It is fair to say that the Reserve Bank of Australia (RBA) would already be cutting interest rates if not for the nation’s low unemployment rate of 3.9%.

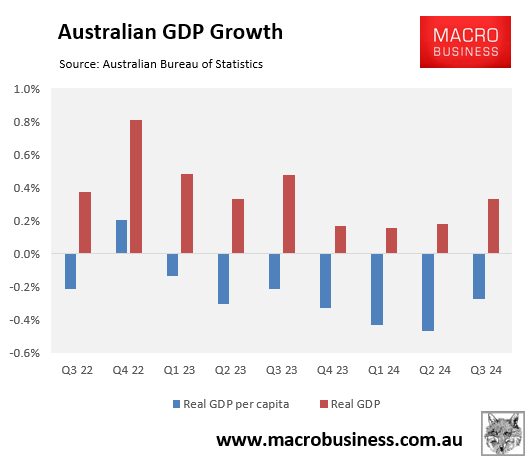

Australia’s economic growth is insipidly weak, with aggregate GDP expanding by only 0.8% in the year to Q3 2024, the slowest annual growth rate since the early 1990s recession outside of the pandemic.

Per capita GDP is worse, shrinking for seven consecutive quarters—the most prolonged decline on record.

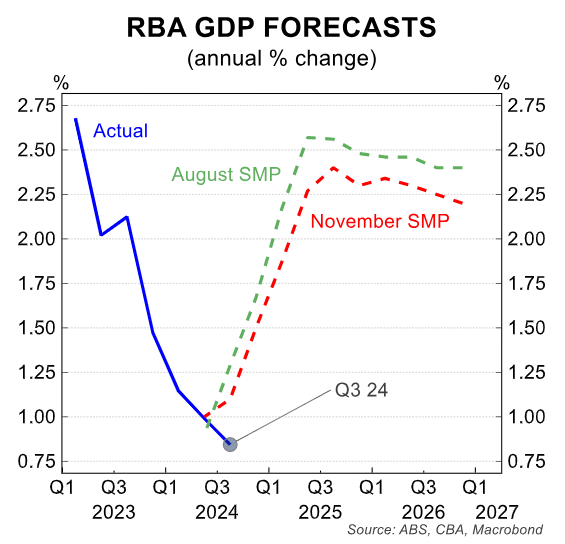

The Australian economy’s growth rate in Q3 2024 was well below the RBA’s projections, as illustrated below.

