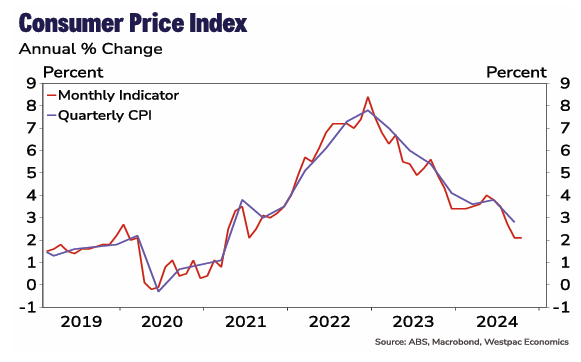

Below are CBA’s and Westpac’s November CPI Previews. Both are predicting a trimmed mean inflation to undershoot the RBA’s expectations.

Westpac:

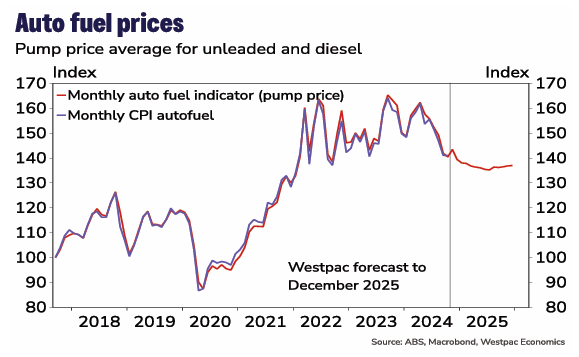

- Westpac’s near-cast for the November Monthly CPI Indicator is 0.4% in the month to be up 2.2% in the year.

- Post the November Monthly CPI Indicator, not only will we have two thirds of the data for those prices that are surveyed monthly, but we will also have an update on the services prices that are surveyed only once a quarter.

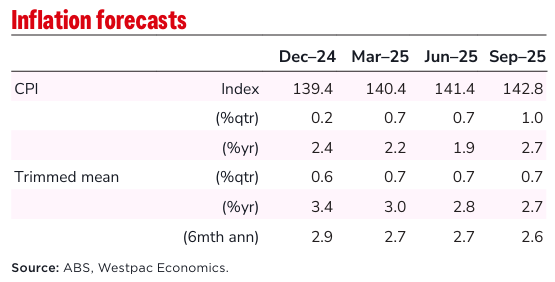

- Westpac’s near-cast for the December quarter CPI is 0.2%qtr/2.4%yr.

- Westpac’s near-cast for the December quarter Trimmed Mean is 0.6%qtr/3.4%yr which will see the two quarter annualised pace drop from 3.3%yr to 2.9%yr.

- The various state and federal government rebates will remain a key focus and the November estimate will set a solid foundation for our Q4 near-cast.

- We are also keen to get a further update on rents and dwellings inflation.

Monthly CPI to set the base for Q4 CPI

The November Monthly CPI Indicator will provide an update on a number of prices that are surveyed only once a quarter and, in particular, some of the more critical market services. The quarterly updates that are provided in November are:

- Restaurant meals

- Take away and fast foods

- Hairdressing & personal grooming services

- Other household services

- Spare parts & accessories for motor vehicles

- Maintenance & repair of motor vehicles

- Other services in respect of motor vehicles

- Audio, visual & computing media and services

- Equipment for sports, camping & open-air recreation

- Games, toys & hobbies, and

- Insurance

Over time, the ABS has introduced more monthly price series to the Monthly Indicator. Recent additions, that moved prices from quarterly to monthly updates, includes:

- Other recreational, sporting & cultural services

- Take away and fast foods

- Sports participation, and

- Urban transport fares

November will also provide us with some critical updates on housing inflation. In particular, we will be looking out for the updates on rents, dwellings, electricity, gas and other household fuels.

Due to the increase in government assistance, rents rose just 0.1% in September and fell –0.3% in October, while the ABS noted that rents would have lifted 0.5% in September and October had it not been for the increase in assistance.

We have pencilled in a 0.5% increase in rents in November and are watching closely to see how rents inflation unfolds as we move into the first half of 2025.

Dwelling prices fell –0.1% in September and rose just 0.1% in October. We suspect that recent changes to the support offered to first home buyers could have suppressed dwelling prices as they are reported in the CPI.

This is why we have pencilled in a slightly stronger 0.3% gain in November, on par with the average monthly gain seen through the first half of the year.

