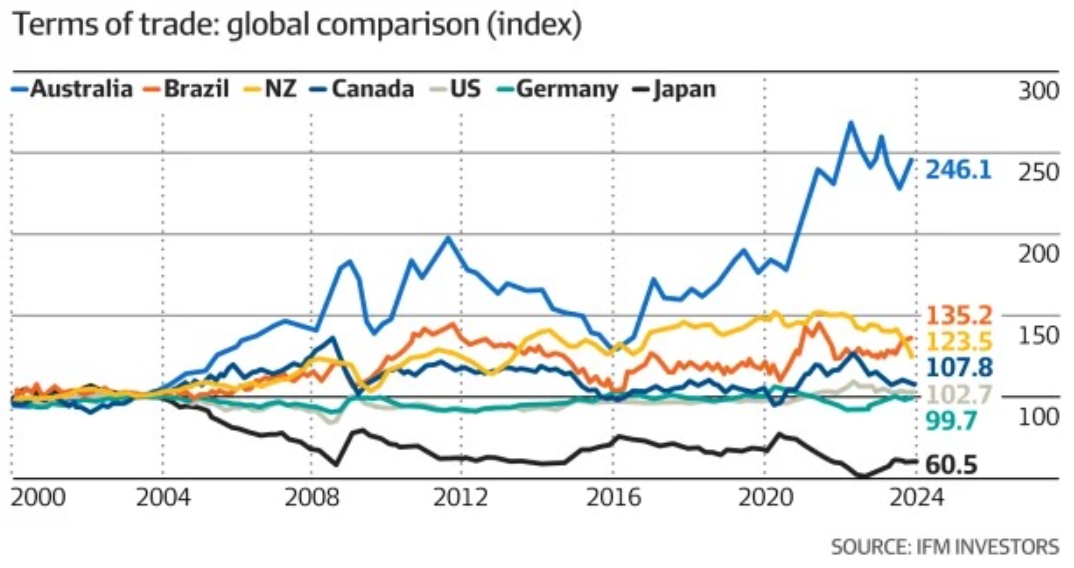

Earlier this year, The AFR posted the following chart showing how Australia has benefited the most from global commodity prices over the last 20 years:

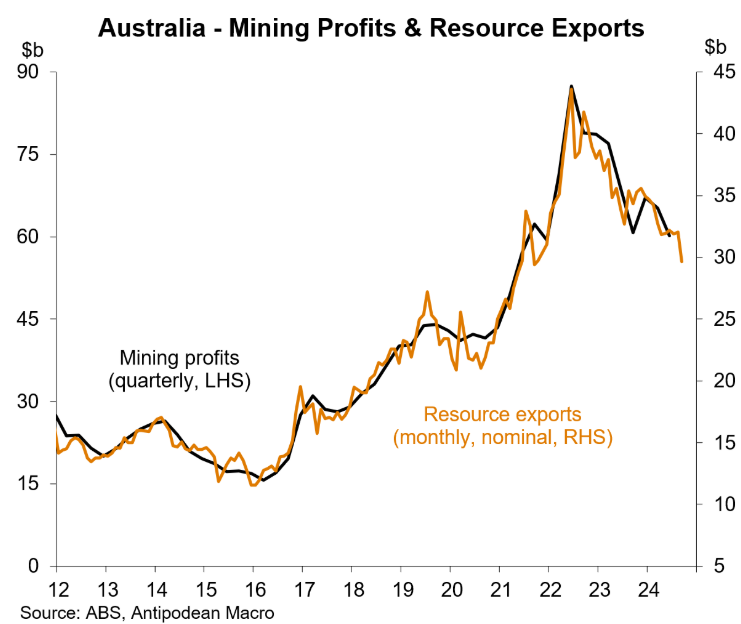

On Friday, Justin Fabo at Antipodean Macro posted the following chart showing mining companies’ massive profits in Australia.

As you can see, mining profits jumped from around $30 billion per quarter between 2012 and 2017 to a peak of $90 billion per quarter in 2022 (after Russia invaded Ukraine) and currently stand at around $60 billion per quarter.

