New Equifax data shows that 32% of Australians now use Buy Now Pay Later (BNPL) or credit cards for everyday essentials—up from 23% in 2022.

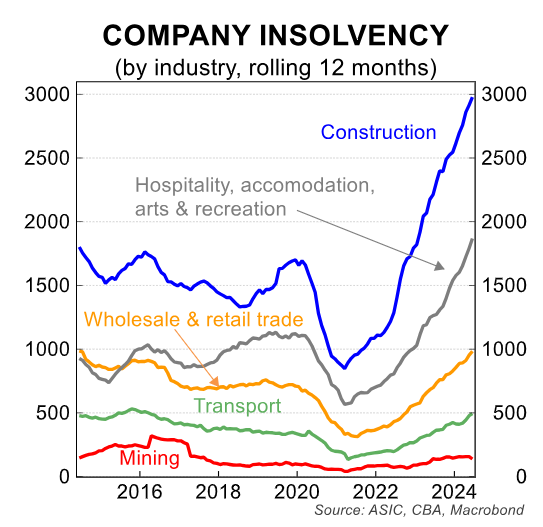

There has also been a 205% annual increase in hospitality sector insolvencies driven by rising costs and lower consumer demand amid the cost-of-living crisis.

Equifax’s Executive General Manager, Moses Samaha, noted that “there is little sign of inflationary pressures easing before the festive season begins”. This suggests that “Australians are turning to options like Buy Now Pay Later and credit cards as a temporary solution to bridge the financial gap”.

“This trend could be a warning sign for increasing financial vulnerability. If rates remain elevated, more consumers will rely on short-term credit solutions and face household budget challenges well into 2025”, he said.

Samaha added, “Hospitality is one of the most challenged industries when it comes to inflationary pressures, experiencing the highest increase in insolvencies in Q3″.

“With no sign of a rate cut on the cards in the lead-up to the festive season, it’s possible the situation will become trickier for hospitality businesses – even over the busy Christmas period”.

“If consumers are focusing on making cutbacks on their spending to pay for essential items, then it is possible that the Christmas period won’t deliver businesses like hospitality and retail the much-needed cash-flow injection that it traditionally does – leaving them without a springboard to start 2025 in a strong position and ultimately leaving them at higher risk of insolvency in the new year”, he said.

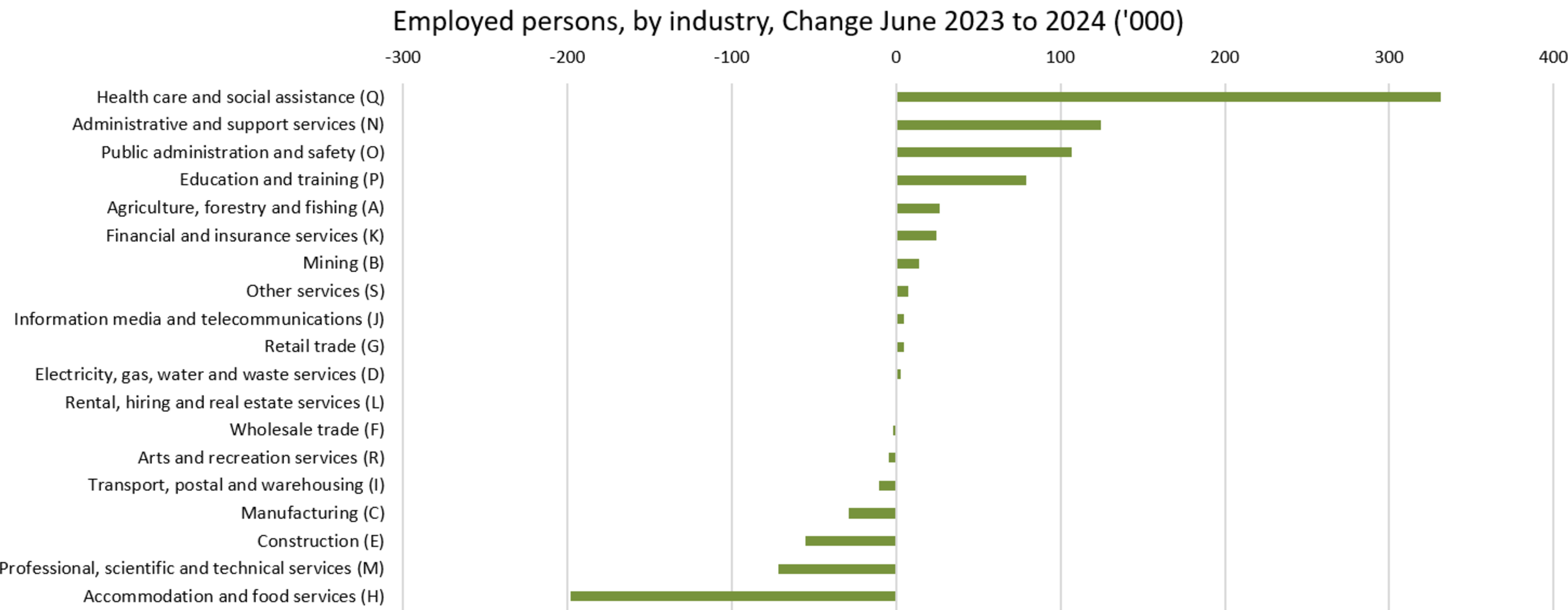

The impact on the hospitality industry is illustrated in the following chart from the Australian Bureau of Statistics (ABS), which shows that around 200,000 jobs were lost in hospitality in the 2023-04 financial year.

