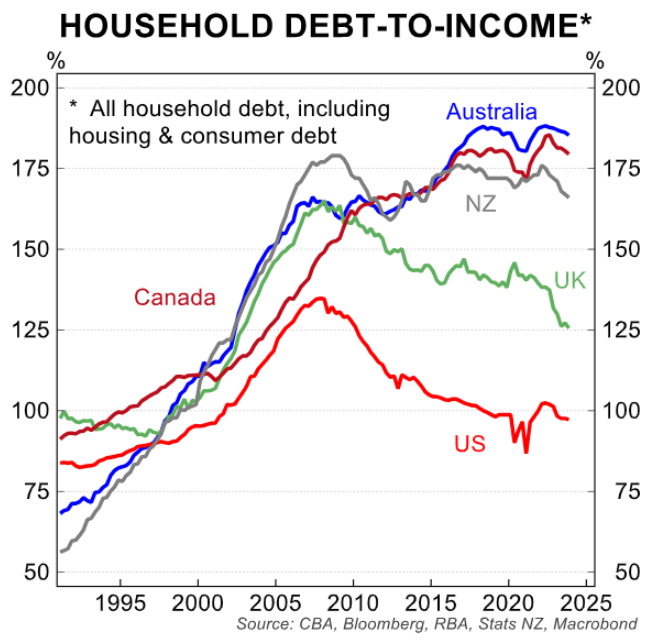

Meanwhile, Australian households have buried themselves in debt, with the average loan size driving up home prices to record levels.

As a result, Australian households have some of the world’s largest debt loads.

Despite Australia’s oversized wealth, primarily from rising housing values, Australian households struggle financially.

Finder Financial Group’s most recent Wealth Building Report indicated that the majority of the country’s wealth was “untouchable” since it was tied up in property and super funds.

Finder estimated that superannuation and property accounted for almost three-quarters of household net wealth.

“A lot of Aussies have a huge amount of their wealth tied up in illiquid assets”, said Graham Cooke, Finder head of research.

“Australian fortunes are primarily tied to property and superannuation, making them cash-poor despite their massive net worth”, the report stated.

“Many of these millionaires have landed in this once-elusive club simply because the value of their homes has grown”.

I strongly believe that much of Australia’s home wealth is an illusion and does not benefit society.

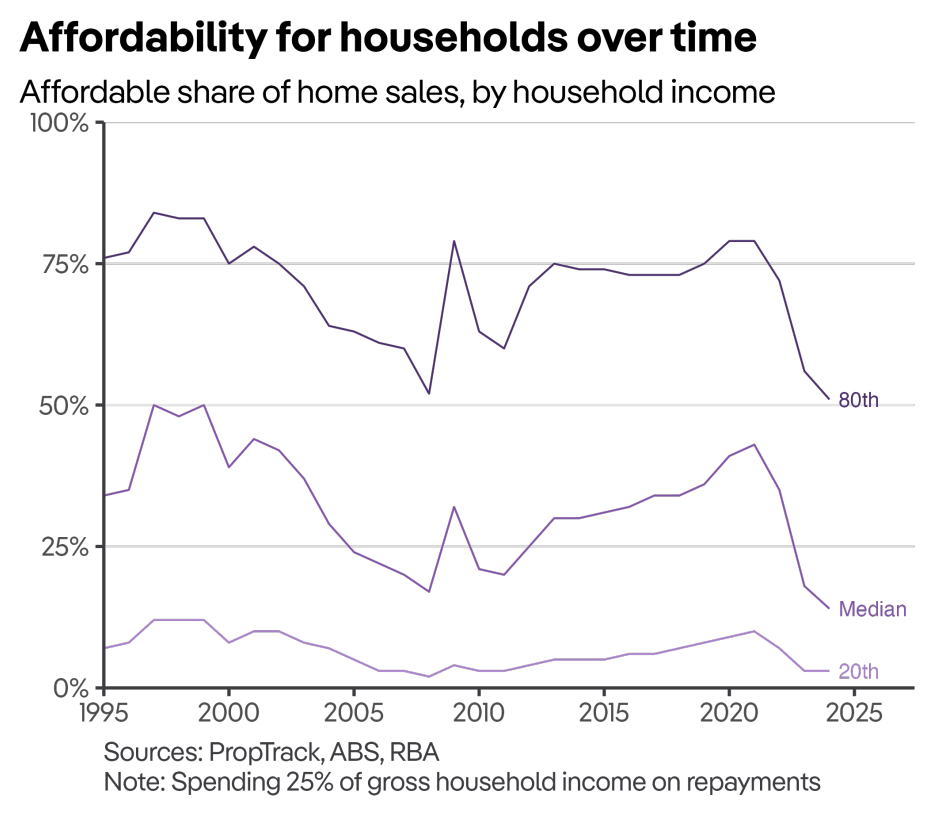

Given that housing affordability is at an all-time low and our younger generations are unable to purchase a home without parental financial support, how can Australian households be dubbed the world’s second wealthiest?

Australians would be “wealthier” if the average home cost around $400,000 instead of $800,000 and household debt was 90% of income rather than 180%.

Australia would be a far more egalitarian society, and we would be financially better off if our homes were half the price they are now, with half the debt.

Australia’s high property prices are harming our children, grandkids, and future generations by forcing them to pay substantially more for housing than is necessary, leaving them worse off.

A home, whether it costs $500,000 or $5 million, serves the same purpose.

Higher housing “wealth” is, therefore, meaningless to the majority of people who live in their homes and do not own investment property.

Australians would be far better off if we had never experienced the 25-year property boom and did not rank second in the world’s wealth rankings.

Instead, potential homeowners in Australia have been condemned to debt servitude or forced to remain in the rental market.