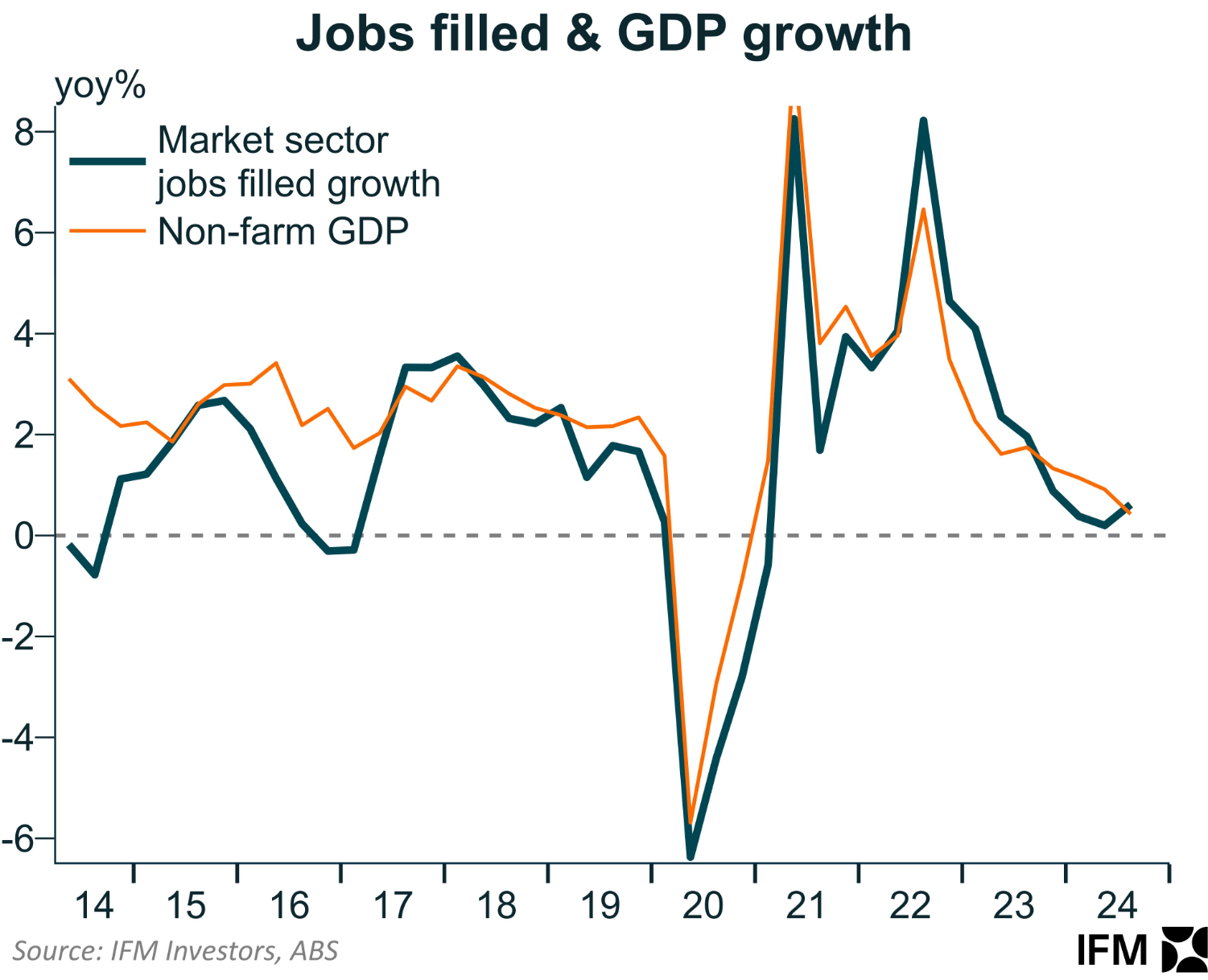

Usually, the decline in GDP would be associated with a commensurate rise in the unemployment rate. And it is true that the market sector is behaving “normally”.

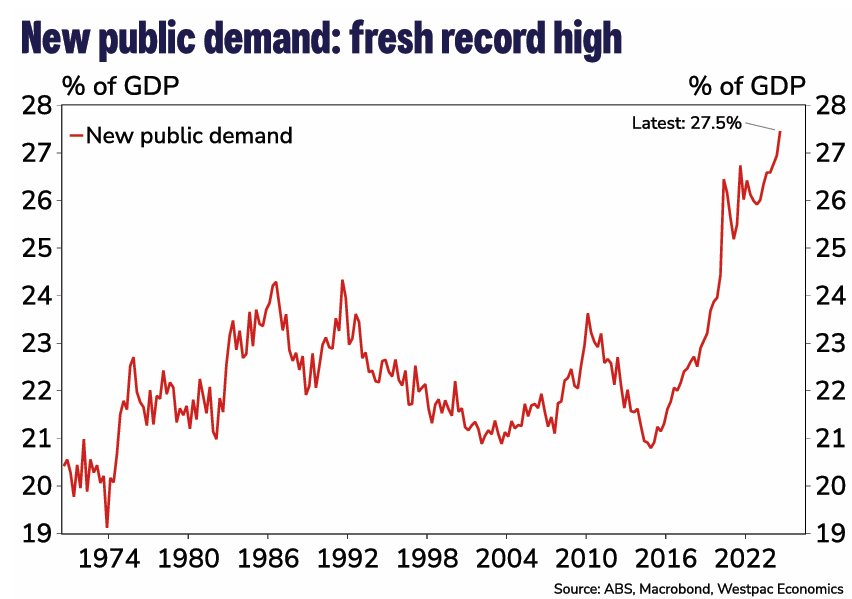

The problem for the RBA is that the federal government is effectively ‘printing’ jobs in the non-market economy, most notably via the NDIS.

