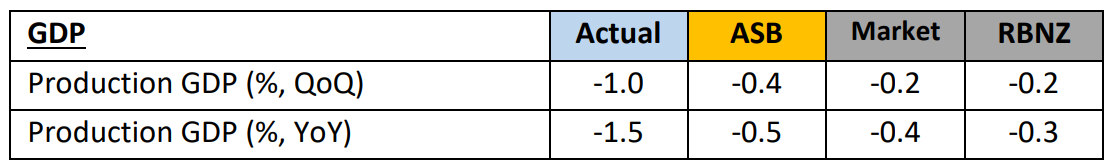

On Thursday, Statistics New Zealand released the national accounts for Q3 2024, which reported a 1.0% decline in GDP over the quarter to be 1.5% lower annually.

As illustrated in the following table from major bank ASB, the result was far worse than economists, the market, and the Reserve Bank’s expectations.

The result meant the economy experienced its worst recession since 1991.

“Combined with a downwardly-revised Q2 figure (-1.1% QoQ), the data highlight that the NZ economy contracted very sharply in the middle of 2024”, noted ABS.

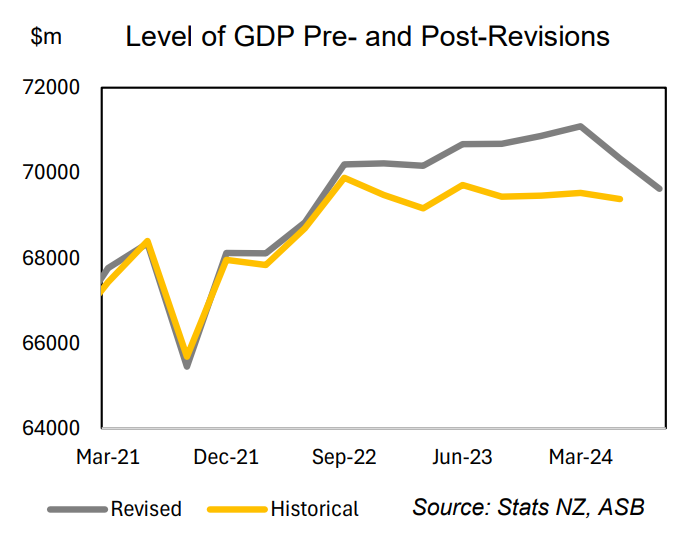

One positive was that the level of GDP over late 2022–early 2024 was revised higher.

“However, the extent of the recession during mid-2024 was much deeper than we thought”, noted ASB. “Indeed, Stats NZ confirmed that this was the steepest 6-monthly decline in GDP since 1991 (excluding COVID)”.

