Australia’s ability to feed itself, build houses, talk about itself, and even wipe its arse is being destroyed by the East Coast gas export cartel.

From breakfast staples to bathroom supplies, the price you pay for goods to run a home are soaring upwards, hastened by energy costs.

…Homestyle Bake, which supplies Queensland supermarkets, schools, nursing homes and prisons, is paying about 200 per cent more for gas now than it was three years ago, said director Lindsay Weber.

Its electricity bills have leapt by about 300 per cent over the same time, Mr Weber said…“Manufacturing is being priced out of existence,” Mr Weber said.

…A spokeswoman for Mondelez – which makes biscuits, chocolates and cream cheese at six plants across South Australia, Victoria and Tasmania – said “gas prices have increased by more than 50 per cent … over the past year where our manufacturing facilities are based.”

A manufacturer of toilet rolls and paper towel, speaking on the condition of anonymity, disclosed that its gas costs had shot up by more than 200 per cent in less than two years.

…Dairy manufacturers are now spending $100 million per year more on energy than they did in 2016, despite a 12 per cent decrease in milk production.

Gas costs are up 157 per cent over that time period, a spokeswoman for Dairy Australia added.

Guess where your food inflation is coming from? Guess why youth is priced out of housing construction? Guess why the RBA won’t cut interest rates to revive the private economy? Guess why we have no media profits left to discuss any of it?

The East Coast gas export cartel is to blame for it all.

There is some relief today from the recent price rises in the local gas spot market, but it is not going to last.

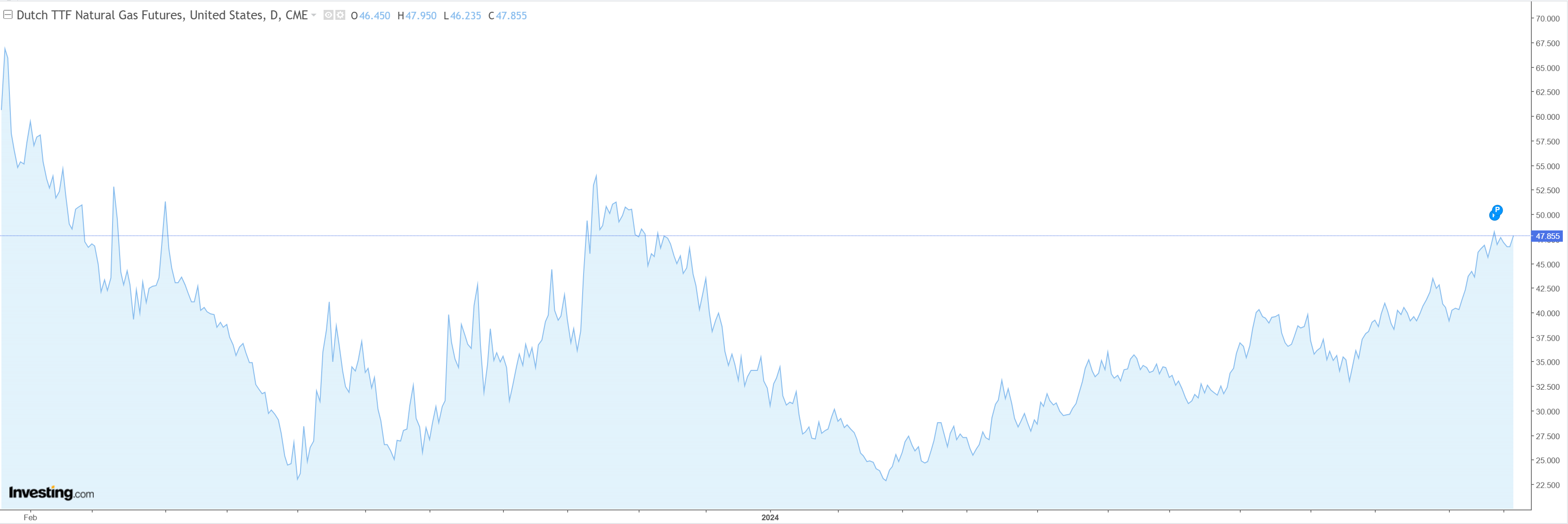

Global gas prices are grinding higher.