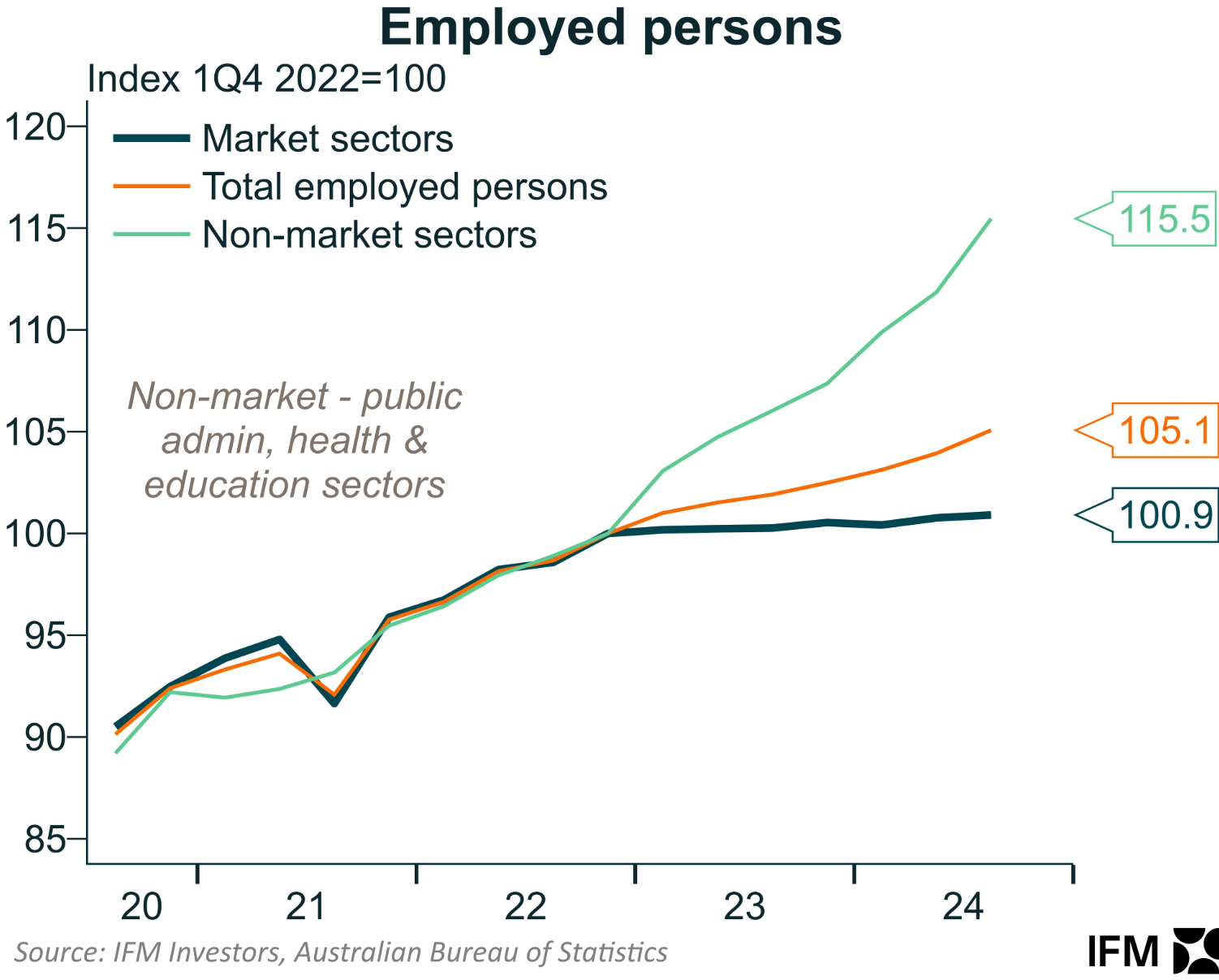

As illustrated below by Alex Joiner at IFM Investors, virtually all of the jobs created in Australia since Q4 2022 have been in the non-market (government-aligned) sector.