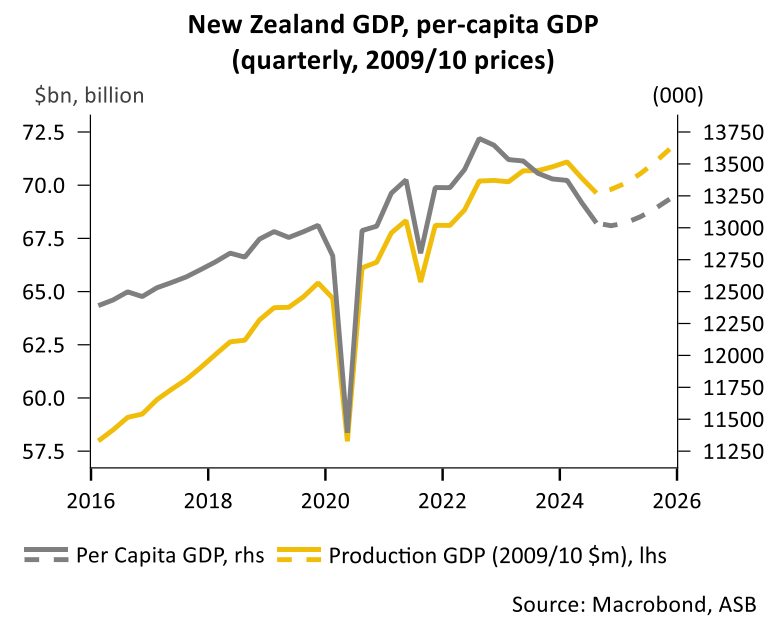

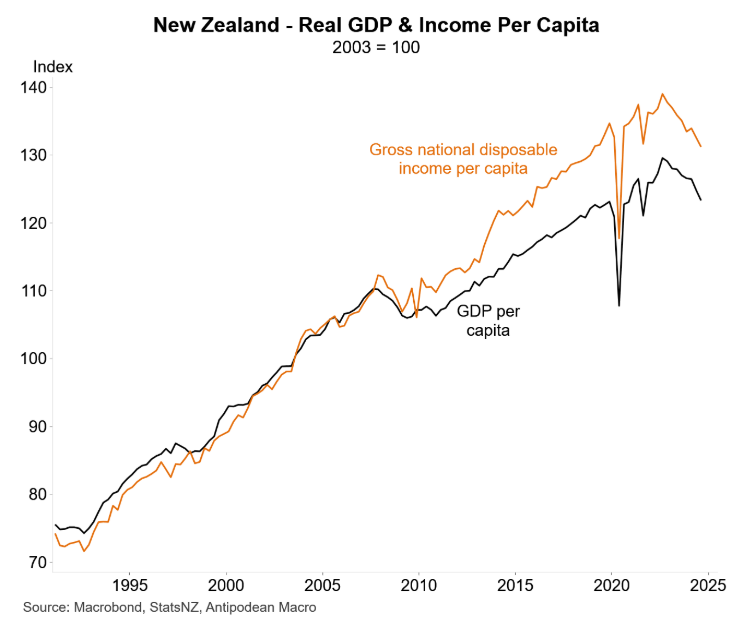

As Justin Fabo from Antipodean Macro illustrated below, New Zealand’s GDP per capita contracted a further 1.2% in Q3—the eighth consecutive quarterly fall—and by 2.9% over the year.

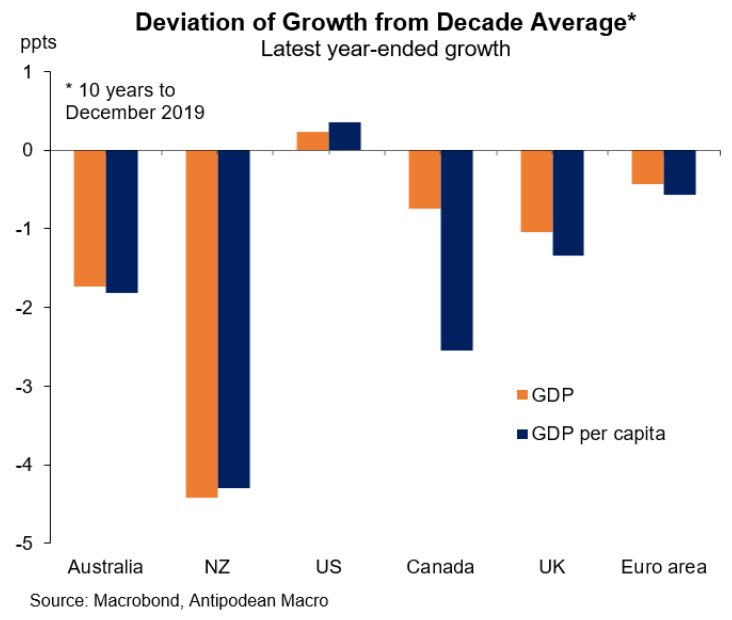

New Zealand’s GDP decline has been among the sharpest in the developed world compared with average growth over the decade to 2019.

