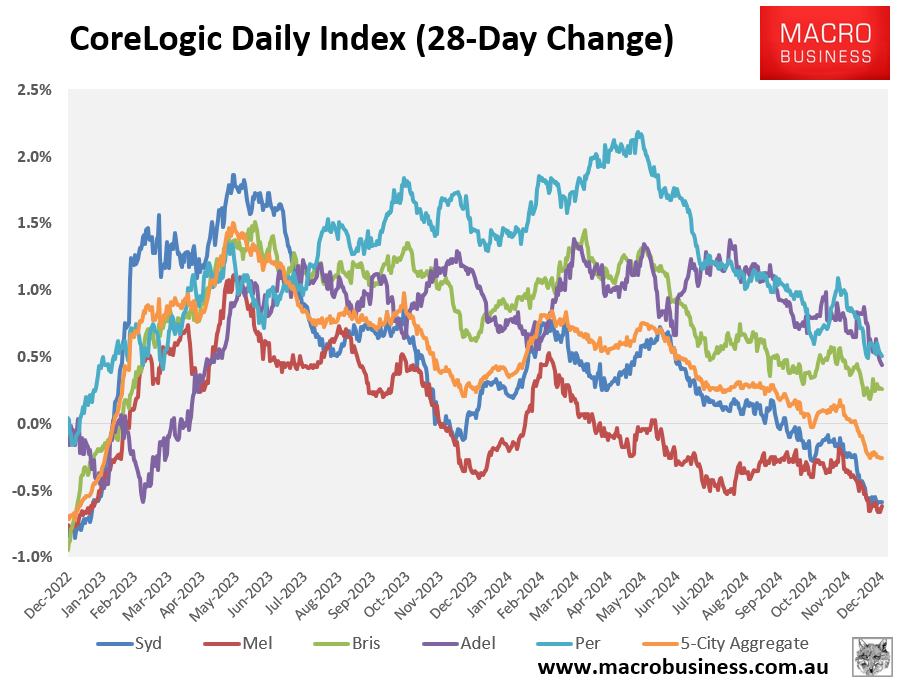

CoreLogic’s daily dwelling value index results for 2024 are in, showing that home prices ended the year in negative territory, pulled down by Melbourne and Sydney.

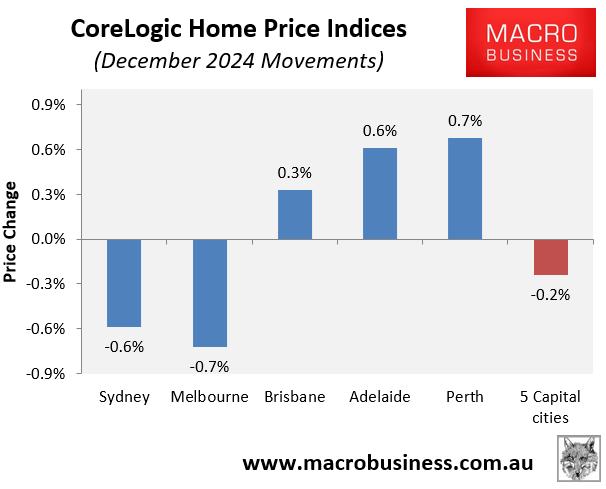

In the month of December 2024, dwelling values at the 5-city aggregate level declined by 0.2%, with falls of 0.7% in Melbourne and 0.6% in Sydney more than offsetting rises across the other major capital cities.

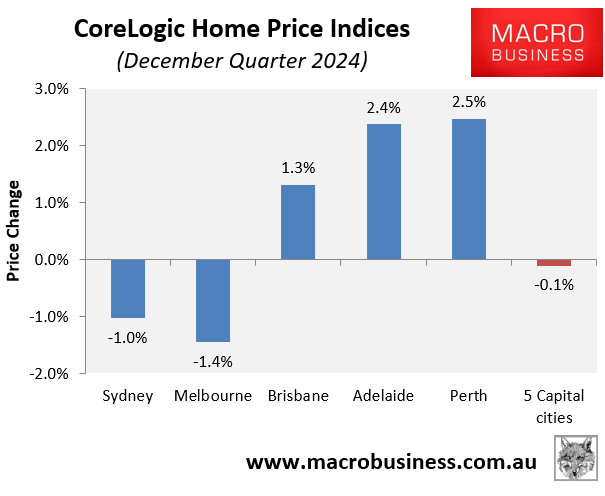

Over Q4 2024, home values at the 5-city aggregate level declined by 0.1%, driven by falls of 1.4% in Melbourne and 1.0% in Sydney.

Commenting on the results, CoreLogic head of Australian research, Eliza Owen, said that the housing market weakened throughout the year.

“When you take a closer look at the dynamic of growth it was strong out of the gate and then weakened throughout the year”, she said.

“Because the promise of a rate reduction was pushed out over the course of the year—meanwhile, buyers were still dealing with high interest rates, expensive housing and cost of living pressures—this has weighed on market performance over the course of the year”.

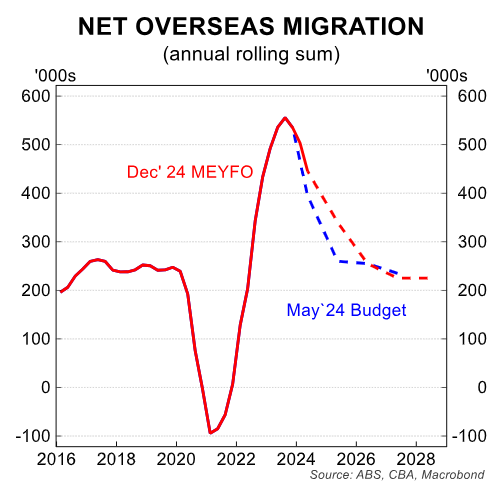

Westpac senior economist Matthew Hassan added that “the markets clearly in Sydney and Melbourne again ran into affordability constraints”, with population growth also slowing.

