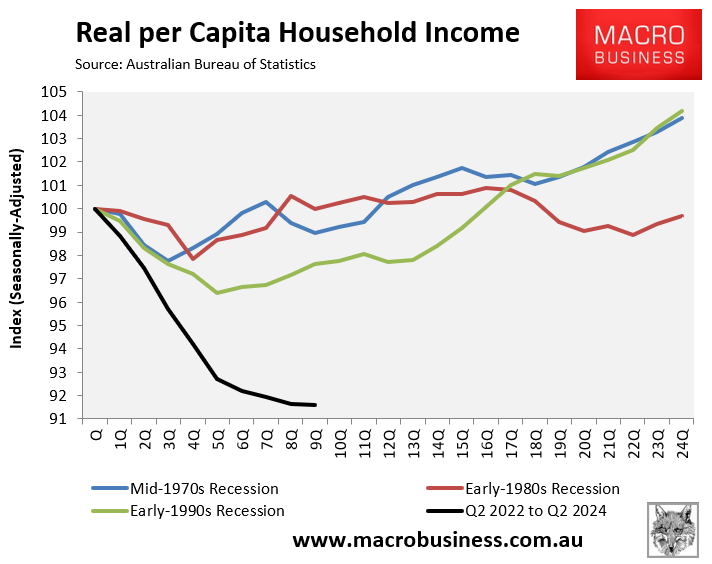

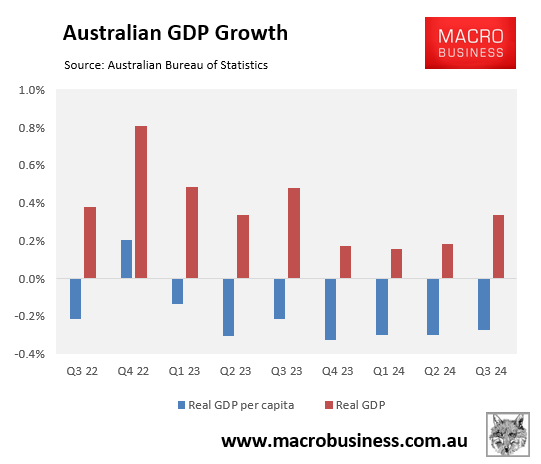

Australia is experiencing its longest-running per capita recession on record at seven consecutive quarters.

This hasn’t stopped Treasurer Jim Chalmers from boasting that record public spending has saved the nation from recession.

“It’s pretty clear that if we had taken a lot of the free advice we’ve been getting over the last 12 to 18 months, Australia would be in recession”, Chalmers said in a interview with The SMH.

“We’ve rejected this free advice that says slash and burn in the budget for good reason, and we’ve been vindicated because there wouldn’t be growth in the economy were it not for our efforts”.

Independent economist Tarric Brooker questioned whether Jim Chalmers should boast about Labor’s record in government.

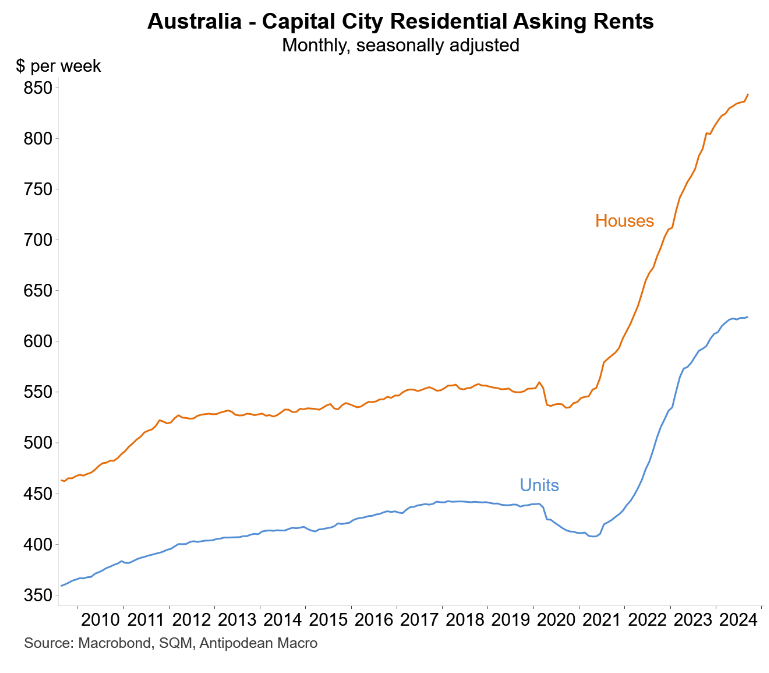

“Was extending the rental crisis, entrenching the housing deficit into the 2030s, pumping housing prices further out of reach and making the economy increasingly reliant on taxpayer-funded employment growth worth avoiding a recession?”, Brooker asked?

