The energy superidiot is hurtling into disaster.

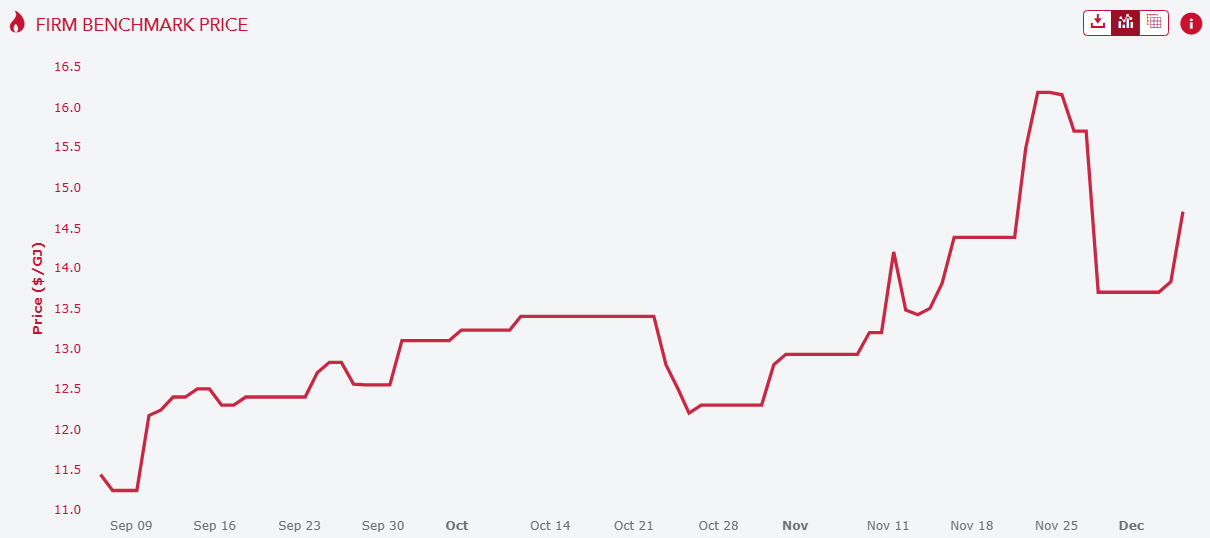

As expected, the East Coast gas export cartel has resumed its price squeeze.

