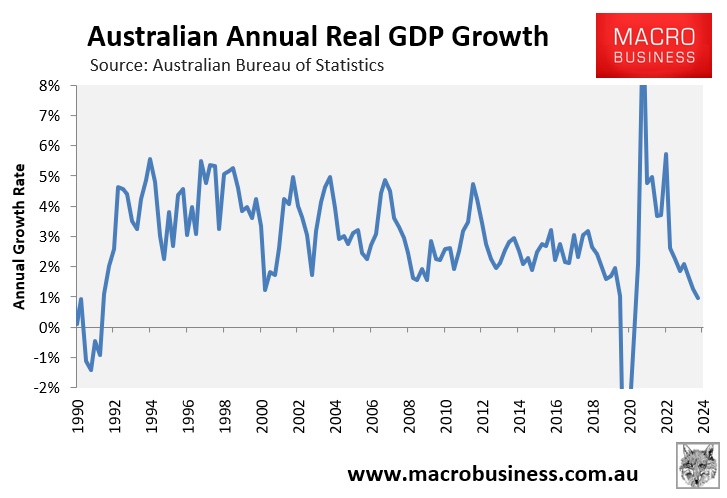

The Q3 2024 national accounts, released this month, revealed that Australia’s economy grew by only 0.8% over the year, the weakest annual growth since the early 1990s recession.

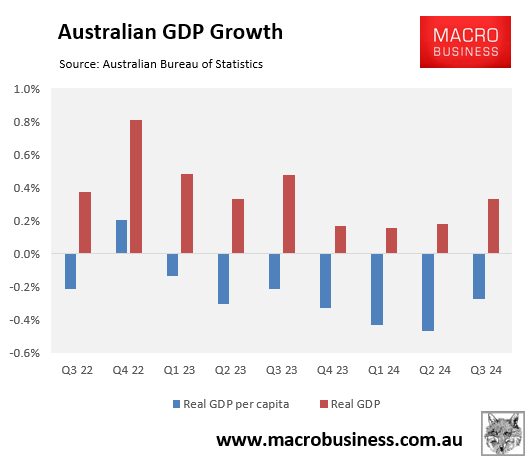

The situation was worse adjusting for population growth, with real per capita GDP declining for six consecutive quarters.

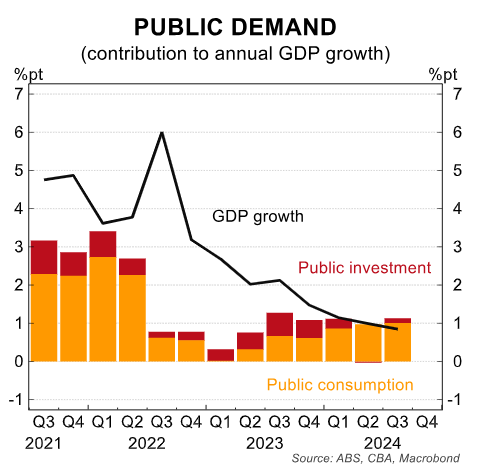

The market (private) sector has borne the brunt of the decline, with public demand driving the economy’s growth over the last three quarters.