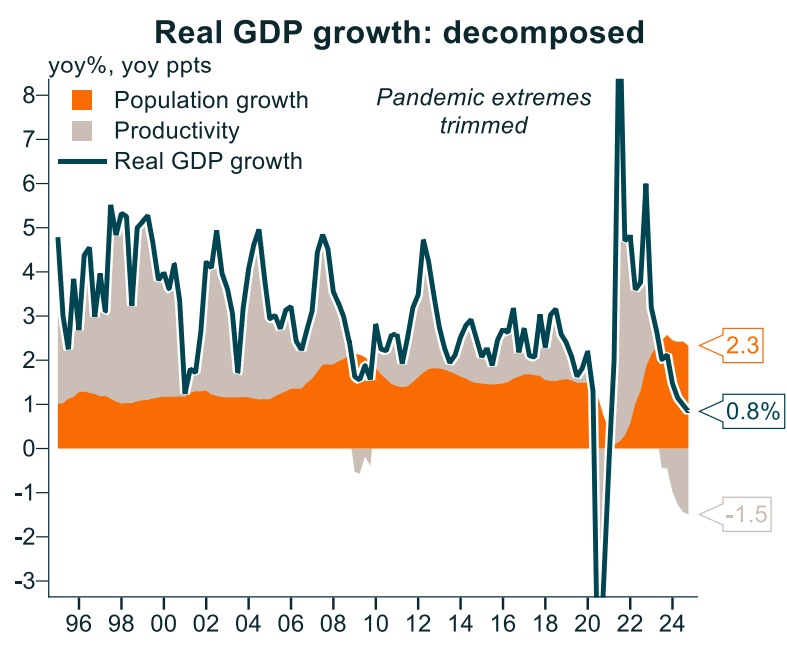

Indeed, Australia has only avoided a technical recession via running immigration a full tilt and record public spending.