Source: ABS

In a similar vein, the hospitality industry experienced a wave of insolvencies in 2023-04:

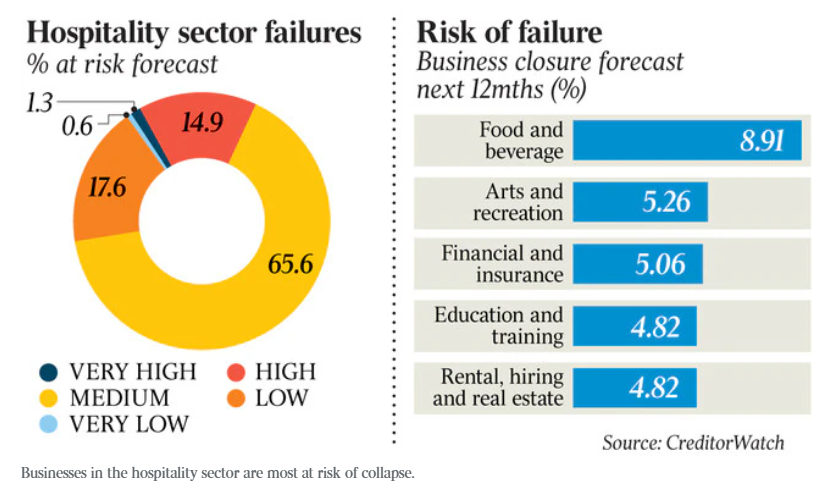

A recent CreditorWatch survey showed that nearly one in six (16.2%) hospitality businesses were at high risk of failure due to high loan rates, rising costs of living, and the hangover from the pandemic.

Moreover, around 9% of food and beverage businesses are expected to close within the following year.

CreditorWatch CEO Patrick Coghlan warned that these businesses are “heavily reliant on discretionary spending” and will “continue to find it tough until consumers feel a reduction in cost-of-living pressures, which won’t happen until we see a couple of rate cuts”.

“Discretionary spending is one of the few ways that consumers can actively cut costs – whether that’s eating out less, buying fewer coffees at cafes or not seeing so many concerts or theatre shows”, he said.

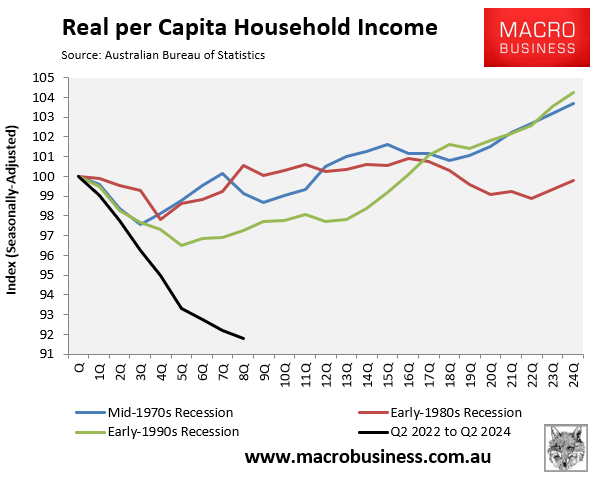

Recall that Australians have experienced their sharpest decline in disposable incomes on record, which has caused them to cut back on discretionary spending, such as cafes and restaurants.

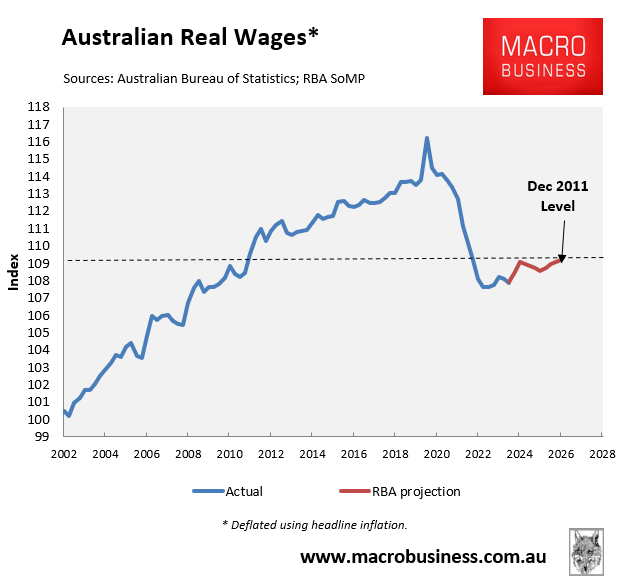

The RBA forecasts a very slow rebound in Australian real wages, indicating continued pressure on hospitality businesses for the foreseeable future.