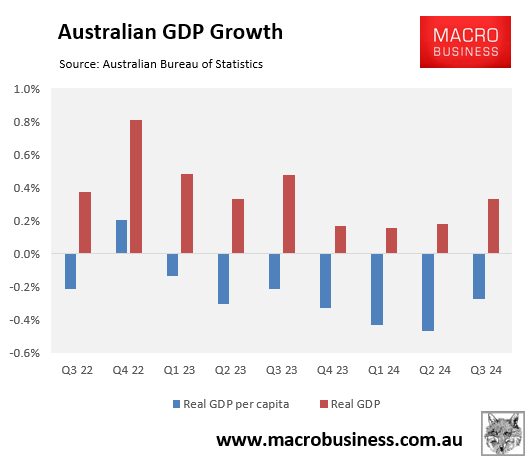

The Australian economy may be incredibly weak, recording the slowest annual growth since the 1991 recession and seven consecutive quarters of negative per capita growth.

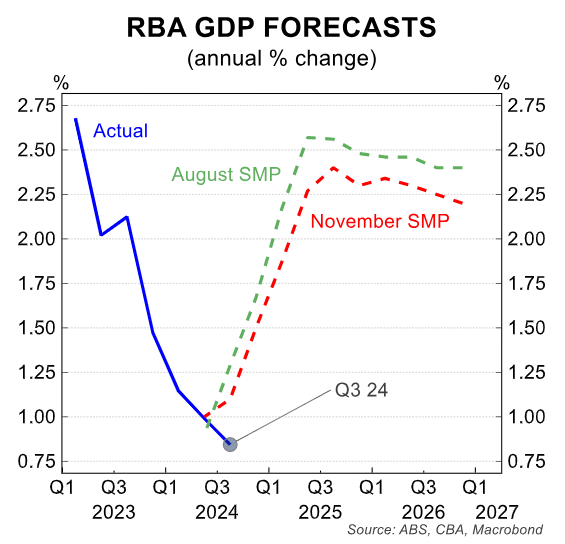

The economy is growing more slowly than the RBA had forecast.

