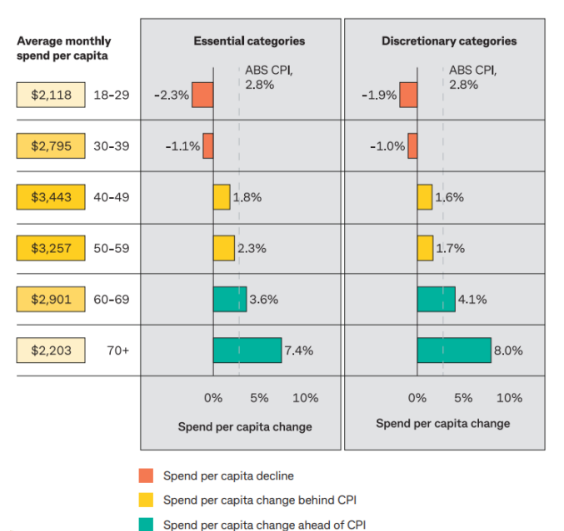

The latest data from CBA, released last month, showed that older Australians are spending freely while younger Australians are cutting back.

Source: CBA

As illustrated above, Australians aged 70-plus increased their spending on discretionary categories by 8.0% in the year ended 30 September, nearly three times more than headline CPI inflation.

Qantas shares have risen by more than 60% in 2024, and the stock rose by 2.7% to $9.06 on Tuesday.

Morgan Stanley equity strategist Simon Clark is upbeat about Qantas’s outlook. He believes that the carrier is set to benefit from demand for premium international air travel among affluent Baby Boomers as this generation redirects its spending from luxury goods to experiences.

Clark also expects other airlines like Delta to benefit from this trend.

“With headwinds building for traditional luxury goods stocks, particularly in relation to Chinese demand, we see airlines as a more effective way to leverage long-term luxury consumer demand growth trends”, Clark wrote in the report.

“While airline companies have been a challenging investment in the past we believe the outlook has turned structurally more favourable, particularly for premium carriers”.

“Rising secular demand growth for premium tickets, alongside diminishing reliance on the marginal economics of economy class, is leading to improved profitability for the premium airlines”.

“This trend is likely to continue over time with the expanding wealth of the ultra-high-net-worth affluent class and with consumers progressively demanding more services and experiences over consumer goods”, Clark said.

“We believe both [Qantas and Delta] face a brighter outlook compared to the challenging conditions the industry has faced in the past”.

“Qantas International revenue per available seat kilometres is tracking at around 40% higher than pre-COVID during the current year, with the company noting strength in leisure demand, and specifically premium cabins”.

“Importantly, we believe this shift is being driven by one of the most compelling long-term demographic forces – the enduring growth of the affluent consumer”, Clark wrote.

While Australian baby boomers’ increased international travel spending is good news for Qantas, it is less beneficial for the Australian economy because their spending will go offshore.