It has been obvious for months that the Australian economy is returning to pre-COVID form of lowflation led by weak wages.

That this is a surprise to anybody is only a measure of the thickness and breadth of the progressive blindfold covering the Australian economy.

Because all public discussion of immigration is deemed “racist” by the media and authorities, nobody includes it in their macroeconomic analysis.

How a robustly liberal nation became such self-censoring idiot we can leave to another day.

Know instead that so long as the Australian economic model is immigration or labour market growth led, there will be no wage growth, and no sustained inflation.

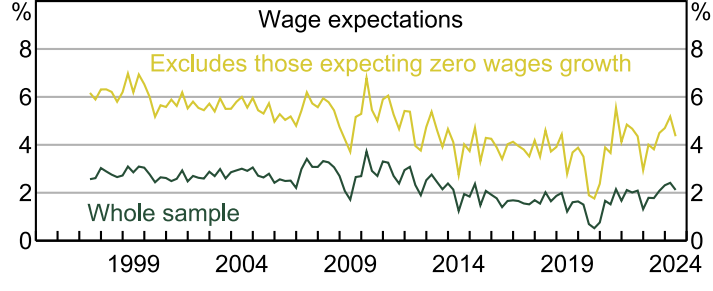

Indeed, wage suppression is so deeply entrenched in the expectations of workers that not even closing the borders and pumping hundreds of billions of fiscal stimulus pushed expectations much above 2%.

Wage expectations have fallen consistently since the modern immigration period began in 2003 and were smashed after the post-2012 immigration-led growth model took shape.

The marginal price setter of Australian wages does not live in Australia. S/he lives in India. Australians know they are prepared to work for less to get Australian residency.

Yet, what Australians know, authorities refuse to acknowledge. I pulled the above chart from a 31 page study into the formation of wage expectations published this year by the RBA.

Not once did it mention immigration, population growth, or even labour market led growth.

The central bank prefers to model some globalist fantasy economy over the real thing.

The immigration-led economy does not do wages growth and the refusal of authorities to admit it means it does even less.

In a services economy like Australia’s, low wage growth equates to low inflation.

The only factor preventing a collapse in Australian interest rates ahead is the East Coast gas export cartel.