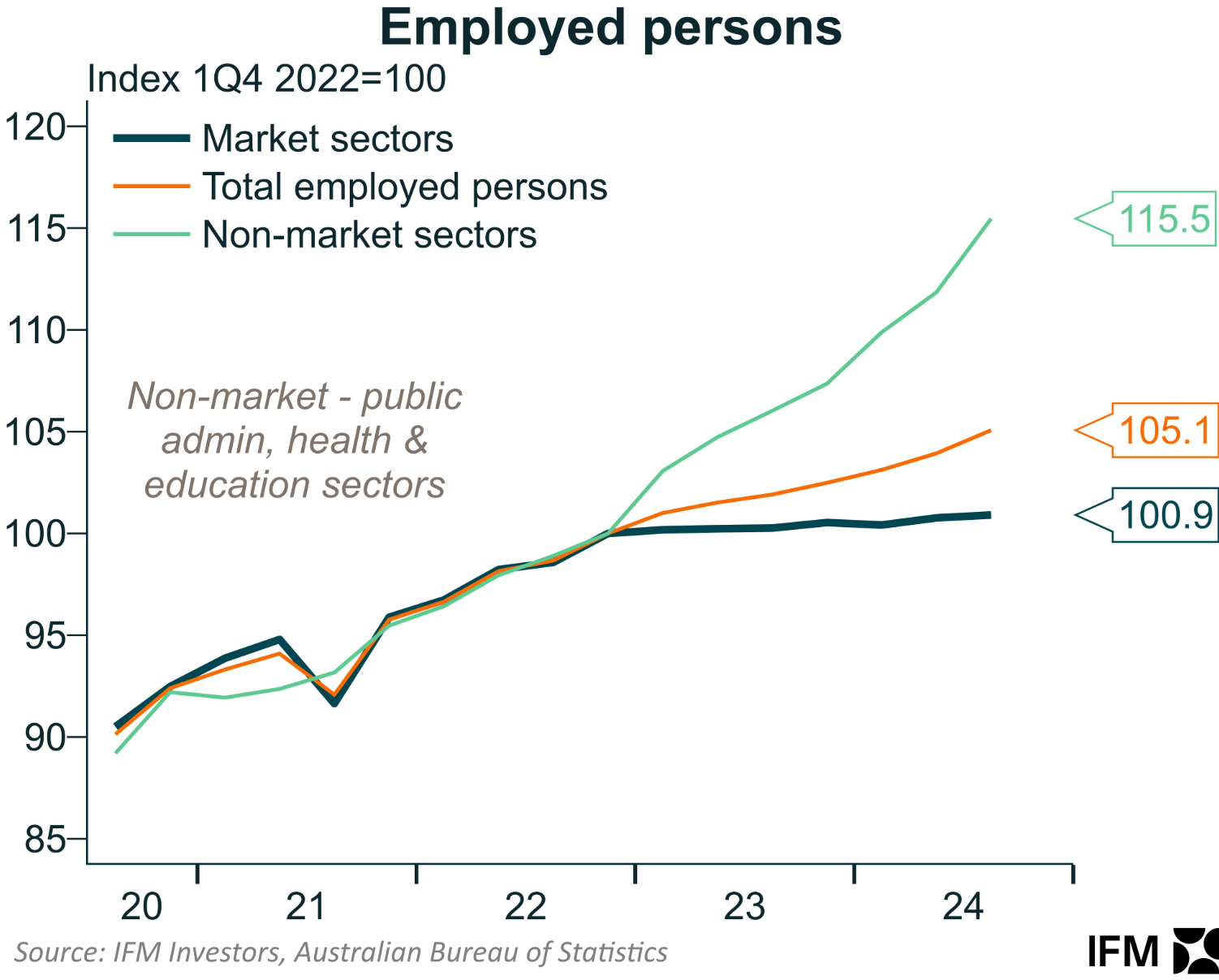

However, the labour market continues to power ahead thanks to government-funded jobs, including the NDIS.