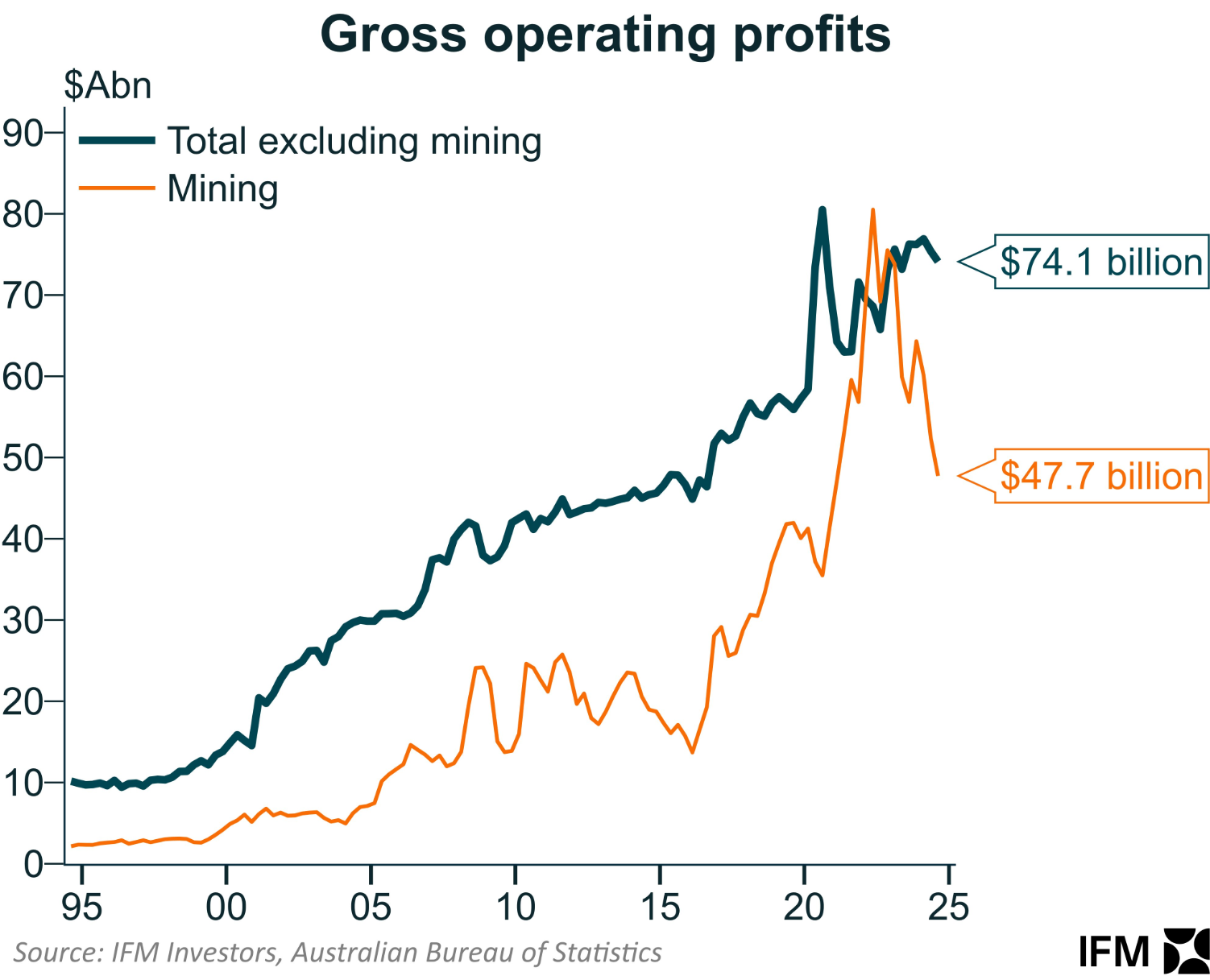

At its peak, the mining sector, which only employs around 2% of Australians, earned more profits than all other businesses combined.

Because most energy companies are foreign-owned and Australia lacks an effective super profits tax, most of the benefits from the Russia-Ukraine War price increases went offshore to foreign owners.

