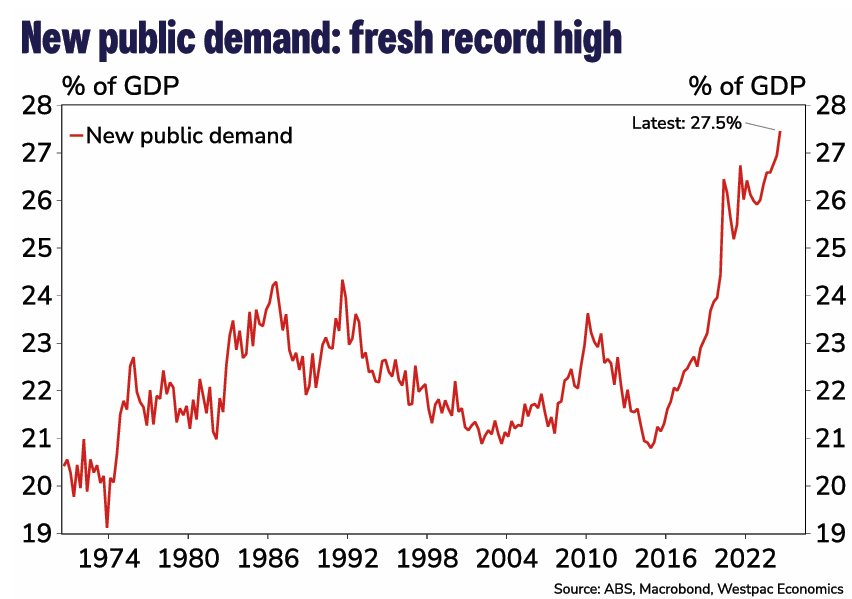

The Q3 national accounts from the Australian Bureau of Statistics (ABS) revealed that public expenditures reached a record-high share of Australian GDP.

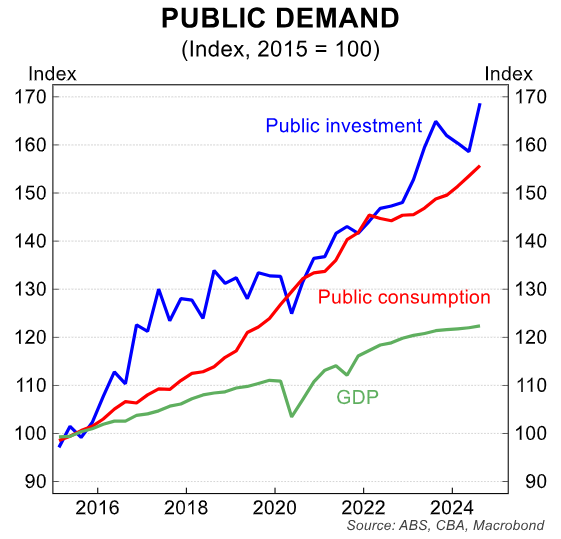

This spending explosion has been driven by massive infrastructure investments (mainly from the states) and public consumption spending (e.g., the NDIS).

Advertisement

Analysis by Westpac suggests that federal and state government borrowing will almost double in 2024–25, to around 6% of GDP.