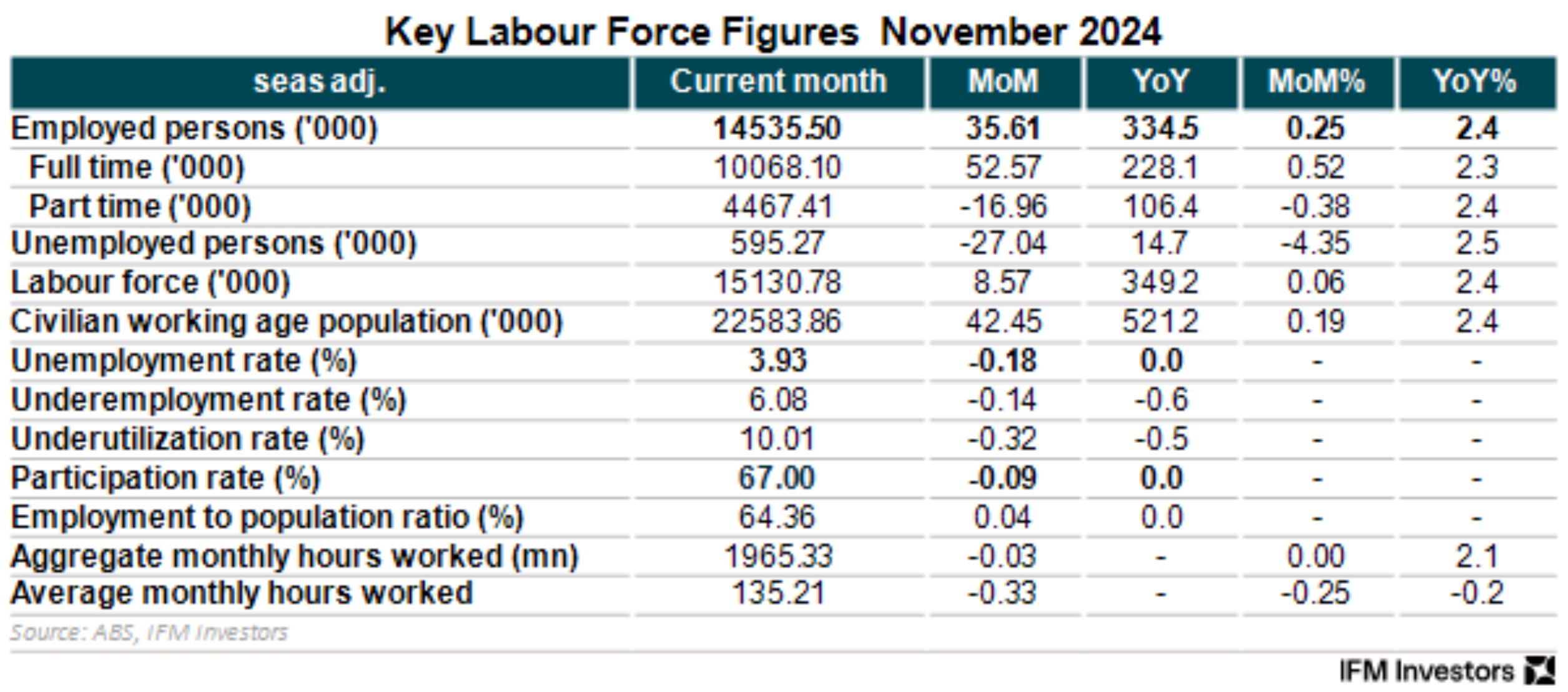

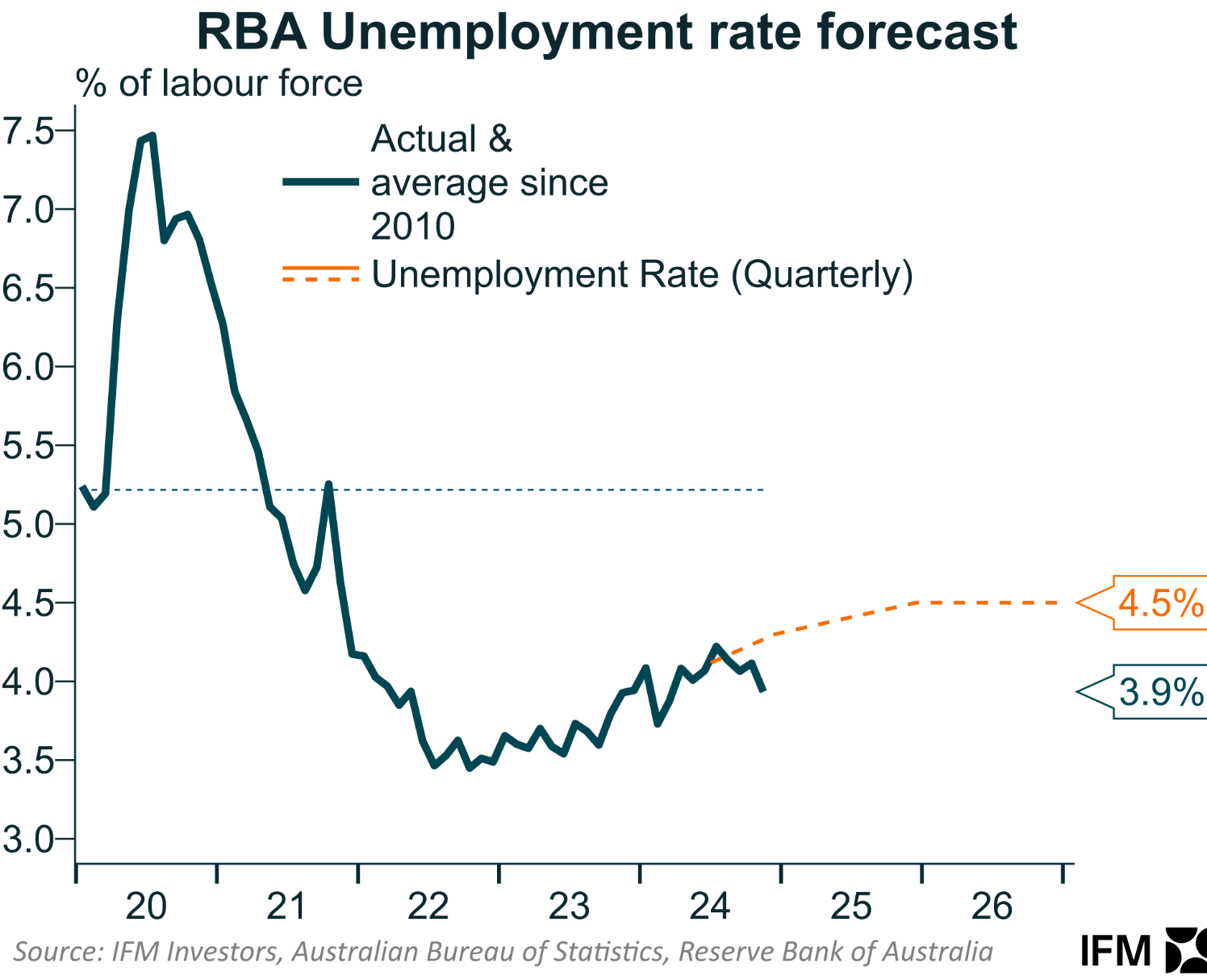

Thursday’s labour force release from the Australian Bureau of Statistics (ABS) revealed that the headline unemployment rate cratered to 3.9% in November, from 4.1% in October.

The total number of jobs rose by a solid 35,600 over the month, with full-time jobs rising by 52,600.

The underemployment rate also fell by 0.1% to 6.1% in November.

On the negative side, the participation rate fell by 0.1% over the month and there was zero growth in hours worked.

As illustrated below by Alex Joiner at IFM Investors, the official unemployment rate is now tracking well below the RBA’s forecast.

Viewed in isolation, this release argues against the RBA cutting rates in the near term.

The Q4 2024 CPI (due 29 January) will need to come in soft to green-light a February rate cut (February Board decision on 18/2).