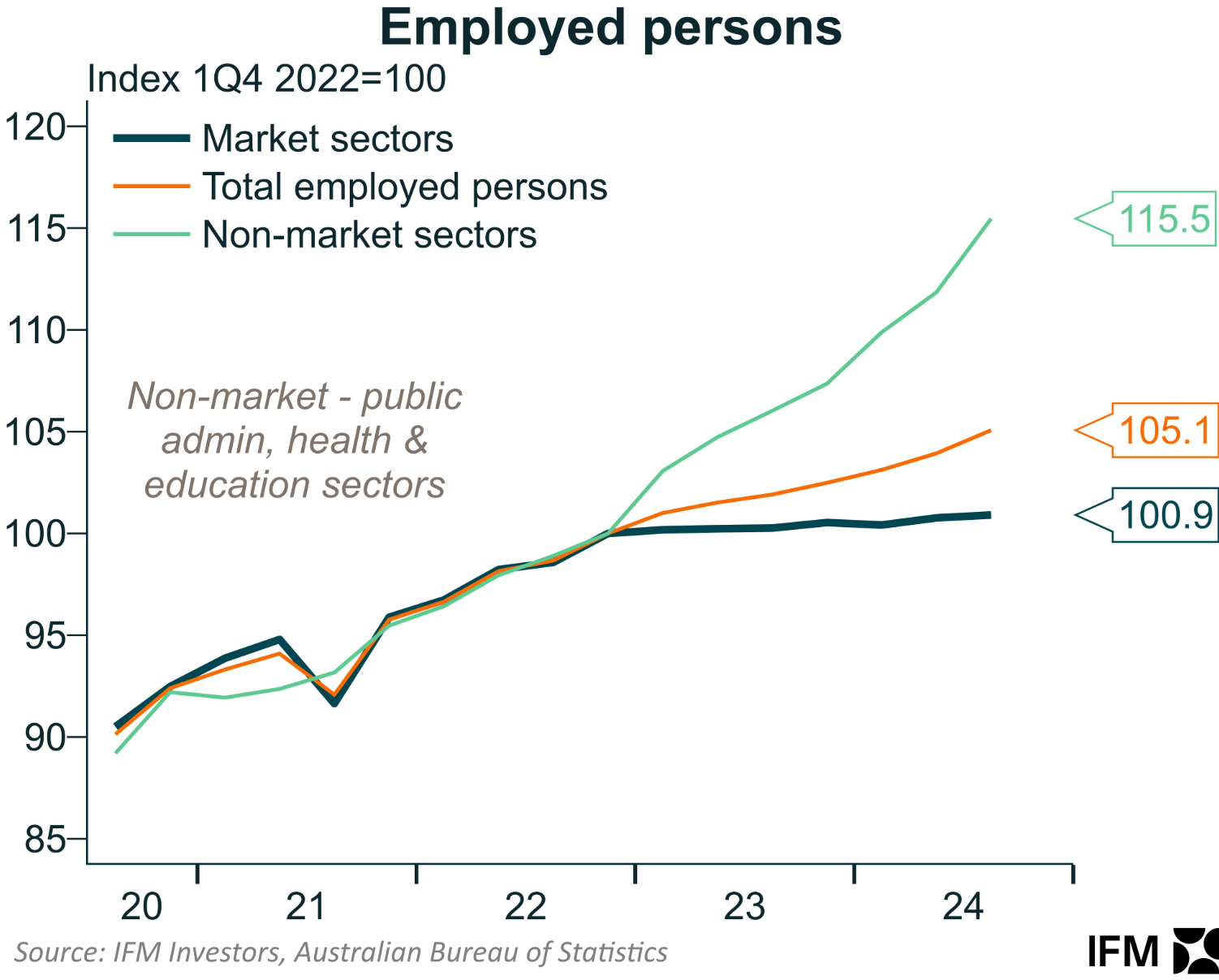

Australia’s market sector has also experienced near-zero job growth since Q4 2022.

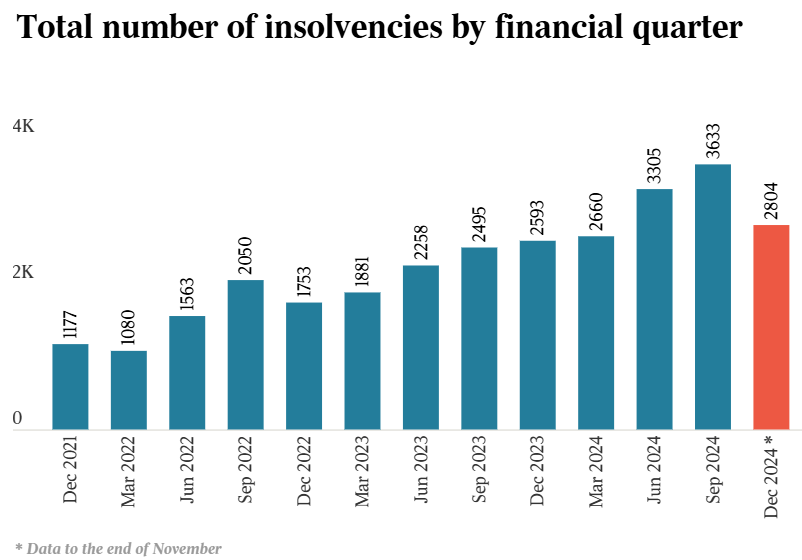

Given the fundamental weakness of Australia’s market sector economy, it makes sense that business insolvencies have soared.

New ASIC data published by The Australian shows that almost 26,000 businesses have fallen into insolvency since the 2022 election, including a record 12,405 insolvencies this calendar year.

A record 1442 businesses became insolvent last month, an increase of 62% compared with November last year and 158% higher than May 2022 levels.