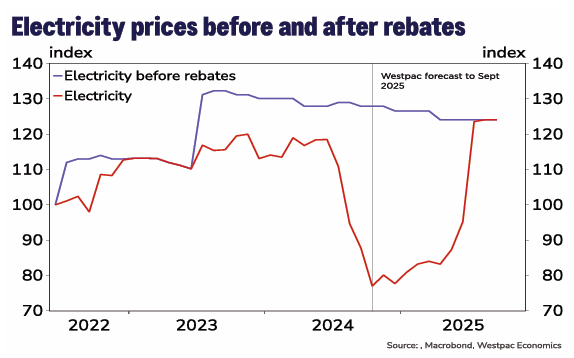

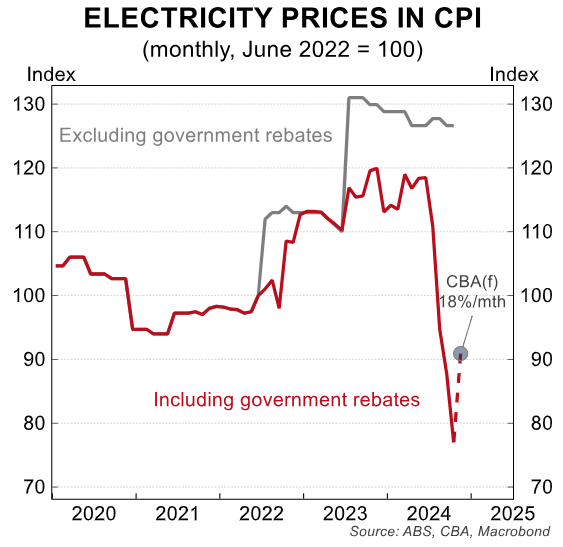

The big unknown for November will be electricity. As the ABS noted in the October Monthly CPI Indicator, the combined impact of Commonwealth Energy Bill Relief Fund (EBRF) rebates and the State Government rebates in Queensland and Western Australia drove the fall in electricity prices in the month.

Households in all states except WA received their second instalment of Commonwealth EBRF while households in NSW, Vic, SA, Tas, NT and ACT received their first instalment of Commonwealth EBRF rebates in August 2024.

The fall of 12.3% in October was due to some households in these states receiving two $75 instalments in October, and some households in WA receiving their first $150 instalment in addition to their first $200 State government rebate instalment in October.

The Tasmanian state government rebate was used up by households in September, while in Queensland, households continued to use up the remainder of that state’s government rebate.

With such a mix of rebates, it is not clear how much of the various rebates are remain unused in November, in particular, the $1,000 Qld rebate. Therefore, we don’t have a good way to estimate what the possible lift in electricity prices could be in November and so have pencilled in a 2% increase.

We will be closely watching to see how much the ABS estimate varies from this and what impact it could have on our Q4 near-casts.

Rebates hold down the increase in the Q4 CPI

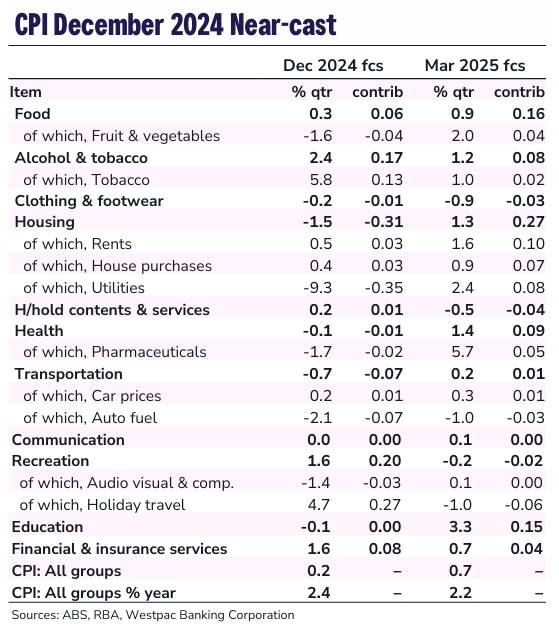

Westpac is forecasting a very modest 0.2% gain in the December quarter CPI. Driving this outcome is a 9.3% fall in utilities, due to the rebates driving down electricity prices, which will shave 0.35ppt of the CPI in the quarter.

Offsetting the fall in electricity, to some extent, is a 4.7% increase in holiday travel & accommodation which would add 0.27ppt to the CPI. There is also the estimated 2.4% increase alcohol & tobacco contributing 0.17ppt.

Our near-cast of 0.2% rise in the December quarter CPI will see the annual pace ease from 2.8%yr in September to 2.4%yr. At this stage we are forecasting a low point in the annual rate of headline inflation of 1.9%yr at June 2025.

Our Trimmed Mean forecast for the Q4 is 0.6%qtr, taking the annual pace down to 3.4%yr from 3.5%yr in September. More importantly, the two-quarter annualised pace highlights the moderation in the pace of core inflation, easing from 3.8%yr at June 2024 to 3.3%yr at September 2024, then to a forecast 2.9%yr by December 2024 edging into the RBA’s target band.

