Are you interested in trading but not sure where to start? That’s completely normal. With so many trading types available, picking the right one can feel overwhelming. Let’s break down each style in simple terms so you can find what works for you.

Day Trading: The Sprint Runner

Think of day trading as running quick sprints. You open and close all your trades within a single day — no positions are held overnight.

What it takes:

- 4-8 hours of active market watching per day

- Quick decision-making skills

- Strong emotional control

- Substantial starting capital

- Advanced chart reading abilities

- Real-time news monitoring skills

- Quick execution capabilities

Best for people who:

- Can focus intensely for hours

- Make decisions quickly

- Handle stress well

- Want to work from home full-time

- Love fast-paced environments

- Can maintain emotional stability under pressure

Not great if you:

- Have a full-time job

- Get anxious about quick decisions

- Can’t watch markets all-day

- Don’t like high-pressure situations

- Need time to analyze decisions

- Have limited starting capital

Swing Trading: The Middle Distance

Swing trading hits the sweet spot for many beginners. You hold positions for several days to a few weeks, trying to profit from “swings” in stock prices.

What it takes:

- 1-2 hours of market analysis per day

- Basic technical analysis knowledge

- Moderate starting capital

- Patience to wait for trades to play out

- Understanding of market trends

- Ability to read financial news

- Knowledge of risk management techniques

Best for people who:

- Have a day job

- Want a balanced approach

- Can wait for profits

- Like to analyze market trends

- Prefer a structured routine

- Want to learn systematically

Not great if you:

- Need immediate results

- Can’t handle temporary losses

- Want very quick profits

- Get impatient easily

- Can’t follow a plan

Position Trading: The Marathon Runner

Position traders think long-term, holding trades for months or even years. They focus on major market trends rather than small price movements.

What it takes:

- Strong understanding of market fundamentals

- Ability to ignore short-term market noise

- Patience to let trades develop

- Regular but not constant market monitoring

- Deep knowledge of economic indicators

- Understanding of company financials

- Long-term market analysis skills

Best for people who:

- Think strategically

- Have long-term goals

- Can stick to their plans

- Don’t need quick profits

- Like fundamental analysis

- Can handle market volatility

Not great if you:

- Get bored easily

- Need regular action

- Want fast returns

- Can’t ignore market noise

- Need constant excitement

Options Trading: The Strategic Player

Options trading is like chess — it offers many strategic possibilities. You can profit whether markets go up, down, or sideways.

What it takes:

- Good understanding of options mechanics

- Risk management skills

- Math skills for calculating probabilities

- Strategic thinking

- Knowledge of Greeks (Delta, Theta, etc.)

- Understanding of volatility

- Advanced risk analysis capabilities

Best for people who:

- Like strategic planning

- Want flexibility in your investments

- Can handle complex concepts

- Like to limit risk

- Enjoy probability calculations

- Think in multiple scenarios

Not great if you:

- Prefer simple approaches

- Don’t like math

- Want straightforward trades

- Need predictable outcomes

- Dislike complex strategies

Forex Trading: The Global Player

The foreign exchange market is a 24/5 market where currencies are exchanged, with each new trading week starting in Asia and ending in New York. With over $7.5 trillion traded daily, it’s the largest financial market in the world. It’s extremely liquid and allows traders to enter and exit positions easily.

What it takes:

- Understanding of global economics

- Ability to analyze multiple markets

- Knowledge of currency pairs

- Comfort with leverage

- Technical analysis proficiency

- Geopolitical awareness

- Strong risk management skills

Best for people who:

- Want to trade at any time

- Like international markets

- Can handle high-leverage

- Want high liquidity

- Follow global news closely

- Understand macroeconomics

Not great if you:

- Get confused by multiple variables

- Don’t like high leverage

- Need simple market hours

- Prefer straightforward assets

- Can’t handle fast markets

Cryptocurrency Trading: The New Market Pioneer

Cryptocurrencies are a younger, more volatile market in which you can trade 24/7. It’s a highly technical field that attracts traders due to its innovations and constant development.

What it takes:

- Strong stomach for volatility

- Technical analysis skills

- Understanding of blockchain technology

- Cybersecurity awareness

- Knowledge of crypto fundamentals

- Ability to research new projects

- Strong risk management skills

Best for people who:

- Can handle high-risk

- Want to trade any time

- Like new technologies

- Don’t mind price swings

- Enjoy learning about innovation

- Can spot market trends

Not great if you:

- Need stable markets

- Want traditional assets

- Can’t handle big price moves

- Prefer regulated markets

- Need predictable patterns

How to Choose Your Trading Style

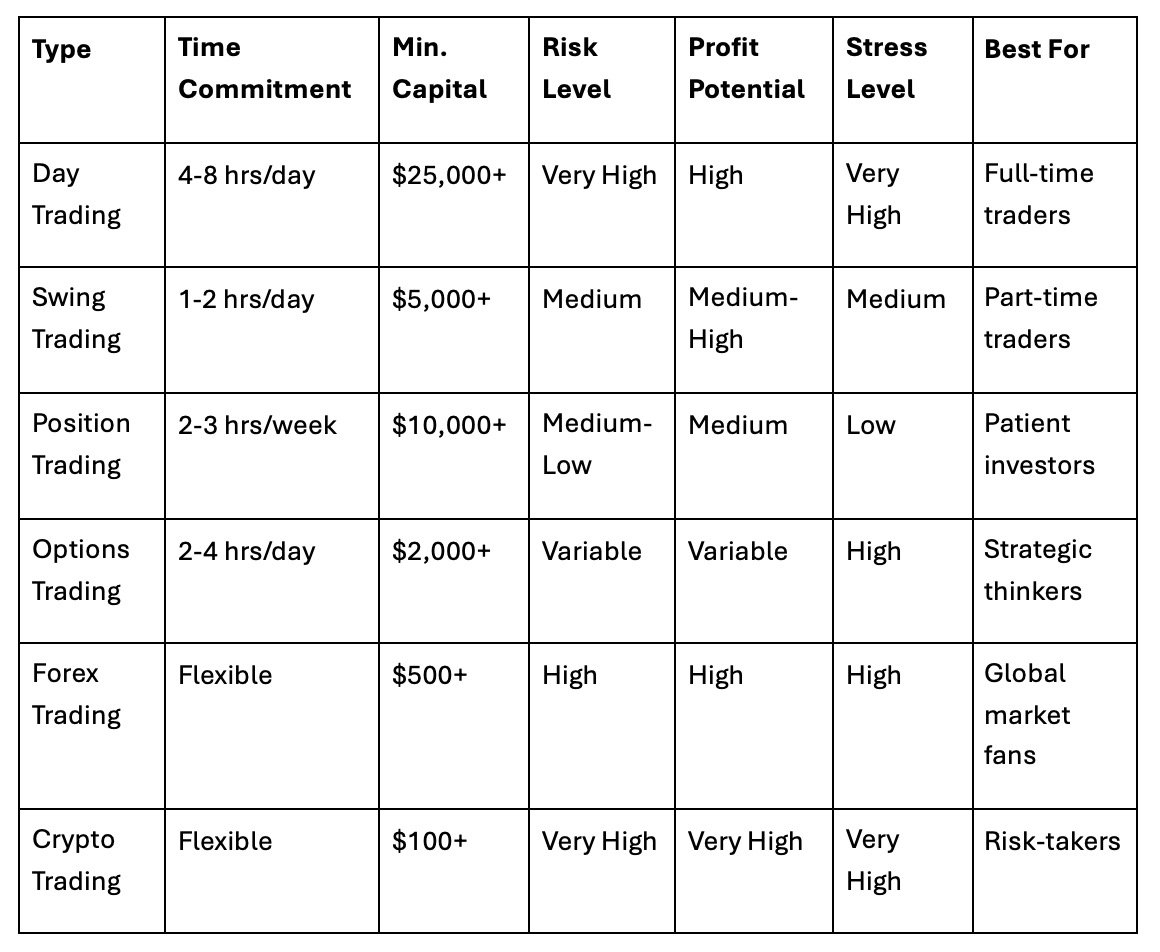

Here’s a detailed comparison table to help you evaluate different styles:

Consider these additional factors when picking your type:

- Technical requirements:

- Fast internet connection

- Multiple monitors (especially for day traders)

- Professional charting software

- News feed subscriptions

- Backup systems

- Skill requirements:

- Technical and fundamental analysis proficiency

- Risk management expertise

- Emotional control

- Market psychology understanding

- Trade execution skills

Getting Started: First Steps

Building a foundation of specialized knowledge before trading is a must. These are the important steps that every beginner should follow:

- Start with education. Find reputable books and online courses about your chosen trading style. Practice with demo accounts and paper trades before risking real money, and learn the basics of technical analysis to understand price charts and market movements.

- Set realistic goals. Make your first trades small and focus on learning from them. If you have a job, keep it while you learn to trade, and if you are serious about it, then have some clear measurable goals for your progress.

- Create a trading plan. Write down specific rules for managing risk and define your entry and exit points. Calculate appropriate position sizes based on your account balance and risk tolerance. Map out your trading schedule and stick to it.

- Use the right tools. Find a trusted broker according to your style and budget. If you’re from Australia, take a look at this curated list of Australian brokers. Buy good charting software and have a distraction-free space to plan your trades. Keep detailed records of all your trades — this way, you can analyze your performance and improve it.

Common Beginner Mistakes to Avoid

If you know what the most common pitfalls are, you can avoid them and shorten your learning curve.

- Starting too big. Begin with basic strategies and small position sizes that won’t cause financial stress if they fail. Keep your leverage low and avoid complex instruments until you’ve mastered simpler ones.

- Skipping education. Take time to educate yourself before risking real money. Study successful traders’ methods and practices through demos first.

- Poor risk management. Set strict limits on how much you’re willing to risk on each trade and never exceed them. Use stop-loss orders consistently and keep your position sizes modest.

- Emotional trading. Establish a good trading plan and follow it irrespective of wins or losses. Take many notes during your trades and try to enter the market without sentiments.

Final Thoughts

The best trading type for you depends on your personality, schedule, and goals. Many successful traders start with swing trading because it offers a good balance of time commitment and potential returns.

Whatever style you choose, remember that success in any investment comes from education, practice, and disciplined execution of a well-planned strategy. In the beginning, most of your time should be dedicated to education. For example, you can learn trading free of charge from the best EU trading expert — Andre Witzel.

Take time to try different approaches through paper trading before committing to real money. Your chosen style should fit your life, not the other way around. Most importantly, start small and scale up only when you show consistent results.