“There may have been some expectations that the RBA might be starting to ease rates this year, and it’s been pushed back, and that might have provided a bit more support that hasn’t been there”, he said.

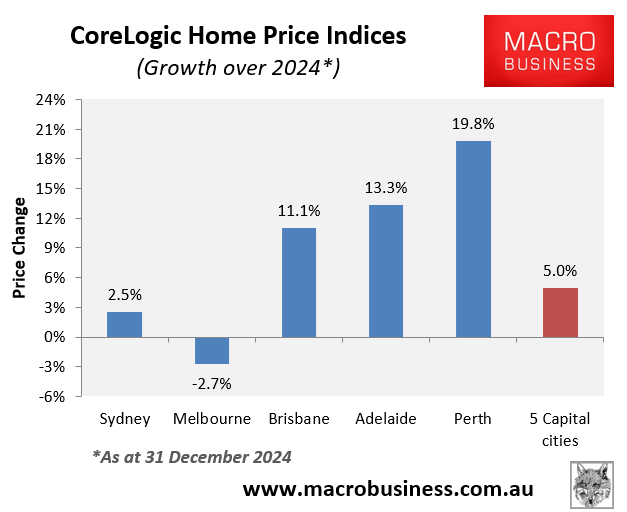

Despite the weakness toward the end of the year, dwelling values still rose by 5.0% in 2024 at the 5-city aggregate level.

In fact, Melbourne (-2.7%) was the only major capital city to record a decline in values in 2024.

The reality is that gravity is finally catching up with the market.

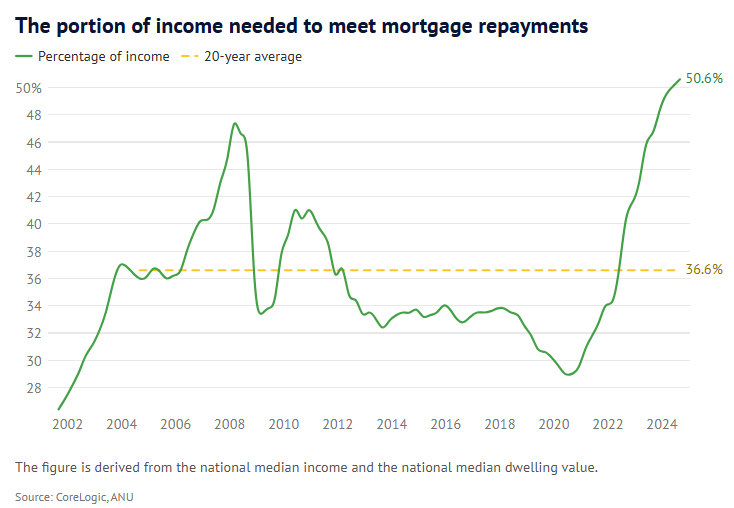

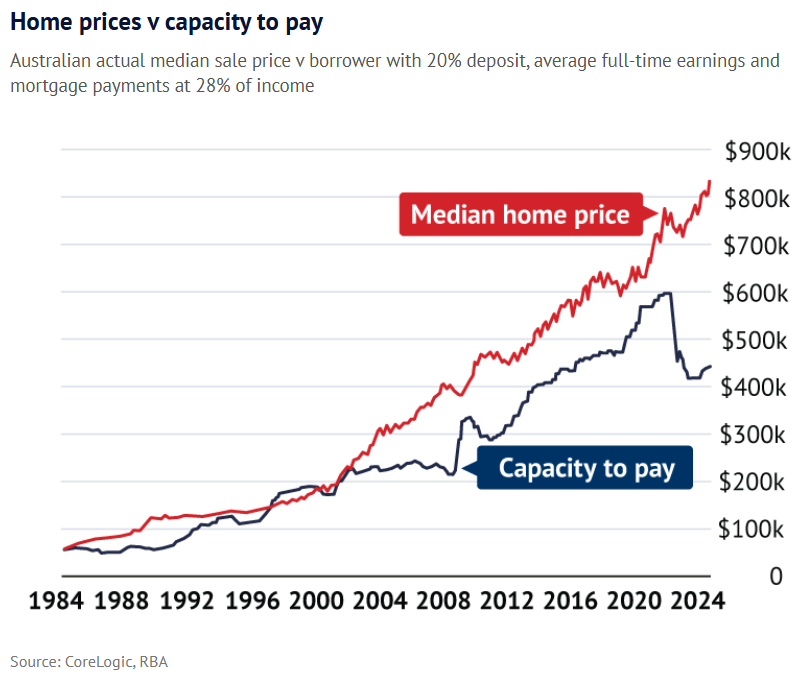

Most observers, including myself, expected home prices to fall in response to the Reserve Bank of Australia’s (RBA) aggressive interest rate hikes, which made property significantly more expensive.

However, prices defied gravity and increased due to record net overseas migration and acute stock shortages.

As a result, Australian property values decoupled from borrowing capacity, resulting in historically low affordability.

Now that net overseas migration has slowed and stock levels have recovered, the historic relationship between mortgage rates and home values is becoming stronger.

Realistically, home prices will continue to fall until the RBA cuts interest rates, increasing affordability and borrowing capacity.