ASB believes that the decline in GDP was demand-driven and suggests the output gap is more negative than thought. In turn, the Reserve Bank will need to cut the official cash rate more sharply than anticipated:

“The output gap is likely to be more negative than the RBNZ had previously expected. In the November MPS the RBNZ estimated the output gap in Q3 was -1.4% – we now think it is closer to -2% of GDP”.

“This means more excess capacity in the economy than previously thought and in the absence of a swift rebound in demand will dampen pressures on domestic inflation. It suggests that the RBNZ will need to quickly pare back monetary policy tightening”.

ASB also believes that the future is “looking somewhat brighter”, thanks to the 1.25% of rate cuts already delivered:

“We expect a more pronounced recovery will become evident as we progress through 2025, with interest-rate sensitive sectors the first ones likely to show signs of life”.

We still expect a total of 100bps of cuts to be delivered in H1 2025″.

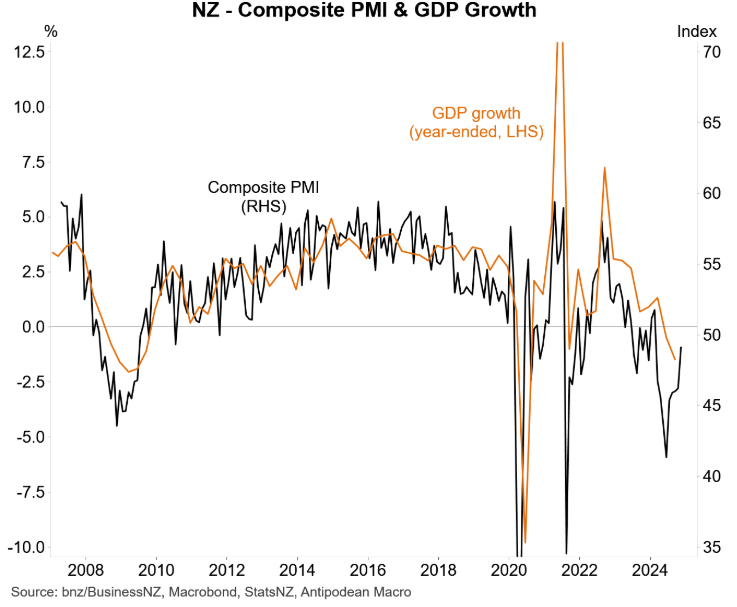

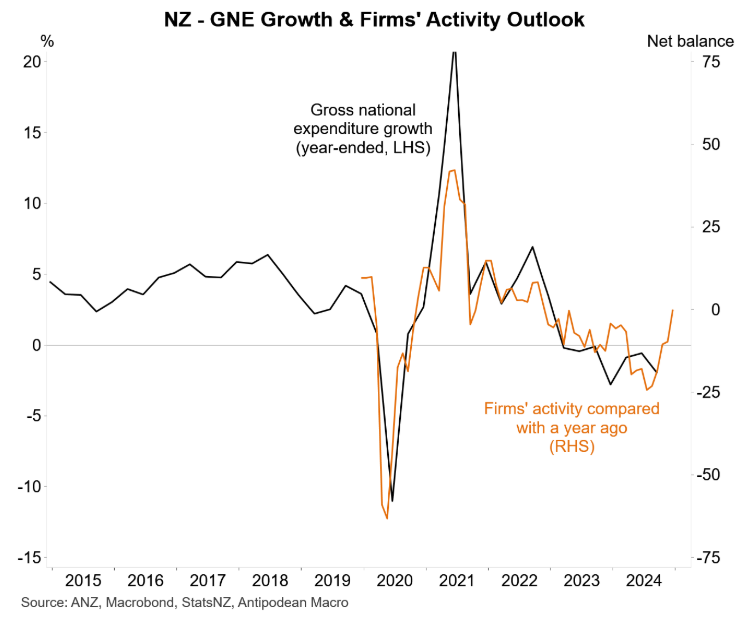

Forward-looking data published by Justin Fabo suggests that better times are ahead.

Firms’ activity outlook indicator has bounced.

So, too, has New Zealand’s composite PMI.