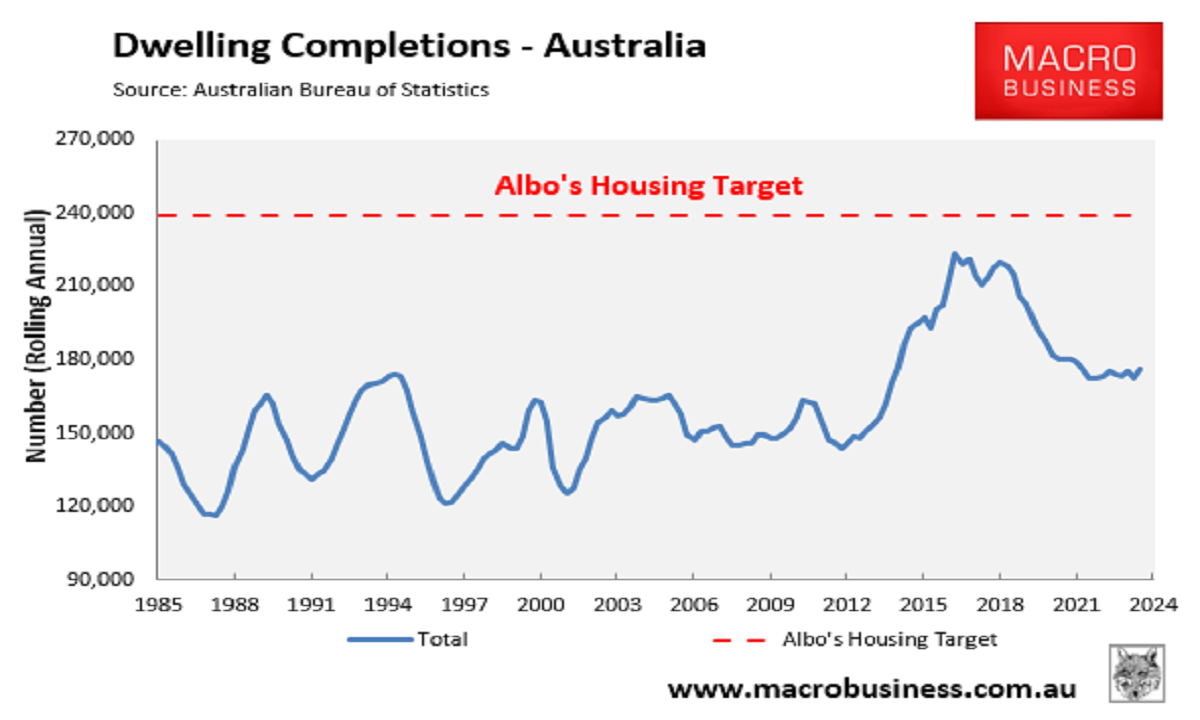

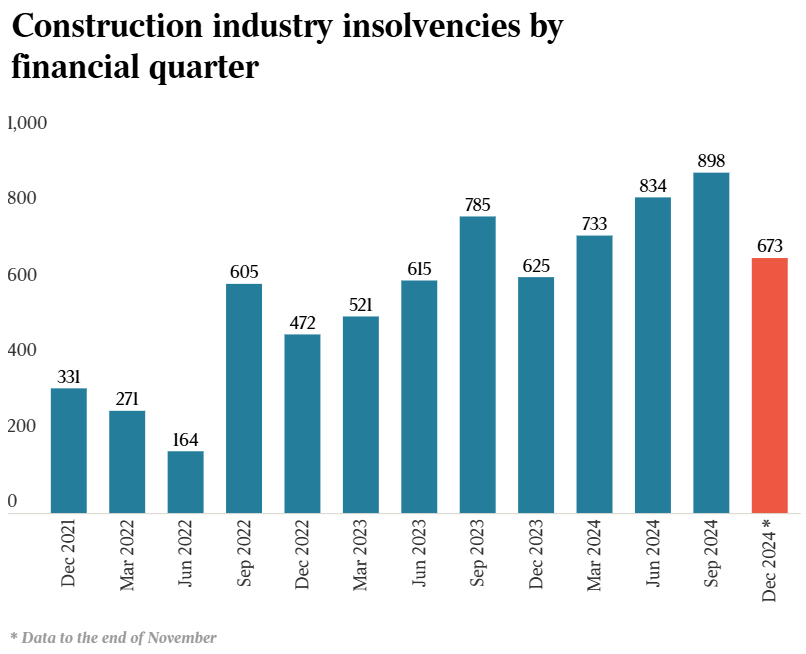

Building industry figures cautioned on Tuesday that the high number of failed construction businesses, ranging from small family businesses to major construction firms, threatened the Albanese government’s fantasy target to build 1.2 million new homes across Australia by mid-2029.

Many in the construction industry are reportedly considering leaving due to rising expenses, a decrease in activity, and tradie shortages.

“While insolvency levels have increased right across the economy, construction still represents the lion’s share, demonstrating that builders – from small, family-run businesses right through to the big construction companies – continue to feel the pressure of decreasing productivity, lack of labour supply and increases to the cost of doing business”, Master Builders Australia deputy chief executive Shaun Schmitke said.

“If we are to have any chance of reaching the 1.2 million new home targets, we need to get the settings right to increase investment in housing and keep builders on the job, delivering the homes Australians desperately need”.

Council of Small Business Australia chief executive Luke Achterstraat said the insolvency data confirmed “our greatest fears – that things would continue to get worse for small business before they get better”. He claimed rising energy, rent, and insurance costs had made the “operating environment unbearable for thousands of mum-and-dad firms”.

“Behind each insolvency statistic is a family, their livelihood, their staff and sometimes even a life’s work. The insolvency crisis must be a wake-up to government that the time for rhetoric and self-congratulation is over”, he said.

Historically high net overseas migration and record public spending are the only things preventing the Australian economy from falling into a technical recession.

But the situation on the ground in the market sector is dire.