Domain’s preliminary auction data for the week ending Saturday show that Sydney’s residential clearance rate fell to 50.7%, its lowest level of 2024.

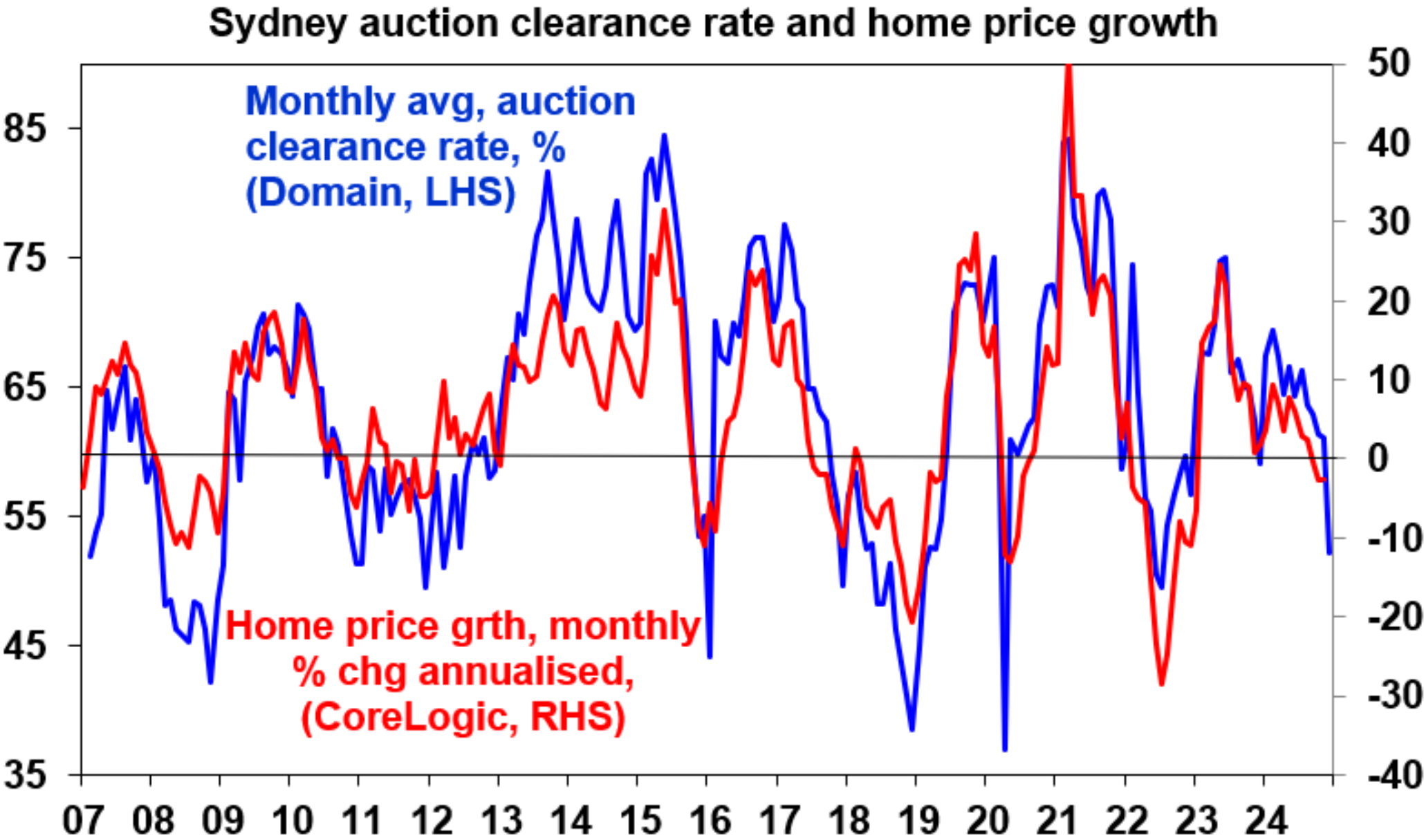

As illustrated below, the decline in Sydney’s auction clearance rate is consistent with falling home prices.

Source: Shane Oliver (AMP)

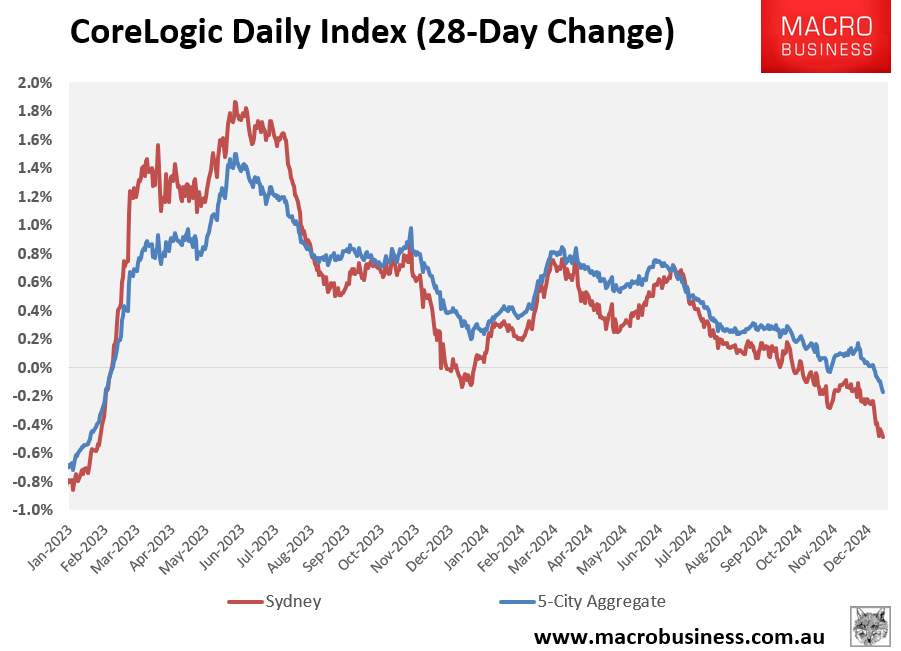

Indeed, CoreLogic’s daily dwelling values index has recorded a decline of 0.5% over the past 28 days, with the trend worsening.

SQM Research Managing Director Louis Christopher says negative sentiment has been steadily weighing on Sydney’s housing market amid a growing realisation that there will be no interest rate cuts in the near term.

“The Sydney housing market continues to weaken, and a little bit of fear has been creeping in”, Christopher said.

“Once participants realised there wasn’t going to be an interest rate cut any time soon, a lot more uncertainty came into the market, starting from about July onwards”.

Selling agent BresicWhitney’s Michael Kirk added, “It did feel like the wind came out of the sails towards the third and last quarter of the year after a robust start”.

“People had been pinning hopes on an interest rate cut”.

BresicWhitney chief executive Thomas McGlynn agreed, noting that “the accumulation of the cost of living and rapidly increasing interest rates is starting to take effect”.

“The property market had been quite insulated against the broader economic challenges, but now it feels like it’s starting to affect clearance rates”, he said.

Most economists and analysts (myself included) thought that house prices would fall as interest rates rose.

However, record immigration and tight supply pushed values higher in spite of rising mortgage rates.

Now that immigration is moderating, and supply has eased, values in Sydney are beginning to reflect the higher interest rate environment.

Source: CoreLogic