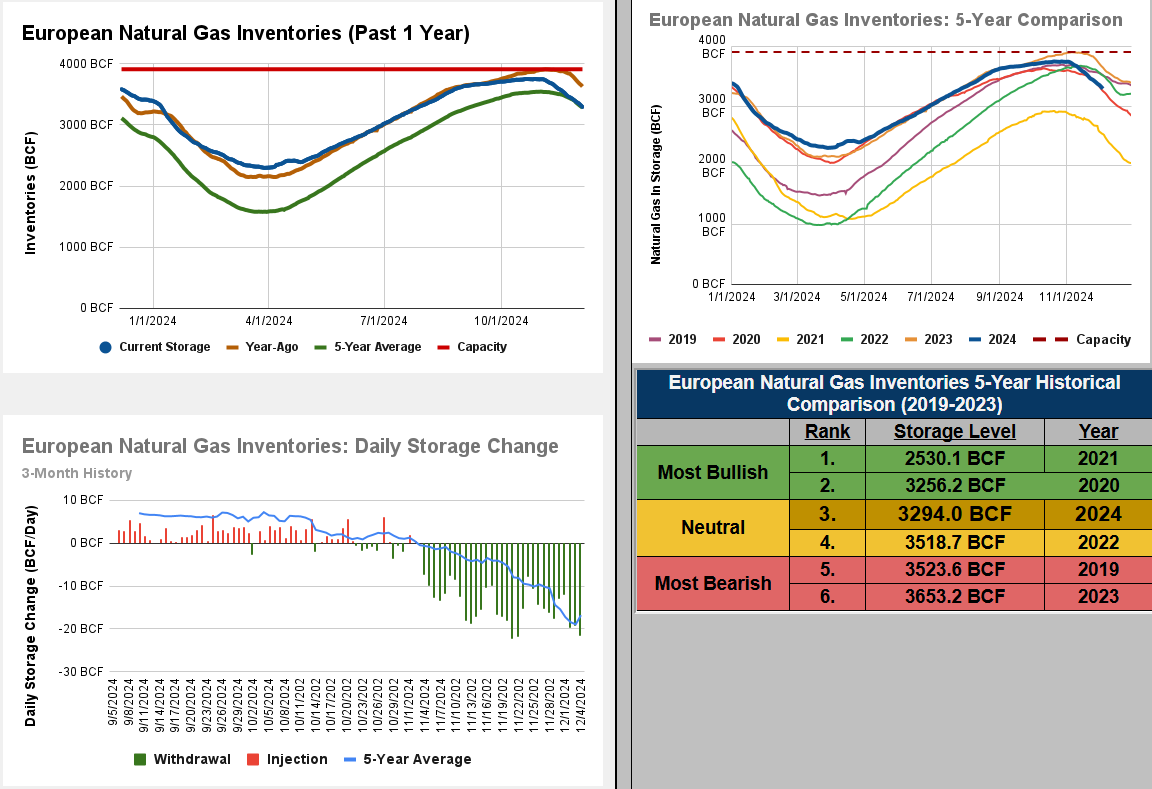

The two key drivers—cold European winter and Asian LNG prices—continue.

Europe is drawing gas inventories fast.

Asian LNG prices are hovering around $AUD23-24Gj.

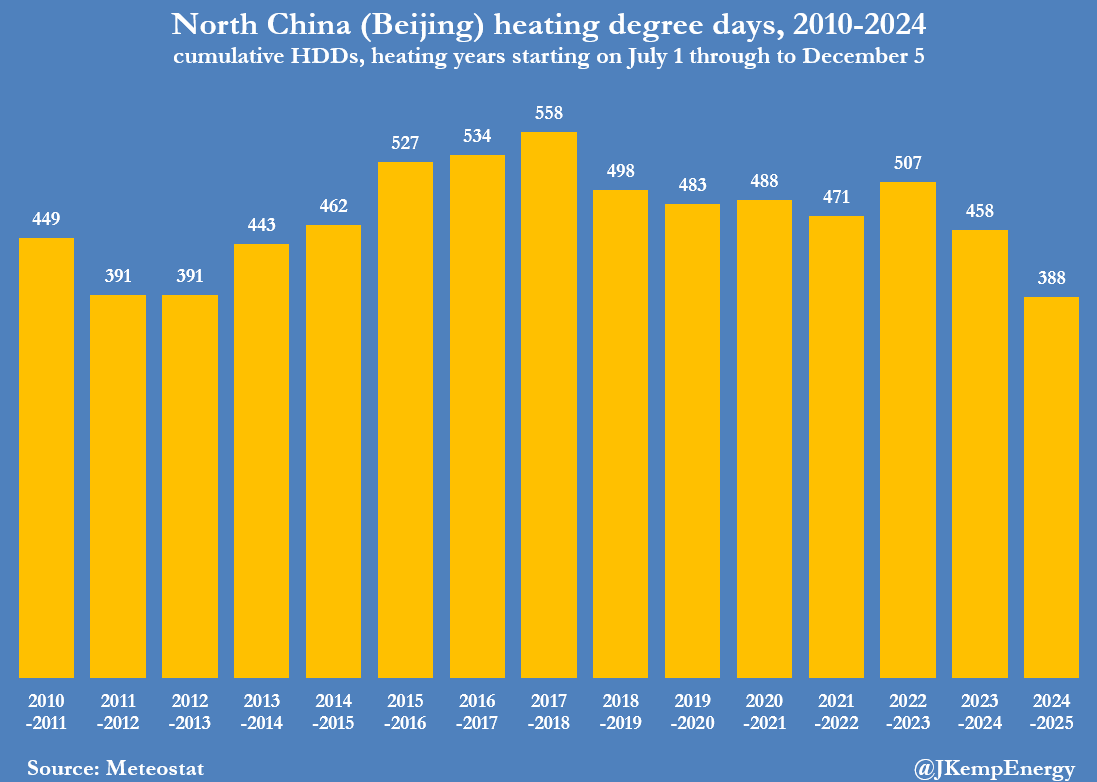

It would be even worse if not for the warm start to winter in China.

