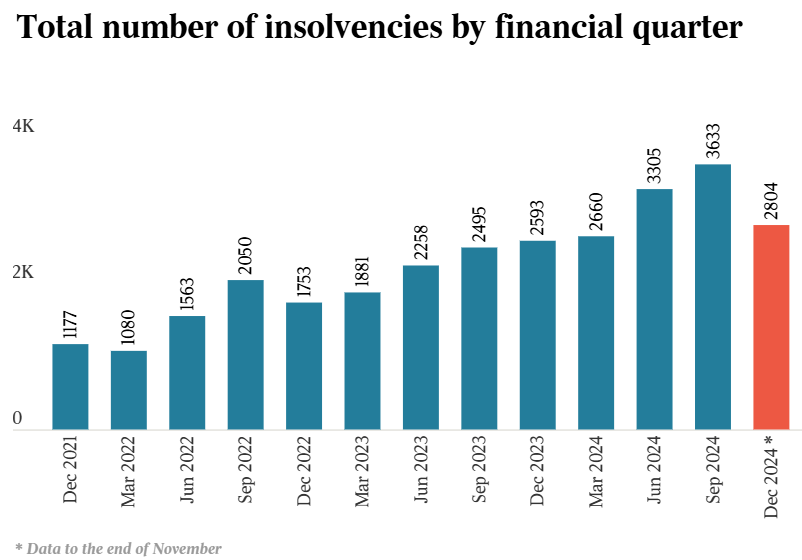

On Wednesday, I reported that 26,000 businesses have fallen into insolvency since the 2022 election, including a record 12,405 insolvencies this calendar year.

Data from the Australian Financial Security Authority (AFSA) shows there were 11,644 personal insolvencies nationwide in 2023-24.

ASFA expects personal insolvencies to rise by 15% to 13,400 in the current financial year and a further 12% in 2025–26.

The ASFA report also shows that 49% of individuals who become insolvent have debts of less than $50,000.

ASFA CEO Tim Beresford says people renting their homes are particularly vulnerable to being declared insolvent. He added that households will remain at risk of personal insolvency until inflation falls.

“Households and businesses are now under the highest level of mortgage stress and cash flow constraints since the GFC”, he said.

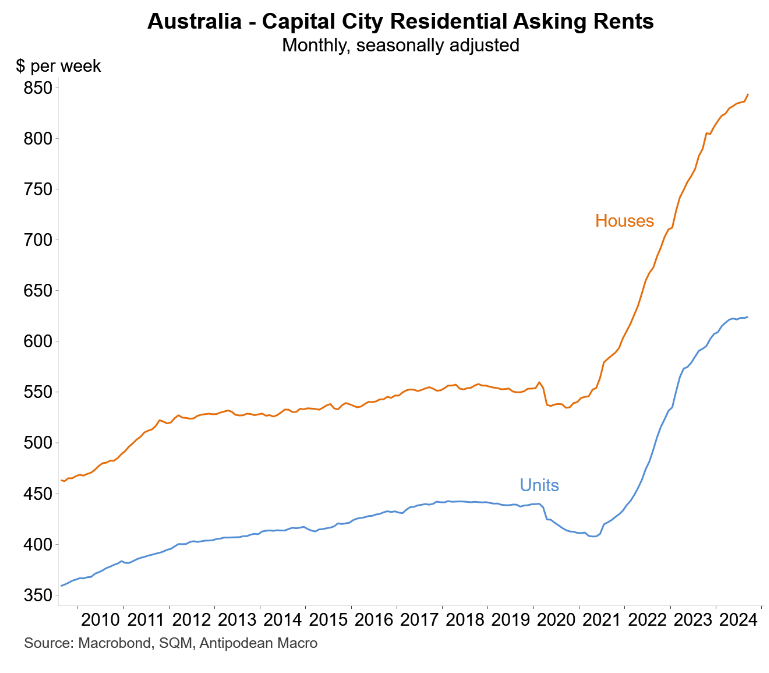

Beresford added that tenant households were suffering more than any other demographic due to the lack of a lack of supply in the market that had driven up rents.

“If they find themselves losing a job or having their hours cut, it is really difficult for them to hang on”, he said.

Thus, the Albanese government’s extreme immigration program is pushing renting households into deep financial stress and insolvency.

Separate data from Equifax, released last week, showed that 39% of Australians are facing financial stress.

According to the Equifax survey, over 50% of Australians lowered their discretionary expenditure last year, compared to 37% in 2022.