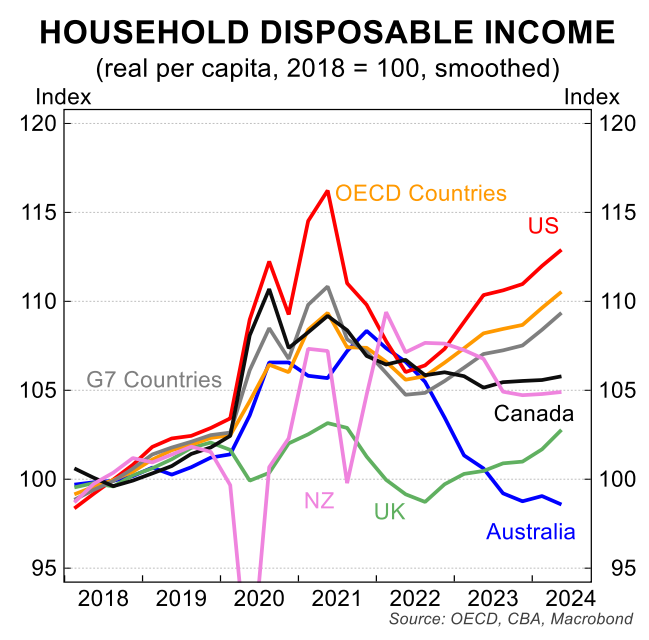

Meanwhile, domestic energy prices have skyrocketed, hurting Australian households and businesses despite the country’s massive gas and coal resources and major exports of both.

The more expensive coal and gas become, and the more Australia exports, the wealthier foreign-owned mining corporations get. By contrast, Australian households and businesses suffer from increased energy costs.

Australian workers have lost ground due to negative real wage and income growth, and some firms have failed due to rising energy costs. Meanwhile, the foreign-owned energy cartel has gouged relentlessly, making huge profits that most Australians do not share.

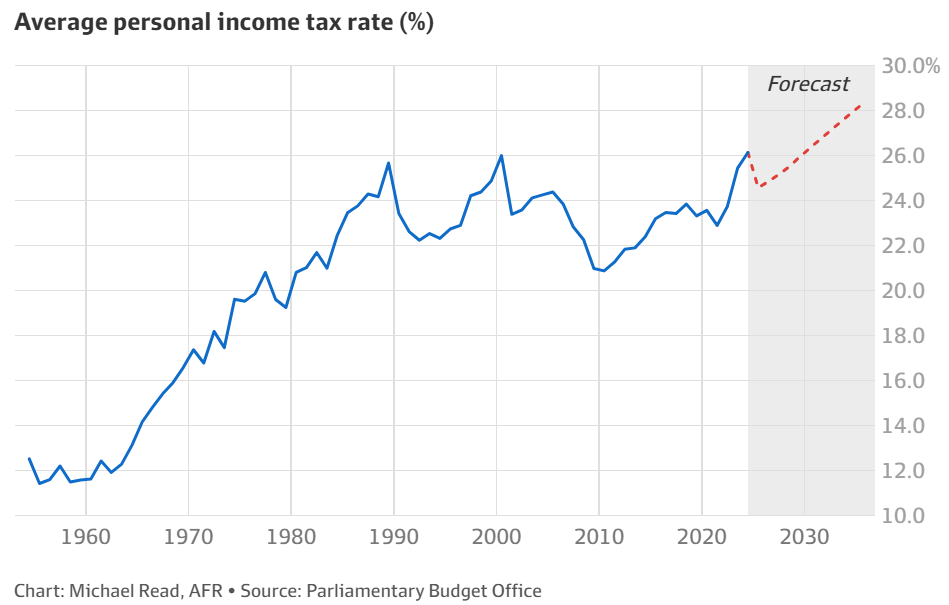

Meanwhile, the cash-strapped federal budget continues to slug households with ever-rising personal income taxes.

By not adequately taxing the resources sector, Australia has deprived itself of trillions of dollars in revenue.