What to watch out for in November

In November, will be keeping a particularly close eye out on:

- Electricity: there are so many uncertainties about the rebates that it is not clear how much prices could jump in November, or if they will rise at all? And being the second month of the quarter, the November prices, along with October prices, will set a sold benchmark for the Q4 print.

- Housing costs: post the recent low income and first home buyers assistance, how much will rents and dwellings jump in November?

- The update on services that being a once a quarter print, will feed directly into the Q4 estimate.

- Food prices: will the recent pressure on the major supermarkets be reflected in a greater discounting?

CBA:

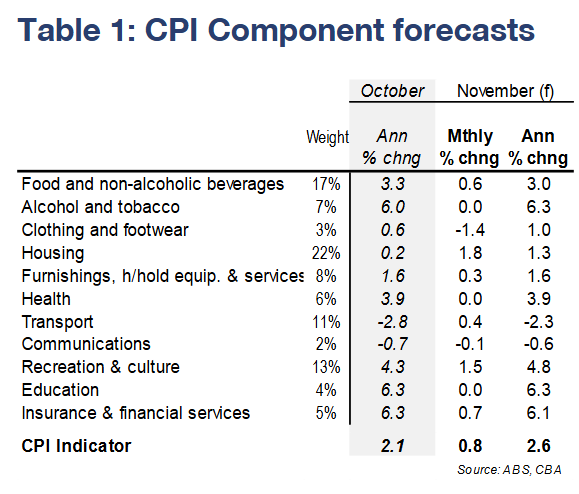

- Headline inflation is expected to have lifted to 2.6%/yr in November.

- The unwinding of electricity rebates will drag headline inflation outcomes higher through to July 2025.

- We expect the print to confirm Q4 24 core inflation will undershoot the RBA’s latest forecasts.

Headline rising on rebate roll-off

We anticipate headline inflation rose to 2.6%/yr in November, a ½ppt rise from the pace in October.

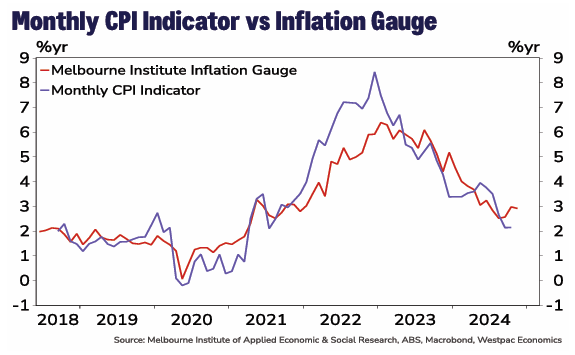

The annual trimmed mean measure of core inflation is expected to have ticked down a touch to 3.4%/yr from 3.5%/yr. This configuration of a solid lift in headline CPI but a slightly lower core inflation figure predominantly reflects the inflationary impact of the gradual unwind of the electricity rebates. This unwind will occur through to July 2025, as currently legislated.

Markets may knee-jerk react to a higher headline print, particularly after the most recent jobs report.The median surveyed market economist on Bloomberg is currently centered on 2.3%/yr.

But we note that it is the underbelly of the inflation data that will be what the RBA focuses on. In particular, prices for key market services are measured in the middle month of the quarter; updates for these prices will drive the RBA’s assessment of domestically generated inflation.

The RBA last week expressed rising confidence that inflationary pressures were easing. We expect the November data to confirm this. Indeed, our current expectation is for Q4 24 trimmed mean inflation to undershoot relative to the RBA’s latest forecast.

Our current point estimate is for a 0.6%/qtr (3.3%/yr) print, with risks firmly skewed to the downside.It would not take much to see us revise lower our nowcast for the trimmed mean CPI; we have been quite conservative in our translation of the monthly figures into their quarterly equivalent.

An inflation outcome lower than the RBA’s forecast is a necessary condition for an easing cycle to begin in February. It may not be sufficient, however, given the RBA’s current views on the unemployment gap.

Some key expected drivers in November are:

- An 18%/mth surge in electricity prices as government energy rebates roll-off. The fall in October owed to some households receiving two instalments of rebates. We anticipate this impact unwoundin November. We expect the largest impact in November froman unwind of WA rebates –as the first of two instalments is used up. Further large increases are set to occur in Q1 25, driven by the unwind of Qld rebates.The extent of these rebates rolling off is a source of uncertainty.

- A substantial step-down in new dwelling cost inflation to 3.5%/yr, where previously it had been sticky at ~5%/yr until recently. This is the single largest individual component of the CPI basket with a weighting of 8%.

- A 3%/mth rise in holiday travel & accommodation, reversing last month’s declines, as prices rise into the turn of the year. The risk is a stronger increase, particularly for domestic travel & accommodation.

- An ongoing moderation in market services inflation, to around 4¼%/yrfrom 4.6%/yr. This will be what the RBA watches most closely.