The revolt is building against Michele Bullhawk’s Psycho RBA.

Amid suggestions the bank runs the risk of repeating a mistake it made in 2018 and 2019 that forced it to dramatically reverse monetary policy settings, a growing number of analysts believe the RBA has misjudged the impact of the jobs market on the inflation rate.

The issue goes to the economic concept of the natural rate of unemployment – the level of unemployment consistent with steady inflation.

…But ANZ’s head of Australian economics, Adam Boyton, believes unemployment could be around 3.75 per cent and inflation would remain steady. If his analysis is correct, there would be an extra 50,000 people in employment.

…Gareth Aird, the Commonwealth Bank’s head of Australian economics, said the RBA could allow the unemployment rate to be lower without adding to the nation’s inflation problems.

…labour market expert Jeff Borland thinks unemployment could safely fall to between 3.5 per cent and 4 per cent…

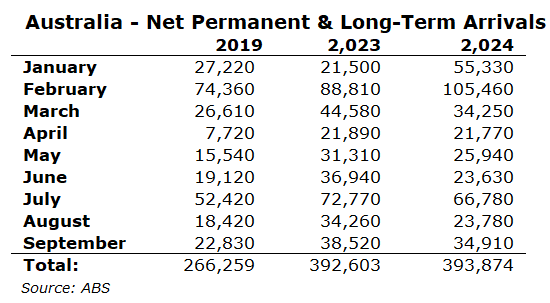

All of these estimates are likely still too hawkish as long as mass immigration is running at current levels far above the 2018/19 period.

The immigration-led economy is a permanent labour supply side shock. It provides its own labor, so worrying about rising wages is incredibly stupid.

At current flows, we need about 40k jobs per month just to employ immigrants.

The RBA has been making this mistake for ten @#$%ing years.

How many years of wretched data does it take to change an economist’s mind?

Infinity, if they assume their own outcome.