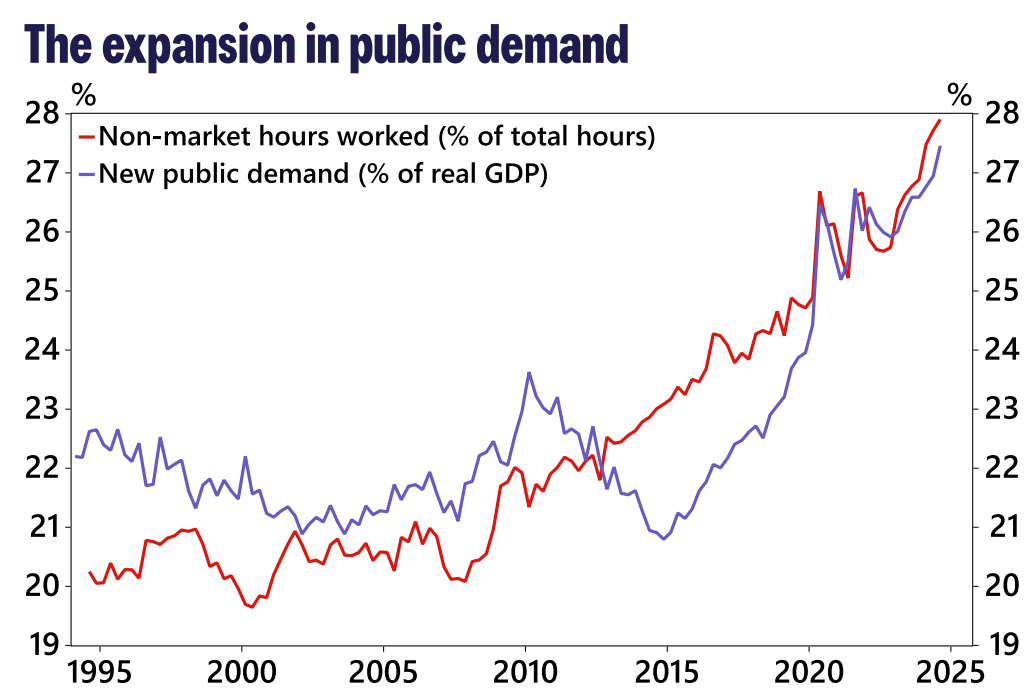

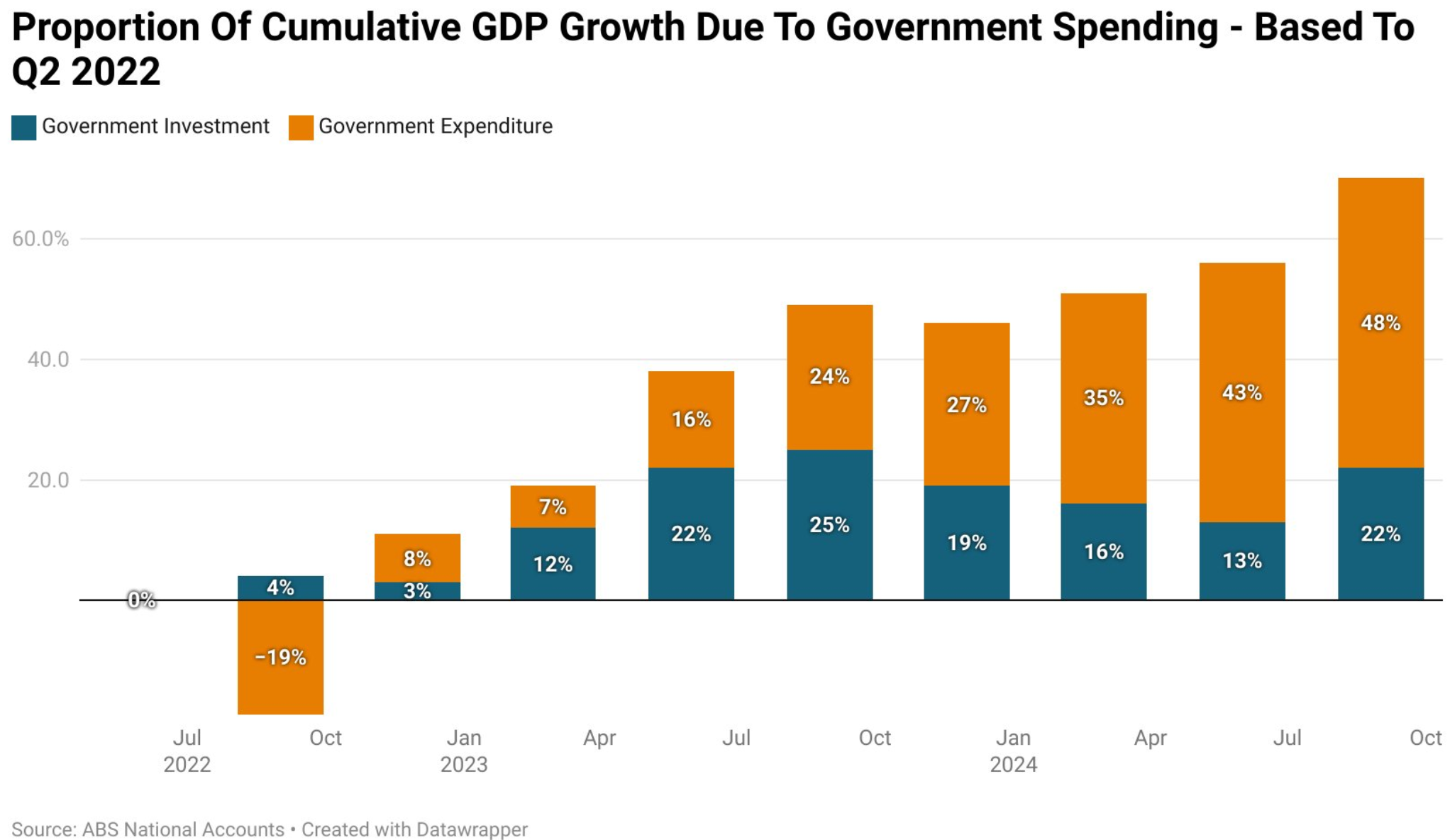

Indeed, as shown below by Brooker, since the Albanese government came to office in Q2 2022, 70% of total Australian GDP growth has been due to government spending.