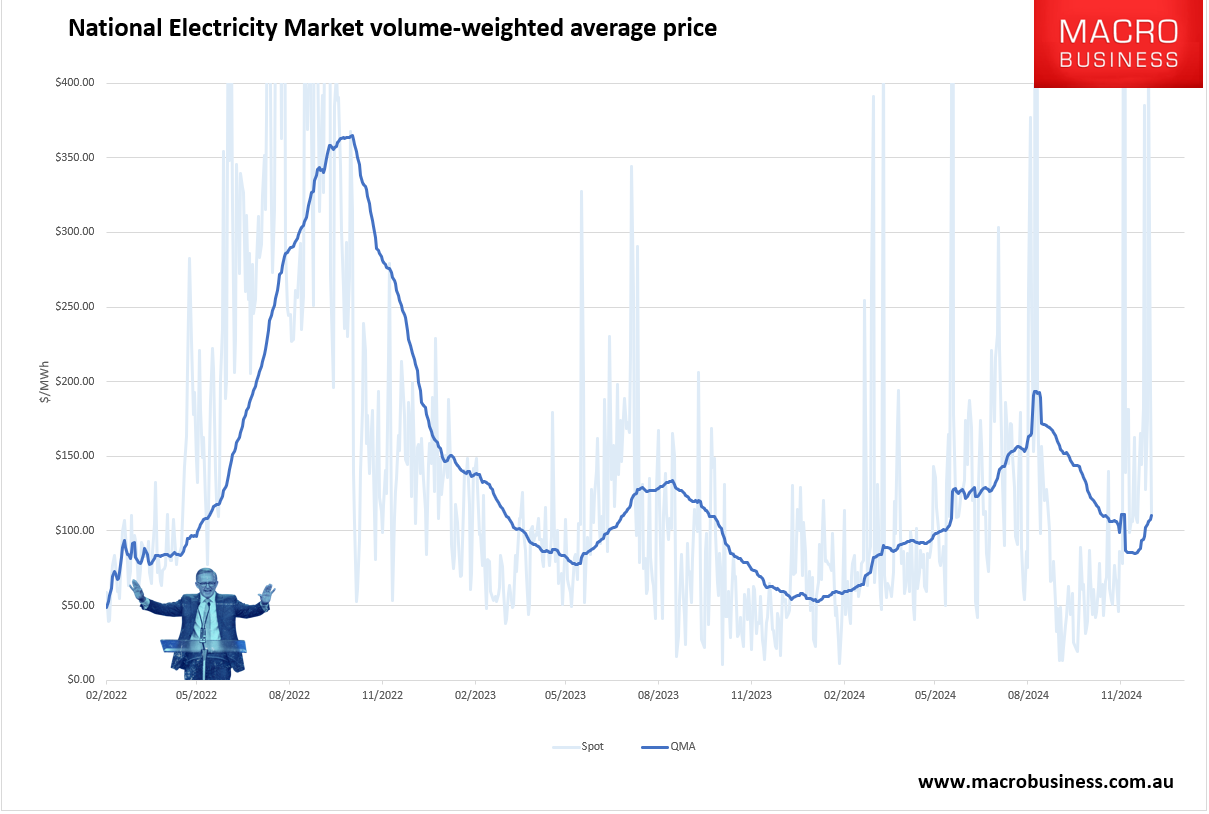

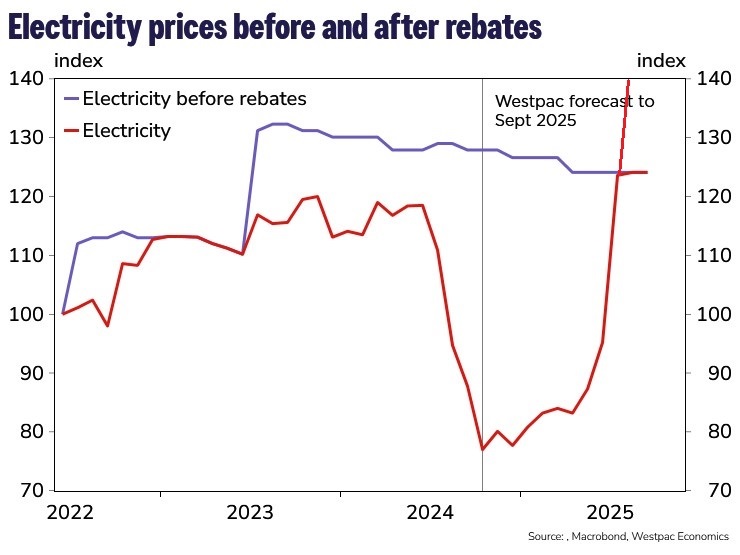

Nonetheless, it is bad and getting worse as gas prices deliver a new electricity price shock as well.

The NEM quarterly moving average is roughly double 2023 shoulder season levels.

AER is going to hike retail tariffs in March for 2025/26.

Whoever the incoming government is, they will either upsize energy rebates or face a doubling of utility bills in 2025.

This is already an existential crisis for monetary and fiscal policy, the currency and the economy.

The only solutions being discussed will make it much worse:

- LNG imports will double gas and electricity prices at today’s rates.

- Renewables are too slow. Coal is stranded. Nuclear is never. More gas supply will not help while the cartel controls reserves.

The only reform that will happen fast is to apply domestic reservation and export levies to the East Coast gas export cartel.

Do it or the economy dies.