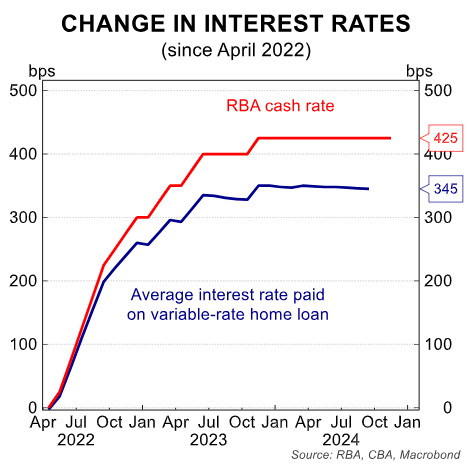

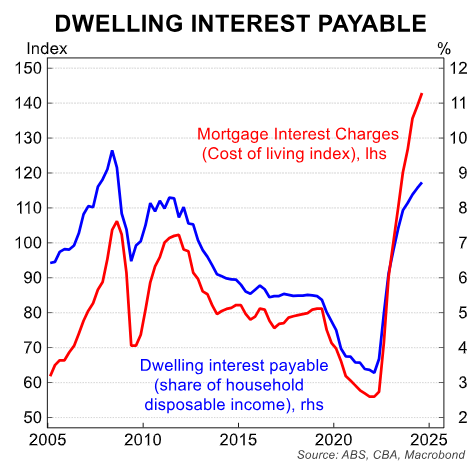

The increase in Australians suffering financial stress coincides with the increase in mortgage payments caused by the RBA’s 4.25% interest rate hikes.

Even though the RBA has not raised the cash rate since November 2023, mortgages continue to roll off at ultra-low fixed rates, and the housing credit stock has grown.

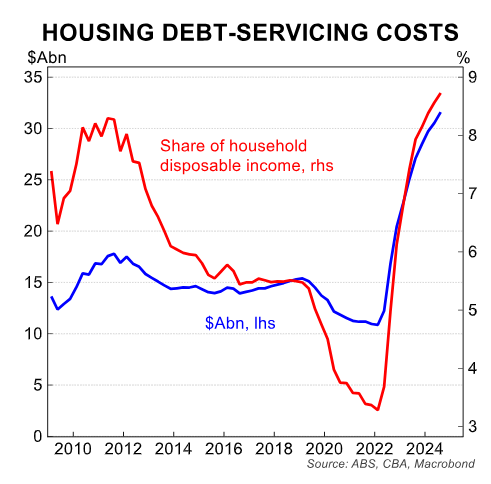

As a result, housing loan servicing expenses continue to climb, both in monetary terms and as a proportion of income.

In turn, interest payments are devouring a larger amount of household disposable income. The interest rate on housing increased by 3.4% in Q3 2024, up from 2.8% in Q2 2024.

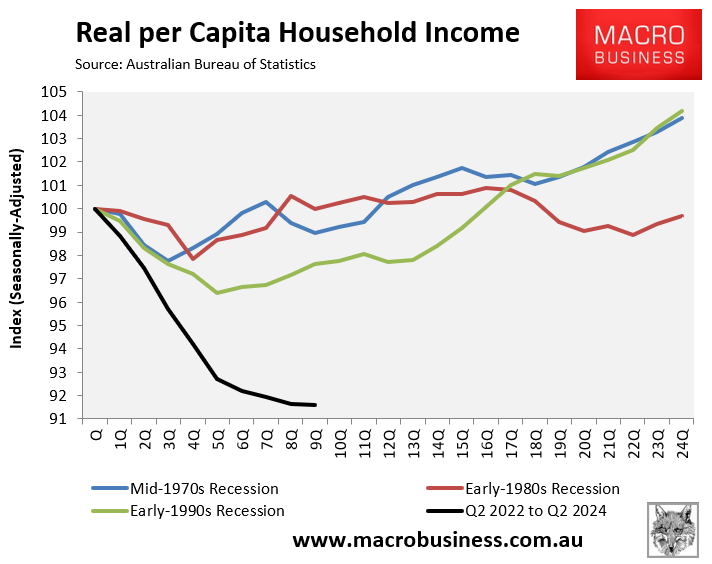

The surge in housing costs is one factor contributing to the 8.4% decline in Australian household disposable income since Q2 2024.

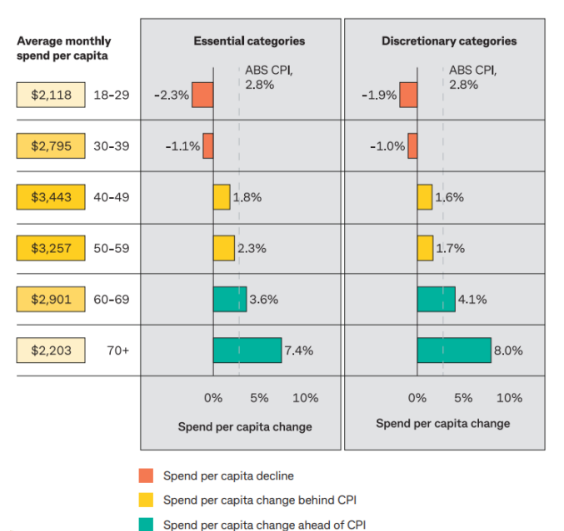

This decline in disposable income has forced younger Australians who are struggling with rent and mortgage payments to cut back on their expenditures.

In short, younger households that are renting or paying down jumbo-sized mortgages are doing it tough.