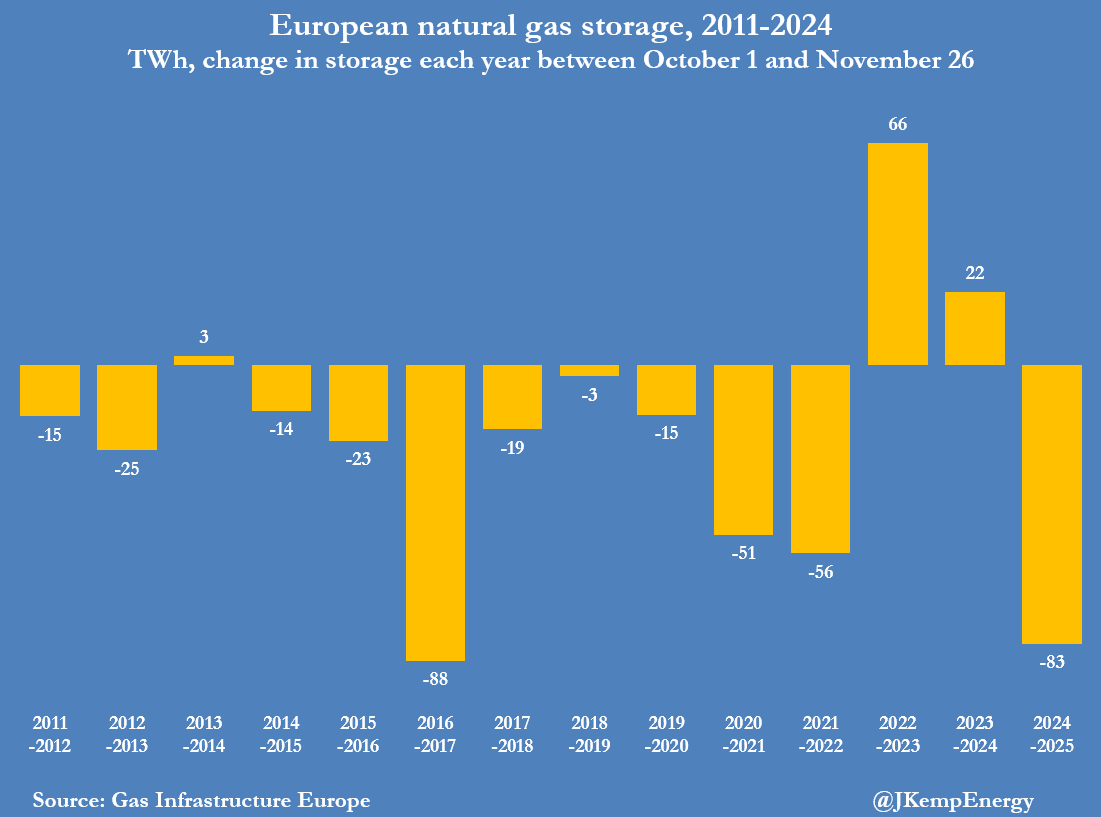

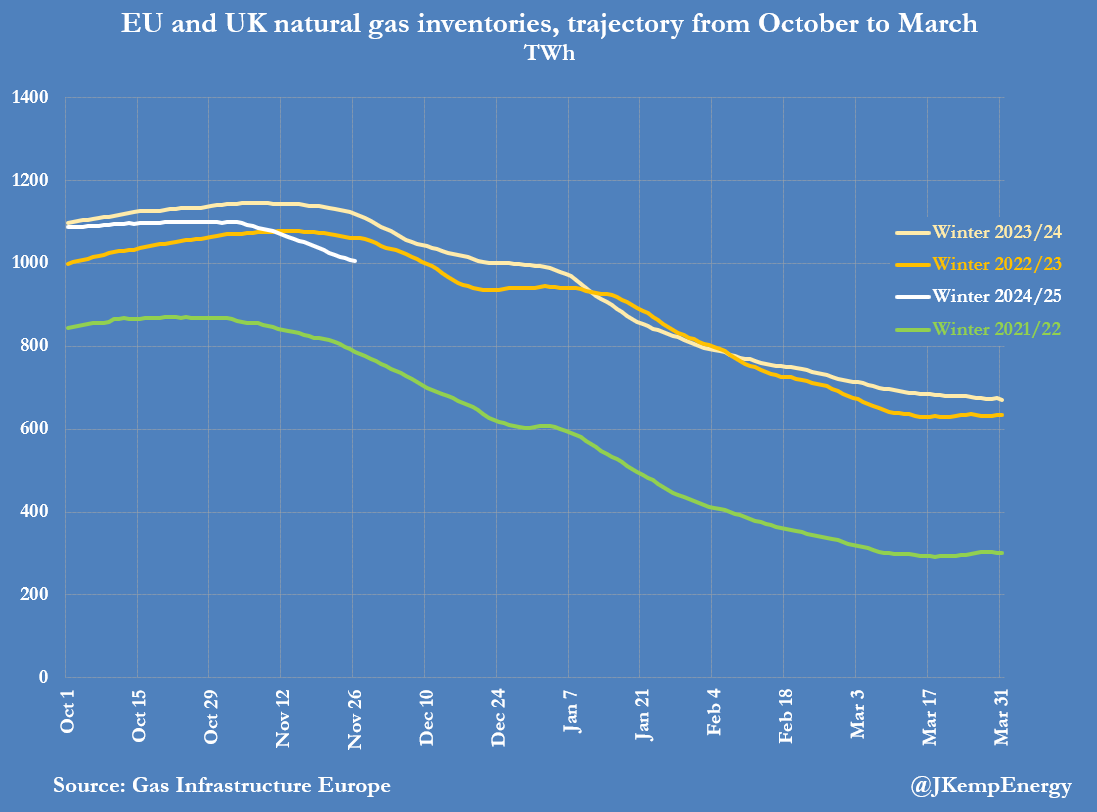

As Europe drains gas reserves in the cold.

While global gas prices rise, the East Coast gas export cartel will bring any and every price shock home.