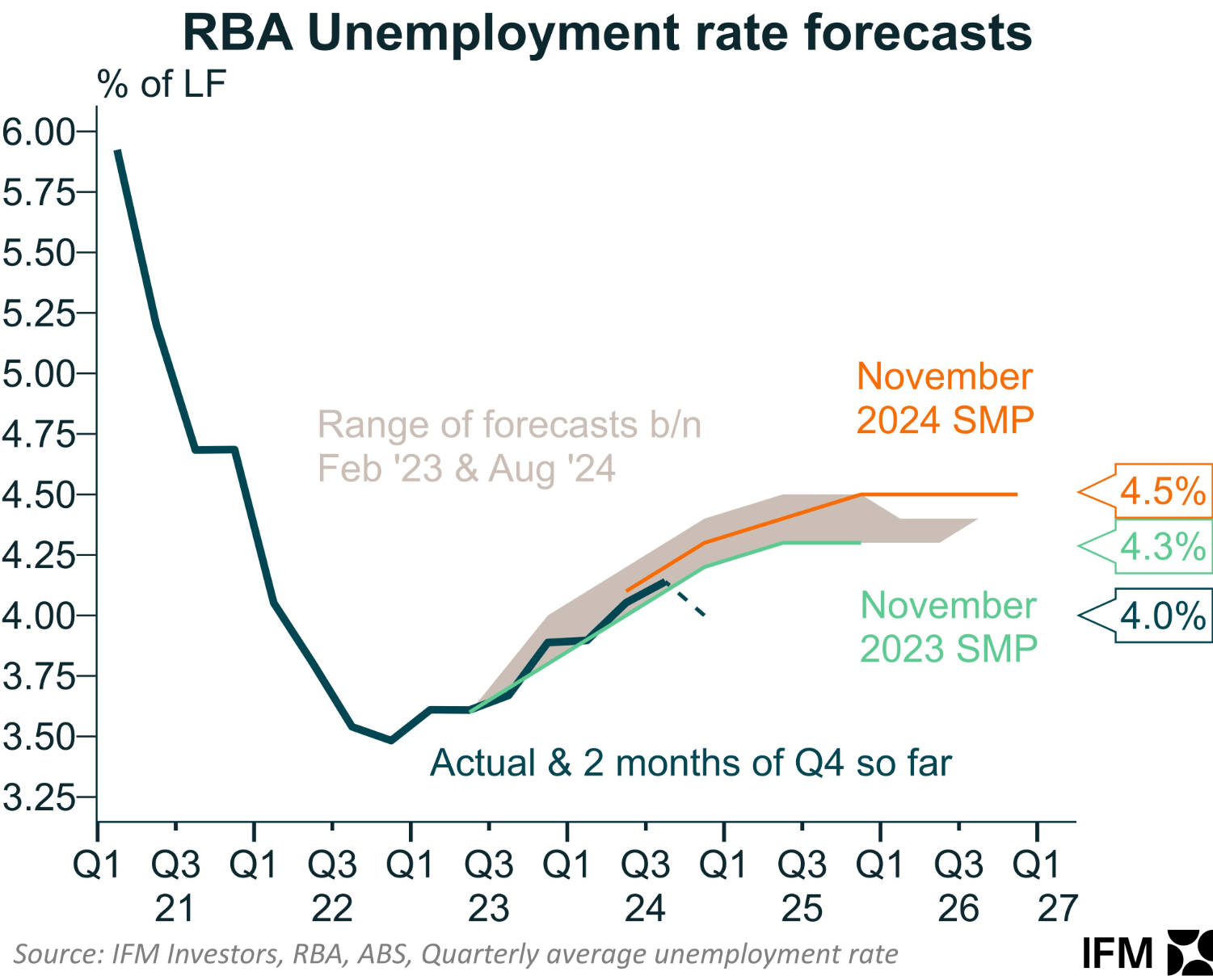

As a result, Australia’s unemployment rate is tracking far below the RBA’s forecasts.

“This unexpected tightness of the labour market seems to imply the RBA has the luxury of being able to wait to get a lot more confidence on inflation”, Joiner noted via Twitter (X).

The private (market) sector economy may be in the doldrums. However, record public sector spending has kept the overall economy and labour market from sliding into a technical recession.

As a result, the RBA is being prevented from cutting rates.