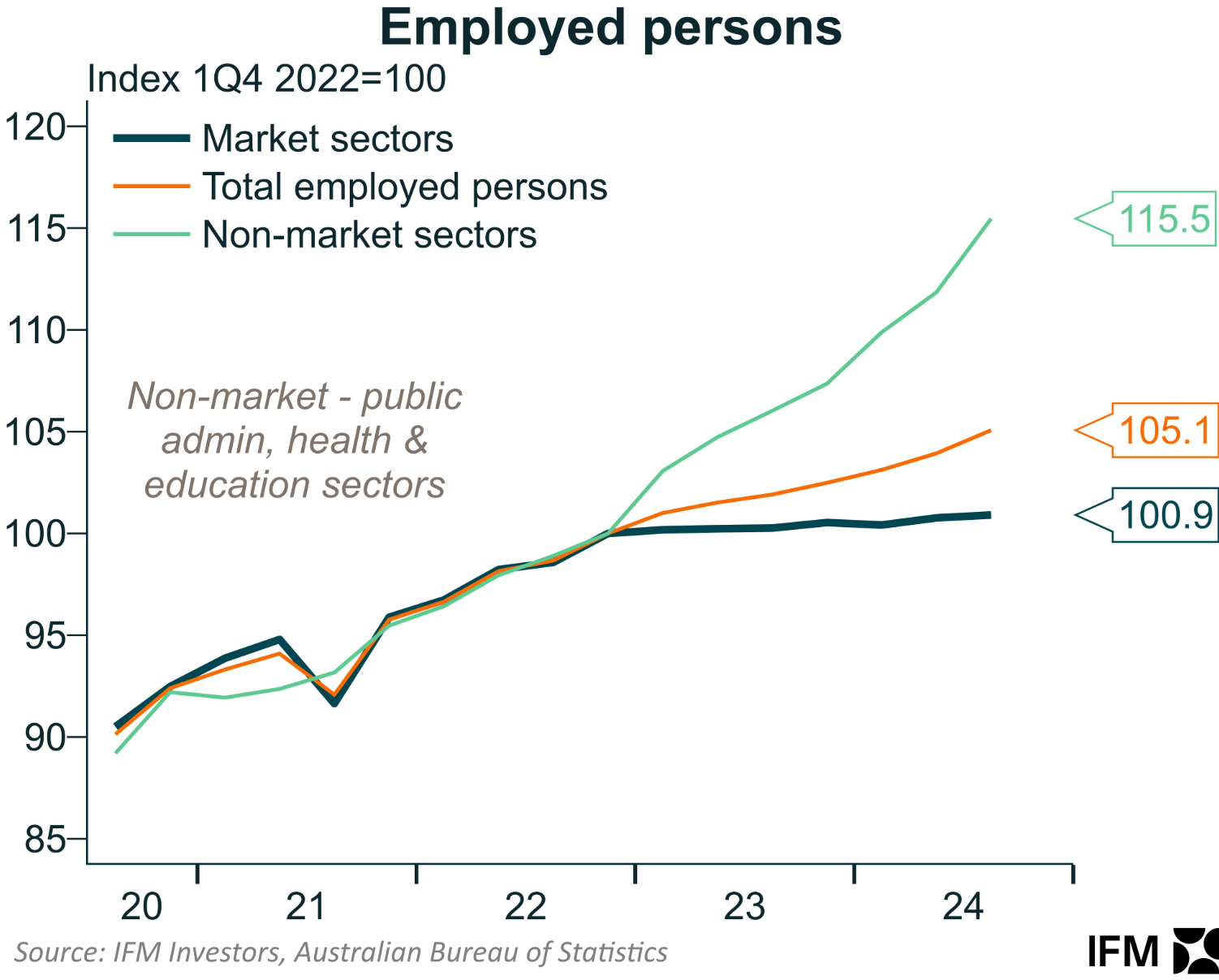

Public spending has also delivered the lion’s share of job growth under Labor.

Finally, historically high immigration has pumped housing demand into a supply-constrained market and delivered a rental crisis.

Sure, Australia has avoided a technical recession through turbo-charged immigration and record government spending.

However, this hasn’t stopped living standards from collapsing under Labor.