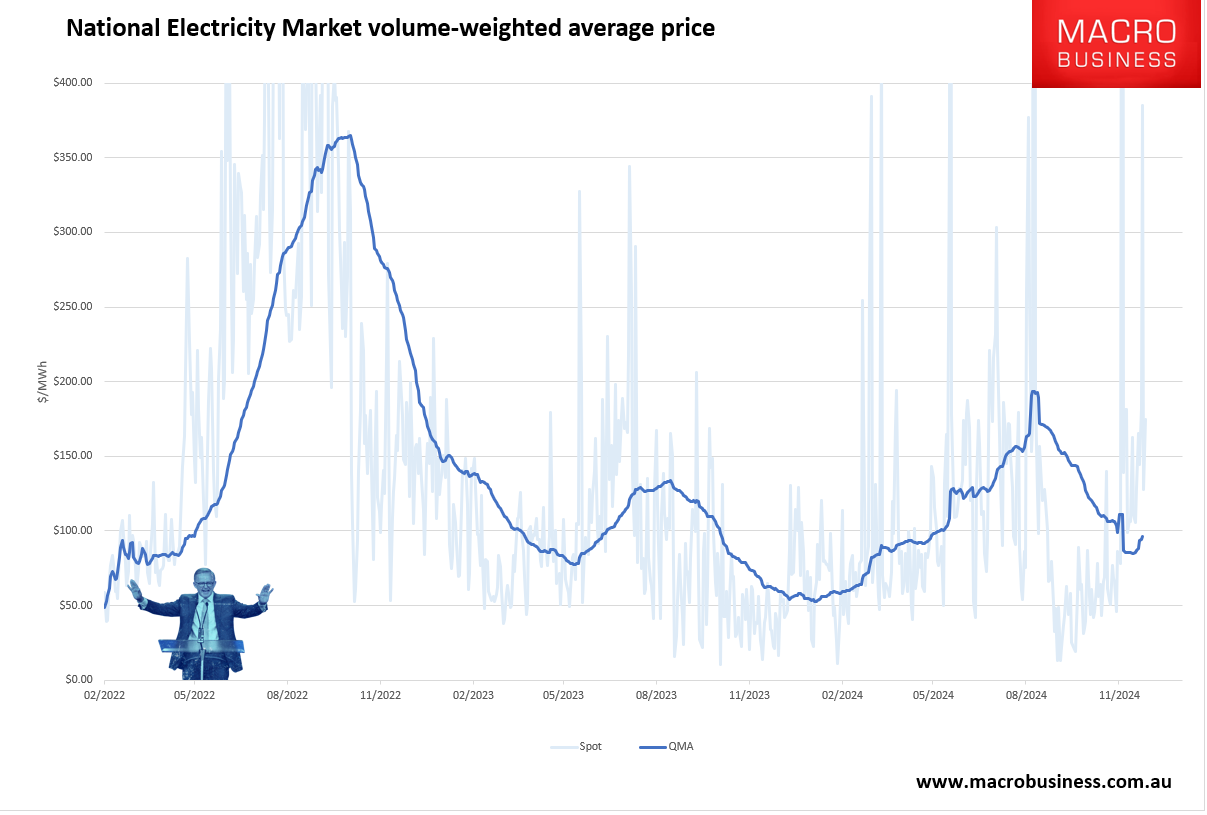

Right now, we should be seeing rapidly cheapening Aussie electricity prices in the off-peak season.

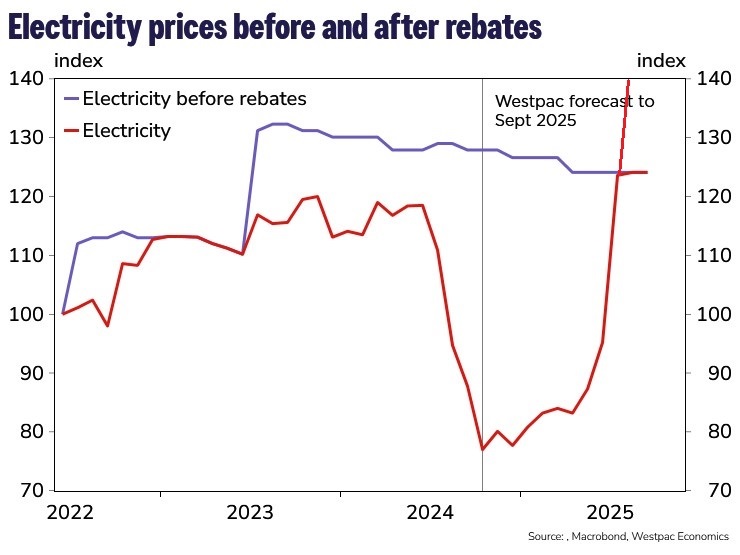

Instead, thanks to the East Coast gas export cartel shock, power prices have bottomed out 60% above 2023 and are climbing.

When the AER meets in March, it will hike retail power bills by another 10-20% (so far) for 2025/26.

Hilariously, this will coincide with rolling off existing rebates, meaning a massive household and business inflation shock in Q3 2025.

I have adjusted a Westpac chart below to give you the idea.

Treasurer Jim “chicken” Chalmers or other incoming government will have to supersize energy rebates or face economic calamity.

Which will only encourage the cartel to gouge even harder as the subsidies rise.

Domestic gas reservation or export levies now or the nation dies.