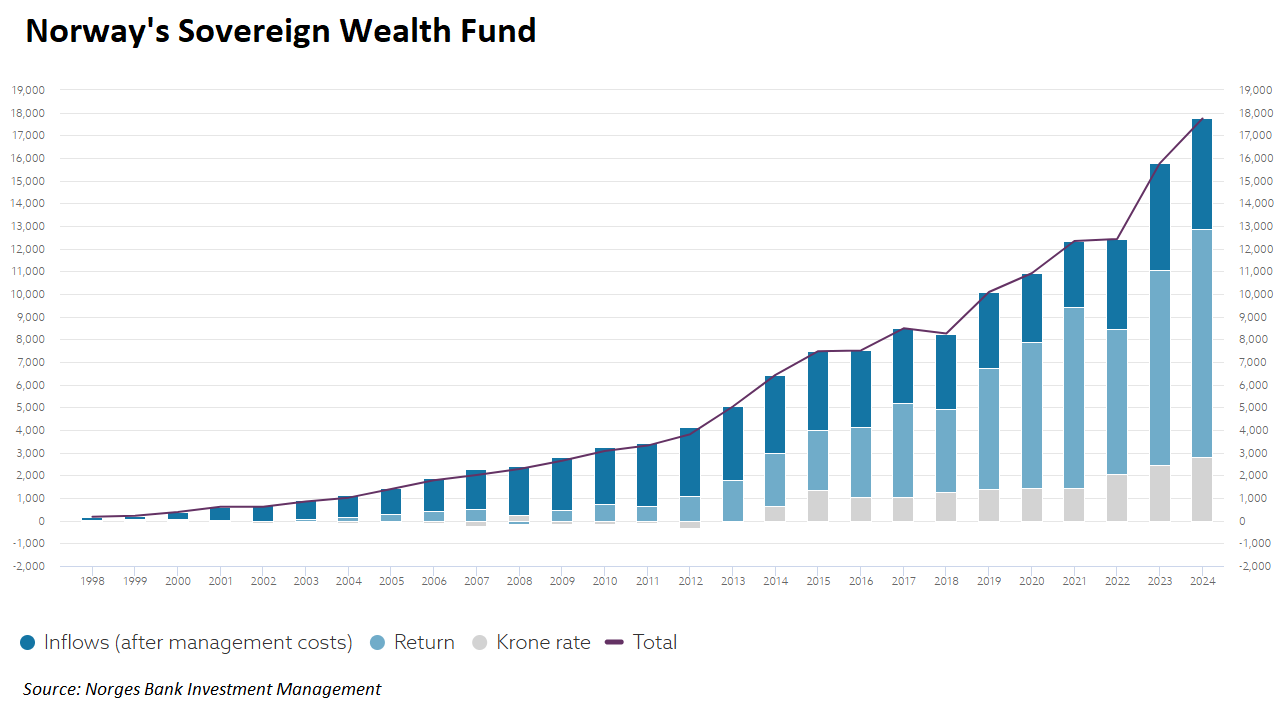

By comparison, Norway’s Sovereign Wealth Fund (SWF) is currently worth 19 304 billion NOK or 1744 USD.

Only 5.5 million people own Norway’s SWF, giving each resident a fund value of $317,000.

By comparison, Australia’s Future Fund is only worth just under $10,000 per resident.

Australia Institute chief economist, Richard Denniss, summarised the stupidity of Australia’s resource tax arrangements in 2022:

“Despite being the world’s third largest exporter of fossil fuels, people are struggling with high prices for petrol, gas and electricity (the vast majority of which is still produced from burning our own coal and gas)”.

“The idea that an energy exporter like Australia is having a tough time when the prices of our energy exports are sky high shows just how broken and detached from reality our political debate has become”.

“The Norwegians, by taxing their oil and gas industry, have accumulated $1.8tn in their sovereign wealth fund. But in Australia, which exports far more fossil fuels than Norway, we have just $200bn in our future fund, most of which came from the privatisation of Telstra”.

“To put it another way, the value of our wealth fund is only a little bigger than one year’s worth of Norway’s oil tax revenue, even though Norway’s economy is a quarter of the size of ours”.

Qataris have also benefited financially by correctly taxing their resources.

As Matt Barrie himself explained earlier this year, “Qatar generates enough wealth from this trade that residents pay zero income tax, zero property tax, zero corporate income tax, have free healthcare, free education, have subsidised housing and plentiful access to cheap electricity and petrol”.

By contrast, “in Australia, most of our export facilities pay no royalties at all to the state or federal government”.

Meanwhile, “China resells about a third of what we need domestically. Half the gas we sell to Japan is resold“.

Australia would not need to worry about federal budget debt if policymakers had taxed our resources appropriately, as Norway and Qatar do.

We should be the richest nation on earth.

Instead, we have impoverished ourselves by engineering an artificial gas shortage, driving up domestic gas and electricity prices, while also diluting the nation’s mineral wealth via mass immigration.

We are not a serious country.